ITEP's Research Priorities

House Democrats’ Suggestion of Retroactively Repealing SALT Cap is a Poor Emergency Relief Measure

March 31, 2020 • By Steve Wamhoff

The House Democrats have plenty of ideas to help workers and families and boost the economy, but Speaker Nancy Pelosi’s recent idea to repeal the cap on deductions for state and local taxes (SALT) is not one of them. The 2017 Trump-GOP tax law includes many provisions that should be repealed. Unfortunately, Congressional Democrats have long made it clear that they want to start by repealing the $10,000 cap on SALT deductions, which is one of the law's few provisions that restrict tax breaks for the rich.

Eater NY: Why NYC’s Undocumented Restaurant Workers Are the Forgotten Victims of the Shutdown

March 31, 2020

Government help is nearly impossible to get, even though undocumented workers in the United States pay $11.74 billion in taxes each year, equivalent to 8 percent of their incomes, according to the Institute on Taxation and Economic Policy. (By comparison, the top 1 percent pays an effective 5.4 percent.) Because undocumented workers are, at least […]

KQED: New COVID-19 Relief Benefits Leave Out Millions Of Undocumented Immigrants

March 31, 2020

In California, undocumented residents contribute $3 billion annually in state and local taxes, according to the nonprofit Institute on Taxation and Economic Policy. Immigrants who are not eligible for a Social Security number, including undocumented ones, can use an Individual Tax Identification Number to pay taxes. The federal government collected $13.7 billion from taxpayers using […]

Fox: Coronavirus stimulus FAQ: Who gets stimulus money? Will paper checks be issued? When will it come?

March 31, 2020

According to the Institute on Taxation and Economic Policy, immigrants who file taxes using an Individual Taxpayer Identification Number (ITIN) instead of a Social Security Number will be exempt from payments, which the institution says excludes an additional estimated 4.3 million adults and 3.5 million children from the benefit. The one-time checks will also go […]

Congress “CARES” for Wealthy with COVID-19 Tax Policy Provisions

March 31, 2020 • By Matthew Gardner

At a time when record numbers of Americans are facing unemployment, state and local governments are facing a perfect storm of growing public investment needs and vanishing tax revenues, and small business owners are struggling to avoid even more layoffs, lavishing tax breaks on the top 1 percent in this way shouldn’t be in anyone’s top 20 list of needed tax changes.

Scripps News Service: It will likely take at least 2 weeks for stimulus checks to arrive

March 30, 2020

Scripps News Service interviewed Amy Hanauer, ITEP’s executive director, about the $2.2 trillion relief package. https://content.uplynk.com/509a8108debf4051984bc3b66951d875.m3u8

Wall Street Journal:Whiting Petroleum Adopts Poison Pill to Protect Potential Tax Breaks

March 28, 2020

One tax analyst said hard-hit industries might be trying to protect their net operating losses from unwelcome distressed investors looking for buying opportunities. “It seems like one of the unforeseen consequences of the economic downturn that you’re now seeing is that it’s probably creating a target-rich environment for anyone who sees this as an acquisition,” […]

Slate: Why Some Americans Entitled to a Coronavirus Relief Check Won’t Get One

March 28, 2020

The reason why is that the government intends to track Americans down and deliver their corona-bonus using the tax information they submitted in 2018 or 2019. But a fairly large number of households don’t file returns to the IRS each year because their income is so small that they are not required to. As a […]

The Job Is Not Yet Done: ITEP Statement on the $2 Trillion Relief Package

March 27, 2020 • By Amy Hanauer

Following is a statement by Amy Hanauer, executive director of the Institute on Taxation and Economic Policy, regarding the $2 trillion relief package expected to be enacted today. ITEP’s distributional analysis of how the rebate checks will affect individuals and families is here and here. “Crisis and unprecedented are overused words at a time like […]

Bloomberg: Delayed Tax Filing Could Mean Larger Stimulus Check for Some

March 27, 2020

For people who were ineligible in 2018 and perhaps took a pay cut or got a divorce that put them under the income thresholds in 2019, “there needs to be a real information campaign to get people to file on time,” said Meg Wiehe, deputy director of the Institute on Taxation and Economic Policy. Read […]

Crooked: Democrats Must Keep Fighting Trump’s Bailouts

March 27, 2020

These massive corporations also reaped huge benefits from Trump’s 2017 corporate tax cuts. An Institute on Taxation and Economic Policy report from March 10 lays it out: “In the two full years since the Trump corporate tax cuts took effect, seven large U.S.-based airlines reported $30 billion of U.S. pretax income and paid an average […]

CNN: These taxpayers won’t get stimulus checks. That’s unjust

March 27, 2020

Unfortunately, the Senate proposal does not include all taxpayers. Those who file their taxes using an Individual Taxpayer Identification Number (ITIN) instead of a Social Security number have been left out, according to the Institute on Taxation and Economic Policy. Omitting these taxpayers will exclude many of the American taxpayers who are most vulnerable in […]

State Rundown 3/26: Pandemic’s Health and Fiscal Fallout Continues to Grow

March 26, 2020 • By ITEP Staff

This week’s Rundown brings you the most useful reading and resources about how states are affected by and responding to the COVID-19 pandemic. These include: landing pages for the most up-to-date lists of state policy responses; ITEP’s own materials on state policy options and the federal response bills; insights on how a race-forward approach can improve these efforts at all levels; updates on state fiscal troubles and legislative postponements; and the developing picture of which states and communities could be affected more than others.

