ITEP's Research Priorities

Illinois ITIN Impact

March 10, 2020 • By ITEP Staff

Impact of Including Illinois ITIN Filers in State & Federal EITCs Based on IRS 2015 ITIN Filer Counts and Current EITC Policy Notes: ITIN filer counts represent estimate of EITC eligible ITIN filers in tax year 2015. All $s expressed in 2020. STATE EITC 2015 Assuming Full Participation EITC eligible ITIN Filers: 156,330 State EITC […]

COVID-19 Is No Excuse for Airline Industry or Any Other Corporate Tax Cut

March 10, 2020 • By Matthew Gardner

Trump administration officials have reportedly floated the idea of including tax breaks for the airline industry in its package of COVID-19-related stimulus proposals, which would allow airline companies to defer income taxes into the future. This is an odd policy choice since most of the biggest airlines are already using deferral to zero out most or all of their federal income taxes on billions of dollars in profits.

Some problems can only be solved when public officials have the resources to act. Today’s public health crisis is that kind of problem. Unfortunately, the Trump administration’s deep tax cuts leave our health infrastructure knee-capped, just when we need it most.

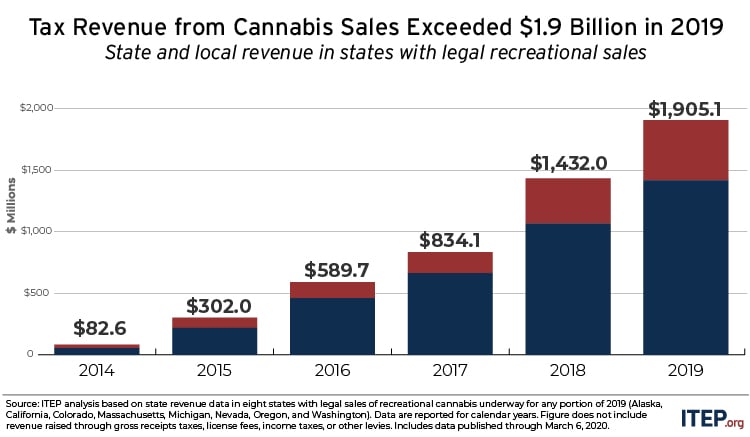

State and Local Cannabis Tax Revenue Jumps 33%, Surpassing $1.9 Billion in 2019

March 10, 2020 • By Carl Davis

Excise and sales taxes on cannabis raised more than $1.9 billion in 2019. This represents a jump of nearly half a billion dollars, or 33 percent, compared to a year earlier. These are the findings of an ITEP analysis of newly released tax revenue data from the eight states where legal sales of adult-use cannabis took place last year.

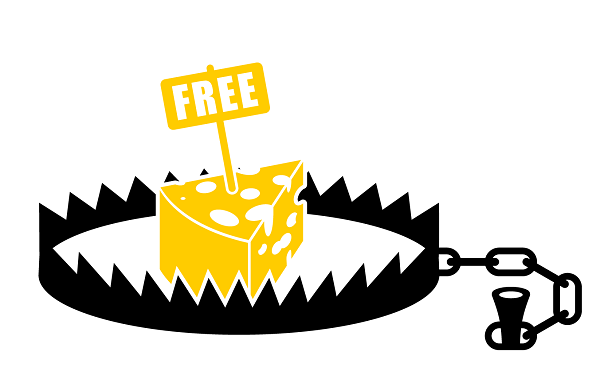

TurboTax Is a Case Study for Why the IRS Should Administer Free File Program

March 9, 2020 • By Jenice Robinson

TurboTax and other online tax preparation companies rely on complicating tax filing and limiting competition as part of their business model.

Washington Post: Virginia General Assembly approves higher gas tax, speed cameras and cellphone ban

March 8, 2020

Virginia joins 31 states that have raised their gas taxes or changed formulas for them in the past decade, responding to declines in revenue, according to the nonprofit Institute on Taxation and Economic Policy. Twenty-two states have variable-rate taxes to guard against inflation. Read more

Alaska’s tax system underwent major changes in the 1970s when oil was found at Prudhoe Bay. Lawmakers repealed the state’s personal income tax (making Alaska the only state ever to do so) and began balancing the state’s budget primarily with oil tax and royalty revenue instead. But as oil prices and production levels have declined, a yawning gap has opened between state revenues and the cost of providing vital public services.

