ITEP's Research Priorities

Gov. Sam Brownback’s tax experiment in Kansas was a failure. His radical tax cuts for the rich eventually had to be partly paid for through tax hikes on low- and middle-income families and also failed to deliver on promises of economic growth. Meanwhile, the tax cuts decimated the state’s budget, diminished its credit rating, and compromised its ability to meet the state’s constitutional standard of adequacy for public education.

Maine Center for Economic Policy: Senate Republican Vote Defies Will of Voters, Compromises Current and Future School Funding to Give Tax Cuts to Wealthy

June 13, 2017

According to the Institute on Taxation and Economic Policy, repealing the citizen approved surcharge would give a $16,300 tax break on average to the top 1% of Maine households and cost the state over $300 million in school funding over current and future biennia.

One of the supposed selling points of the House GOP’s “Better Way” tax plan is that it will make the tax system so simple that you could do your taxes on a postcard. The reality, however, is that their promised postcard is a deception that would require numerous additional pages of worksheets to fill out. A better solution to making tax preparation simpler is called “return-free filing.” It does not just reduce your work to filling out a postcard, it could eliminate it altogether.

Oregon Center for Public Policy: Commercial Activities Tax Fairness Credit Would Strengthen the Tax Reform Package

June 9, 2017

Analysis by the Institute on Taxation and Economic Policy (ITEP) shows that, all else being equal, a tax reform package with a CAT Fairness Credit would be more progressive than a tax reform package with an income tax rate reduction.

A Better Wyoming: Guess Which Sparsely Populated Mineral Rich State is Getting an Income Tax…

June 8, 2017

Alaska stopped collecting income taxes 35 years ago, and Wyoming has never remotely considered implementing one in the 82 years since it decided instead to charge state and local sales taxes. The Institute on Taxation and Economic Policy (ITEP) discovered recently that nearly 82 percent of Alaskans could expect to pay less under a progressive income tax than they would under a sales tax designed to generate an identical level of revenue.

Kentucky Center for Economic Policy: Troubling Hints About Direction for Tax Reform

June 8, 2017

The corporate tax cuts described above mean profitable businesses chip in less for the public services that help them succeed. And the result of less reliance on income and inheritance taxes is clear (see graph below): those at the top in Tennessee and Indiana pay an even smaller share of their income in state and local taxes than the wealthiest Kentuckians do, and their lowest-income residents pay an even higher share than the poorest Kentuckians.

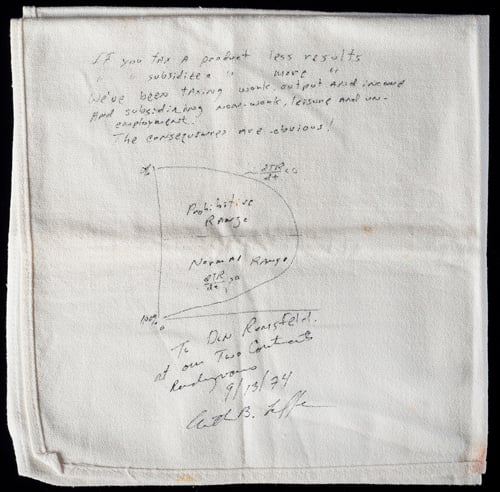

Sitting in the National Museum of American History in Washington, DC, hidden in the jumble of Americana like Thomas Jefferson’s desk, Michelle Obama’s inaugural gown and the ruby slippers worn in the Wizard of Oz, is a napkin with a drawing on it. Probably one of the least known exhibits in the museum, this napkin, quietly hiding behind glass lest some child wandering from a school group wipe his nose on it, has on several occasions destroyed the finances of the federal government and several state governments, most recently in Kansas.

Steve Wamhoff

June 8, 2017 • By ITEP Staff

Steve is ITEP’s director of federal tax policy. In this role, he is responsible for setting the organization’s federal research and policy agenda. He is the author of numerous reports and analyses of federal tax policies as well as in-depth policy briefs that outline how the federal income tax and corporate tax code can be overhauled to improve tax fairness.

PBS News Hour: How Much Do the Poor Actually Pay in Taxes? Probably More Than You Think.

