West Virginia

State Rundown 6/14: Some States Wrapping Up Tax Debates, Others Looking Ahead to Next Round

June 14, 2017 • By ITEP Staff

This week lawmakers in California and Nevada resolved significant tax debates, while budget and tax wrangling continued in West Virginia, and structural revenue shortfalls were revealed in Iowa and Pennsylvania. Airbnb increased the number of states in which it collects state-level taxes to 21. We also share interesting reads on state fiscal uncertainty, the tax experiences of Alaska and Wyoming, the future of taxing robots, and more!

This week, we celebrate a victory in Kansas where lawmakers rolled back Brownback's tax cuts for the richest taxpayers. Governors in West Virginia and Alaska promote compromise tax plans. Texas heads into special session and Vermont faces another budget veto, while Louisiana and New Mexico are on the verge of wrapping up. Voters in Massachusetts may soon be able to weigh in on a millionaire's tax, the California Senate passed single-payer health care, and more!

Charleston Gazette-Mail: Senate Tax Plan is Upward Redistribution

June 3, 2017

“Some West Virginia Senators are singing a similar tune as Reagan with their tax plan. While they say their plan is a tax cut for everyone, the facts say otherwise. According to a recent analysis by the Institute on Taxation and Economic Policy, the Senate tax plan would increase taxes for most West Virginia households […]

State Rundown 5/31: Budget Woes Spurring Special Legislative Sessions

May 31, 2017 • By ITEP Staff

This week, special legislative sessions featuring tax and budget debates are underway or in the works in Kentucky, Minnesota, New Mexico, and West Virginia, as lawmakers are also running up against regular session deadlines in Illinois, Kansas, and Oklahoma. Meanwhile, a legislative study in Wyoming and an independent analysis in New Jersey are both calling for tax increases to overcome budget shortfalls.

Evidence Counts: Senate Tax Plan Punches More Holes Into Budget (Updated)

May 24, 2017

Similar to previous tax plans from the Senate, this plan increase taxes on most West Virginians while lowering them for higher-income residents. According to the Institute on Taxation and Economic Policy, the Senate tax plan increases taxes on 60 percent of West Virginia households while lowering taxes on the top 40 percent of households. This is because lower income West Virginians pay more in sales taxes than income taxes, while the opposite is true for higher income people.

This week, Kansas lawmakers continued work on fixing the fiscal mess created by tax cuts in recent years, as legislators in Louisiana, Minnesota, Oklahoma, and West Virginia attempted to wrap up difficult budget negotiations before their sessions come to an end, and Delaware lawmakers advanced a corporate tax increase as one piece of a plan to close that state's budget shortfall. Our "what we're reading" section this week is also packed with articles about state and local effects of the Trump budget, new 50-state research on property taxes, and more.

This week saw tax debates heat up in many states. Late-session discovered revenue shortfalls, for example, are creating friction in Delaware, New Jersey, and Oklahoma, while special sessions featuring tax debates continue in Louisiana, New Mexico, and West Virginia. Meanwhile the effort to revive Alaska's personal income tax has cooled off.

West Virginia Metro News: West Virginia Has Miserable Company When It Comes to Budget Troubles

May 14, 2017

If there’s a bright side to West Virginia’s state budget troubles — in a misery-loves-company kind of way — it’s that plenty of other states have been having trouble too. “West Virginia is not unique this year or even in recent years in taking a little longer than usual to agree on a budget, largely […]

State Rundown 5/10: Spring Tax Debates at Different Stages in Different States

May 10, 2017 • By Meg Wiehe

This week saw a springtime mix of state tax debates in all stages of life. In West Virginia and Louisiana, debates over income tax reductions and comprehensive tax reform are full of vigor. Other debates that bloomed earlier are now settled, such as Florida‘s now-complete budget debate and the more florid debates over gas taxes […]

