ITEP's Research Priorities

Sorry, States: GOP Senate Ignores Need for Federal Relief to State and Local Governments

July 31, 2020 • By Meg Wiehe

During the Great Recession, the most ambitious state revenue-raising efforts closed just 10 percent of shortfalls and most states relied heavily on federal aid and budget cuts to balance their budgets. Of course, states can and should turn to progressive revenue-raising options now, but as the pandemic rages on, the extent of this crisis will become too significant for states and localities to handle on their own. The federal government should step in to help.

Newsweek: Tax-Paying Undocumented Immigrants Should Get Stimulus Checks, Democrats Tell McConnell

July 31, 2020

Their provision would benefit roughly 7.8 million people—4.3 million adults and 3.5 million children—according to the left-leaning Institute on Taxation and Economic Policy. Roughly 4.4 million undocumented immigrants who are ITIN holders paid $23.6 billion in taxes in 2015, according to the Internal Revenue Service. Democrats included the same provision in the House-passed HEROES Act. […]

As many of the country’s major professional sports leagues attempt to return to action amid concerns that the pandemic will find a way to ruin even the best-laid plans, state legislatures find themselves in a similar boat. Lawmakers would normally be enjoying their summer breaks at this time of year, but instead are returning to work in special sessions surrounded by plexiglass and uncertainty. Read on for information on ongoing sessions in states including California, Massachusetts, and Nebraska, as well as upcoming sessions in Missouri and Oregon.

Biden’s Minimum Corporate Tax Proposal: Yes, Please Limit Amazon’s Tax Breaks

July 29, 2020 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

A large majority of Americans want corporations to pay more taxes and Democratic presidential candidate Joe Biden has several proposals to achieve that. The newest idea is to require corporations to pay a minimum tax equal to 15 percent of profits they report to shareholders and to the public if this is less than what they pay under regular corporate tax rules. A recent article in the Wall Street Journal quotes several critics of the proposal, but none of their points are convincing.

Bloomberg: States Eye Anti-Poverty Tax Credit to Ease Covid Impact

July 29, 2020

The various state programs differ widely with the key distinction being refundability. Twenty-three of the 29 EITC states have made their credits refundable—widely considered an important check against regressivity. “Almost every state has an upside-down tax code, where the lowest-income taxpayers pay a much higher share of their income in state and local taxes than […]

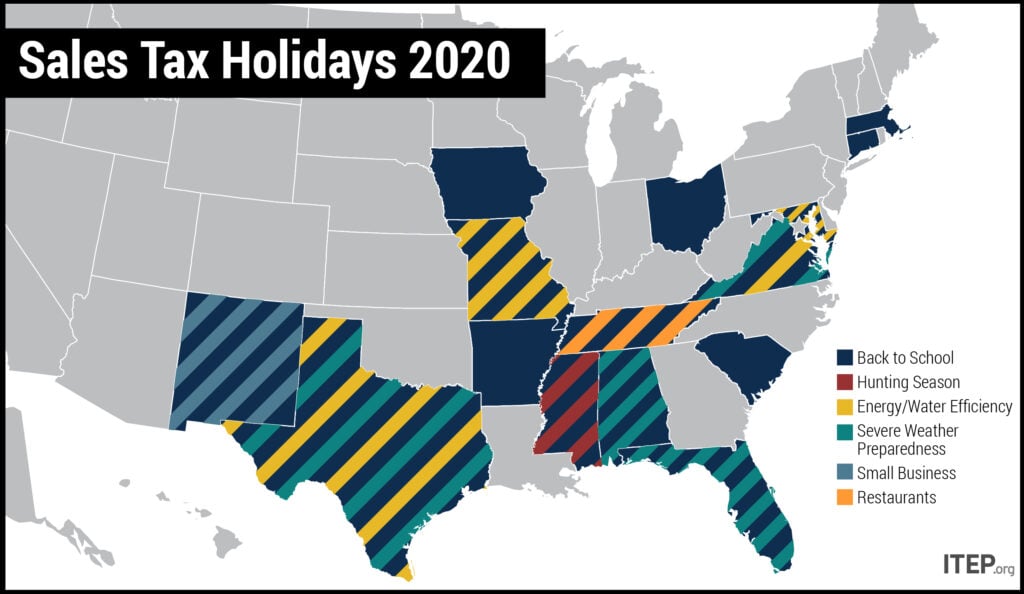

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 29, 2020 • By Dylan Grundman O'Neill

Lawmakers in many states have enacted “sales tax holidays” (16 states will hold them in 2020) to provide a temporary break on paying the tax on purchases of clothing, school supplies, and other items. These holidays may seem to lessen the regressive impacts of the sales tax, but their benefits are minimal while their downsides are significant—and amplified in the context of the COVID-19 pandemic. This policy brief looks at sales tax holidays as a tax reduction device.

