Washington

State Rundown 12/7: States Try to Plan While Awaiting Federal Tax Decisions

December 7, 2017 • By ITEP Staff

Though most eyes were on Congress rather than states this week, several states have been taking stock of their fiscal situations. Wyoming lawmakers considered ways to resolve budget shortfalls, Kansas and New Mexico legislators got some minor good news about their states' revenues, their counterparts in Minnesota and Vermont grappled with less encouraging revenue news, and those in West Virginia were just happy to hear their revenues had at least met expectations for once.

How the House and Senate Tax Bills Would Affect Washington Residents’ Federal Taxes

December 6, 2017 • By ITEP Staff

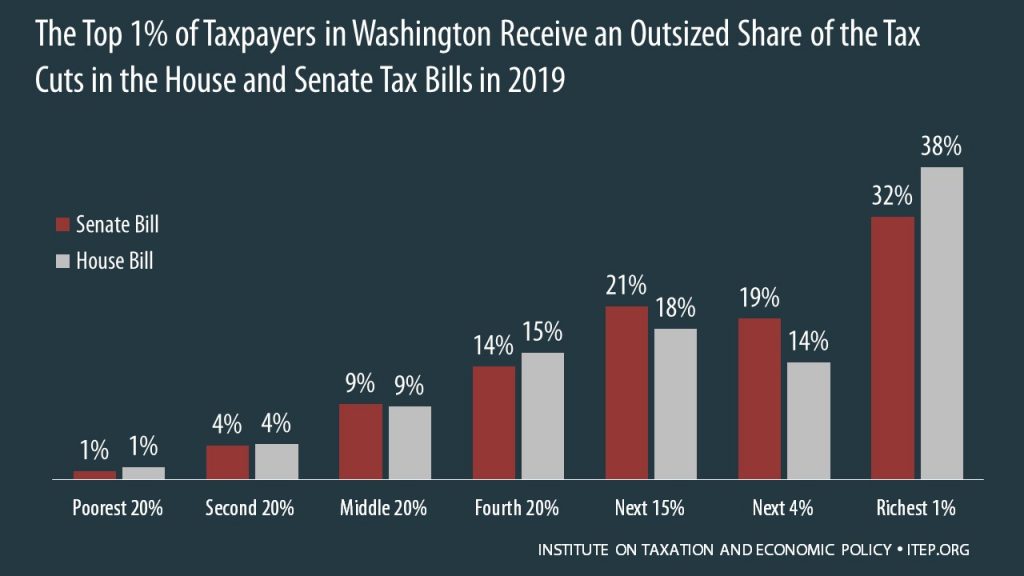

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. The graph below shows that both bills are skewed to the richest 1 percent of Washington residents.

Lawmakers Are Allowing Monied Interests to Trump the Voices of Their Constituents

November 30, 2017 • By Alan Essig

George Washington is said to have described the U.S. Senate as the body that cools the passions of an impulsive House of Representatives just as a saucer cools tea. But current Senate leaders appear to think of themselves as more of a Bunsen burner.

The State Rundown is back from Thanksgiving break with a heaping helping of leftover state tax news, but beware, some of it may be rotten.

The Senate Tax Plan’s Big Giveaway to Multinational Corporations

November 21, 2017 • By Richard Phillips

Instead of addressing the hundreds of billions in lost federal tax revenue due to offshore tax avoidance schemes, the Senate tax bill would forgive most of the taxes owed on these profits and open the floodgates to even more offshore profit-shifting in the future.

Washington Post: For Some GOP Women, the Ultimate Women’s Issue Right Now Is the GOP Tax Plan

November 20, 2017

However, according to the Institute on Taxation and Economic Policy, Alabama voters may be taking a bit of a risk by assuming that a vote for the GOP tax plan is in their best interest. According to the non-profit, non-partisan research organization, nearly half — 48 percent — of the federal tax cuts would go to the […]

Washington Post: Almost Third of Marylanders Are Set to Pay Higher Taxes

November 18, 2017

The Institute on Taxation and Economic Policy has determined that 30.5 percent of Marylanders would pay substantially higher taxes under the Republican plan. The capping of deductions for state and local taxes would make this bill onerous to Maryland residents. The removal of the tax deduction for student loan interest is mean-spirited and anti-education. Read […]

Washington Post: The GOP Tax Plan Is Moving Forward. It’s a Big Scam on Trump’s Base

November 17, 2017

While this JCT document doesn’t say exactly how many people will see their taxes rise, other analyses give us a hint. For instance, the Institute on Taxation and Economic Policy estimates that under the Senate plan, 19 million households will see a tax increase in 2019, and more than 23 million will get a tax […]

The Washington Post (Morning Plum): Tax Plan Favors Trump States

November 16, 2017

The House GOP tax plan nixes most state and local deductions, hitting higher-taxed states harder. Jim Tankersley reports on a new analysis by Carl Davis of the Institute on Taxation and Economic Policy in Washington: The House bill would raise personal taxes on Californians and New Yorkers by a combined $16 billion in 2027, Mr. […]

New York Times: Republican Tax Plan Puts Corporations over People

November 16, 2017

The plans also differ on their treatment of state and local tax deductions. The Senate would kill them entirely. The House would maintain them only for property taxes and cap the deduction at $10,000 a year. Economists generally say that those tax breaks are inefficient. But eliminating them, in the context of the House bill, […]

