Tax Breaks

Despite wintry conditions across much of the country, that hasn’t stopped state lawmakers from debating major tax policy changes.

Tesla Reported Zero Federal Income Tax on $5.7 Billion of U.S. Income in 2025

January 29, 2026 • By Matthew Gardner

Tesla enjoyed almost $5.7 billion of U.S. income in 2025 but paid $0 in federal income tax. Over the past three years, the Elon Musk-led company reported $12.5 billion of U.S. income on which its current federal tax was just $48 million.

As state legislative sessions ramp up across the country, property taxes are one of many issues dominating tax policy conversations in statehouses.

10 Reasons Why the U.S. Should Reform Its Corporate Income Tax

December 17, 2025 • By Steve Wamhoff

The U.S. needs a tax code that is more progressive and that raises more revenue than the one we have now. An important way to achieve this is to reform the taxation of business profits. These four key policy reforms would greatly strengthen the corporate tax system: Eliminating or restricting special breaks and loopholes that […]

Proposed Missouri Tax Shelter Would Aid the Wealthy, Anti-Abortion Centers Alike

March 6, 2025 • By Carl Davis

In Missouri, donations to anti-abortion pregnancy resource centers come with state tax credits valued at 70 cents on the dollar. One bill currently being debated in the state would increase that matching rate to 100 percent—that is a full, state-funded reimbursement of gifts to anti-abortion groups.

Corporate Tax Breaks Contribute to Income and Racial Inequality and Shift Resources to Foreign Investors

July 16, 2024 • By Emma Sifre, Steve Wamhoff

Corporate tax cuts and corporate tax avoidance worsen income and racial inequality in our country. Most of the benefits flow to foreign investors and the richest 20% of Americans.

Corporations Reap Billions in Tax Breaks Under ‘Bonus Depreciation’

June 29, 2023 • By Matthew Gardner, Steve Wamhoff

Since TCJA expanded tax breaks for “accelerated depreciation” starting in 2018, it has reduced taxes by nearly $67 billion for the 25 profitable corporations that benefited the most. Congress is now looking at extending this policy.

Trio of GOP Tax Bills Would Expand Corporate Tax Breaks While Doing Little for Americans Who Most Need Help

June 11, 2023 • By Steve Wamhoff

The trio of tax bills that cleared the House Ways and Means Committee in June include tax cuts that would mostly benefit the richest one percent of Americans and foreign investors.

