ITEP's Research Priorities

USA Today: Gas Taxes Rise in Seven States As Travelers Hit the Road for July 4 Holiday

June 30, 2017

The urge to hit the road comes as the national average gas price is 4 cents per gallon cheaper than at the same time last year, at $2.28 per gallon, according to AAA. “With gas prices at historically low levels, state lawmakers have decided that now is a good time to ask drivers to pay […]

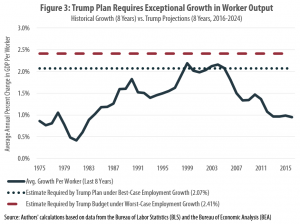

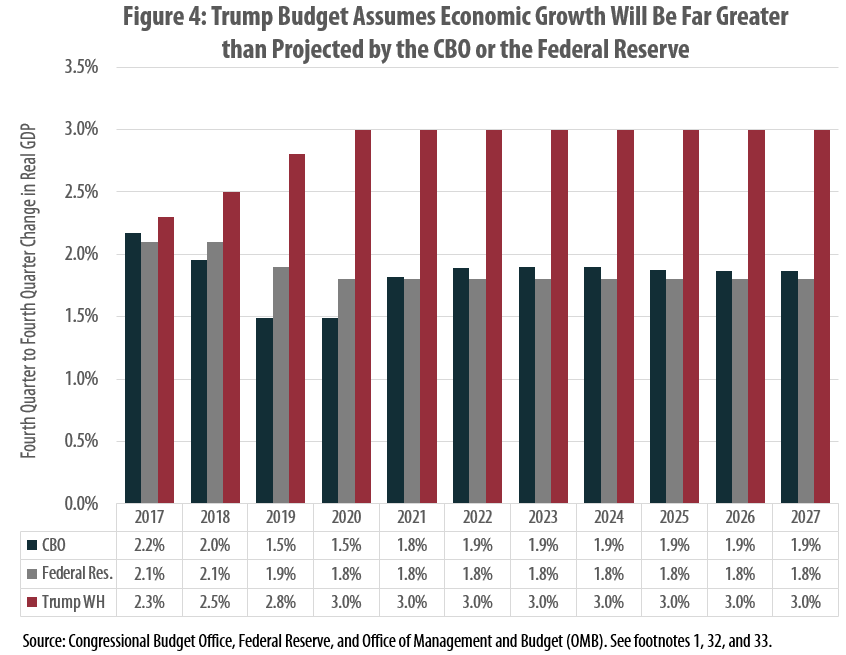

Last month, the Trump Administration released a budget proposal that relies on unrealistic projections of economic growth to create the illusion that it will balance the budget by 2027. By making the federal budget outlook appear more favorable than it actually is, the administration is seeking to bolster its case for enacting a multi-trillion-dollar tax cut. Fortunately, Congress has its own independent forecaster that just chimed in with a more rational assessment of the economy.

Trump Budget Uses Unrealistic Economic Forecast to Tee Up Tax Cuts

June 29, 2017 • By Carl Davis

The Trump Administration recently released its proposed budget for Fiscal Year 2018. The administration claims that its proposals would reduce the deficit in nearly every year over the next decade before eventually achieving a balanced budget in 2027, but the assumptions it uses to reach this conclusion are deeply flawed. This report explains these flaws and their consequences for the debate over major federal tax changes.

Huffpost: Why States Are Struggling To Tax Services

June 29, 2017

Another challenge is that taxes on services are regressive, with a disproportionate impact on low-income residents, and are sometimes seen as an unfair way to plug a budget hole or reduce other taxes, prompting opposition from advocates for the poor. “The services that get pulled into these plans … are not necessarily the ones that […]

State Rundown 6/28: States Scramble to Finish Budgets Before July Deadlines

June 28, 2017 • By ITEP Staff

This week, several states attempt to wrap up their budget debates before new fiscal years (and holiday vacations) begin in July. Lawmakers reached at least short-term agreement on budgets in Alaska, New Hampshire, Rhode Island, and Vermont, but such resolution remains elusive in Connecticut, Delaware, Illinois, Maine, Pennsylvania, Washington, and Wisconsin.

