Tennessee

State Rundown 3/19: Spring Is Here but States Brace for Long Winter

March 19, 2020 • By ITEP Staff

As the COVID-19 pandemic continues to disrupt more and more aspects of life and cause greater and greater harms to public health and the economy, information is changing by the hour. State policymakers, if they are even able to convene, are wholly focused on how to respond to the crisis. The pandemic is certain to pose a series of fiscal challenges for states and their economies, and this week’s Rundown focuses on the most helpful resources and the latest state-by-state updates available.

This weekend’s Leap Day should be a welcome extra day for state lawmakers, advocates, and observers who care about tax and budget policy, as there is an overflow of proposals and information to digest. Most importantly, as emphasized in our “What We’re Reading” section, there are never enough days in a month to do justice to the importance of Black History Month and Black Futures Month. In state-specific debates, Oregon and Washington leaders are hoping to take a leap forward in raising funds for homelessness and housing affordability measures. Lawmakers in West Virginia and Wisconsin could use a day to…

State Rundown 2/20: Property Taxes and School Finance Take Center Stage

February 20, 2020 • By ITEP Staff

Property taxes and education funding are a major focus in state fiscal debates this week. California voters will soon vote on borrowing billions of dollars to fill just part of the funding hole created in large part by 1978’s anti-property-tax Proposition 13. Nebraska lawmakers are debating major school finance changes that some fear will create similar long-term fiscal issues. And Idaho and South Dakota leaders are looking to avoid that fate by reducing property taxes in ways that will target the families who most need the help. Meanwhile, Arkansas, Nevada, and New Hampshire are taking close looks at their transportation…

State Rundown 2/13: What’s Trendy in State Tax Debates This Year

February 13, 2020 • By ITEP Staff

We wrote earlier this week about Trends We’re Watching in 2020, and this week’s Rundown includes news on several of those trends. Maine lawmakers are considering a refundable credit for caregivers. Efforts to tax high-income households made news in Maryland, Oregon, and Washington. Grocery taxes are receiving scrutiny in Alabama, Idaho, and Tennessee. Tax cuts or shifts are being discussed in Arizona, Nebraska, and West Virginia. And Arizona, Maryland, and Nevada continue to seek funding solutions for K-12 education as Alaska and Virginia do the same for transportation infrastructure.

State lawmakers have plenty to keep them busy on the tax policy front in 2020. Encouraging trends we’re watching this year include opportunities to enact and enhance refundable tax credits and increase the tax contributions of high-income households, each of which would improve tax equity and help to reduce income inequality.

State Rundown 1/30: Flip-Flops and Steady Marches in State Tax Debates

January 30, 2020 • By ITEP Staff

State tax and budget debates can turn on a dime sometimes, as in Utah this past week, where lawmakers unanimously repealed a tax package they had just approved in a special session last month. Delaware lawmakers are hoping to avoid the similarly abrupt end to their last effort to improve their Earned Income Tax Credit (EITC) by crafting a bill that Gov. John Carney will have no reason to unexpectedly veto as he did two years ago. But at other times, these debates just can’t change fast enough, as in New Hampshire and Virginia, where leaders are searching for revenue to address long-standing transportation needs, and in Hawaii, Nebraska, and North Carolina, where education funding issues remain painfully unresolved.

This week as Americans celebrate Martin Luther King Jr.’s messages of resisting oppression and fighting for progress, state policymakers can look to some bright spots where tax and budget debates are bending toward justice. Among those highlights, Hawaii leaders are considering improvements to minimum wage policy, early childhood education, and affordable housing; Kansas Gov. Laura Kelly is seeking to reduce sales taxes applied to food and restore the state’s grocery tax credit; and advocates in Connecticut and Maryland are pushing for meaningful progressive tax reforms.