June 8, 2017

“All told, those in the bottom fifth of earners pay almost a fifth of their income in taxes. According to the Institute on Taxation and Economic Policy, the lowest-income quintile — those making less than $19,000 a year — pay almost 11 percent of their income in state and local taxes. Working people, even if […]

Kansas City Star: Kansas Tax ‘Experiment’ Offers Lessons to the Nation, Analysts Say

June 7, 2017

“An analysis by the Institute on Taxation and Economic Policy found in 2015 that taxpayers in the bottom 40 percent saw an overall increase in their taxes under Brownback when the 2015 sales tax increase is included.” Read more

This week, we celebrate a victory in Kansas where lawmakers rolled back Brownback's tax cuts for the richest taxpayers. Governors in West Virginia and Alaska promote compromise tax plans. Texas heads into special session and Vermont faces another budget veto, while Louisiana and New Mexico are on the verge of wrapping up. Voters in Massachusetts may soon be able to weigh in on a millionaire's tax, the California Senate passed single-payer health care, and more!

The Atlantic: Can America’s Farms Survive the Threat of Deportations?

June 6, 2017

“Pete points out that the undocumented community is a net contributor to taxes. It’s true: A recent report by the Institute on Taxation and Economic Policy found that undocumented immigrants contribute billions of dollars to state and local taxes across the country. Deporting them, Pete added, will only hurt Americans. “If they just stopped contributing […]

A Better Wyoming: Everything You Know About Wyoming Taxes is Wrong

June 6, 2017

Wrong. According to the Institute on Taxation and Economic Policy (ITEP), a D.C. think tank that studies state tax policy, Wyoming’s wealthiest residents pay the lowest tax rate in the country. Meanwhile, people at the bottom 20 percent of Wyoming’s shaky economic ladder pay taxes at seven-times the rate that the top one percent of earners do. That’s the largest tax rate discrepancy between rich and poor in the United States.

Charleston Gazette-Mail: Senate Tax Plan is Upward Redistribution

June 3, 2017

“Some West Virginia Senators are singing a similar tune as Reagan with their tax plan. While they say their plan is a tax cut for everyone, the facts say otherwise. According to a recent analysis by the Institute on Taxation and Economic Policy, the Senate tax plan would increase taxes for most West Virginia households […]

Politifact: Richest 1 Percent Pay Lowest Rate of State and Local Taxes in Wisconsin?

June 2, 2017

McCabe, who says he is not a member of any political party, cited a 50-state analysis of state and local taxes published in January 2015 by the Institute on Taxation and Economic Policy, a left-leaning research organization based in Washington, D.C. Experts told us it is the only recent report of its kind on state […]

Oklahoma’s Budget Signed by Governor, but Long-Run Challenges Remain

June 2, 2017 • By Aidan Davis

On the last day of their legislative session, Oklahoma lawmakers finalized a $6.8 billion budget bill that was later signed by Gov. Mary Fallin. In the governor's statement on the bill, she noted that state agencies will be hard hit by the agreement--"it leaves many agencies facing cuts for the sixth year in a row"--and that while it does include some recurring revenue, it does not address the state's long-run structural budget challenges.

A truly populist budget would seek to ensure that middle- and low-income families have the resources that they need to get ahead, that the wealthy and corporations are paying their fair share in taxes, and that our country is making the public investments we need to ensure full employment and improve productivity over the long term. The Congressional Progressive Caucus’s (CPC) 2018 budget proposal would make real progress on all of these fronts.

Bloomberg: Trump ‘Self-Help’ Infrastructure Plan Irks State, Local Leaders

June 1, 2017

Six states this year raised their gas taxes — joining 18 others that have raised or changed the tax since 2013 to generate more money for transportation work, according to the Institute on Taxation and Economic Policy. The federal gas tax hasn’t been increased since 1993. Read more

Chicago Magazine: What Can Illinois Learn from Other States’ Budget Disasters

June 1, 2017

In 2012, Kansas would go on to enact tax cuts that the Institute on Taxation and Economic Policy called ”among the largest” enacted by any state. Under the leadership of recently elected Governor Sam Brownback, the state dropped the top income tax rate by one-fourth, nixed taxes on “pass through” business profits (business profits passed directly to the […]