Gas Taxes Will Rise in 7 States to Fund Transportation Improvements

June 28, 2017 • By Carl Davis

Summer gas prices are at their lowest level in twelve years, which makes right now a sensible time to ask drivers to pay a little more toward improving the transportation infrastructure they use every day. Seven states will be doing this on Saturday, July 1 when they raise their gasoline tax rates. At the same time, two states will be implementing small gas tax rate cuts.

Many state governments are struggling to repair and expand their transportation infrastructure because they are attempting to cover the rising cost of asphalt, machinery, and other construction materials with fixed-rate gasoline taxes that are rarely increased.

The flawed design of federal and state gasoline taxes has made it exceedingly difficult to raise adequate funds to maintain the nation’s transportation infrastructure. Thirty states and the federal government levy fixed-rate gas taxes where the tax rate does not change even when the cost of infrastructure materials rises or when drivers transition toward more fuel-efficient vehicles and pay less in gas tax. The federal government’s 18.4 cent gas tax, for example, has not increased in over twenty-three years. Likewise, nineteen states have waited a decade or more since last raising their own gas tax rates.

Wisconsin Budget Project: Missing Out: Recent Tax Cuts Slanted in Favor of those with Highest Incomes

June 27, 2017

Since 2011, Wisconsin state lawmakers have made it a high priority to cut taxes, particularly personal income and property taxes. The tax cuts they have passed have disproportionately gone to Wisconsin residents with the highest incomes. Middle-class residents received less than the wealthy, and residents with low incomes received the smallest tax cut. Read more […]

Senate Health Care Reform Bill Just as “Mean” as the House Version

June 26, 2017 • By Alan Essig

The Congressional Budget Office today released its score of the Senate Health Care proposal and the news is not good. It’s no wonder a narrow group of 13 lawmakers cobbled together the bill behind closed doors. Now that the measure has seen the light of day, we know that it epitomizes Robin Hood in reverse policies by snatching health coverage from 22 million people by 2026 (15 million in 2018) while showering tax cuts on the already wealthy.

Scripps News Service: Money Diverted from Public Schools?

June 26, 2017

All the programs basically work this way: Individuals and businesses make cash or stock donations to scholarship granting organizations. The organizations award scholarships to qualifying families with K-12 students, primarily children in failing public schools or whose families’ income meets the state’s poverty threshold. Students can then attend a private or religious school of their […]

Bloomberg: Corporate Tax Rate at 28% Seen as More Likely Than Historic Cut

June 26, 2017

Both men have pitched their rate-cut plans as a way to spur hiring and economic growth. But setting a 28 percent tax rate would be largely meaningless for more than 150 of the largest U.S. companies, which already paid lower rates than that from 2008 through 2015, according to a recent study. The companies took […]

Rather than being known for its pioneering pharmaceuticals, Mylan is increasingly becoming infamous for its pioneering tax avoidance strategies. In 2015, Mylan used an inversion to claim that it is now based in the Netherlands for tax purposes. It is a Dutch company only on paper because ownership of the company was mostly unchanged and it continues to operate largely out of the United States. This maneuver has allowed the company to avoid millions in taxes on its earnings in the U.S. and abroad. But that’s not the end of Mylan’s innovation when it comes to tax planning. A new…

Minnesota Budget Project: DACA recipients make important tax contributions to Minnesota

June 22, 2017

Minnesota’s Deferred Action for Childhood Arrival (DACA) recipients pay an estimated $15 million in state and local taxes, according to a report from the Institute on Taxation and Economic Policy (ITEP). They are contributing to our communities and our economy, and the report shows they would contribute even more if given the opportunity to apply […]

Explaining our Analysis of Washington State’s Highly Regressive Tax Code

June 22, 2017 • By Carl Davis

Supporters of creating a local personal income tax in Seattle are rightly concerned about the lopsided nature of their state’s tax code. In a 50-state study titled Who Pays?, produced using our microsimulation tax model, we found that Washington State’s tax system is the most regressive in the nation.

West Virginia Lawmakers Settle on Imperfect Budget, Delay Tax Debate for Next Session

June 21, 2017 • By Aidan Davis

West Virginia’s roller coaster ride of a session is nearing its tumultuous end. In a press conference this morning, Gov. Jim Justice announced that he will let the legislature’s most recent budget bill become law without his signature.