A Cautionary Tale on Sales Tax Holidays During a Pandemic

July 29, 2020 • By Dylan Grundman O'Neill

Sixteen U.S. states will hold “sales tax holidays” this year. As ITEP’s newly updated brief explains, these events offer dubious benefits at significant public expense even in normal years, problems which are only amplified in the context of the COVID-19 pandemic.

Americans are demanding policy that meets the needs of this urgent moment. There are now competing proposals from the U.S. House and Senate: One is a reasonable response to the staggering crisis we’re in. One is not.

A Tax Loophole You Could Drive a Food Truck Through: Senate GOP Proposes Full Deductibility of Business Meals

July 28, 2020 • By Matthew Gardner

After weeks of being in no particular hurry to assemble a new COVID-19 economic relief package, the Senate GOP has released its plan. It includes the “Supporting America’s Restaurant Workers Act,” which would allow business owners to write off 100 percent of the cost of their restaurant meals through the end of 2020. The two most obvious questions to ask about such a plan are “why” and “why now?” Republican lawmakers have not offered sensible responses to either because they have none.

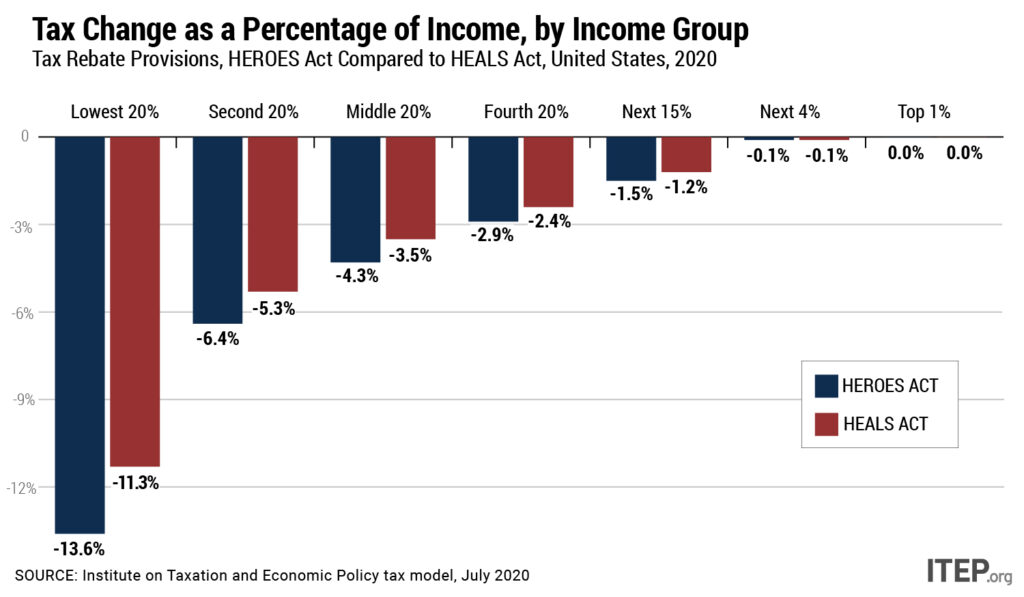

New Analysis Compares HEROES Act and HEALS Act, Disaggregates Data by Race and Income

July 28, 2020 • By ITEP Staff, Jessica Schieder, Meg Wiehe, Steve Wamhoff

The Health, Economic Assistance, Liability Protection and Schools (HEALS) Act released by Senate Republicans Monday includes a tax rebate that is slightly more generous than the one provided under the March CARES Act, but fails to correct most of the earlier act’s problems. House Democrats addressed these shortcomings in the May HEROES Act, a better starting place for negotiations over the next round of COVID-19 relief. ITEP has analyzed both acts to provide a detailed comparison of how the tax rebate provisions would affect families across the income spectrum and by race. Both measures would provide cash payments to a…

Politico Morning Tax: Another View

July 27, 2020

Meg Wiehe of the liberal Institute on Taxation and Economic Policy noted that most states, with just a couple of exceptions, have budgets lined up for fiscal 2021 — but added that she expects most or all of them will have to take another look at those budgets in the fall or winter once they […]

Forbes: Rubio Renews Stimulus Check Eligibility Push; 1.7 Million U.S. Citizens Currently Excluded

July 26, 2020

The 1.7 million American citizens is only a subset of individuals excluded from receiving stimulus checks. The CARES Act had excluded undocumented immigrants, who do not have a Social Security Number (SSN), from receiving stimulus checks, despite the fact that some of these individuals pay taxes using an Individual Tax Identification Number (ITIN). The left-leaning […]

Treasury Secretary Mnuchin to Unemployed Workers: Don’t Worry, Get a Bank Loan

July 24, 2020 • By Jenice Robinson

In an explanation that can only be called richsplaining, Treasury Secretary Steve Mnuchin on Thursday suggested that Congress’s delay in approving expanded unemployment benefits was no problem because banks would extend loans to people in the meantime.