Miami Herald: Millions of immigrant families won’t get coronavirus stimulus checks, experts say

March 26, 2020

ITIN filers collectively contribute an estimated $11.74 billion in state and local taxes each year, according to the Institute on Taxation and Economic Policy. In 2015, ITIN filers paid $23.6 billion in total federal taxes. Deferred Action for Childhood Arrivals (DACA) and Temporary Protected Status (TPS) holders would be able to qualify for the money […]

ABC News: New York and DC call out shortcomings of relief bill while others stand to gain

March 26, 2020

Who has been left out? Undocumented workers: Those who file their taxes using an Individual Taxpayer Identification Number (ITIN) instead of a Social Security number have been left out, according to the Institute on Taxation and Economic Policy. This means undocumented workers — despite their enormous role in the economy — are left out of […]

Fox NYC: Expand / Collapse search Coronavirus stimulus FAQ

March 26, 2020

According to the Institute on Taxation and Economic Policy, immigrants who file taxes using an Individual Taxpayer Identification Number (ITIN) instead of a Social Security Number will be exempt from payments, which the institution says excludes an additional estimated 4.3 million adults and 3.5 million children from the benefit. Read more

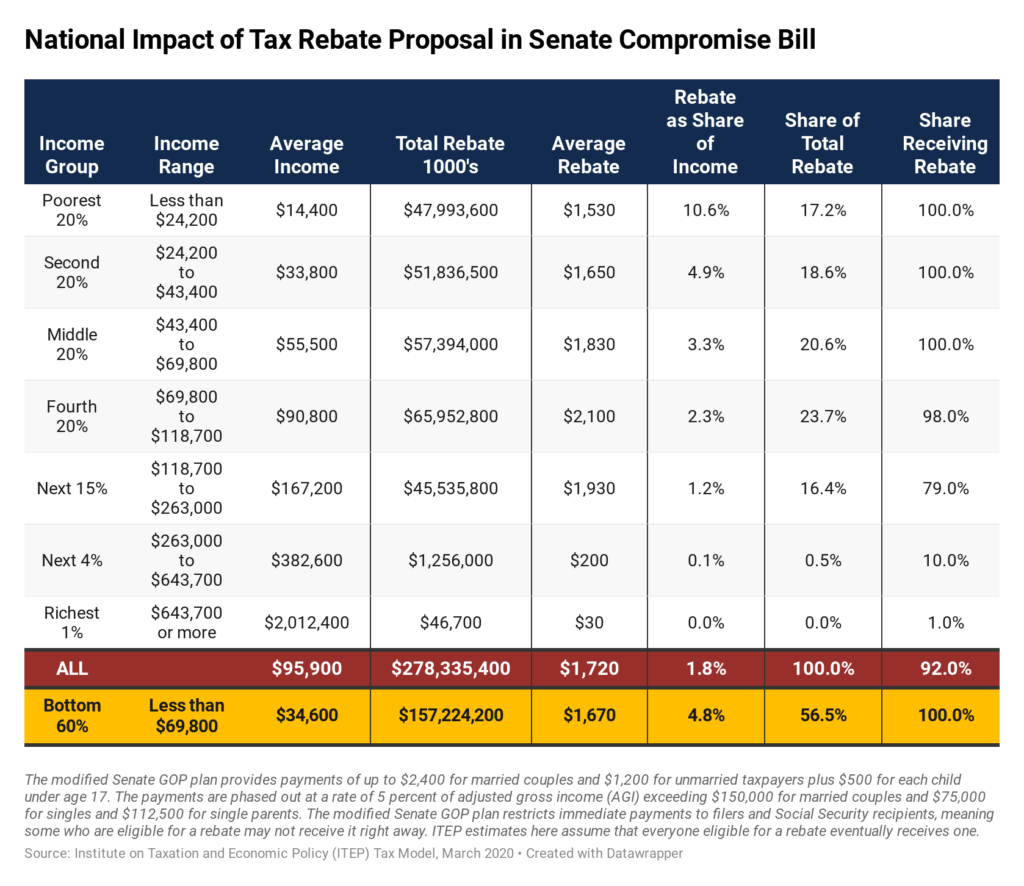

Data available for download Congress passed and the president signed a $2 trillion plan that includes $150 billion in fiscal aid to states, $150 billion in health care spending, large expansions of unemployment compensation and more. These measures are clearly needed as the economy teeters on the brink. Though the bill improves on flaws in […]

