Tax Credits for Workers and Families

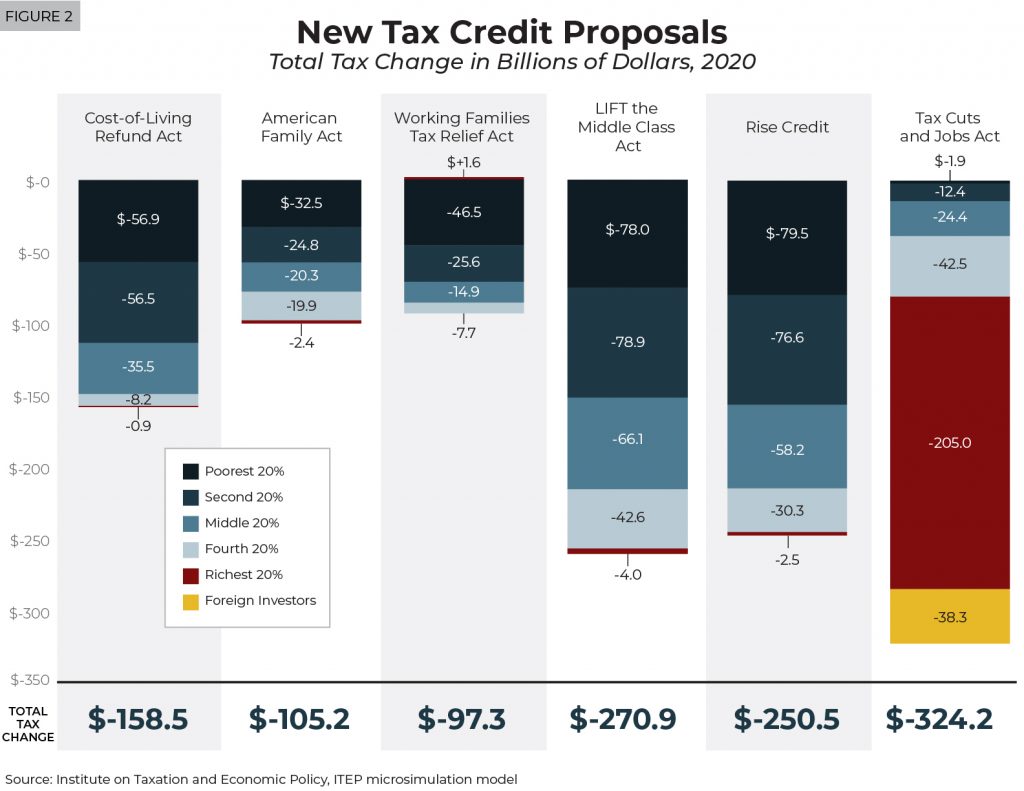

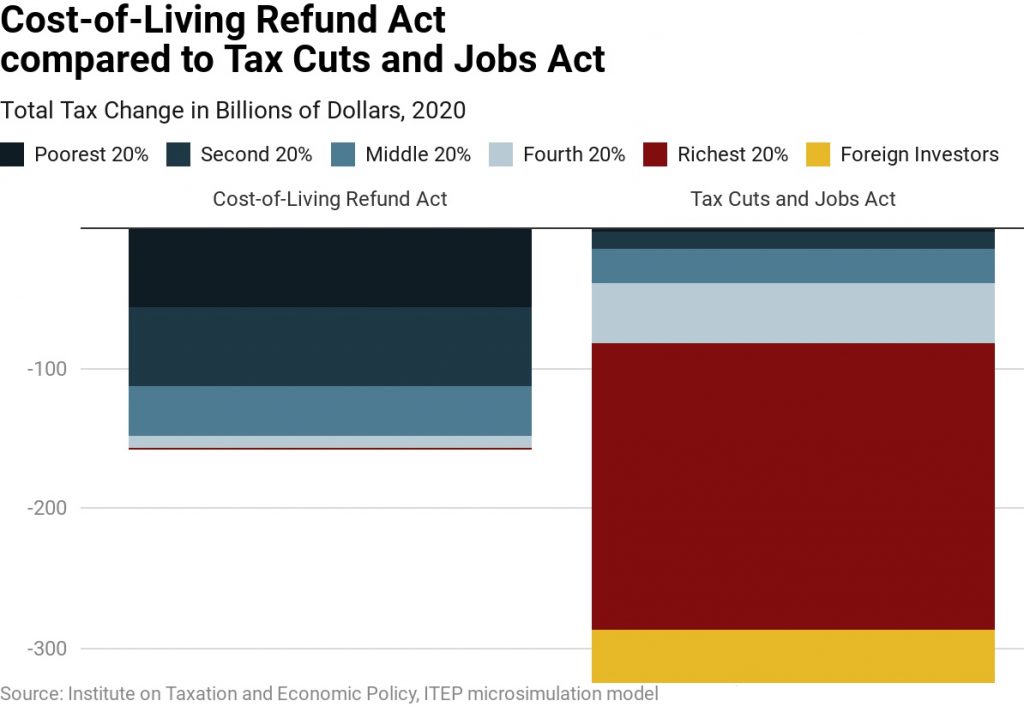

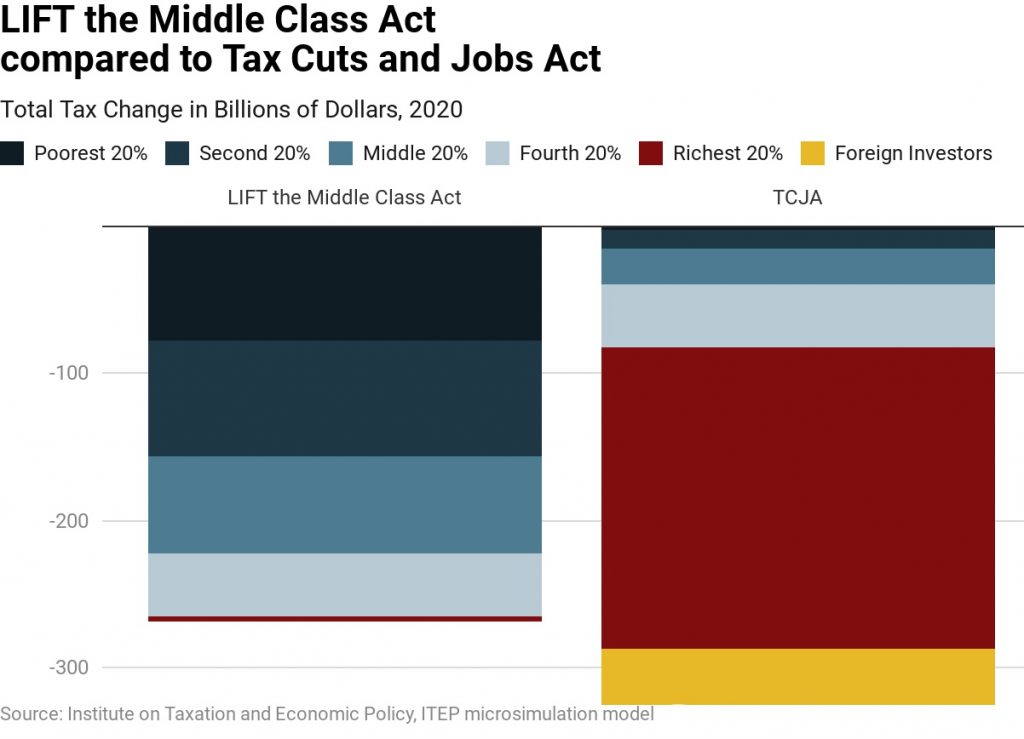

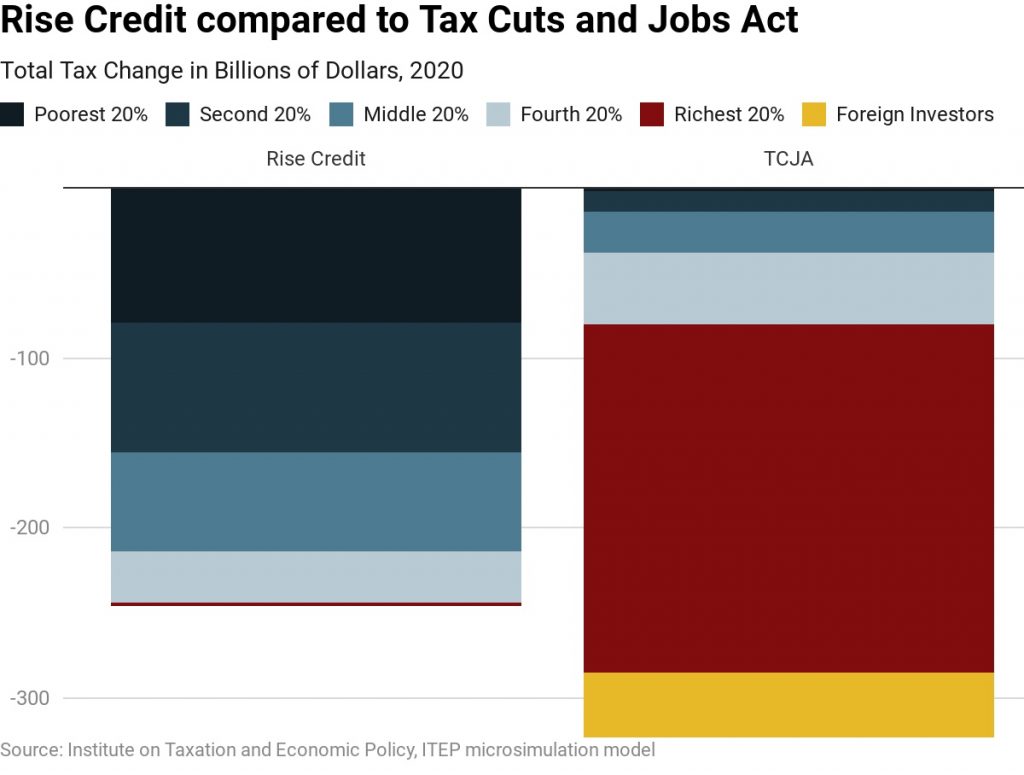

Federal lawmakers have recently announced at least five proposals to significantly expand existing tax credits or create new ones to benefit low- and moderate-income people. While these proposals vary a great deal and take different approaches, all would primarily benefit taxpayers who received only a small share of benefits from the Tax Cuts and Jobs Act.

The Cost-of-Living Refund Act would expand the Earned Income Tax Credit (EITC) for low- and moderate-income working people. The maximum EITC would nearly double for working families with children. Working people without children would receive an EITC that is nearly six times the size of the small EITC that they are allowed under current law.

The American Family Act would expand the Child Tax Credit (CTC) for low- and middle-income families. The CTC would increase from $2,000 under current law to $3,000 for each child age six and older and to $3,600 for each child younger than age six. The proposal removes limits on the refundable part of the credit so that low- and moderate-income families with children could receive the entire credit.