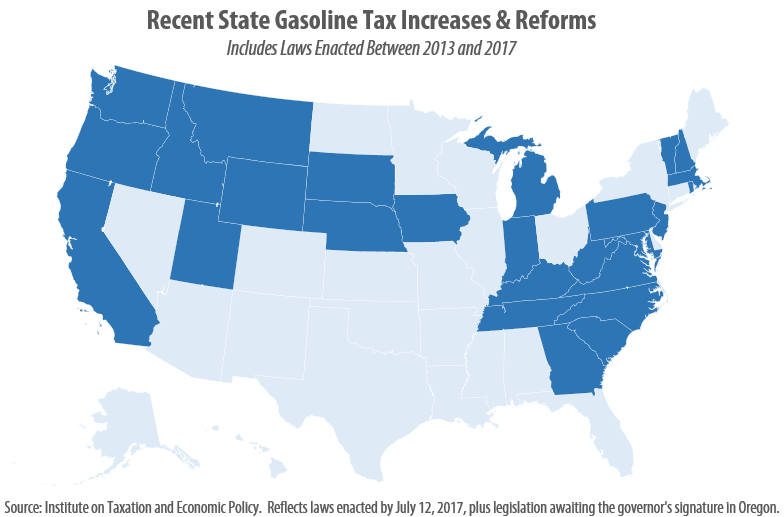

This post was updated July 12, 2017 to reflect recent gas tax increases in Oregon and West Virginia. As expected, 2017 has brought a flurry of action relating to state gasoline taxes. As of this writing, eight states (California, Indiana, Montana, Oregon, South Carolina, Tennessee, Utah, and West Virginia) have enacted gas tax increases this year, bringing the total number of states that have raised or reformed their gas taxes to 26 since 2013.

Evidence Counts: Latest Compromise Tax Plan Still a Bad Deal for West Virginia

May 10, 2017

Last week, the governor called the legislature back into special session to continue work on the state budget. The actual budget bill, however, was not part of the call, instead the intention was for the legislature to vote on a compromise tax plan that would influence how the budget was finalized. The version of the plan ( […]

Charleston Gazette Mail: Beware a Compromise That Takes from the Poor and Gives to the Rich

May 3, 2017

An assessment by Mark Muchow, deputy secretary of the Department of Revenue, estimates that by 2020, this will cause a revenue decline of $220 million due to income tax cuts. This would come on top of year after year of major budget cuts. On top of that, the Institute on Taxation and Economic Policy found […]

State Rundown 5/3: Lawmakers See Value in State EITCs, Danger in Tax Cut Triggers

May 3, 2017 • By ITEP Staff

This week, Kansas lawmakers found that they’ll have to roll back Gov. Brownback’s tax cuts and then some to adequately fund state needs. Nebraska legislators took notice of their southern neighbors’ predicament and rejected a major tax cut. Both Hawaii and Montana‘s legislatures sent new state EITCs to their governors, and West Virginia began an […]

3 Percent and Dropping: State Corporate Tax Avoidance in the Fortune 500, 2008 to 2015

April 27, 2017 • By Aidan Davis, Matthew Gardner, Richard Phillips

The trend is clear: states are experiencing a rapid decline in state corporate income tax revenue. Despite rebounding and even booming bottom lines for many corporations, this downward trend has become increasingly apparent in recent years. Since our last analysis of these data, in 2014, the state effective corporate tax rate paid by profitable Fortune 500 corporations has declined, dropping from 3.1 percent to 2.9 percent of their U.S. profits. A number of factors are driving this decline, including: a race to the bottom by states providing significant “incentives” for specific companies to relocate or stay put; blatant manipulation of…

States are experiencing a rapid decline in state corporate income tax revenue, and the downward trend has become increasingly pronounced in recent years. Despite rebounding bottom lines for many corporations, a new ITEP report, 3 Percent and Dropping: State Corporate Tax Avoidance in the Fortune 500, 2008 to 2015,finds that effective tax rates paid by […]

State Rundown 4/27: States Finally Reaching Resolution on Gas Taxes

April 27, 2017 • By ITEP Staff

This week, transportation funding debates finally concluded with gas tax updates in Indiana, Montana, and Tennessee, and appear to be nearing an end in South Carolina. Meanwhile, Louisiana and Oregon lawmakers debated new Gross Receipts Taxes, and Texas legislators considered eliminating the state’s franchise tax. — Meg Wiehe, ITEP Deputy Director, @megwiehe Louisiana Gov. Bel Edward’s Commercial Activities Tax (CAT) was pulled from committee early this week without a vote due to opposition, […]

Evidence Counts: What is the Impact of the “Compromise Tax Proposal” on the Budget and Working Families?