Washington Post: GOP Tax Cuts Would Be Tax Hikes for Some Families

November 15, 2017

A separate analysis released by the Institute on Taxation and Economic Policy found that District-wide, about 39 percent of households earning between $77,220 and $131,900 would see their taxes increase next year under the House plan. Read more

Washington Post: Republican Tax Bill Would Be Paradise for Plutocrats

November 14, 2017

As Thomas Frank wrote in the Guardian, these “tax havens are not a sideshow” to the global economy; “they are a central reality.” And that reality makes a mockery of the Republican case for their tax cuts. The Institute on Taxation and Economic Policy reports that the most recent data from the IRS in 2012 […]

How the Revised Senate Tax Bill Would Affect Washington Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Washington, 54 percent of the federal tax cuts would go to the richest 5 percent of residents, and 12 percent of households would face a tax increase, once the bill is fully implemented.

Washington Post: What Is Carried Interest and Why It Matters in the GOP Tax Bill

November 7, 2017

Critics argue that these wealthy financiers should be paying more. The preferential tax treatment gives the wealthy an unfair advantage and deepens the divide between the rich and poor, they say. “If you thought that this tax plan would reflect populist goals, it was very strange that repealing carried interest is not in it,” said […]

The Washington Post: Guess What? Republicans May Be About to Raise Your Taxes

November 7, 2017

Now let’s look at an analysis by the Institute on Taxation and Economic Policy. Its data shows that in 2018, 8 percent of taxpayers will see a tax increase. Since some provisions are set to expire, by 2027, 18 percent of taxpayers will be paying more than they do now. But that’s only part of the […]

Washington Post: Welcome to the New Gilded Age

November 7, 2017

As the corporate welfare is doled out, the same bill widens the gap between the rich and everybody else. The liberal Institute on Taxation and Economic Policy concluded that the middle fifth of Americans would get a modest tax cut of $460 (1.4 percent of their income) in 2018, while the richest 1 percent would […]

Washington Post: No Doubt About Who Wins Under GOP Tax Proposal

November 7, 2017

In another study, the Institute on Taxation and Economic Policy finds: The middle 20 percent of income-earners in America, the group that is quite literally the “middle-class,” would receive 10 percent of the benefits in the U.S. in 2018 and just 8 percent of the benefits in 2027. In other words, in 2027 the middle […]

Australian Broadcasting Corp: The Surprising Journey Your Money Takes after Buying a Pair of Nikes

November 6, 2017

Tax activists ask why it is that Australia makes $2 in profit from that $100 but Nike in America makes about $14 in profit. “That’s a pretty good indication that there’s some income shifting going on,” says Matt Gardner, a senior fellow at the Washington-based Institute on Taxation and Economic Policy. Read more

How the House Tax Proposal Would Affect Washington Residents’ Federal Taxes

November 6, 2017 • By ITEP Staff

The Tax Cuts and Jobs Act, which was introduced on November 2 in the House of Representatives, includes some provisions that raise taxes and some that cut taxes, so the net effect for any particular family’s federal tax bill depends on their situation. Some of the provisions that benefit the middle class — like lower tax rates, an increased standard deduction, and a $300 tax credit for each adult in a household — are designed to expire or become less generous over time. Some of the provisions that benefit the wealthy, such as the reduction and eventual repeal of the estate…

Washington Post: Answers to Major Questions about the Republican Tax Plan

November 3, 2017

Boosting corporate income tax rates and squeezing loopholes would hurt other companies, such as capital intensive industries. Oil and gas companies, for example, take advantage of special depreciation rates, two of which are about a century old. International companies – such as pharmaceutical or technology firms – shelter income abroad to avoid taxes in the […]

The Street: Proposed Gas Tax Increase Could Harm Consumers

October 27, 2017

Since 2013, 26 states have raised their gas taxes with eight alone in 2017, according to a report conducted by the Institute on Taxation and Economic Policy, a non-profit and non-partisan research organization in Washington. Read more

Washington Post: Happy Hour Roundup

October 27, 2017

The Institute on Taxation and Economic Policy releases a report showing that states with higher personal income taxes have higher economic growth, higher wage growth, and lower unemployment than states with lower taxes. Read more

Star-Ledger: You’re Now More at Risk of Losing Your Property Tax Break

October 26, 2017

The loss of the state and local tax deduction would mean higher taxes for 26.4 percent of New Jersey taxpayers, according to a study by the Institute on Taxation and Economic Policy, a progressive research group in Washington. That was second to Maryland, at 30.5 percent, the group said. Read more

International Business Times: Do Lower Taxes Spur Economic Growth? What Happened In No-Tax States

October 26, 2017

Researchers at the non-partisan and non-profit Institute on Taxation and Economic Policy compared the nine states without personal income taxes, which include Florida, Texas and Washington, to the nine states with the highest top marginal tax rates over the last decade, which include California, New York and Oregon. They found the states with the highest […]

Trickle-Down Dries Up: States without personal income taxes lag behind states with the highest top tax rates

October 26, 2017 • By Carl Davis, Nick Buffie

Lawmakers who support reducing or eliminating state personal income taxes typically claim that doing so will spur economic growth. Often, this claim is accompanied by the assertion that states without income taxes are booming, and that their success could be replicated by any state that abandons its income tax. To help evaluate these arguments, this study compares the economic performance of the nine states without broad-based personal income taxes to their mirror opposites—the nine states levying the highest top marginal personal income tax rates throughout the last decade.