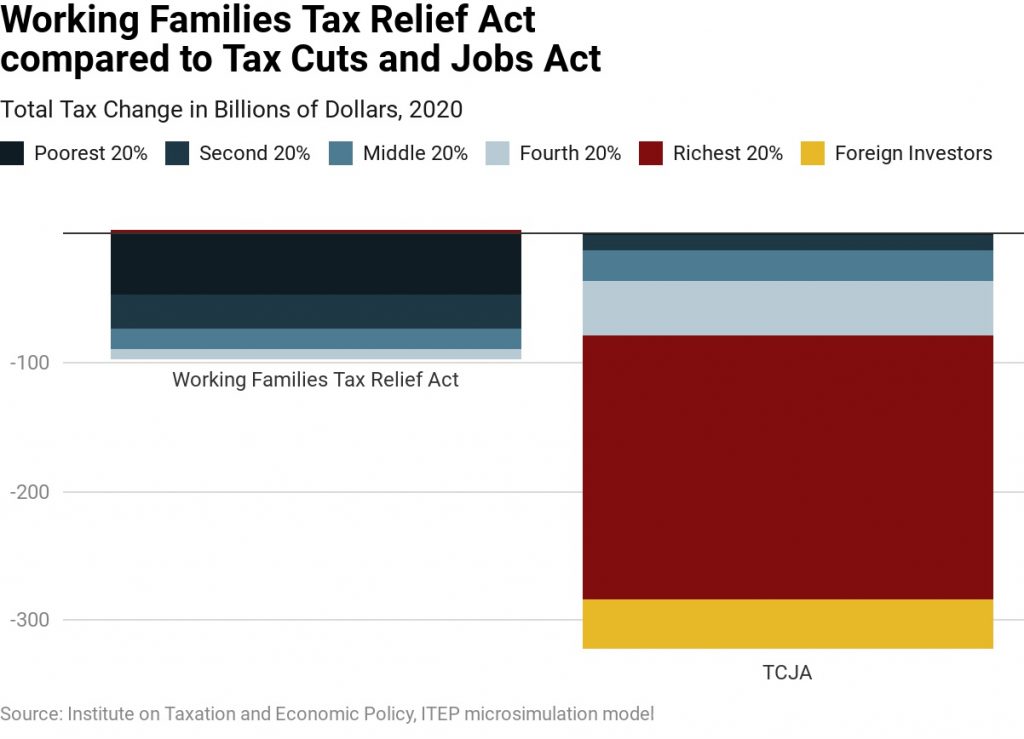

The Working Families Tax Relief Act would expand the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC) for low- and middle-income families.

The LIFT (Livable Incomes for Families Today) the Middle Class Act would create a new tax credit of up to $3,000 for single people and up to $6,000 for married couples, which would be an addition to existing tax credits. Eligible taxpayers would be allowed a credit equal to the maximum amount or their earnings, whichever is less. Income limits would prevent well-off households from receiving the credit.

The Rise Credit would replace the existing EITC. In most cases, the Rise Credit would be $4,000 for single people and $8,000 for married couples. Eligible taxpayers would be allowed a credit equal to the maximum amount or their earnings, whichever is less.

The Case for Extending State-Level Child Tax Credits to Those Left Out: A 50-State Analysis

April 17, 2019 • By Aidan Davis, Meg Wiehe

As of 2017, 11.5 million children in the United States were living in poverty. A national, fully-refundable Child Tax Credit (CTC) would effectively address persistently high child poverty rates at the national and state levels. The federal CTC in its current form falls short of achieving this goal due to its earnings requirement and lack of full refundability. Fortunately, states have options to make state-level improvements in the absence of federal policy change. A state-level CTC is a tool that states can employ to remedy inequalities created by the current structure of the federal CTC. State-level CTCs would significantly reduce…

The Working Families Tax Relief Act Would Boost Incomes and Economic Security for Workers and Children

April 10, 2019 • By Steve Wamhoff

Sens. Sherrod Brown, Michael Bennet, Richard Durbin, and Ron Wyden (along with the backing of most of the Democratic caucus in the Senate) today rolled out a new proposal to expand the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC). Called the Working Families Tax Relief Act (WFTRA), the proposal would provide a substantial benefit, especially to low-income working families.

