ITEP's Research Priorities

Nonprofit Quarterly: The $370 Billion Fiscal Cliff: Why State Budgets Need Our Attention

June 30, 2020

A 2018 study released by the nonprofit Institute on Taxation and Economic Policy finds that the poorest fifth spend on average 11.4 percent of their income on state and local taxes, compared to 7.4 percent for the top one percent. As Peter Sabonis wrote for NPQ this spring, particularly during times of crisis, we rely […]

Law 360: Biz Tax Credit Proposals Would Aid Wealthy, Report Says

June 30, 2020

Republican proposals to make business tax credits refundable to mitigate the economic downturn caused by the novel coronavirus pandemic would provide unnecessary tax breaks to high-income people, the Institute on Taxation and Economic Policy said in a report. Read more

POLITICO Morning Tax: Welcome, commissioner

June 30, 2020

FOOT OFF THE ACCELERATOR, PLEASE: The Institute on Taxation and Economic Policy’s Matthew Gardner and Steve Wamhoff maintain in a new paper that the proposals to allow companies to cash out on their tax credits won’t just help businesses in desperate need of cash. Instead, they argue that companies like Amazon and Netflix, which are already […]

Republican Tax Credit Proposal Would Provide New Breaks to Tax Avoiders Like Amazon and Netflix

June 30, 2020 • By Matthew Gardner, Steve Wamhoff

While lawmakers of both parties and policy experts discuss various ways to respond to the continuing COVID-19 crisis and resulting economic downturn, Republicans in Congress are offering a new solution. Their idea, which is still being discussed, is to waive existing limits on business tax credits. This could benefit corporations that are profitable but that nonetheless pay no taxes or very little in taxes because of the many tax breaks and legal loopholes they already enjoy.

State Rundown 6/26: States Take Varying Fiscal Approaches While Awaiting Federal Action

June 26, 2020 • By ITEP Staff

State policymakers this week took a variety of approaches to their fiscal situations amid the COVID-19 pandemic. Tennessee lawmakers chose to balance their budget through $1.5 billion in cuts to public services, but not before adding to those cuts by going forward with planned tax cuts. California legislators also passed a budget but relied on a number of temporary measures and delays to do so. Their counterparts in Massachusetts, New Jersey, and Rhode Island opted for interim budgets to tide them over for a few months while they continue to look for lasting solutions. Meanwhile, many states are debating whether…

Beyond SCOTUS: States Recognize Need for More Inclusive Immigrant Policy

June 26, 2020 • By Marco Guzman

The U.S. Supreme Court last week halted an effort by the Trump administration that would have stripped DACA (Deferred Action for Childhood Arrivals) recipients of their lawful status in the country. The 5-4 ruling is a significant victory for immigrant rights advocates and over 643,000 Dreamers—as they’re known—who were brought here as children and have […]

McSally “Travel Tax Credit” Is an Invitation for Tax Avoidance

June 23, 2020 • By Matthew Gardner

Earlier this week, U.S. Sen. Martha McSally (R-AZ) introduced the “American TRIP Act,” a bill ostensibly designed to encourage Americans to boost the economy by traveling within the United States. The bill is certainly a trip in the colloquial sense of the word.

The Fiscal Times: A ‘Wacky’ Tax Credit Idea: $4,000 for Vacation

June 23, 2020

Matthew Gardner, a senior fellow at the Institute on Taxation and Economic Policy, says that the loose requirements in the bill mean “that any car owner with an ounce of creativity should be able to gin up an excuse for taking a tax credit for every tank of gas they’ve purchased in 2020.” That, says […]

The Institute on Taxation and Economic Policy stands with activists who are guiding the movement to transform America, dismantle systemic racism in policing, and envision a better justice system. Committed protestors in big cities, small towns, and suburban enclaves have spurred a sea change in public opinion and policy possibility on policing and incarceration. Their work and activism builds on years of action by Black Lives Matter and other leaders.

