Washington

Washington Post: Amazon Paid No Federal Taxes on $11.2 Billion in Profits Last Year

February 16, 2019

Amazon, the e-commerce giant helmed by the world’s richest man, paid no federal taxes on profit of $11.2 billion last year, according to an analysis of the company’s corporate filings by the Institute for Taxation and Economic Policy (ITEP), a progressive think tank. Read more

The Tax Cuts and Jobs Act (TCJA), enacted by President Trump and Congressional Republicans at the end of 2017, has caused quite a bit of confusion, and a recent “Fact Checker” column by the Washington Post’s Glenn Kessler does not help. TCJA created real problems that can't be resolved without real tax reform. To begin that process fact checkers, lawmakers, and everyone else need to be clear about what TCJA did, and did not, do to our tax system.

Newsweek: We Shouldn’t Wait for Washington to Tax the Rich: We Can Begin at the State Level

February 11, 2019

Following is an excerpt from an op-ed by ITEP deputy director Meg Wiehe published in Newsweek Magazine: The historic role tax and other policies have played in exacerbating the wealth divide and discussions about how to remedy this injustice is a national conversation that is long overdue. Examining the federal policy landscape is a logical […]

Washington Post: Live Commentary on Trump’s SOTU

February 5, 2019

E.J. DIONNE JR., 9:27 p.m.: “A massive tax cut for working families.” Really? “If you look at the richest 1 percent, they’re getting more than the bottom 60 percent of Americans,” said Steve Wamhoff, director of federal tax policy at the Institute on Taxation and Economic Policy. Read more

Data for the Win: Advocating for Equitable State and Local Tax Policy (Webinar)

January 30, 2019 • By Aidan Davis, Dylan Grundman O'Neill, ITEP Staff, Meg Wiehe

Watch the video recording below for discussion on how ITEP’s distributional data can be part of an advocacy and communications strategy for securing state tax policies that raise enough revenue to fund various priorities. Outline includes a brief overview of findings from the sixth edition of Who Pays? A Distributional Analysis of the Tax Systems in All 50 States as well as insight from state advocates who use Who Pays? and other tax policy analyses research to pursue their legislative agendas.

Washington Post: Warren’s Push for a Wealth Tax Could Be a Game Changer

January 29, 2019

Many on the right are already lashing out at Warren’s proposal. (On Fox News, it was preposterously likened to Venezuelan socialism.) Others have argued that it would be unconstitutional, a dubious claim that relies on a controversial 1895 Supreme Court ruling that, as the Institute on Taxation and Economic Policy explains, “has been limited to […]

Washington Post: Elizabeth Warren to Propose Wealth Tax

January 25, 2019

Estimates of how much money can be raised by taxing the very rich vary dramatically. The Institute on Taxation and Economic Policy, a left-leaning think tank, published a report on Wednesday finding that a 1 percent wealth tax on the wealthiest 0.1 percent of Americans would raise $1.3 trillion over a decade. That would affect […]

Wall Street Journal: Democrat Elizabeth Warren Proposes Wealth Tax

January 24, 2019

That is roughly 10 times the revenue that the current estate and gift taxes are projected to raise, but Ms. Warren’s “ultramillionaire-tax” proposal on the top 0.1% isn’t just about generating money to pay for government programs. It marks Democrats’ intense emphasis on inequality as the party tries to reclaim the White House in 2020. […]

New York Times: Warren’s Plan Is Latest Push by Democrats to Raise Taxes on the Rich

January 24, 2019

Ms. Warren appears to be the first declared Democratic candidate to release a plan for a wealth tax, but the idea is quickly gaining steam among liberal activists and policy experts. Two think tanks, the Institute on Taxation and Economic Policy and the Washington Center for Equitable Growth, released wealth-tax-themed policy briefs this week in […]

