Washington

Action (lack thereof) on Economic Aid Reflects Longstanding Anti-Government Agenda

August 14, 2020 • By Amy Hanauer

The biggest danger we face right now is that politicians will fail to get this health crisis under control and Americans will continue to die. The second biggest danger is that elected officials will fail to help families and communities, leading to foreclosures, evictions, and impoverishment—and also torpedoing the economy. With their inaction this week, the Senate seems determined to do both. Hold on everyone, we’re in for a sickening ride.

The Center Square: Washington clearing backlogged unemployment claims as jobless residents set to see end to pandemic assistance

August 4, 2020

A 2018 study from the Institute on Taxation and Economic Policy further found Washington to have the most regressive tax system in the country. Washington workers in the bottom 20th percentile can pay up to six times more in taxes as their wealthier peers because of how the state’s high gas and sales taxes disproportionately hits […]

Politico Morning Tax: Another View

July 27, 2020

Meg Wiehe of the liberal Institute on Taxation and Economic Policy noted that most states, with just a couple of exceptions, have budgets lined up for fiscal 2021 — but added that she expects most or all of them will have to take another look at those budgets in the fall or winter once they […]

As ITEP analyst Kamolika Das wrote today, July 1 is typically the beginning of state fiscal years and “a point when one can take a step back and reflect on the wins and disappointments of the past state legislative sessions.” Not so in 2020, she writes, as uncertainty surrounding the virus, state revenues, and potential federal action give state lawmakers no such time to relax and reflect. Although most recent state actions, such as those covered below in California, Mississippi, and West Virginia, have focused on funding cuts and temporary measures to bring budgets into short-term balance, the need for…

State Rundown 6/18: States Work to “Finalize” Budgets in Uncertain Times

June 18, 2020 • By ITEP Staff

Despite uncertainty all around the nation, a few states passed budgets this week and many more are negotiating to enact theirs before fiscal years close at the end of June. Colorado notably pared back some of its own tax breaks and limited the potential damage on its budget from new federal breaks. California also passed a budget but few in the state actually think the dealing is done. Iowa quietly enacted its budget too, though advocates in the state are making noise about non-fiscal bills that were added late in the game.

Crain’s New York Business: Legalizing Marijuana Can’t Cure Inequality, But It Will Ease Budget Crisis

June 14, 2020

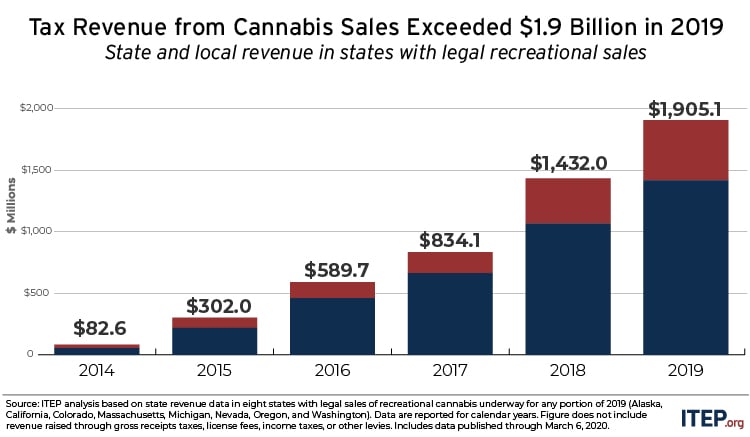

My methodology is informed by the work of Carl Davis, research director at the Institute on Taxation and Economic Policy, who recently published a thoughtful blog post on per-capita cannabis excise tax collections. Davis found that last year more than $1.9 billion of tax revenue was collected across seven adult-use states (Alaska, California, Colorado, Massachusetts, Nevada, Oregon, […]

As calls to defund the police demonstrate, state and local decisions about funding priorities and how those funds are raised are deeply embedded in racial justice issues. Tax justice is also a key component in advancing racial justice. Racial wealth disparities are the result of countless historic inequities and tax policy choices are certainly among […]

State Rundown 5/27: Some States Finally Talking Revenue Solutions to Revenue Crisis

May 27, 2020 • By ITEP Staff

This week the immense scale and uneven distribution of economic and health damage from the COVID-19 pandemic continued to come into focus, hand in hand with greater clarity around pandemic-related revenue losses threatening state and local revenues and the priorities—such as health care, education, and public safety—they fund. Officials in many states, including Ohio and Tennessee, nonetheless rushed to declare their unwillingness to be part of any solution that includes raising the tax contributions of their highest-income residents. On the brighter side, some leaders are willing to do just that, for example through progressive tax increases proposed in New York…

Washington State Budget and Policy Center: It’s time to include undocumented immigrants in state response to COVID-19

May 21, 2020

In addition to state and local taxes, new estimates show that the labor of undocumented workers in Washington state has resulted in nearly $400 million of contributions to the state and federal unemployment trust fund over the past ten years. Yet these workers are systematically denied protection when they become unemployed. Read more

A bipartisan group of governors and senators from Louisiana to Maryland to Ohio have called for at least $500 billion in state and local fiscal relief. They also need specific help with testing, protective equipment, unemployment costs, Medicaid costs, social services, education and infrastructure. States can’t be on their own as they address the double whammy of plunging revenue and skyrocketing needs.

Pandemic Profits: Netflix’s Record Profit Haul, Past Tax Avoidance Raise Questions about Tax Law’s Weaknesses

April 29, 2020 • By Matthew Gardner

At a time when many companies are facing existential threats due to the COVID-19 pandemic and associated economic shutdown, it is vital to ensure that our corporate tax laws apply fairly to companies that are still turning a profit in these turbulent times.