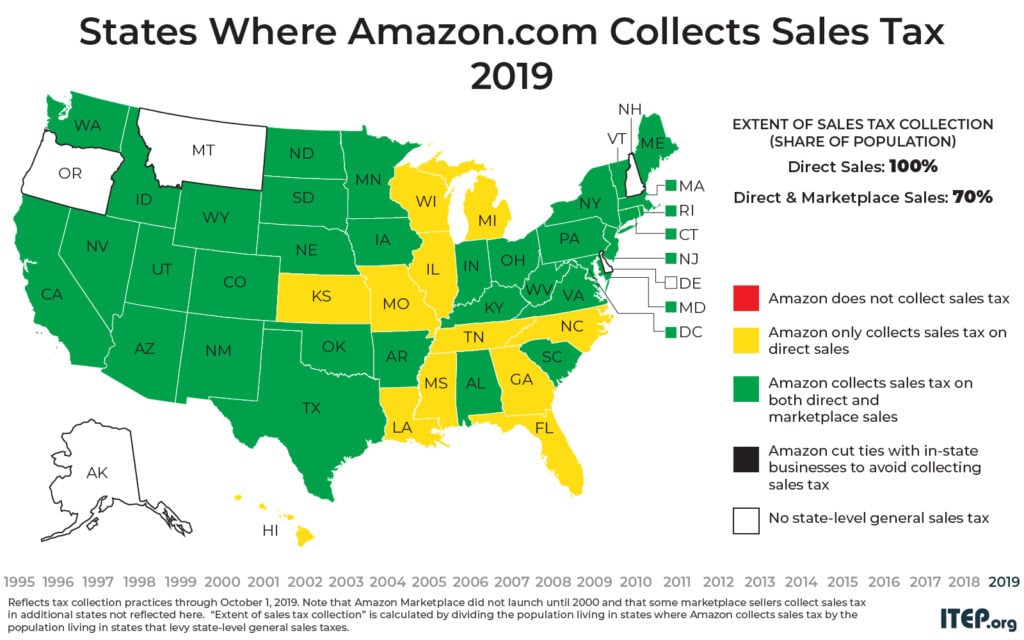

A Lump of Coal for 12 States Not Collecting Marketplace Sales Taxes this Holiday Season

November 25, 2019 • By Carl Davis

The last few years have brought major improvements in how states enforce their sales tax laws on purchases made over the Internet. Less than a decade ago, e-retailers almost never collected the sales taxes owed by their customers. The result was a multi-billion dollar drain on state coffers and a competitive disadvantage for local businesses. But this holiday season looks a bit different.

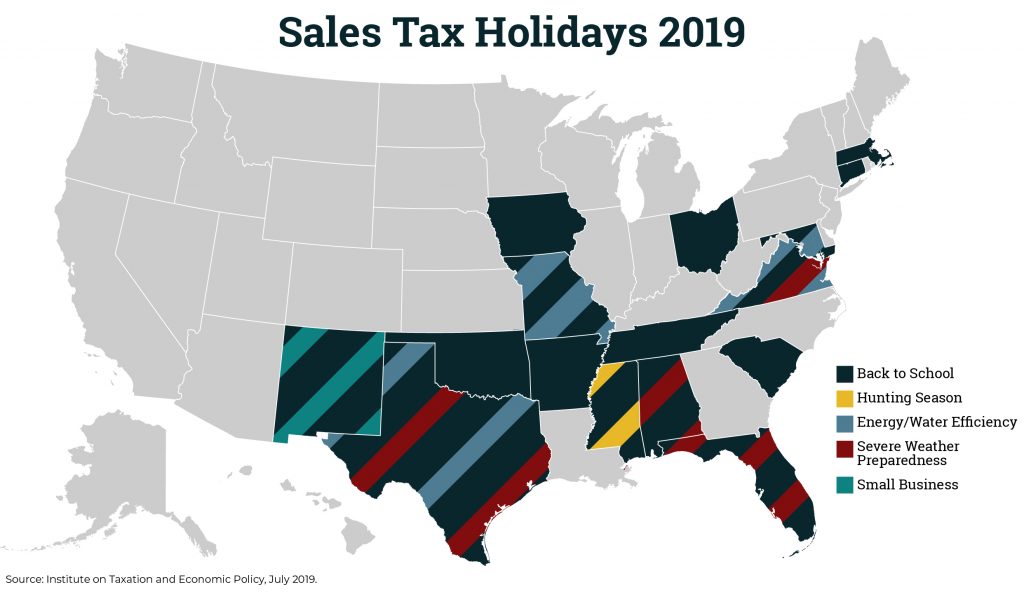

WPEC: Retailers Ready for Back-to-School Tax ‘Holiday’

July 31, 2019

But not everyone is sold on the value of sales-tax holidays. The Washington, D.C.-based Institute on Taxation and Economic Policy, a non-profit liberal think tank, calls such holidays an “outdated gimmick.” Dylan Grundman, a senior policy analyst for the institute, argued in a news release that the brief holiday periods don’t reduce taxes for low- […]