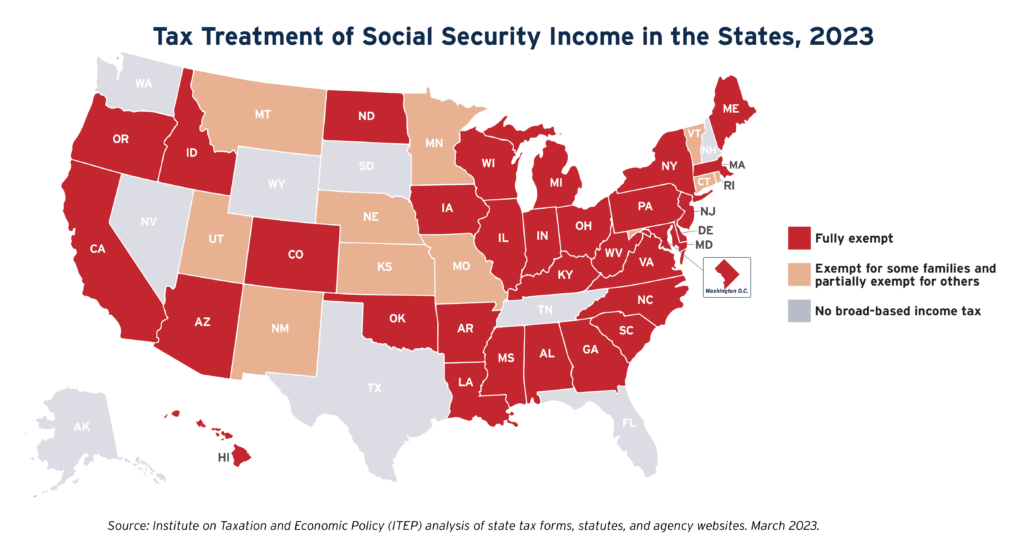

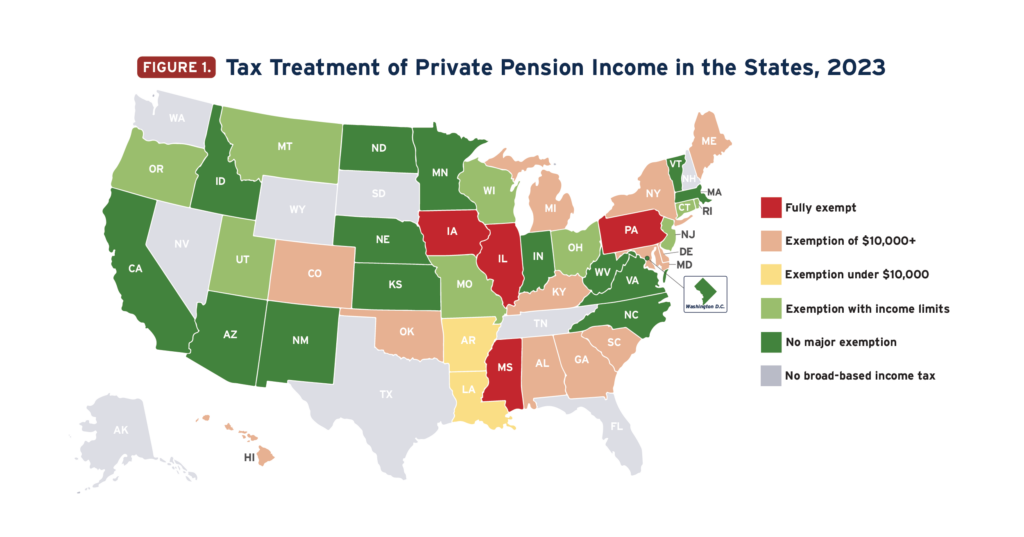

Every state with a personal income tax offers tax subsidies for seniors that are unavailable to younger taxpayers. The best academic research suggests that the median state asks senior citizens to pay about one-third less in personal income tax than younger families with similar incomes. The majority of these subsidies are costly and poorly targeted. […]

States Prioritize Old Over Young in Push for Larger Senior Tax Subsidies

March 23, 2023 • By Carl Davis, Eli Byerly-Duke

Under a well-designed income tax based on ability to pay, it is simply not necessary to offer special tax subsidies to older adults but not younger families. At the end of the day, your income tax bill should depend on what you can afford to pay, not the year you were born. It’s really as simple as that.

State governments provide a wide array of tax subsidies to their older residents. But too many of these carveouts focus on predominately wealthy and white seniors, all while the cost climbs.

Covering federal, state, and corporate tax work, here are our top 5 charts of 2022. It’s worth noting that the biggest tax news of 2022 – the adoption of a federal 15 percent corporate minimum tax in the Inflation Reduction Act – should make some of these charts look much better after the new law is implemented.

Any tax legislation enacted before this Congress ends should prioritize policies that have a proven track record of helping workers and children rather than policies that cut taxes for corporations or for individuals who are already well-off. It's not clear right now whether lawmakers will do that - or whether they will enact any tax legislation at all before the year ends, but here we take a look at the key tax issues that lawmakers are discussing.

Lawmakers Seek to Extend Tax Break for “Research” that Corporations Use to Develop Frozen Foods, New Beer Flavors, Casino Games and Tax Avoidance

December 8, 2022 • By Steve Wamhoff

If Congress creates a tax break to encourage businesses to conduct research that benefits society, should Netflix be eligible for it? There is no shame in binge-watching Stranger Things or Bridgerton or The Crown, but how many of us really think Netflix deserves a tax break for whatever “research” the company did to provide this […]