The Washington Post: Why Paying off Your Mortgage Early Makes Sense

April 24, 2020

The number of homeowners who benefit from the mortgage tax break plummeted following the passage of the 2017 Tax Cuts and Jobs Act, which nearly doubled the standard deduction, with the result that fewer taxpayers itemized deductions on their tax returns. The tax law reduced the share of taxpayers claiming the mortgage-interest deduction from 23% […]

To Avoid the CARES Act’s Flaws, Invest in Automatic Relief

April 23, 2020 • By Jessica Schieder

With adequate automatic stabilizers, the United States might not end up with economic relief bills that have provisions tucked in them mostly helping millionaires, as we learned was the case with a CARES Act provision suspending limits on business losses. And regular people could get help more quickly, blunting the economic downturn.

Pot Sector Cut Off From Federal Pandemic Loans, Turns to States

April 14, 2020

Pot has boosted state tax revenues in recent years, funding core state initiatives from education to infrastructure to health care. California collected about $629 million in taxes on cannabis in 2019. Washington raised more tax revenue than any other state in 2019, about $67 per person, according to a study by the Institute on Taxation […]

Bloomberg: Pot, Liquor ‘Essential’ to Keep Up Spirits, Revenue During Virus

April 10, 2020

The state of Washington raised the most cannabis tax revenue last year—$67.31 per person, according to the Institute on Taxation and Economic Policy. That compares with $60.11 per person raised in Colorado, $53.50 in Nevada, $38.83 in Alaska, $31.75 in Oregon, $15.93 in California, and $12.92 in Massachusetts, the institute said. Read more

Sales Taxes and Social Distancing: State and Local Governments May Face Their Steepest Sales Tax Decline Ever

April 2, 2020 • By Carl Davis, ITEP Staff, Meg Wiehe

One pressing question is what will an economic downturn in which consumers are anxious, facing job loss, or simply spending their time sheltering in place and not spending money in typical ways, mean for states’ ability to raise revenue?

Bloomberg:Billion-Dollar Blows to U.S. States Crater Spending Plans

April 1, 2020

At least 38 states and territories have issued some version of a stay-at-home order, shuttering parts of the economy as residents stay inside and restaurants and stores close. The result may be the steepest drop in sales taxes ever, according to the Institute on Taxation and Economic Policy, a left-leaning think tank. States like Florida, […]

New York Times: Trump’s Payroll Tax Cut Would Dwarf the 2008 Bank Bailout

March 12, 2020

The largest gains in dollar figures would go to households earning more than $123,000 a year, according to an analysis by the Institute on Taxation and Economic Policy in Washington. Read more

Washington Examiner: In cutting payroll taxes to spur the economy, Trump would be following in Obama’s footsteps

March 12, 2020

The Institute on Taxation and Economic Policy, a left-of-center nonpartisan tax policy organization, found that Obama’s payroll tax cut didn’t benefit the lower and middle class very well. The study showed that the portion of the payroll tax cut that went to the richest 20% of households was 47% in 2011 and 46% in 2012. […]

State Rundown 3/11: Georgia Bucks Trend of Cautious Policymaking Amid Crises

March 11, 2020 • By ITEP Staff

With all eyes on the potential effects of the oil price war and COVID-19 coronavirus on lives, communities, and economies, Georgia House lawmakers this week crammed through a regressive and costly tax cut for the rich with essentially no debate, information, or transparency. Most states are proceeding much more responsibly, assessing the ramifications for their service provision needs and revenues to fund those needs.

State and Local Cannabis Tax Revenue Jumps 33%, Surpassing $1.9 Billion in 2019

March 10, 2020 • By Carl Davis

Excise and sales taxes on cannabis raised more than $1.9 billion in 2019. This represents a jump of nearly half a billion dollars, or 33 percent, compared to a year earlier. These are the findings of an ITEP analysis of newly released tax revenue data from the eight states where legal sales of adult-use cannabis took place last year.

Washington Post: Virginia General Assembly approves higher gas tax, speed cameras and cellphone ban

March 8, 2020

Virginia joins 31 states that have raised their gas taxes or changed formulas for them in the past decade, responding to declines in revenue, according to the nonprofit Institute on Taxation and Economic Policy. Twenty-two states have variable-rate taxes to guard against inflation. Read more

State Rundown 3/4: Sun Shining on Progressive Tax Efforts This Week

March 4, 2020 • By ITEP Staff

Wisconsin’s expansion of a capital gains tax break for high-income households represents a dark spot on this week’s state fiscal news, and the growing threat of COVID-19 is casting an ominous shadow over all of it, but otherwise the picture is pleasantly sunny, featuring small steps forward for sound, progressive tax policy. An initiative to create a graduated income tax in Illinois, for example, got a vote of confidence from a major ratings agency, while a similar effort went public in Michigan and two progressive income tax improvements were debated in Rhode Island. Gas tax updates made encouraging progress in…

This weekend’s Leap Day should be a welcome extra day for state lawmakers, advocates, and observers who care about tax and budget policy, as there is an overflow of proposals and information to digest. Most importantly, as emphasized in our “What We’re Reading” section, there are never enough days in a month to do justice to the importance of Black History Month and Black Futures Month. In state-specific debates, Oregon and Washington leaders are hoping to take a leap forward in raising funds for homelessness and housing affordability measures. Lawmakers in West Virginia and Wisconsin could use a day to…

Tax Cuts Floated by White House Advisors Are an Attempt to Deflect from TCJA’s Failings

February 21, 2020 • By ITEP Staff, Jenice Robinson, Steve Wamhoff

Now that multiple data points reveal the current administration, which promised to look out for the common man, is, in fact, presiding over an upward redistribution of wealth, the public is being treated to pasta policymaking in which advisors are conducting informal public opinion polling by throwing tax-cut ideas against the wall to see if any stick. But the intent behind these ideas is as transparent as a glass noodle.