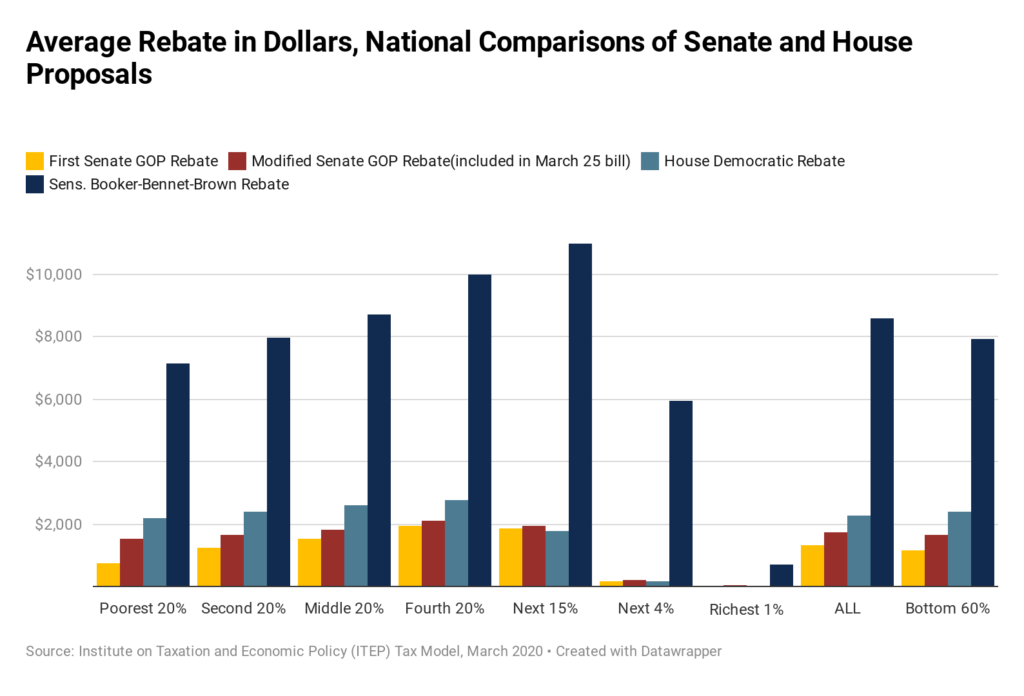

How the Tax Rebate in the Senate’s Bill Compares to Other Proposals

March 25, 2020 • By Steve Wamhoff

Congress is poised to pass a $2 trillion plan that includes $150 billion in fiscal aid to states, $150 billion in health care spending, large expansions of unemployment compensation and more. These measures are clearly needed as the economy teeters on the brink. As the Senate votes on its stimulus/COVID19 bill, one provision ITEP has deeper insights on is the payments to households in the form of tax rebates. ITEP has provided several analyses over the past few days showing that the rebate in the current bill is an improvement over a previous GOP proposal but still falls short of…

Fortune: Everything you need to know about the stimulus checks in the coronavirus relief bill

March 25, 2020

That said, not all older people who are already reliant on government assistance are immediately eligible for a rebate. According to Steve Wamhoff of the Institute on Taxation and Economic Policy (ITEP) think tank, the current bill excludes recipients of Supplemental Security Income (SSI), a federal welfare program granted to elderly and disabled people who […]

WV Metro News: How the federal financial relief package could aid West Virginia citizens and businesses

March 25, 2020

In West Virginia, the average rebate for households is $1,830, according to an analysis from the Institute on Taxation and Economic Policy. Read more

American Prospect: Avoid Taxes, Receive Federal Bailouts

March 25, 2020

On that haul, they paid an average effective federal income tax rate of 2.3 percent. According to Matthew Gardner at the Institute on Taxation and Economic Policy, that rate is actually inflated by Southwest Airlines, which accounts for the overwhelming majority of the income taxes paid by this group. “The other six—Delta, American, United, Alaska […]

Labor Notes: $1,200 per Adult, $500 per Child: Stimulus Bill Nears Passage

March 25, 2020

Below is an excerpt from an op-ed by Amy Hanauer, ITEP’s executive director, published in Labor Notes. The economic catastrophe made this middle-of-the-night package urgent. Unemployment is spiking in ways never before seen and without it, a starkly unequal nation with a badly frayed safety net faces possible Depression-era pain. Today’s bill, while not perfect, […]

Investment News: Recession could hit Social Security financial outlook

March 25, 2020

Trump has proposed eliminating payroll taxes that fund Social Security and Medicare beginning through the end of the year. The Institute on Taxation and Economic Policy, a nonpartisan think tank, estimates the proposed payroll tax holiday would cost $843 billion and 65% of its benefits would go to the richest 20% of taxpayers. Read more

Politico: Who’s Looking Ahead to Phase 4

March 25, 2020

For instance, the House bill would expand the Earned Income Tax Credit in ways Democrats have sought for awhile — like making the incentive larger for childless workers, and making more of them eligible. The liberal Institute on Taxation and Economic Policy said the more robust refundable credits could give families an extra half-trillion dollars […]

New Analysis Shows Average Rebate for Families in the Stimulus Bill

March 25, 2020 • By ITEP Staff

The Senate agreed to a compromise stimulus bill last night that improves on flaws in its initial bill but still fails to go as far as other proposals and leaves out immigrants who file taxes via Individual Taxpayer Identification Numbers (ITIN), the Institute on Taxation and Economic Policy said today.