Sometimes policy developments move at a rapid-fire pace, so we’re taking time over the next 12 days to reflect on some of the most significant federal and state tax policy developments and/or tax policy analyses that happened this year.

Check back daily for updates or look for #12DaysofTaxPolicy on Twitter.

12. Tax reform proposals aimed at the middle class

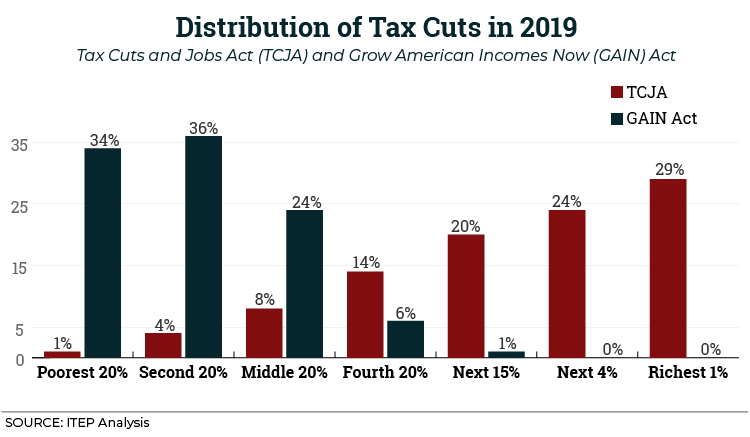

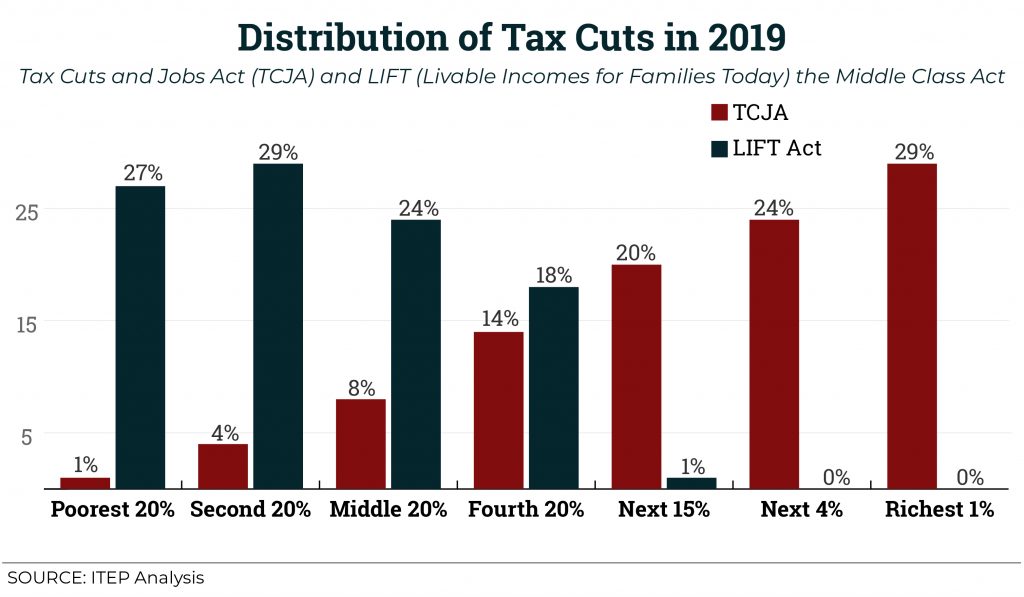

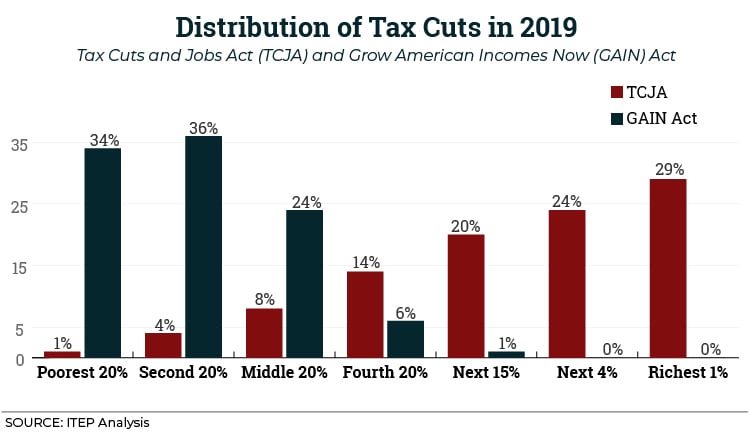

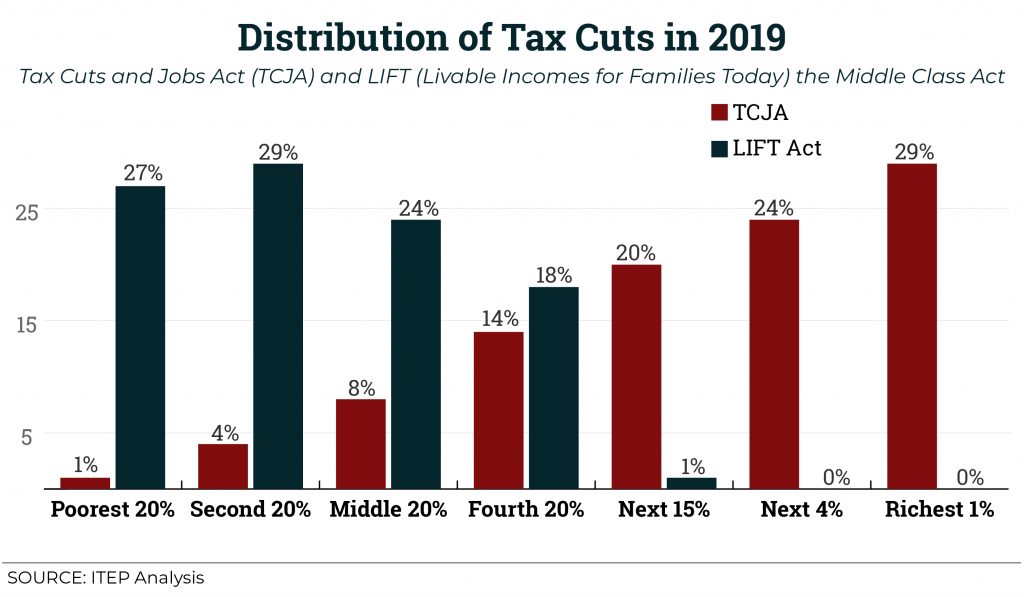

Two bills introduced this year, the GAIN Act and the LIFT Act show how targeted tax cuts can help boost the economic security of working families instead of showering more tax cuts on the wealthy.