Chattanooga Times Free-Press: Yet Again, Tennessee Combined State, Local Sales Tax Rates Nation’s Highest

July 27, 2019

While the sales tax is the workhorse of Tennessee’s budget, it’s also seen by critics as a “regressive tax” in that it takes a larger percentage of income from the pockets of lower-income and, some say, middle-income earners than those with higher incomes. Heavy reliance on the sales tax has thrust Tennessee into the No. […]

New York Times: State and Local Taxes Are Worsening Inequality

July 21, 2019

Low-income households in Illinois pay about 14 cents in state and local taxes from every dollar of income, while the state’s most affluent households pay about 7 cents per dollar. That gap between the poor and the wealthy in Illinois is one of the largest in any state, but the poor pay taxes at higher […]

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 17, 2019 • By Dylan Grundman O'Neill

Lawmakers in many states have enacted “sales tax holidays” (16 states will hold them in 2019), to provide a temporary break on paying the tax on purchases of clothing, school supplies, and other items. While these holidays may seem to lessen the regressive impacts of the sales tax, their benefits are minimal. This policy brief looks at sales tax holidays as a tax reduction device.

Sales Tax Holidays Are Outdated Gimmicks That Have Run Their Course

July 17, 2019 • By ITEP Staff

Just as the very first sales tax holiday for car sales did not fix the auto industry’s challenges, providing consumers a temporary reprieve on sales tax will not address families’ pocketbook concerns.

Travelers in 12 States Will Pay More in Gas Taxes Beginning Monday

June 27, 2019 • By Carl Davis

Drivers in 12 states who hit the road during this summer driving season will be paying more in gas tax beginning Monday, July 1. While the federal gas tax has remained stagnant for nearly 26 years, many states have stepped up and increased their taxes so they can raise revenue to fund infrastructure and other projects. California, Indiana, Maryland, Michigan, Montana, Nebraska, Ohio, Rhode Island, South Carolina, Tennessee and Vermont all will raise their gas taxes.

Gas Taxes Rise in a Dozen States, Including an Historic Increase in Illinois

June 27, 2019 • By Carl Davis

On July 1, 12 states will boost their gasoline taxes and 11 will boost their diesel taxes. The reasons for these increases vary, but they’re generally intended to fund maintenance and improvement of our nation’s transportation infrastructure–a job at which Congress has not excelled in recent years.

Ohio now enjoys the distinction of being the 30th state to raise or reform its gas tax this decade, and the third state to do so this year, under a bill signed into law by Gov. Mike DeWine. While state tax policy can be a contentious topic, there has been a remarkable level of agreement on the gasoline tax. Increasingly, state lawmakers are deciding that outdated gas taxes need to be raised and reformed to fund infrastructure projects that are vital to their economies. These actions are helping reverse losses in gas tax purchasing power caused by rising construction costs…