State Rundown 3/4: Sun Shining on Progressive Tax Efforts This Week

March 4, 2020 • By ITEP Staff

Wisconsin’s expansion of a capital gains tax break for high-income households represents a dark spot on this week’s state fiscal news, and the growing threat of COVID-19 is casting an ominous shadow over all of it, but otherwise the picture is pleasantly sunny, featuring small steps forward for sound, progressive tax policy. An initiative to create a graduated income tax in Illinois, for example, got a vote of confidence from a major ratings agency, while a similar effort went public in Michigan and two progressive income tax improvements were debated in Rhode Island. Gas tax updates made encouraging progress in…

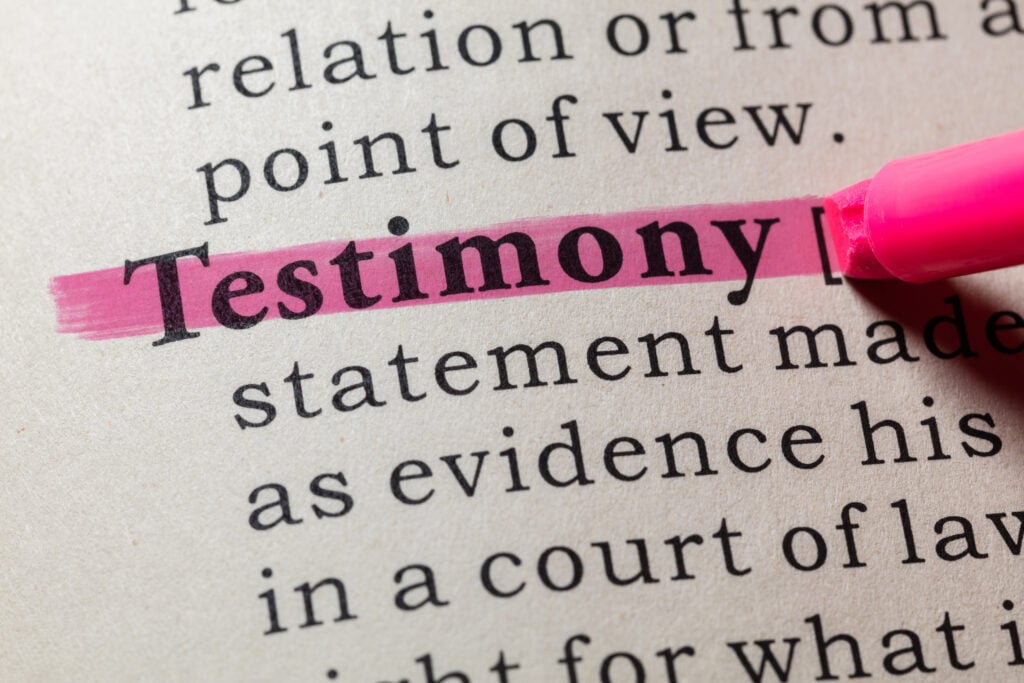

ITEP Testimony Regarding Connecticut Senate Bill 16, An Act Concerning the Adult Use of Cannabis

March 4, 2020 • By Carl Davis

This testimony explains the advantages of the cannabis tax structure proposed in Connecticut’s Senate Bill 16 and offers additional background information as well as ideas for potential changes to the bill.