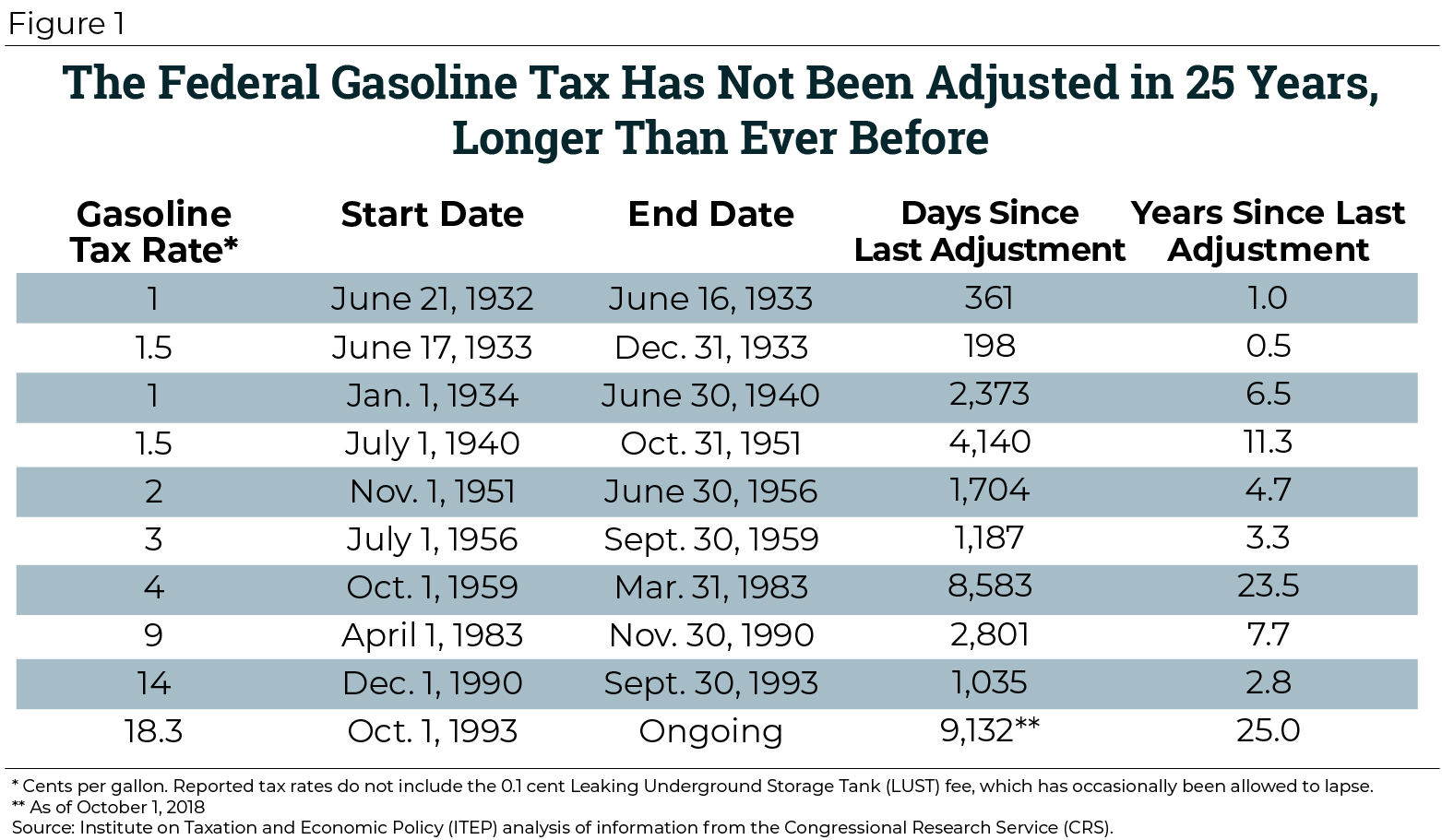

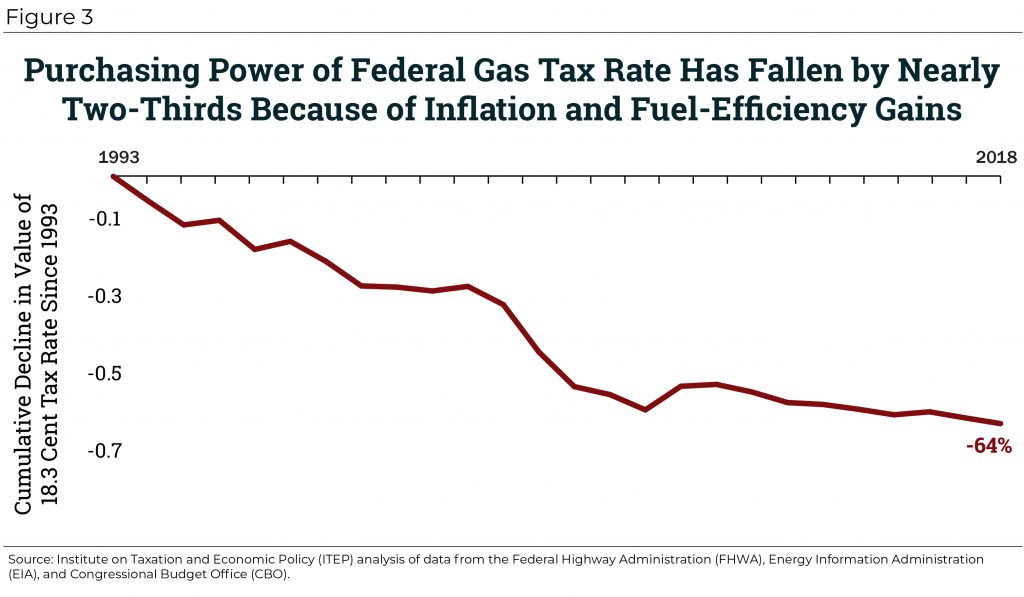

11. A stagnating federal gas tax

Bill Clinton was president the last time the federal government raised the gas tax in 1993.