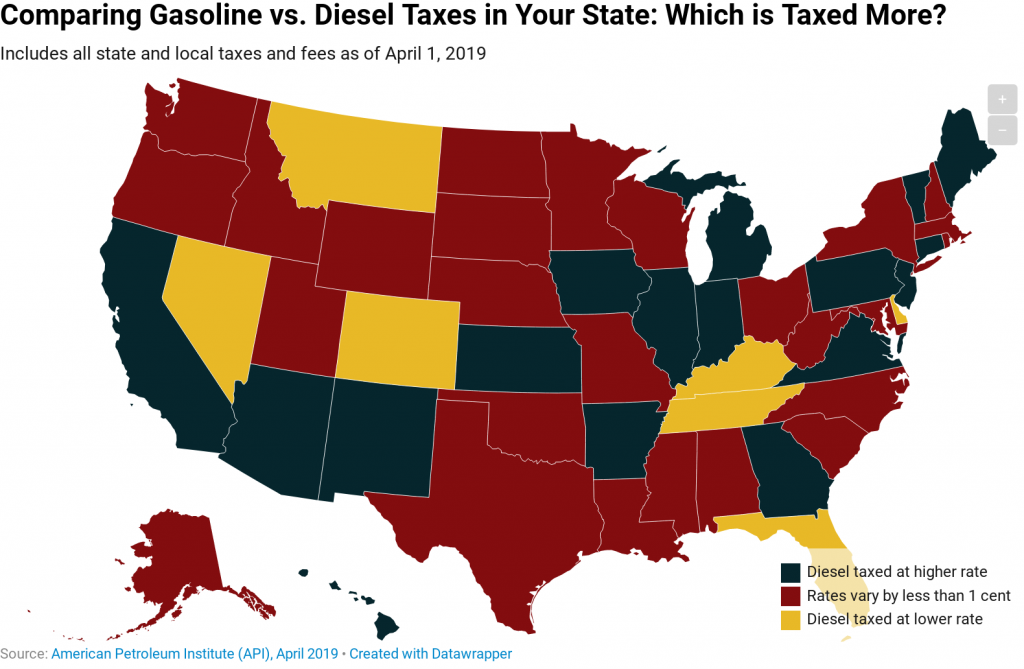

Twenty-six states and the District of Columbia tax these two fuel types at the same rate or very similar rates, as of April 2019, according to data from the American Petroleum Institute.

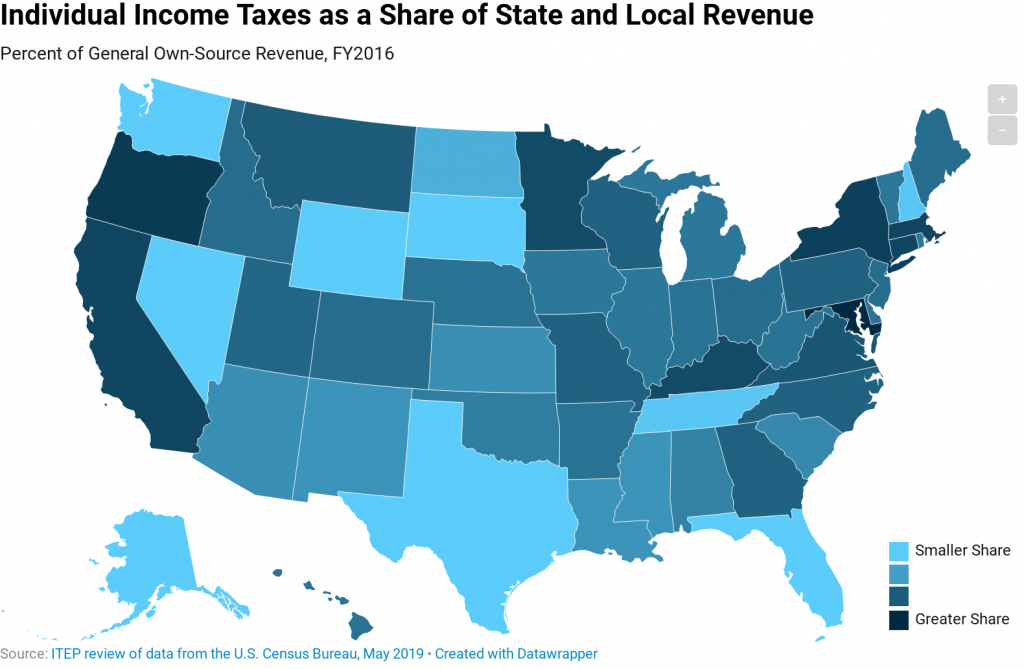

Income taxes vary considerably in their structure across states, though the best taxes are fine-tuned to taxpayers’ ability-to-pay.

The Case for Extending State-Level Child Tax Credits to Those Left Out: A 50-State Analysis

April 17, 2019 • By Aidan Davis, Meg Wiehe

As of 2017, 11.5 million children in the United States were living in poverty. A national, fully-refundable Child Tax Credit (CTC) would effectively address persistently high child poverty rates at the national and state levels. The federal CTC in its current form falls short of achieving this goal due to its earnings requirement and lack of full refundability. Fortunately, states have options to make state-level improvements in the absence of federal policy change. A state-level CTC is a tool that states can employ to remedy inequalities created by the current structure of the federal CTC. State-level CTCs would significantly reduce…

State Rundown 3/6: March Tax Debates Contain Sanity Amid Usual Madness

March 6, 2019 • By ITEP Staff

State policymakers around the nation this week served up a handful of harmful and upside-down tax proposals, but these were refreshingly outnumbered by sound tax and budget policy proposals in several other states. NEW JERSEY Gov. Phil Murphy made tax fairness an explicit priority in his budget address, the NEW MEXICO House passed progressive reforms to improve the state’s schools and tax code, states such as VERMONT are looking to raise funds from legalized cannabis and put it to good use, and many states, including ALABAMA, ARKANSAS, OHIO, and WISCONSIN, are seriously considering much-needed gas tax updates to improve their…

