Tax Credits for Workers and Families

State Rundown 2/19: Necktie (NCTI) Offers a Way Out of a Knotty Situation

February 19, 2026 • By ITEP Staff

State lawmakers are grappling with a range of challenges as their fiscal outlooks deteriorate, federal tax enforcement wanes (after the Trump administration cut the IRS workforce by 25 percent), and a rewritten federal tax code sends states scrambling to decide what changes they might want to make in their own codes.

State Rundown 2/11: This Valentine’s Day, Conscious Decoupling Is Our Love Language

February 11, 2026 • By ITEP Staff

While some may be excited for a romantic Valentine’s Day this weekend, many state lawmakers are breaking up and decoupling from recent federal tax changes that are poised to leave states with revenue shortfalls – much like a bad date who forgets their wallet and asks you to pick up the tab.

What Did 2025 State Tax Changes Mean for Racial and Economic Equity?

February 9, 2026 • By Brakeyshia Samms

The results are a mixed bag, with some states enacting promising policies that will improve tax equity and others going in the opposite direction.

D.C.’s Fiscal Autonomy is at Stake, District’s Conformity Decisions Should Stand

February 6, 2026 • By Kamolika Das

Federal lawmakers passed a bill along party lines that would force the District of Columbia to override the decision of local elected officials and implement all of the costly and inequitable federal tax cuts passed under the “One Big Beautiful Bill Act” (OBBBA).

State Rundown 1/22: Cautious Tone Noticeable in Most Statehouses

January 22, 2026 • By ITEP Staff

Most states are adopting a very cautious approach so far this year as legislators begin their sessions and governors make their annual addresses, thanks to ongoing economic uncertainty and federal retrenchment.

Pennsylvania Just Gave Low-Income Workers a Tax Credit Boost. Now It’s Philadelphia’s Turn.

December 30, 2025 • By Kamolika Das

In the same way states are building upon federal tax credits, localities should consider building on state tax credits.

States Can Create or Expand Refundable Credits by Taxing Wealth, Addressing Federal Conformity

December 19, 2025 • By Zachary Sarver

Many states already recognize the potential of these credits to boost low- and moderate-income households. Other states should follow suit.

The Potential of Local Child Tax Credits to Reduce Child Poverty

October 8, 2025 • By Kamolika Das, Aidan Davis, Galen Hendricks, Rita Jefferson

Local governments have a critical role to play in reducing child poverty. Local Child Tax Credits could provide large tax cuts to families at the bottom of the income scale, lessening the overall regressivity of state and local tax systems.

State Earned Income Tax Credits Support Families and Workers in 2025

September 11, 2025 • By Neva Butkus

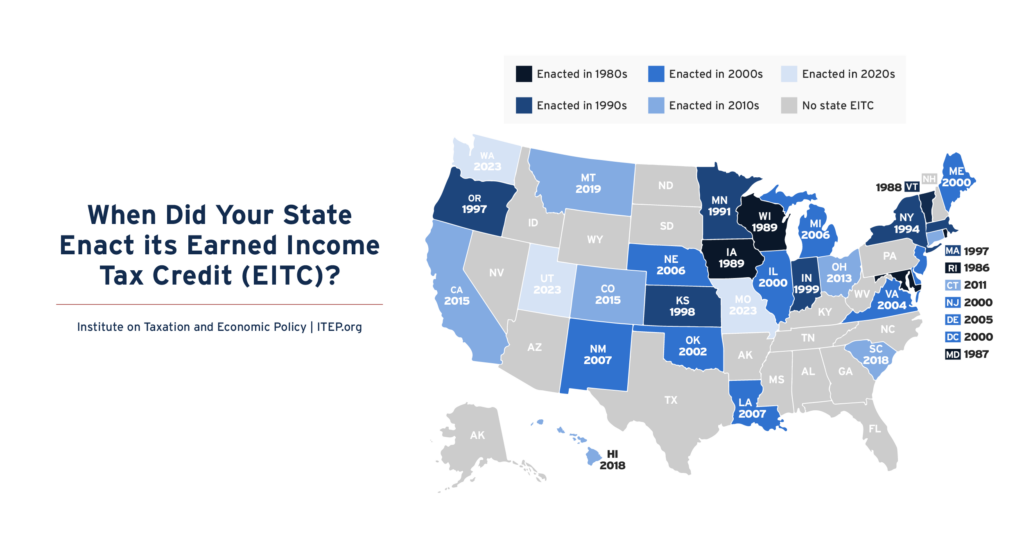

Nearly two-thirds of states now have an Earned Income Tax Credit (EITC). Momentum continues to build on these credits that boost low-paid workers’ incomes and offset some of the taxes they pay, helping lower-income families achieve greater economic security.

State Child Tax Credits Boosted Financial Security for Families and Children in 2025

September 11, 2025 • By Neva Butkus

Child Tax Credits (CTCs) are effective tools to bolster the economic security of low- and middle-income families and position the next generation for success.