The Dallas Morning News: DACA Texans Are Essential to our COVID-19 Response and Economic Future

June 22, 2020

In total, Texas is home to more than 107,000 DACA recipients, according to U.S. Citizenship and Immigration Services. Those DACA recipients pay $244.5 million annually in state and local taxes, the Institute on Taxation and Economic Policy estimates. Read more

Sentinel & Enterprise: It’s Been a Year Without Equal

June 21, 2020

Instead, the last real action on the fiscal 2021 budget came in January when Baker rolled out a $44.6 billion spending plan that would have its underlying assumptions wiped away before lawmakers could try their hands at producing a budget of their own. The Institute on Taxation and Economic Policy this week said that “despite […]

State Rundown 6/18: States Work to “Finalize” Budgets in Uncertain Times

June 18, 2020 • By ITEP Staff

Despite uncertainty all around the nation, a few states passed budgets this week and many more are negotiating to enact theirs before fiscal years close at the end of June. Colorado notably pared back some of its own tax breaks and limited the potential damage on its budget from new federal breaks. California also passed a budget but few in the state actually think the dealing is done. Iowa quietly enacted its budget too, though advocates in the state are making noise about non-fiscal bills that were added late in the game.

CNN: This Is Who’s Affected by the Supreme Court Decision on DACA

June 18, 2020

According to a 2018 report from the Institute on Taxation and Economic Policy, the young undocumented immigrants who are enrolled in DACA and those who would be eligible for the program if it were still accepting new applicants contribute about $1.7 billion in state and local taxes annually. That figure includes personal income, property, and […]

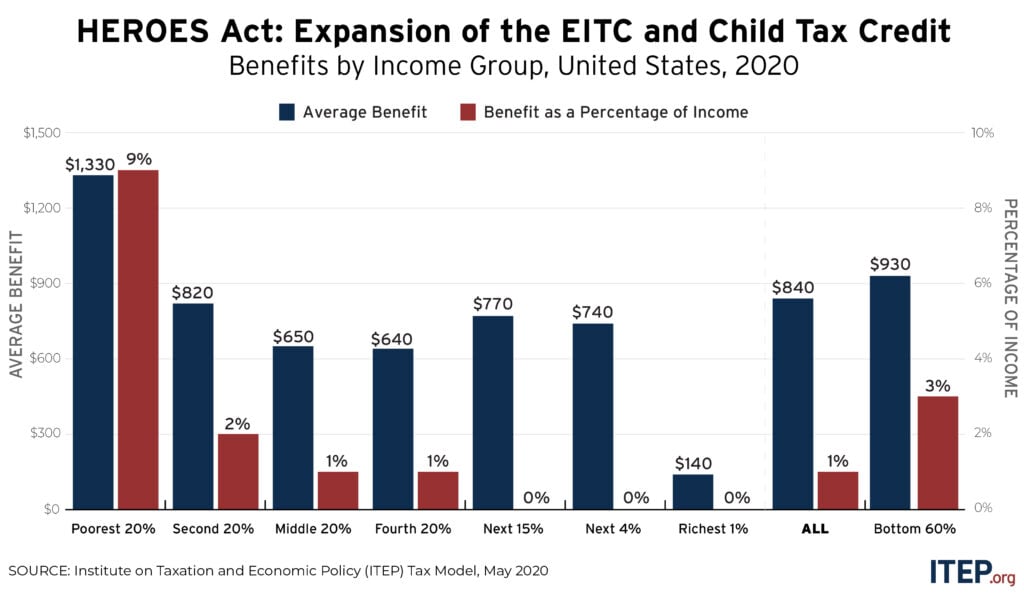

National and State-by-State Estimates of House-Passed Improvements in Tax Credits for Workers and Children

June 18, 2020 • By Steve Wamhoff

Among other important provisions, the HEROES Act includes reforms to the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) to make these tax credits more effective in helping working people and helping parents afford the costs of raising children.