Fairness Matters: A Chart Book on Who Pays State and Local Taxes

March 6, 2019 • By ITEP Staff

There is significant room for improvement in state and local tax codes. State tax codes are filled with top-heavy exemptions and deductions and often fail to tax higher incomes at higher rates. States and localities have come to rely too heavily on regressive sales taxes that fail to reflect the modern economy. And overall tax collections are often inadequate in the short-run and unsustainable in the long-run. These types of shortcomings provide compelling reason to pursue state and local tax reforms to make these systems more equitable, adequate, and sustainable.

State Rundown 1/24: States Reflect on MLK’s Dream and Teacher Uprisings

January 24, 2019 • By ITEP Staff

This week, as Americans in every state celebrated Martin Luther King Jr. Day and reflected on his dream of peaceful protest and racial and economic justice, many eyes were on the teachers’ strike pressing for parts of this dream amid the “curvaceous slopes of California.” Governors and lawmakers in many states—including Arizona, Georgia, Indiana, Louisiana, Nevada, New Mexico, South Carolina, and Wisconsin—discussed ways to raise pay for teachers and/or enhance education investments generally.

State Rundown 1/10: States Should Resolve to Pursue Equitable Tax Options

January 10, 2019 • By ITEP Staff

This week we released a handy guide of policy options for Moving Toward More Equitable State Tax Systems, and are pleased to report that many state lawmakers are promoting policies that are in line with our recommendations. For example, Puerto Rico lawmakers recently enacted a targeted EITC-like credit for working families, and leaders in Virginia and elsewhere are working toward similar improvements. Arkansas residents also saw their tax code improve as laws reducing regressive consumption taxes and enhancing income tax progressivity just went into effect. And there is still time for governors and legislators pushing for regressive income tax cuts…