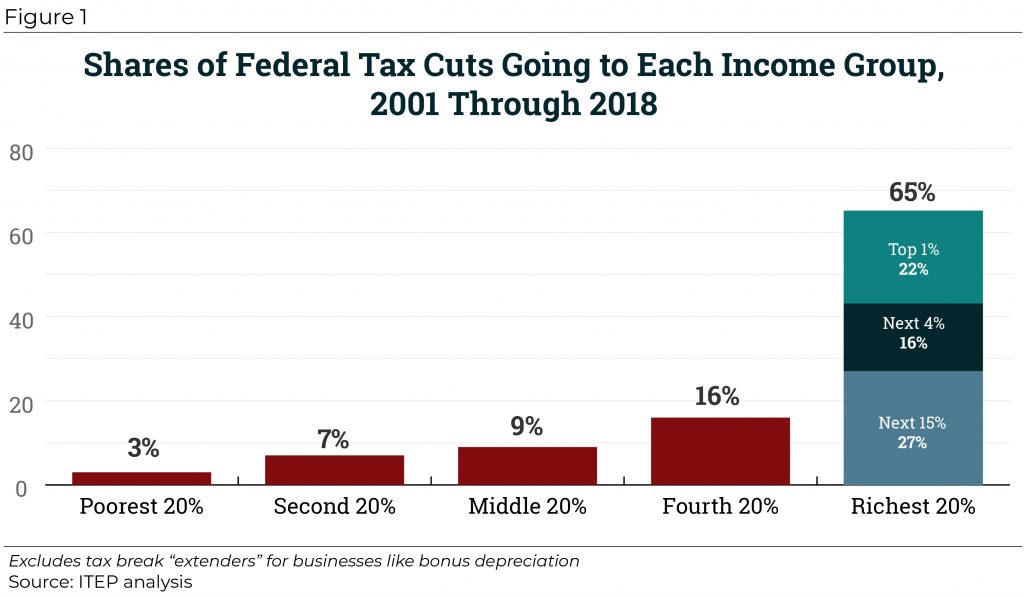

Since 2000, tax cuts have reduced federal revenue by trillions of dollars and disproportionately benefited well-off households. From 2001 through 2018, significant federal tax changes have reduced revenue by $5.1 trillion, with nearly two-thirds of that flowing to the richest fifth of Americans.

Teachers’ Strikes Are Emblematic of Larger Tax Challenges for States

March 30, 2018 • By Meg Wiehe

As other researchers as well as journalists have noted, teachers striking or threatening to strike over low wages and overall lack of investment isn’t simply a narrative about schools and public workers’ pay. It is illustrative of a broader conflict over tax laws and how states and local jurisdictions fund critical public services that range from K-12 education, public safety, roads and bridges, health care, parks, to higher education.

Trends We’re Watching in 2018, Part 3: Improvements to Tax Credits for Workers and Families

March 26, 2018 • By Aidan Davis

This has been a big year for state action on tax credits that support low-and moderate-income workers and families. And this makes sense given the bad hand low- and middle-income families were dealt under the recent Trump-GOP tax law, which provides most of its benefits to high-income households and wealthy investors. Many proposed changes are part of states’ broader reaction to the impact of the new federal law on state tax systems. Unfortunately, some of those proposals left much to be desired.

Federal Tax Law Will Have Mixed Effect on Taxpayers’ State Tax Bills and States’ Revenue

January 26, 2018 • By Meg Wiehe

Most states piggyback on federal law to some extent for their own taxes, especially personal and corporate income taxes. These states in particular must understand what the federal changes mean for their own tax codes and decide whether to remain “coupled” to changes in the tax bill, decouple from them or take other action in response.

Census Data Shows Importance of Refundable Tax Credits in Reducing Poverty, But Lawmakers Move to Restrict Them

September 12, 2017 • By Steve Wamhoff

The annual poverty data released by the Census Bureau today continues to show that federal refundable tax credits are the second most important anti-poverty program after Social Security. But this could change if the House Republicans have their way. The budget resolution approved by Republicans on the House Budget Committee in July would place new […]

Avocado Toast, iPhones, Billionairesplaining and the Trump Budget

May 30, 2017 • By Jenice Robinson

A couple weeks ago, a billionaire set the Internet ablaze when on 60 Minutes Australia he chided millennials to stop buying avocado toast and fancy coffee if they wanted to buy a home. The backlash was swift and deserved. Twenty- and early thirty-something people rightly took offense to the suggestion that they haven’t purchased homes […]

Two states are on the verge of embracing a tried and tested anti-poverty policy, the Earned Income Tax Credit (EITC). In the past two weeks, lawmakers in both Hawaii and Montana passed EITC legislation, which governors in both states are expected to sign. Once officially enacted, these states will join 26 other states and the […]

Rewarding Work Through State Earned Income Tax Credits

February 11, 2016 • By Aidan Davis, Lisa Christensen Gee, Meg Wiehe

See the 2016 Updated Brief Here Read the brief in a PDF here. that time, the EITC has been improved to lift and keep more working families out of poverty. The most recent improvements enhanced the credit for families with three or more children and for married couples. First enacted temporarily as part of the […]