New Jersey Policy Perspective: Unemployment Insurance Taxes Paid by Undocumented Workers Top $1 Billion

June 17, 2020

Over the past ten years, unemployment insurance taxes paid based on undocumented immigrants’ work in New Jersey added more than $1.36 billion to state and federal unemployment insurance trust funds, according to a recent analysis conducted by the Institute on Taxation and Economic Policy and the Fiscal Policy Institute. In addition to contributions to unemployment […]

Tax Justice and Racial Justice: Transformative Change Is Overdue

June 16, 2020 • By Amy Hanauer, ITEP Staff

Progressive tax policy can spur deep investments in communities, help families afford childcare and college, provide healthcare for everyone, re-imagine energy consumption to stop heating the planet, expand parks and bike lanes and public transit. Economic justice can give workers a greater voice than corporations in our democracy. People are protesting because the moment for transformative change in policing and our economy is long overdue.

Crain’s New York Business: Legalizing Marijuana Can’t Cure Inequality, But It Will Ease Budget Crisis

June 14, 2020

My methodology is informed by the work of Carl Davis, research director at the Institute on Taxation and Economic Policy, who recently published a thoughtful blog post on per-capita cannabis excise tax collections. Davis found that last year more than $1.9 billion of tax revenue was collected across seven adult-use states (Alaska, California, Colorado, Massachusetts, Nevada, Oregon, […]

As calls to defund the police demonstrate, state and local decisions about funding priorities and how those funds are raised are deeply embedded in racial justice issues. Tax justice is also a key component in advancing racial justice. Racial wealth disparities are the result of countless historic inequities and tax policy choices are certainly among […]

Most people assume that the federal government is the main—if not only—agent for ensuring economic stability and recovery in response to COVID. Yet, the fight for tax fairness at the state level will have a dramatic impact on economic recovery.

New Jersey Policy Perspective: Road to Recovery: Reforming New Jersey’s Income Tax Code

June 9, 2020

A sensible way to address revenue shortfalls and an unfair tax code is to raise income taxes on the state’s wealthiest households. By reforming New Jersey’s income tax, our recovery can be strengthened by reducing the tax burden that low-paid and middle class families pay, while generating more revenue for public programs and services that […]

POLITICO: States Move Cautiously in Contending With Huge Budget Gaps

June 5, 2020

“This crisis is still in its very early stages,” said Carl Davis of the Institute on Taxation and Economic Policy. Davis noted that the last recession began in December 2007, about nine months before the global financial system really imploded. And yet, many state tax increases didn’t happen until 2009 or even later as they […]

White House Incredibly Still Believes Tax Cuts Are the Answer to America’s Problems

June 2, 2020 • By Steve Wamhoff

White House officials continue to discuss tax cuts in response to the COVID-19 pandemic. Steve Wamhoff provides a roundup of these terrible ideas that would do little to boost investment or reach those who need it most.

Depreciation Breaks Have Saved 20 Major Corporations $26.5 Billion Over Past Two Years

June 2, 2020 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

The Trump administration and its congressional allies have proposed making permanent the expensing provision in the Trump-GOP tax law. Expensing is the most extreme form of accelerated depreciation, which allows businesses to deduct the cost of purchasing equipment more quickly than it wears out. But expensing and other types of accelerated depreciation already account for a very large share of corporate tax breaks and allows many companies to pay nothing at all.

Trump-GOP Tax Law Encourages Companies to Move Jobs Offshore–and New Tax Cuts Won’t Change That

June 2, 2020 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

New tax cuts to incentivize bringing jobs back to the United States will fail. No new tax provisions can be more generous than the zero percent rate the 2017 law provides for many offshore profits or the loopholes that allow corporations to shift profits to countries with minimal or no corporate income taxes.

Minneapolis Star Tribune: Minnesota Companies Cashing in on CARES Act Business Tax Breaks

June 2, 2020

Other taxation watchdogs call it a windfall, and one that disproportionately benefits large companies with volatile earnings, not the neighborhood auto shop or hair salon whose business vanished in the wake of COVID-19. Plus, unlike the Paycheck Protection Program, which has limits on how the loans can be used in order for the loan to […]