With most of the results of the 2018 midterm elections in, the broad landscape for federal tax policy over the next couple years is coming into view. Democratic control of the House and Republican control of the Senate means a significant tax overhaul is unlikely, but minor tax changes may happen. And the run-up to the 2020 presidential election will force more robust debate over the impact of the Tax Cuts and Jobs Act (TCJA) and what aspects of the legislation should be repealed, reformed, or built upon.

Potential Legislation

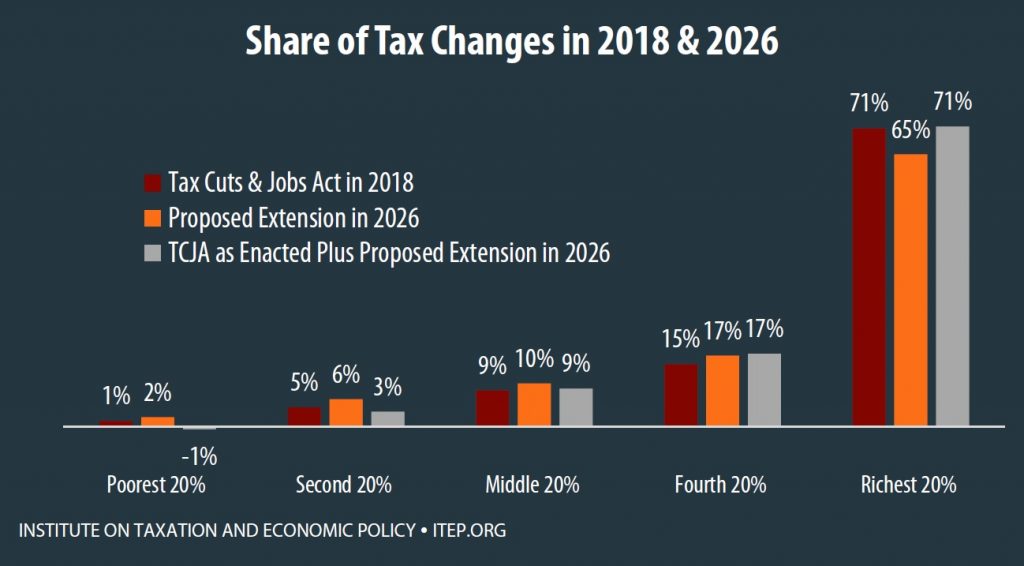

The most immediate consequence of the midterm victory for Democrats in the House is the end of any serious chance for the passage of the Tax Cuts 2.0 legislation – which would have made permanent individual provisions of the TCJA – given House Democrats’ near universal opposition to the proposal. Relatedly, President Trump’s recent proposal of a 10 percent middle-class tax cut is effectively dead, though this is an overly generous statement since such a proposal may never have really been alive in the first place.

With split control of Congress, smaller, bipartisan tax packages are the bills likely to pass. Temporary provisions in the tax code are one such area. A budget deal in early February 2018 retroactively extended 26 tax extenders through the end of 2017, but did not address whether they would be extended through 2018 or any other years. Lawmakers could take up their renewal during the lame duck session this year or they could wait until early next session to deal with them. It is worth noting that those tax extenders that are costly and ineffective should remain expired and those that are effective should be paid for to avoid paying for tax cuts via deficit spending.

If a tax extenders package comes together in the next few months, it could provide a vehicle for minor or technical changes to the TCJA, such as a provision addressing expensing for renovations. On these smaller provisions, lawmakers have shown a propensity for quid pro quo. For example, to reach a budget deal, Republicans traded an increase in the Low-Income Housing Tax Credit in exchange for a fix to the so-called Grain Glitch.

Other potential areas of legislation could be a smaller package around retirement tax incentives, which would be shaped by previous and forthcoming bipartisan legislative packages. In addition, lawmakers could move to further delay or repeal healthcare-related taxes such as the medical device tax, Cadillac tax, or health insurance tax. There also is some discussion that a bipartisan group of lawmakers could seek to pass an infrastructure bill, including some form of revenue raisers, though previous discussions on such a package have proven beyond reach. Looking further forward, there is another group of temporary provisions set to expire after a 5-year extension as part of the 2015 PATH Act, such as the New Markets Tax Credit and the CFC Look-Through Rule, that could be subject to future extenders legislation.

A key question for any of these potential pieces of legislation is whether Congress will close tax loopholes to pay for them or continue the fiscally irresponsible practice of piling on more unpaid for tax cuts on top of trillions in tax cuts since 2001.

The New Tax Debate

Should House Democrats make the effect of the TCJA central to their agenda going forward, it would likely mean a series of hearings examining the specific areas where the legislation is increasing inequity. It could also mean a series of legislative proposals from Democrats highlighting how they would go about repealing or reforming the TCJA. For example, Democrats have proposed a number of bills this year that would reform the TCJA’s problematic changes to the international corporate tax code.

Repealing the TCJA’s cap on state and local tax deductions (SALT) is one area where lawmakers on both sides of the aisle may find common ground. The SALT cap mostly affected higher-income earners, and a significant percentage of them are in wealthier blue states. At a cost of over $85 billion in just 2019 and with 63 percent of the benefits going to the top 1 percent of taxpayers, repeal of the SALT deduction cap would be tremendously costly and regressive. Rather than repeal, lawmakers could explore options to replace the SALT cap with alternative limits on itemized deductions.

Some Democrats have also expressed interest in passing larger tax cuts for low- and middle-class taxpayers potentially in the form of expanding the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC).

The forthcoming debate will also inevitably focus on President Trump’s own tax-paying behavior as Democrats on the Ways and Means Committee seek to obtain and release his tax returns.

The tax reform debate will also be shaped significantly by the 2020 Democratic presidential primary. As with the 2016 or any other presidential primary, the country will likely see a whole host of different tax reform plans. Rumored contenders such as Sens. Kamila Harris (D-CA), Elizabeth Warren (D-MA), and Cory Booker (D-NJ) all recently released proposed initiatives that would fundamentally change the tax code.

The next couple years will provide insight into what major tax changes could look like after the 2020 election or the next time that either party takes unified control of Congress and the White House. Tax policies passed by the Bush Administration, extended during the Obama Administration, and the recent Trump tax cuts combined have set the nation’s federal tax policy on a regressive and unsustainable track. The best start for conversations about tax reform are progressive tax change through reforming the taxation of capital gains, the estate tax, the international tax code, and other crucial areas.