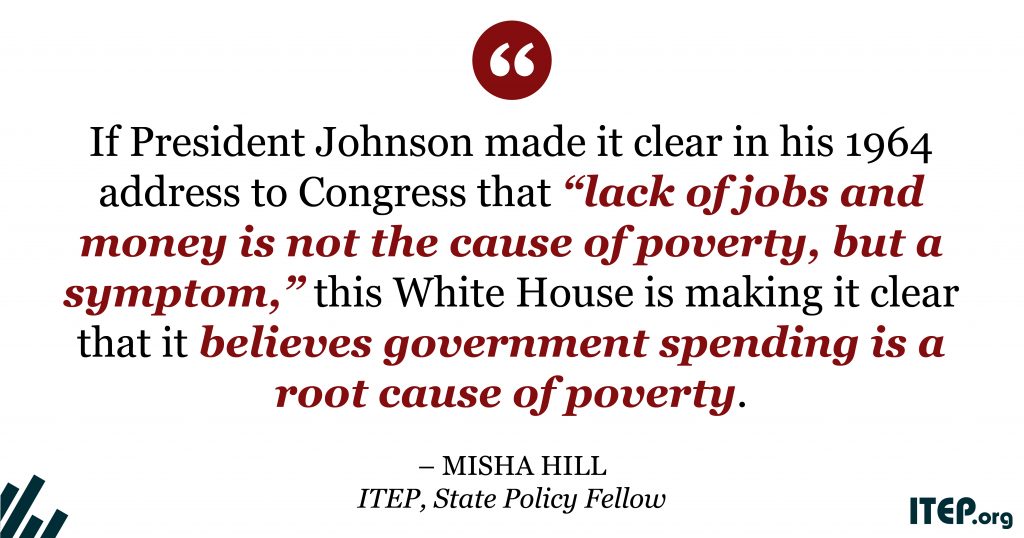

10. Woefully misguided war on the poor

Earlier this year, the Trump Administration wrongly declared that the war on poverty is over and largely won and made clear its intent to dramatically slash anti-poverty programs.