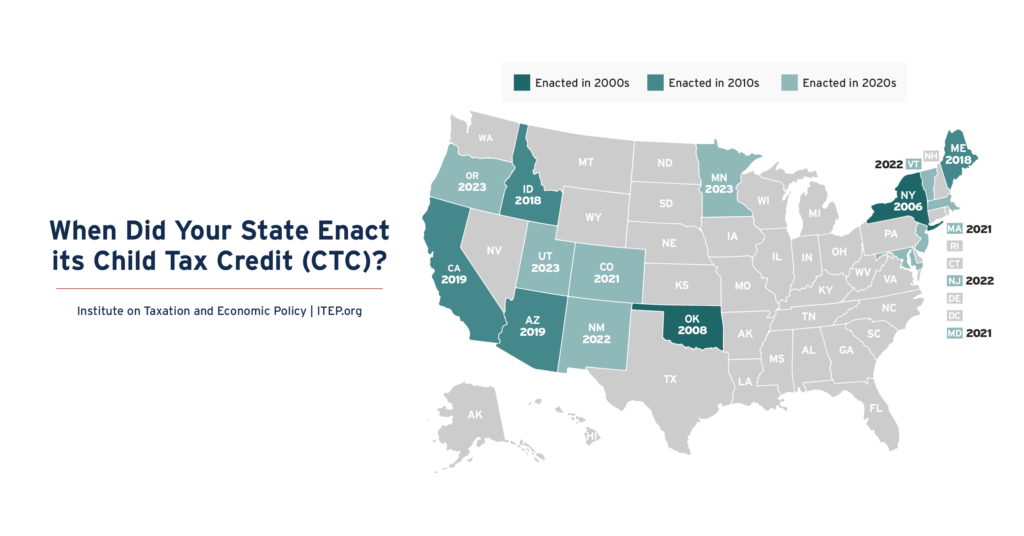

The Child Tax Credit (CTC) is an important tool to fight child poverty and help families make ends meet. When designed well, it can also make tax systems less regressive. As of 2020, only six states had CTCs. Today, 15 states have CTCs, with many credits exceeding $1,000 per qualifying child.

State Tax Action in 2025: Amid Uncertainty, Tax Cuts and New Revenue

July 28, 2025 • By Aidan Davis, Neva Butkus, Marco Guzman

Federal policy choices on tariffs, taxes, and spending cuts will be deeply felt by all states, which will have less money available to fund key priorities. This year some states raised revenue to ensure that their coffers were well-funded, some proceeded with warranted caution, and many others passed large regressive tax cuts that pile on to the massive tax cuts the wealthiest just received under the federal megabill.

The Earned Income Tax Credit (EITC) supports millions of workers and families and continues to grow in states and localities across the country. Today, 31 states plus the District of Columbia and Puerto Rico offer EITCs. Local EITCs can also now be found in Montgomery County, Maryland, New York City, and San Francisco, where they benefited 700,000 households in 2023.

A Well Targeted Federal Renter Credit Could Help Reduce Wealth Gaps

March 3, 2025 • By Brakeyshia Samms

While lawmakers often speak about income inequality, less attention is paid to wealth inequality. Wealth is distributed even more unequally than income in the U.S. in ways that reinforce racial divides, leave some households with too little to handle unexpected expenses, and enable some households to pass down enormous intergenerational wealth. A renter tax credit is one tool lawmakers can use to reduce wealth inequalities both within racial and ethnic groups and between these groups. As we show in our new analysis, Black and Hispanic households are more likely to be renters and hold less wealth than white households.

High-Rent, Low-Wealth: Addressing the Racial Wealth Gap through a Federal Renter Credit

March 3, 2025 • By Brakeyshia Samms, Emma Sifre, Joe Hughes

While the federal tax code has some policies focused on raising income of low earners, it contains fewer provisions designed specifically to address wealth inequality. A renter tax credit offers a simple, administratively practical means of reaching low-wealth populations through the federal tax code without requiring a comprehensive measurement of every household’s wealth.

In the face of immense uncertainty around looming federal tax and budget decisions, many of which could threaten state budgets, state lawmakers have an opportunity to show up for their constituents by raising and protecting the revenue needed to fund shared priorities. Lawmakers have a choice: advance tax policies that improve equity and help communities thrive, or push tax policies that disproportionately benefit the wealthy, drain funding for critical public services, and make it harder for most families to get ahead.

How Would the Harris and Trump Tax Plans Affect Different Income Groups?

October 23, 2024 • By Jon Whiten

Presidential candidates Kamala Harris and Donald Trump have put forward a wide range of different tax proposals during this year’s campaign. We have now fully analyzed the distributional impacts of the major proposals of both Vice President Harris and former President Trump in separate analyses. In all, the tax proposals announced by Harris would, on average, lead to a tax cut for all income groups except the richest 1 percent of Americans, while the proposals announced by Trump would, on average, lead to a tax increase for all income groups except the richest 5 percent of Americans.