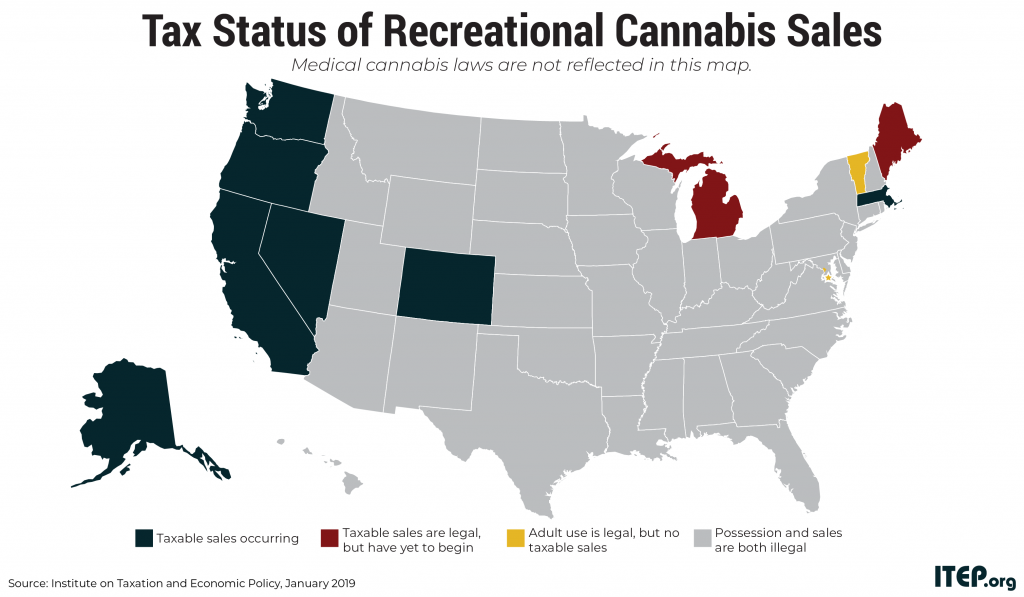

Bloomberg: Cannabis Excise Tax Revenue Could Eclipse Alcohol Revenue in 2019

January 23, 2019

Excise tax revenue from marijuana sales is expected to surpass alcohol excise collections in 2019, according to the co-author of a new report. Carl Davis, a research director at the Institute on Taxation and Economic Policy, noted in his report that state and local retail marijuana excise tax collections already rivaled alcohol tax collections in […]

Five Years in, Cannabis Tax Haul Rivals or Exceeds Alcohol Taxes in Many States

January 23, 2019 • By ITEP Staff

A first-of-its-kind look at state excise taxes on legal cannabis sales finds that taxing the substance can be a meaningful source of state revenue but cautions that achieving sustainable revenues over time will be difficult under the price-based tax structures adopted in most states thus far.

Cannabis Tax Debates are Ramping Up; Here’s What We’ve Learned from Five Years of Cannabis Taxation Thus Far

January 23, 2019 • By Carl Davis

This year lawmakers in Connecticut, Delaware, Hawaii, Illinois, New Jersey, New York, Rhode Island, and Vermont will all be debating the taxation of recreational cannabis. A new ITEP report reviews the track record of recreational cannabis taxes thus far and offers recommendations for structuring cannabis taxes to achieve stable revenue growth over the long haul.

State Rundown 1/18: Governors’ Speeches Kick Off State Fiscal Debates

January 18, 2019 • By ITEP Staff

Gubernatorial speeches and budget proposals dominated state fiscal news this week, as governors proposed a wide array of policies including positive reforms such as Earned Income Tax Credit (EITC) enhancements in CALIFORNIA, a capital gains tax on wealthy households in WASHINGTON, and investments in education in several states. Proposals to exempt more retirement income from tax, particularly for veterans, are a common theme so far this year, having been raised in multiple states including MARYLAND, MICHIGAN, and SOUTH CAROLINA. And NEW JERSEY became the fourth state with a $15 minimum hourly wage. Those wishing to better understand and influence important debates about equitable tax policy should mark their…

The Daily Chronicle: Senate Hears Testimony on Governor’s Proposed Capital Gains Tax

January 18, 2019

Last fall, a report from the Institute on Taxation and Economic Policy showed that the lowest 20 percent of earners pay almost 18 percent of family income in taxes, while the top one percent pay just three percent in taxes. Multiple people testified that Washington’s “upside-down” tax system needs to be changed. Read more

Who Pays and Why It Matters | MECEP Policy Insights Conference Keynote Address

January 16, 2019 • By Aidan Davis

States have broad discretion in how they secure the resources to fund education, health care, infrastructure, and other priorities important to communities and families. Aidan Davis with the Institute on Taxation and Economic Policy will offer a national perspective on state-level approaches to funding public investments and the implications of those approaches on tax fairness and revenue adequacy, and their economic outcomes. She’ll also provide insight on what’s in store for 2019 among the states.