Market Watch: This is how much American workers saved during the first year after Trump tax overhaul

March 4, 2020

Focusing on personal taxes didn’t tell the whole story, according to Steve Wamhoff, director of federal tax policy at the progressive Institute on Taxation and Economic Policy, or ITEP. “The parts of the Trump tax cuts that really benefit the rich are not the personal-income-tax cuts but the corporate-income-tax cuts and estate-tax cuts,” according to […]

Administration Once Again Touts Misleading Information on 2017 Tax Law

March 3, 2020 • By Matthew Gardner

The Trump administration has remained consistently on message about its 2017 Tax Cuts and Jobs Act. More than two years after the passage of the law, Treasury Secretary Steve Mnuchin is still forlornly attempting to portray it as a boon for working families, despite mounds of evidence to the contrary. Earlier this week the Treasury […]

Connecticut Mirror: After one alarming tax fairness study, CT is wary of launching a second

March 3, 2020

Gasoline distributors shift the entire cost of Connecticut’s 8.1% wholesale fuel tax onto local filling stations, which then pass it all onto motorists — who also pay a 25-cents-per-gallon retail tax. Meg Wiehe, deputy executive director of the Institute on Taxation and Economic Policy, said Connecticut already is a land of “stagnating working-class incomes” and […]

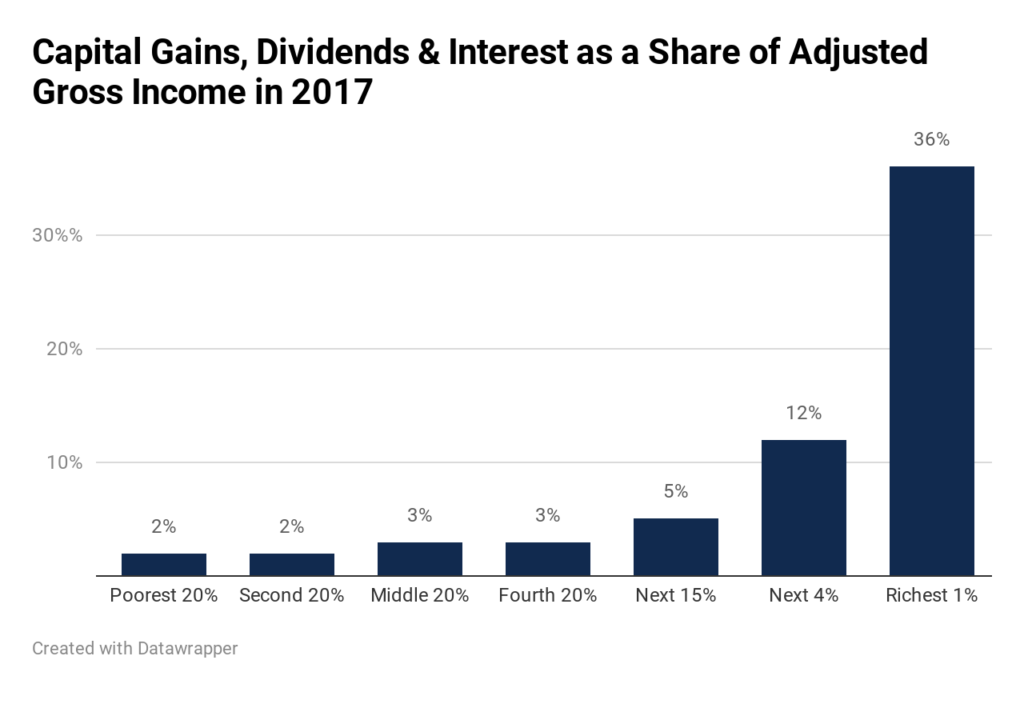

Anti-tax activists’ convoluted claims that the rich pay too much in taxes broke new ground with an op-ed published last week in the Wall Street Journal. Penned by former Texas Sen. Phil Gramm and John Early, a former official of the Bureau of Labor Statistics, the piece is particularly misleading. The so-called evidence in support of their argument against raising taxes on the rich fails to correctly calculate effective tax rates.

West Virginia Center on Budget and Policy: House Income Tax Plan Benefits Wealthy and Could Punch Large Holes in State Budget

March 2, 2020

Once the fund reaches “an amount equal to or exceeding 2.5 times the total net reduction in personal income tax revenue collections that would have been received in that fiscal year if the income tax rates for that fiscal year had been reduced by 0.25 percent” it triggers a reduction in the state’s personal income […]