April 24, 2017

Earlier this week, the West Virginia Center on Budget and Policy examined the fiscal impact of the proposed compromise tax plan between Governor Justice and Senate leadership that will influence how the budget is finalized. It appears House leadership is saying “nope” to this plan and it is unclear how the plan would close the state’s […]

State Rundown 4/19: Alaska’s Long Income Tax Freeze May Be Thawing

April 19, 2017 • By ITEP Staff

This week Alaska‘s House advanced a historic bill to reinstate an income tax in the state, Oklahoma‘s House voted to cancel a misguided tax cut “trigger,” West Virginia‘s governor colorfully vetoed his state’s budget, tax reform debate kicked off in Louisiana, and gas tax updates were considered in South Carolina and Tennessee, among other tax-related news […]

State Rundown 4/12: Season in Transition as Some States Close, Others Open Tax Debates

April 12, 2017 • By ITEP Staff

This week in state tax news we see Louisiana‘s session getting started, budgets passed in New York and West Virginia, Kansas lawmakers taking a rest after defeating a harmful flat tax proposal, and Nebraska legislators preparing for full debate on major tax cuts. Nevada lawmakers may make tax decisions related to tampons, diapers, marijuana, and […]

This week in state tax news we saw a destructive tax cut effort defeated in Georgia, a state shutdown avoided in New York, and lawmakers hone in on major tax debates in Massachusetts, Nebraska, South Carolina, and WestVirginia. State efforts to collect taxes owed on online purchases continue to heat up as well. — Meg […]

Evidence Counts: Senate Tax Plan Creates Big Budget Hole, Shifts Tax Load Onto Working Families (Updated)

March 31, 2017

Last Wednesday, the Senate passed Senate Bill 409 that makes sweeping changes to the state’s tax system that decrease personal income and severance taxes while increasing sales taxes. Similar to previous Senate tax proposals, SB 409 shifts the tax load onto working families to pay for tax cuts for wealthier West Virginians. On top of […]

In the Tax Justice Digest we recap the latest reports, blog posts, and analyses from Citizens for Tax Justice and the Institute on Taxation and Economic Policy. Here’s a rundown of what we’ve been working on lately. Corporations Offshore Cash Hoard Grows to $2.6 Trillion U.S. corporations now hold a record $2.6 trillion offshore, a […]

Evidence Counts: Tax Reform Might Improve WV’s Business Tax Climate, Sound Familiar?

March 29, 2017

Today, the House will vote on HB 2933, the latest version of “tax reform” in the state. HB 2933 would broaden the sales tax base, lower the sales tax rate to 5%, and create a flat 5.1% income tax rate. The bill would drastically increase West Virginia’s already regressive tax system. The vast majority of […]

State Rundown 3/29: More States Looking to Raise or Protect Revenues Amid Fiscal and Federal Uncertainty

March 29, 2017 • By ITEP Staff

This week we see West Virginia, Georgia, Minnesota, and Nebraska continue to deliberate regressive tax cut proposals, as the District of Columbia considers cancelling tax cut triggers it put in place in prior years, and lawmakers in Hawaii, Washington, Kansas, and Delaware ponder raising revenues to shore up their budgets. Meanwhile, gas tax debates continue […]

Evidence Counts: House and Senate Tax Proposals Shift Tax Load Onto Working Families (Updated)

March 26, 2017

The House and the Senate have advanced two similar tax bills that make substantial changes to the state’s personal income and sales tax, which account for over 75 percent of state general revenue fund collections. Both of these bills will shift the tax load from the wealthy onto working families. It is unclear how either […]