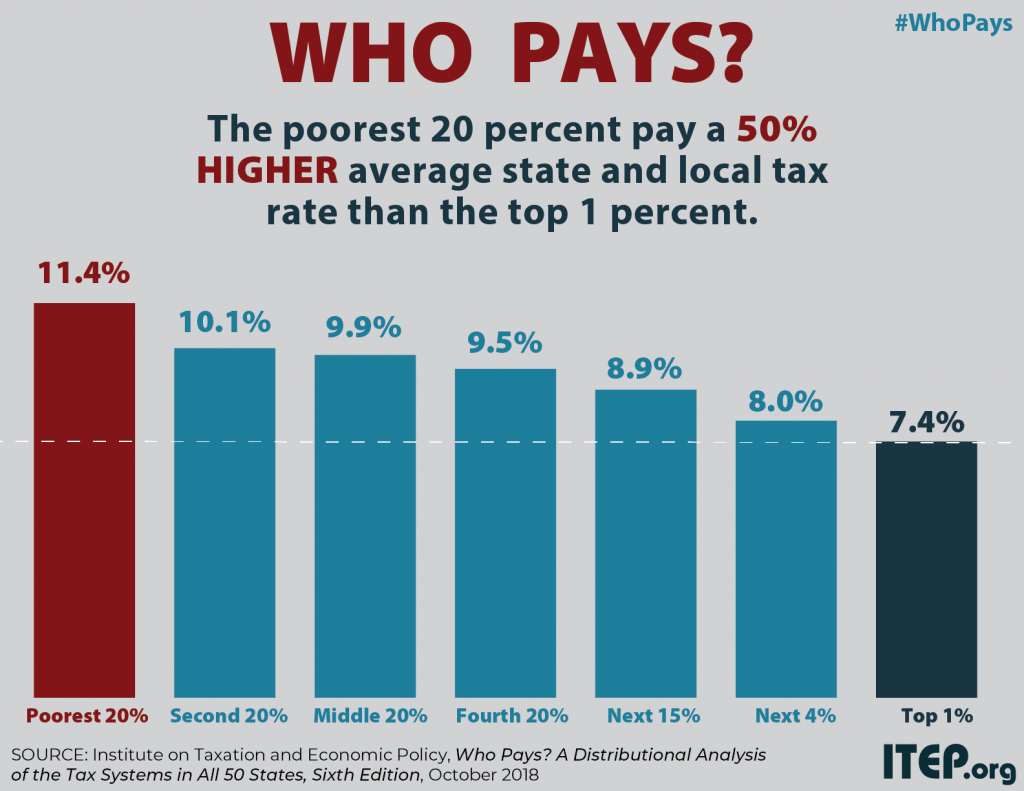

9. Upside down state and local tax systems

The poorest 20 percent of taxpayers pay a state and local tax rate that is 50 percent higher than the tax rate paid by the richest 1 percent.

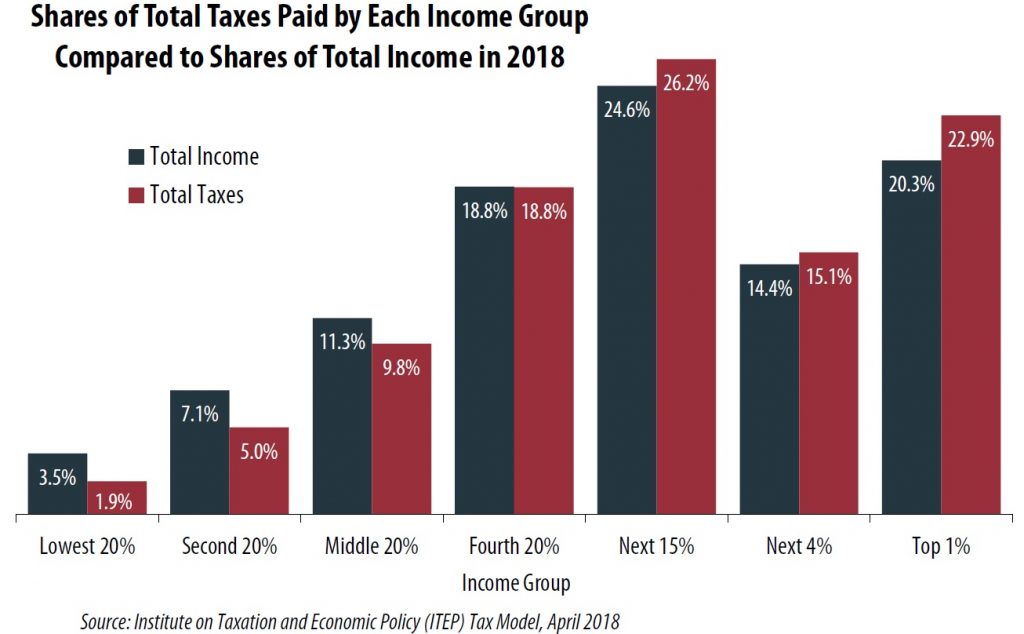

8. A barely progressive combined tax system

An examination of all taxes that we pay finds that our collective local, state and federal tax system is barely progressive.

7. More riches for the superrich

The Tax Cuts and Jobs Act decimated the estate tax, reducing the number of estates subject to the tax from an already incredibly low 0.18 percent to 0.06 percent in 2018.