Motley Fool: 3 Reasons Why Trump’s Payroll Tax Cut Won’t Be in the Senate’s Coronavirus Stimulus Bill

July 24, 2020

With a complete payroll tax cut — meaning, no Social Security or Medicare taxes taken out of paychecks at all — 64% of the benefit would be reaped by the country’s wealthiest 20%, according to the Institute on Taxation and Economic Policy. Leaving out the top 5% of earners from that top quintile (their savings […]

Alternet: As laid off workers face a financial cliff, Amazon’s Jeff Bezos grows $13 billion richer in one day

July 24, 2020

While Amazon reported $13.9 billion in income in 2019, Bezos’ company managed to pay just $162 million in federal taxes last year—a 1.2% tax rate despite the United States’ 21% federal tax rate for corporations. The previous two years, according to the Institute on Taxation and Economic Policy, Amazon paid $0 in federal income tax. Read more

Forbes: Why You Won’t See A Payroll Tax Cut In Second Stimulus Round

July 24, 2020

But the financial benefit to taxpayers is so disproportionate toward the wealthy that most economists agree a payroll tax cut is not a logical choice during the pandemic. The Institute on Taxation and Economic Policy estimated in March that 65% of the benefits of a payroll tax cut would go to the richest 20% of […]

New York Times: 16 States Go Ahead With ‘Back to School’ Sales Tax Holidays

July 24, 2020

Still, the drain on state revenue, combined with the incentive to crowd into stores looking for bargains when coronavirus cases are surging, suggests that 2020 may have been a good year for states to skip the tax holidays, said Dylan Grundman, senior state policy analyst at the Institute on Taxation and Economic Policy. “They should […]

Media contact Following is a statement by Amy Hanauer, executive director of the Institute on Taxation and Economic Policy (ITEP), regarding the pending Republican plan for phase IV COVID-19 relief. Details are emerging about the plan, which Senate leadership has not formally released. “Republicans are struggling to agree on the next round of COVID relief […]

The Hill: Congress cannot ignore the need for COVID-19 relief

July 23, 2020

Following is an excerpt from an op-ed by Amy Hanauer published in The Hill. Yet, the economy is keeping afloat because Congress put cash in people’s pockets all spring, with direct payments and expanded unemployment insurance benefits. The CARES Act, passed in March, contained much to criticize, including tax cuts to the richest and $500 […]

Axios: Why economists don’t like the idea of a payroll tax cut

July 23, 2020

“The White House’s latest economic policy trial balloon leaves out the most important solutions and floats some policies that are diametrically opposed to what the country needs,” Amy Hanauer, executive director of the Institute on Taxation and Economic Policy, said in a recent analysis. Read more

Temperatures and tensions are high right now across the country as Congress debates its next pandemic response and states continue to sweat through difficult decisions. Nevada lawmakers, for example, just wrapped up a special session during which they came within one vote of a proposed tax increase but ultimately chose to balance their shortfall through only funding cuts. But advocates in many states, including California, New Jersey, New York, and Rhode Island are trying to light a fire under lawmakers to encourage them to enact progressive tax increases on their wealthiest households.

Bloomberg: Biden Attacks $50 Billion Real Estate Tax Break in Jab at Trump

July 22, 2020

On its merits, the like-kind exchange — sometimes referred to as a “1031” exchange for its tax code designation — is difficult to defend, according to some tax experts. “There are big real estate investors who are very comfortable with the idea that they don’t pay taxes,” said Steve Wamhoff, director of federal tax policy […]

CNBC: These are the taxpayers who benefit most from Trump’s call for a payroll tax holiday

July 22, 2020

The wealthiest 20% of taxpayers would reap the most from a suspension of this levy, according to a recent analysis from the Institute on Taxation and Economic Policy. The non-partisan tax policy organization modeled the impact of eliminating both the employer and employees’ shares of these taxes from Sept. 1 through the end of the […]

Forbes: Here’s Who Gets The Money On Further Covid-19 Relief

July 22, 2020

The Institute on Taxation and Economic Policy (ITEP) performed an analysisto estimate who would benefit most for the cut. An elimination of payroll taxes from September through December 2020 would be worth $336 billion. Read more

11 Alive (Atlanta): President Trump signs memo to keep undocumented immigrants from participating in census

July 22, 2020

The Institute on Taxation and Economic Policy found undocumented immigrants pay eight percent of their incomes in state and local taxes each year. Advocates worry Tuesday’s memo will deter immigrants from responding to the census, and therefore lead to less funding. Read more