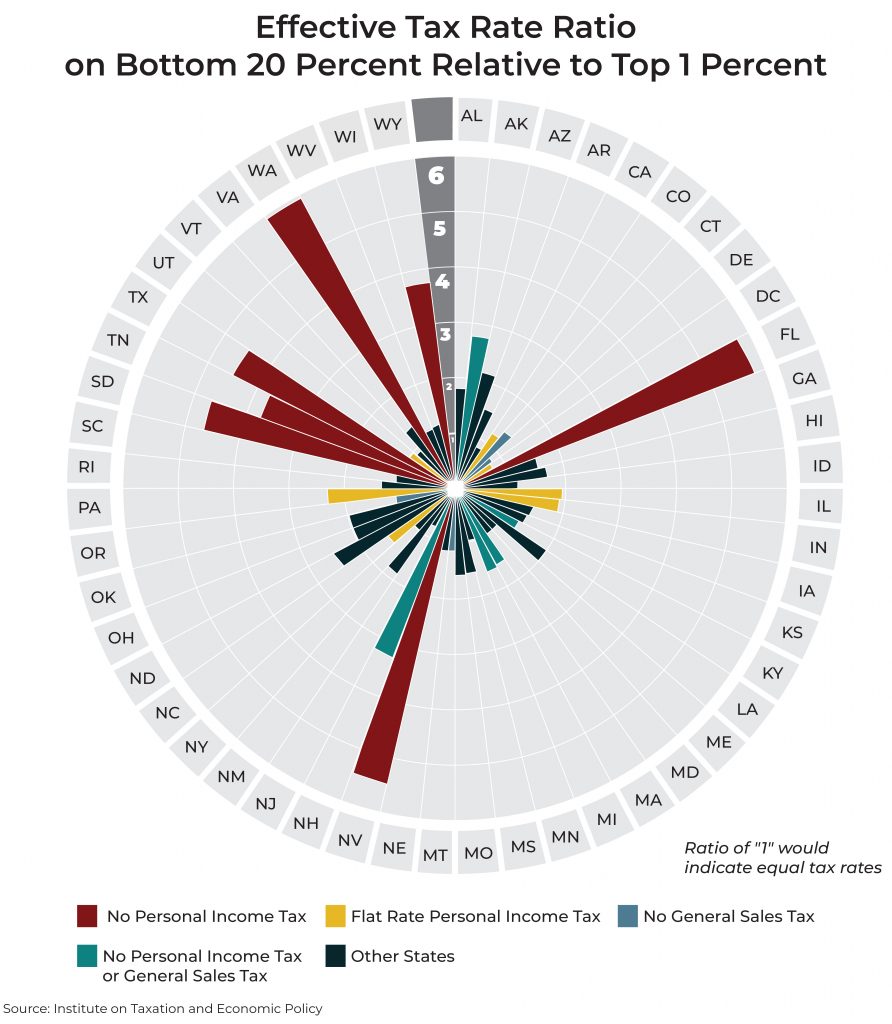

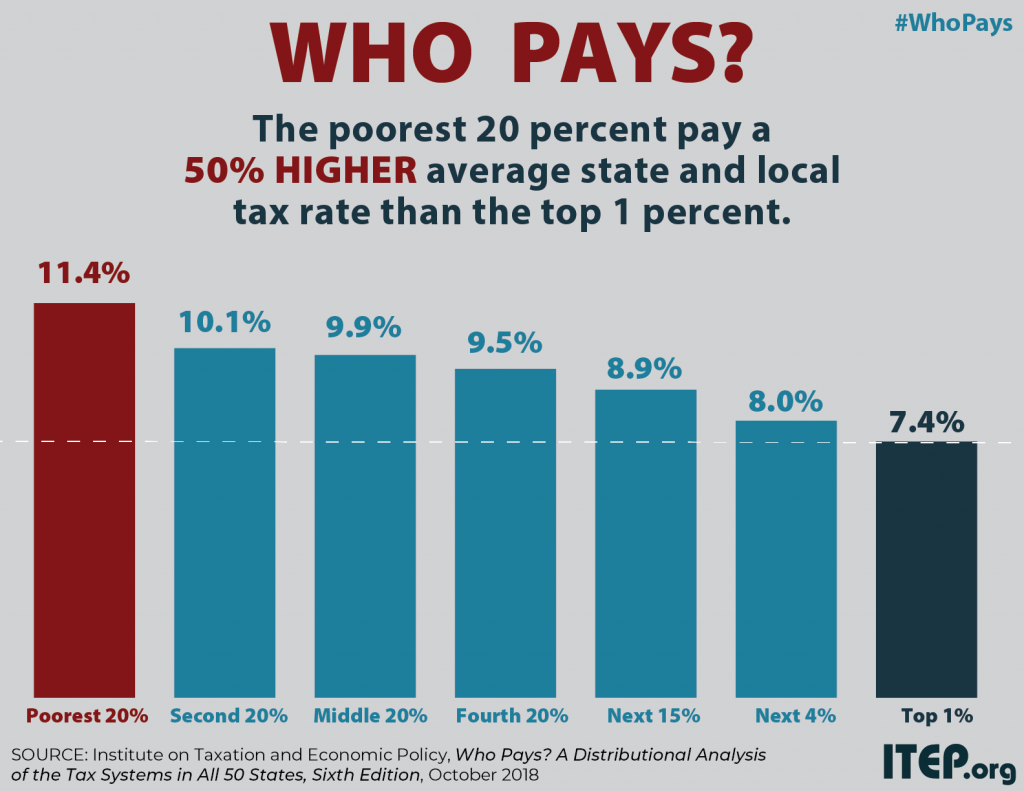

Poorest 20 Percent Pays a 50 Percent Higher Effective State and Local Tax Rate than the Top 1 Percent

October 17, 2018 • By ITEP Staff

A comprehensive 50-state study released today by the Institute on Taxation and Economic Policy (ITEP) finds that most state and local tax systems tax low- and middle-income households at significantly higher rates than wealthy taxpayers, with the lowest-income households paying an average of 50 percent more of their income in taxes than the very rich.

New Report Finds that Upside-down State and Local Tax Systems Persist, Contributing to Inequality in Most States

October 17, 2018 • By Aidan Davis

State and local tax systems in 45 states worsen income inequality by making incomes more unequal after taxes. The worst among these are identified in ITEP’s Terrible 10. Washington, Texas, Florida, South Dakota, Nevada, Tennessee, Pennsylvania, Illinois, Oklahoma, and Wyoming hold the dubious honor of having the most regressive state and local tax systems in the nation. These states ask far more of their lower- and middle-income residents than of their wealthiest taxpayers.