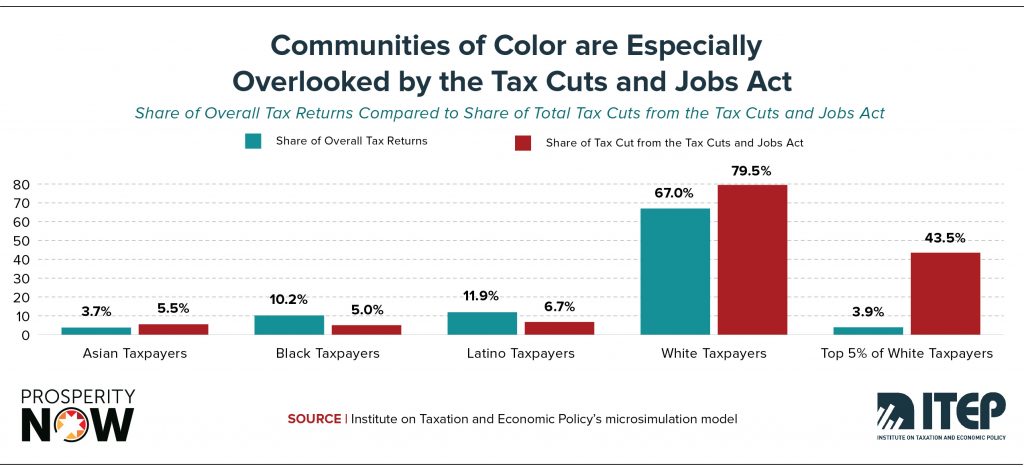

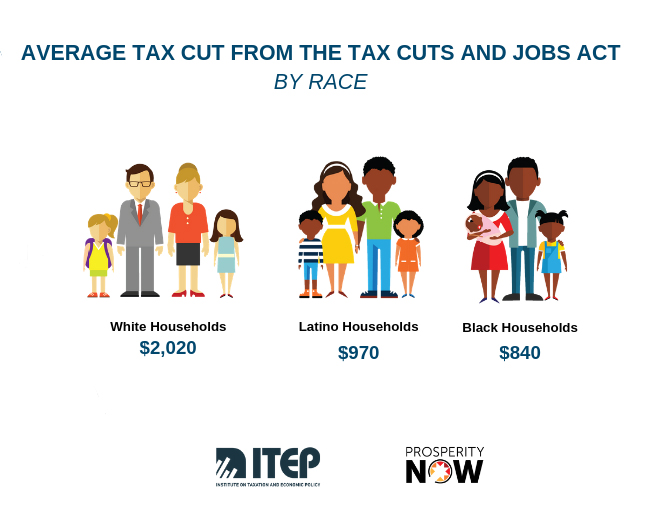

6. A tax law that worsens the racial wealth divide.

A report from ITEP and Prosperity Now revealed the new tax law perpetuates the racial wealth gap, funneling the greatest share of its benefit to wealthier white taxpayers.