Improving Refundable Tax Credits by Making Them Immigrant-Inclusive

July 17, 2024 • By Emma Sifre, Marco Guzman

Undocumented immigrants who work and pay taxes but don't have a valid Social Security number for either themselves or their children are excluded from federal EITC and CTC benefits. Fortunately, several states have stepped in to ensure undocumented immigrants are not left behind by the gaps in the federal EITC and CTC. State lawmakers should continue to ensure that immigrants who are otherwise eligible for these tax credits receive them.

Local Earned Income Tax Credits: How Localities Are Boosting Economic Security and Advancing Equity with EITCs

October 30, 2023 • By Andrew Boardman, Galen Hendricks, Kamolika Das

Leading localities are using refundable EITCs to boost incomes and reduce taxes for workers and families with low and moderate incomes. These local credits build on the success of EITCs at the federal and state levels, reduce economic hardship and improve the fairness of the tax code.

Deep Public Investment Changes Lives, Yet Too Many States Continue to Seek Tax Cuts

April 12, 2023 • By Aidan Davis

When state budgets are strong, lawmakers should put those revenues toward building a stronger and more inclusive society for the long haul. Yet, many state lawmakers have made clear that their top priority is repeatedly cutting taxes for the wealthy.

More Than One in Three Young Workers Would Benefit from EITC Reforms in Build Back Better Plan

February 8, 2022 • By Aidan Davis

Although the EITC expansion did not receive as much attention as the expanded Child Tax Credit, a new ITEP report shows the positive impact of allowing young workers without children in the home to maintain access to one of the nation’s most significant and effective anti-poverty programs.

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2021

October 21, 2021 • By Aidan Davis

The EITC benefits low-income people of all races and ethnicities. But it is particularly impactful in historically excluded Black and Hispanic communities where discrimination in the labor market, inequitable educational systems, and countless other inequities have relegated a disproportionate share of people to low-wage jobs.

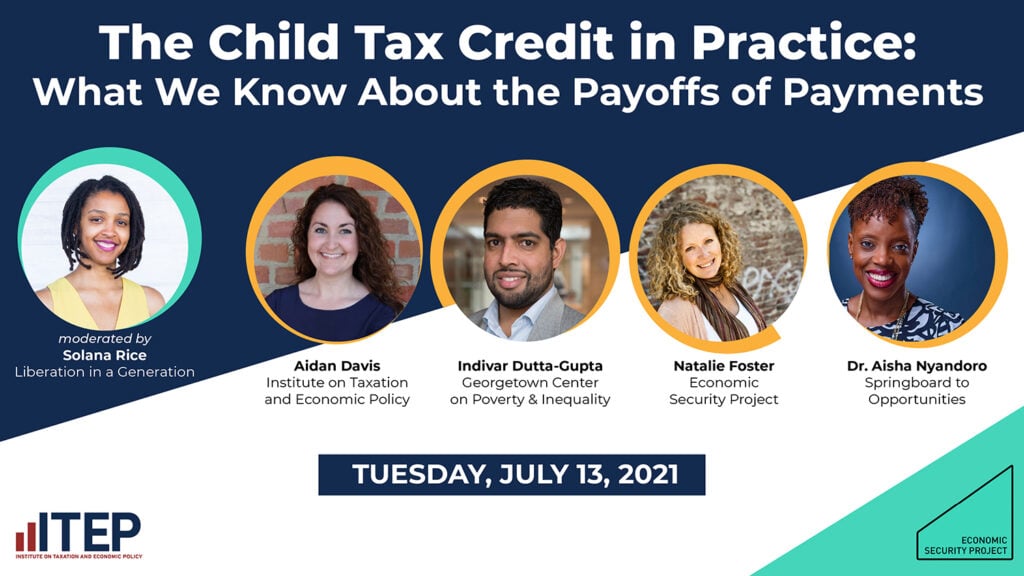

The Child Tax Credit in Practice: What We Know About the Payoffs of Payments (Webinar)

July 7, 2021 • By ITEP Staff

Join us for a discussion on why tax credits like the Child Tax Credit (CTC) expansion are good economic policy. You’ll hear from anti-poverty experts on why Congress should extend the policy beyond 2021 and what we can learn from an initiative providing low-income mothers in Jackson, Miss., $1,000 cash on a monthly basis, no strings attached. From theory to practice and what it means for American families, this CTC webinar will provide a unique angle through which to view this transformative policy.

A growing group of state lawmakers are recognizing the extent to which low- and middle-income Americans are struggling and the ways in which their state and local tax systems can do more to ensure the economic security of their residents over the long run. To that end, lawmakers across the country have made strides in enacting, increasing, or expanding tax credits that benefit low- and middle-income families. Here is a summary of those changes and a celebration of those successes.

Child Tax Credit Is a Critical Component of Biden Administration’s Recovery Package

June 11, 2021 • By Aidan Davis

Nearly one in seven children in the United States live in poverty and about 6 percent of all children live in deep poverty. President Joe Biden’s American Families Plan would tackle child poverty in an immediate, meaningful way. It is expected to extend the one-year Child Tax Credit (CTC) enhancements included in the March 2021 American Rescue Plan (ARP) through 2025. Next year alone, this would provide around a $110 billion collective income boost to roughly 88 percent of children in the United States.