State Rundown 6/21: Crunch Time for Many States with New Fiscal Year on Horizon

June 21, 2017 • By Meg Wiehe

This week several states rush to finalize their budget and tax debates before the start of most state fiscal years on July 1. West Virginia lawmakers considered tax increases as part of a balanced approach to closing the state’s budget gap but took a funding-cuts-only approach in the end. Delaware legislators face a similar choice, […]

Failed Tax-Cut Experiment (in North Carolina) Will Continue Under Final Budget Agreement, Pushes Fiscal Reckoning Down the Line

June 21, 2017

The final budget agreement from leaders of the House and Senate puts North Carolina on precarious fiscal footing, The tax changes that leaders agreed to—which were less a compromise and more of a decision to combine the tax cuts in both chambers’ proposals—make the cost of these tax cuts bigger than what either chamber proposed. Including the new tax cuts,approximately 80 percent of the net tax cut since 2013 will have gone to the top 20 percent. More than half of the net tax cut will go to the top 1 percent.

Oregon Center for Public Policy: Reason to Hope for a Commercial Activities Tax (CAT) Accompanied by a CAT Fairness Credit

June 21, 2017

The CAT Fairness Credit would be a credit on personal income taxes based on family size and income. It would cost about the same as the combined impact of the personal income tax changes and EITC increase, and would target relief to low- and middle-income taxpayers.

Public News Service: GOP Health Bill Would Deliver Tax Breaks to the Wealthiest

June 20, 2017

Alan Essig, executive director of the Institute on Taxation and Economic Policy, says data from the Congressional Budget Office confirms that the health bill that cleared the U.S. House is less about health policy than tax breaks for the top 3 percent of U.S. earners. “The end result is 23 million people losing health care […]

Speaker Ryan’s “Bold Agenda” for the Country Boils Down to Tax Breaks for the Wealthy

June 20, 2017 • By Alan Essig

Speaker Paul Ryan today correctly outlined some of working people’s concerns, including the desire for more good jobs and access to the training required to secure those jobs. But his bottom line policy prescriptions for addressing the concerns of working people are the same old trickle-down economic policies that time after time have proven to primarily benefit the wealthy.

Salon: Apple CEO Tim Cook Thinks a Big Corporate Tax Cut is “What’s Good for America”

June 18, 2017

Earlier this year, the Institute on Taxation and Economic Policy, a nonpartisan liberal think tank, published research showing that few large profitable companies even come close to paying the 35 percent federal income tax rate on U.S. profits. The study, which looked at 258 large U.S. companies that reported annual U.S.-based profit from 2008 to 2015, […]

The GOP Health Plan Cuts Medicaid to Lower Taxes for the Richest 3 Percent

June 16, 2017 • By Alan Essig

The bill passed by the House of Representatives last month to repeal the Affordable Care Act (ACA) is the most unpopular legislation in decades. Lawmakers should reverse course and take the necessary time to put together legislation that would preserve or, better yet, improve access to health care. But this isn’t likely to happen because at its core, the American Health Care Act isn’t truly health care reform. It is tax cuts that disproportionately benefit the rich shrouded in legislative provisions that would weaken the existing health care law.

Which States Benefit from the Tax Cuts in the GOP Health Plan?

June 15, 2017 • By Steve Wamhoff

Congressional Republicans’ plans to repeal the two largest tax increases on individuals that were enacted as part of the Affordable Care Act (ACA) would disproportionately benefit residents of Connecticut, New York, the District of Columbia and 10 other states. The remaining states would receive a share of the tax cuts that is less than their share of the total U.S. population.

State Rundown 6/14: Some States Wrapping Up Tax Debates, Others Looking Ahead to Next Round

June 14, 2017 • By ITEP Staff

This week lawmakers in California and Nevada resolved significant tax debates, while budget and tax wrangling continued in West Virginia, and structural revenue shortfalls were revealed in Iowa and Pennsylvania. Airbnb increased the number of states in which it collects state-level taxes to 21. We also share interesting reads on state fiscal uncertainty, the tax experiences of Alaska and Wyoming, the future of taxing robots, and more!