In January, our conclusion that Tesla paid no federal income tax for 2024 (and very little over the previous three years) sparked a chorus of criticism towards the company from the halls of Congress to the social media channel controlled by Elon Musk himself. Most Americans intuitively understand that a tax code allowing big corporations to avoid paying much of anything is a tax code that is failing. Our new report explains why this intuition is correct.

Anything allowing corporations to pay less than they might otherwise pay worsens income and racial inequality.

This is true of reductions in the statutory corporate income tax rate, such as the slashing of that rate from 35 to 21 percent under the Trump tax law.

This is also true of special breaks and loopholes that allow corporations to pay an effective tax rate even lower than the statutory rate. Anything allowing a corporation to pay less than 21 percent of its profits in federal income taxes drives up inequality more than if it was required to pay the full 21 percent.

Unfortunately, there are many of these special breaks and loopholes. Our 2024 report clearly demonstrated that this happened when the statutory rate was 35 percent and continued after it was cut to 21 percent.

That report examined the companies in the Fortune 500 and S&P 500 that were consistently profitable for 9 years, 2013 through 2021. During the four years before the Trump law was enacted, while the statutory tax rate was 35 percent, these 296 companies collectively paid an effective tax rate of just 22 percent. During the four years after the Trump law, when the statutory tax rate was 21 percent, these companies paid an effective tax rate of just 12.8 percent.

Many huge corporations that are household names paid effective tax rates that were less than the statutory rate before the Trump law and then paid even lower effective rates after it was enacted.

Before and After the Trump Tax Law for 16 Prominent Corporations

| Company | Effective tax rates from 2013-2016 |

Effective tax rates from 2018-2021 |

| Verizon Communications | 21% | 8% |

| Walmart | 31% | 17% |

| AT&T | 13% | 3% |

| Meta | 28% | 18% |

| Intel | 27% | 13% |

| Comcast | 24% | 14% |

| Walt Disney | 26% | 8% |

| Visa | 32% | 18% |

| Lockheed Martin | 33% | 15% |

| Capital One Financial | 31% | 16% |

| Target | 34% | 16% |

| Honeywell International | 23% | 6% |

| FedEx | 18% | 1% |

| Deere | 30% | 13% |

| Archer Daniels Midland | 26% | 6% |

| Domino’s Pizza | 29% | 9% |

*2017 was a transition year between the prior and post-Trump tax regimes and was thus excluded.

Source: ITEP analysis of Securities and Exchange Commission filings of publicly traded corporations

In the four years from 2013 through 2016, if the 296 corporations in this study paid an effective tax rate equal to the statutory rate of 35 percent, they would have paid $666.4 billion. Instead, they paid 418.4 billion, a full 37 percent less. That is another way of saying that these corporations sheltered 37 percent of their income from the corporate income tax during those years.

Rather than reducing tax avoidance as any successful tax reform would be expected to do, the 2017 law increased it. The same calculation for the 2018-2021 period demonstrates that these companies sheltered 39 percent of their income from the corporate income tax.

The Cost of Tax Avoidance: Tax Subsidies to 296 Companies

| Years | U.S. income | Tax at statutory rate |

Actual tax | Tax subsidies |

% of profits sheltered from tax |

| 2013 to 2016 | $1.90 trillion | $666.4 billion | $418.4 billion | $248.0 billion | 37% |

| 2018 to 2021 | $2.75 trillion | $577.0 billion | $351.5 billion | $225.6 billion | 39% |

Source: ITEP analysis of Securities and Exchange Commission filings of publicly traded corporations

Our new report explains how this kind of corporate tax avoidance exacerbates inequality.

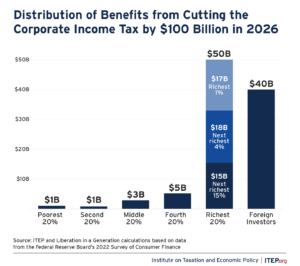

The benefits of lower corporate taxes flow to shareholders of American corporations. Most of these shareholders are either very high-income (and disproportionately white) Americans or foreign investors. Lower corporate taxes result in increased income for shareholders, in the form of increased dividends paid, more frequent stock buybacks or greater appreciation of the shares which yield larger capital gains when sold.

The figure below from the new report illustrates the distribution of benefits from a hypothetical $100 billion break from the federal corporate income tax.

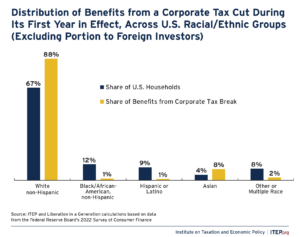

Corporate tax breaks also increase racial inequality. Because white households own a disproportionate share of corporate stocks, they disproportionately benefit. White Americans receive 88 percent of the benefits that remain in the U.S. even though they make up only 67 percent of U.S. households. In contrast, Black and Hispanic households each receive just 1 percent of the benefits despite making up 12 percent and 9 percent of households respectively.

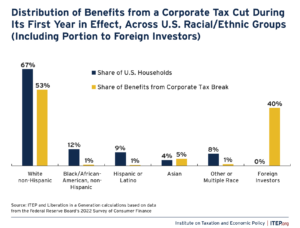

When we include the benefits that flow out of the country to foreign investors, we find that even white Americans receive a disproportionately small share of a corporate tax cut. White Americans make up 67 percent of the population but receive just 53 percent of the total benefits from a corporate tax break. The share of benefits flowing to nearly all the major racial/ethnic groups is noticeably below their share of U.S. households, as illustrated in the figure below.

If lawmakers wanted to reduce income inequality and racial inequality, shutting down or at least limiting corporate tax breaks would be one option to achieve that goal. Unfortunately, President Trump and the current Congress show little interest in this and may even move in the opposite direction by introducing new corporate tax breaks.