Washington Times: Trump Tax Cut Foiled by State’s Itemized Deduction Rule

December 31, 2018

Last year, many states opened their legislative sessions at the beginning of January, just after the federal tax law passed in December 2017, leaving them little time to figure out the new landscape. “I think they were very flat-footed,” said Meg Wiehe, deputy director of the Institute on Taxation and Economic Policy. “We were even […]

CNBC: Democrats Are Going to Attack the GOP Tax Law from Several Angles, Including SALT Caps and Breaks for Corporations

December 18, 2018

Many of the changes that Democrats are seeking have little chance of enactment amid divided government in Washington. But Alan Essig, executive director of the Institute on Taxation and Economic Policy, said Democrats are looking beyond the next two years. “While it may be difficult for the next Congress and President Trump to agree on […]

Washington Post: In Early Win for Party’s Left, House Democrats Back off Tax Rule

December 11, 2018

Henry Connelly, a spokesman for Pelosi, said the rule was unnecessary to prevent Democrats from hiking taxes on the middle class. He also noted that House Republicans waived their rule to pass their tax law in 2017, because the legislation did raise taxes on some families. “Unlike the House GOP, at the end of the […]

Washington Post: Does the Republican Tax Law Encourage Outsourcing?

December 6, 2018

“These multinational firms are going to want to stay below the 10 percent threshold, because that means the U.S. tax system won’t touch their foreign earnings,” said Matt Gardner, a tax expert at the Institute on Taxation and Economic Policy, a left-leaning think tank. “If you move a whole factory overseas, that sharply increases what […]

The Federal Estate Tax: An Important Progressive Revenue Source

December 6, 2018 • By ITEP Staff

For years, wealth and income inequality have been widening at a troubling pace. One study estimated that the wealthiest 1 percent of Americans held 42 percent of the nation’s wealth in 2012, up from 28 percent in 1989. Lawmakers have exacerbated this trend by dramatically cutting federal taxes on inherited wealth, most recently by doubling the estate tax exemption as part of the 2017 Tax Cuts and Jobs Act. Further, lawmakers have done little to stop aggressive accounting schemes designed to avoid the estate tax altogether. This report explains how the percentage of estates subject to the federal estate tax…

The Failure of Expensing and Other Depreciation Tax Breaks

November 19, 2018 • By Richard Phillips, Steve Wamhoff

Congress permitted full expensing only for five years, which will encourage businesses to speed up investments they would have made later. Republicans in Congress have discussed making the expensing provision permanent. This report argues that Congress should move in the other direction and repeal not just the full expensing provision but even some of the permanent accelerated depreciation breaks in the tax code, for several reasons.

Washington Post: Democrats Face Early Division in Rules over Taxes

November 16, 2018

The richest fifth of taxpayers are those who make more than $108,000 annually, said Steve Wamhoff, director of federal tax policy at the Institute on Taxation and Economic Policy. Some liberal Democrats said that if the party limits its own ability to raise taxes, it could make it harder for the House to adopt policies […]

Today Amazon announced major expansions in New York and Virginia, where it intends to hire up to 50,000 full-time employees. The announcement marks the culmination of a highly publicized search that lasted more than a year and involved aggressive courting of the company by cities across the nation. The following are three tax-related observations on the announcement.

Tuesday’s elections shook up statehouses, governors’ offices, and tax laws in many states, and in this week’s Rundown we bring you the top 3 election state tax policy stories to emerge. First, voters in Kansas and other states sent a message that regressive tax cuts and supply-side economics have not succeeded and are not welcome among their state fiscal policies. Meanwhile, residents of many other states, including most notably Illinois, voted for representatives who reflect their preference for equitable, sustainable policies to improve their state economies through smart public investments and improve the lives of all residents through progressive tax structures. Lastly, while some states missed…

Washington Post: In blow to liberal efforts, voters across the country reject tax increases. (California is the exception.)

November 7, 2018

North Carolina voters, for instance, approved a change to their state constitution bringing down the maximum allowable tax rate from 10 percent to 7 percent. That will effectively only spare the rich from higher taxes, because no tax increases in that neighborhood are on the table for the middle class, but the average voter may […]