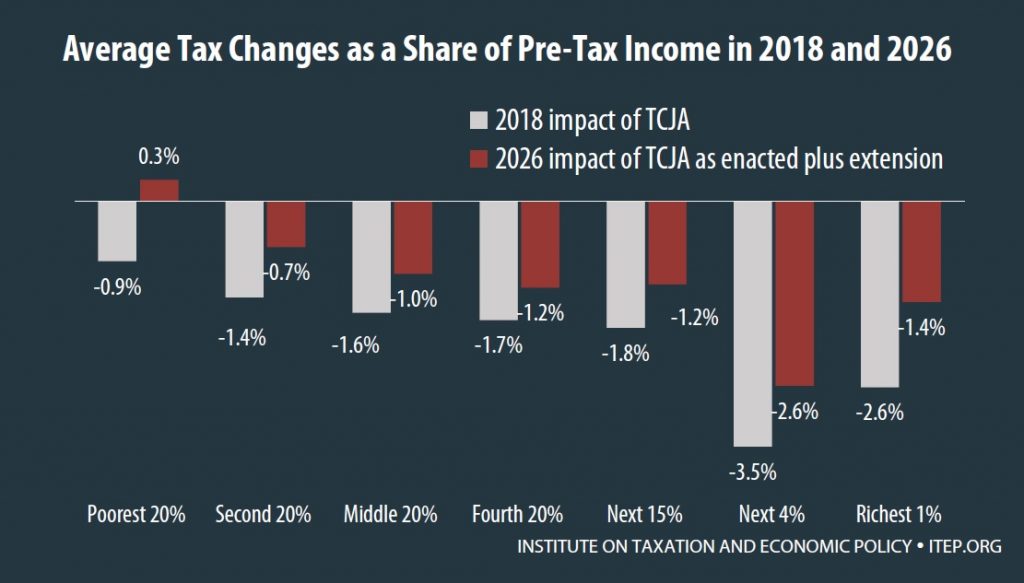

5. Tax cuts benefiting the wealthy.

Throughout the year, news articles and analyses have explored whether the Tax Cuts and Jobs Act is delivering on its promises. ITEP has produced a timeline revealing that GOP tax promises made are tax promises unkept. On this anniversary of its passage, here are the five takeaways about the legacy and continuing effect of the TCJA.

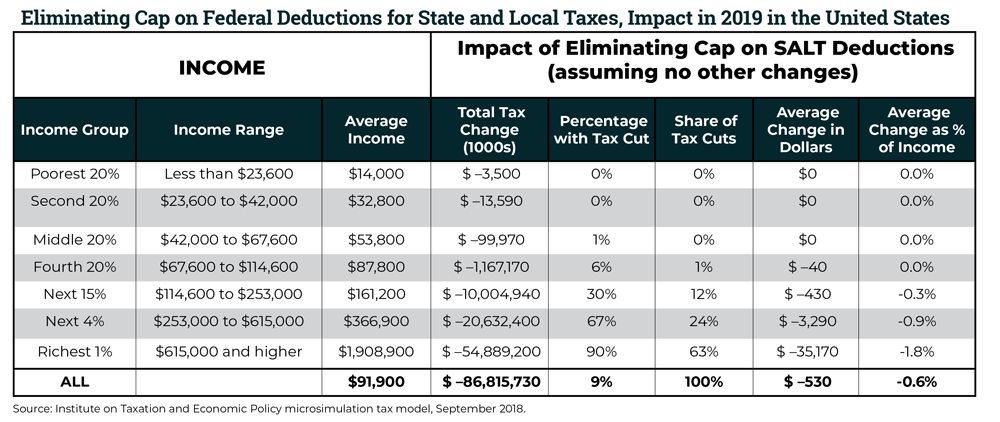

4. Proposals to replace bad tax policy with bad tax policy.

ITEP produced a 50-state analysis that reveals repealing the Tax Cuts and Jobs Act cap on state and local tax deductions (SALT) would overwhelmingly benefit the top 1 percent of households.

3. Teachers walking out.

Educators across the country staged walkouts or strikes throughout the late winter and early spring, to demand state lawmakers invest more in education, including teachers’ salaries, building, classroom supplies and technology.

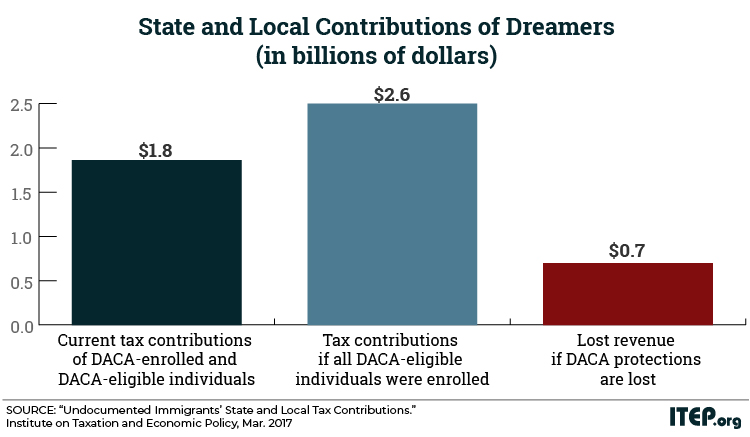

2. Undocumented immigrants pay state and local taxes.

And ITEP analysis finds aspirational U.S. citizens contribute just and much in state and local taxes as others in similar income brackets.

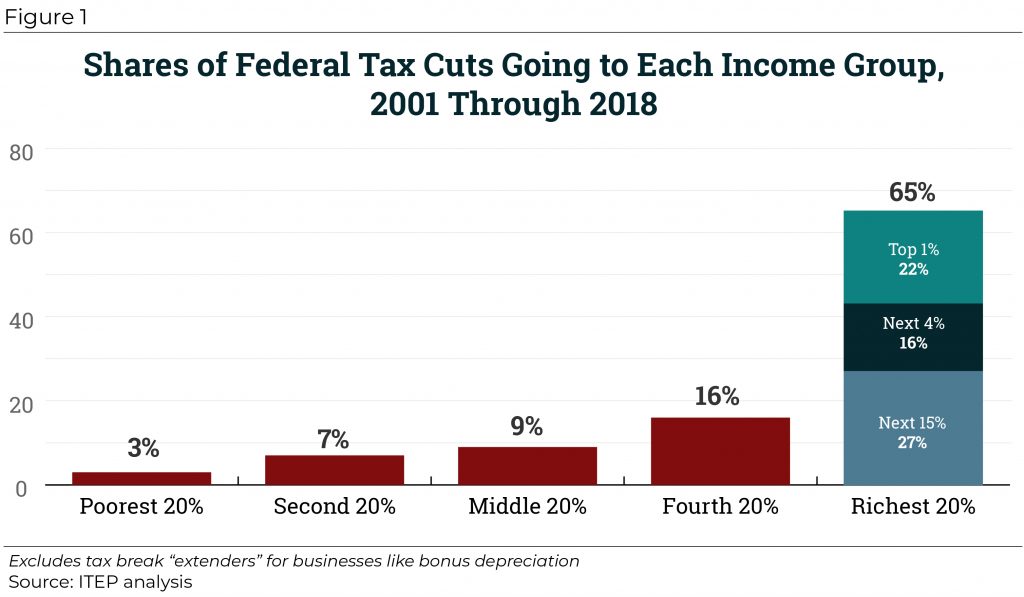

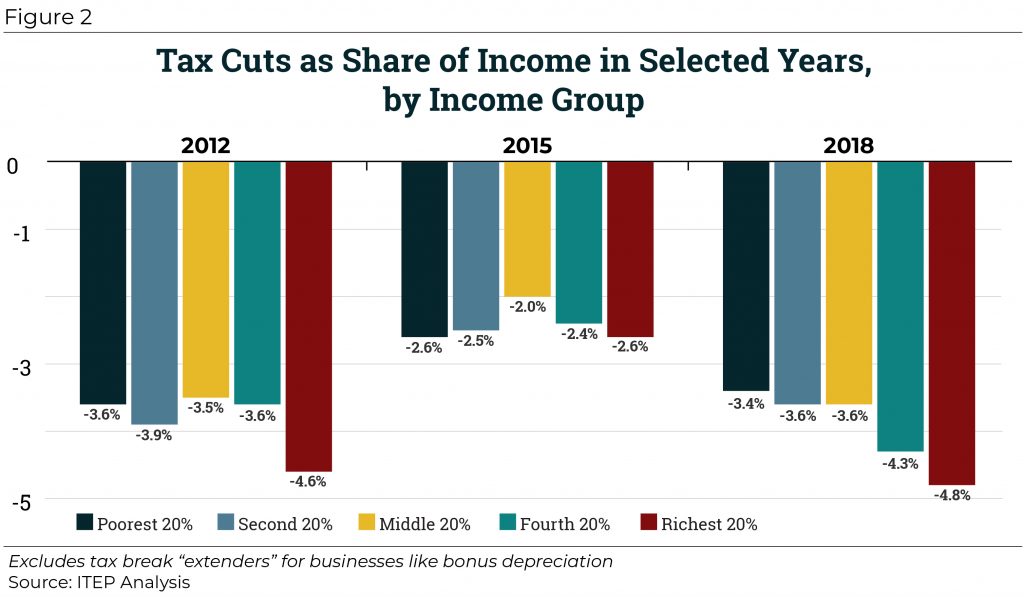

1. $3.3 trillion in tax cuts for those who have the most

An ITEP report reveals that since 2000, the top 20 percent of households have received 65 percent of all federal tax cuts.