Hawaii made progress in pushing back against the increasing concentration of wealth and power by beefing up its estate tax. Delaware, New Jersey, and Rhode Island all took steps toward taxing opioid producers to raise funds to address the ongoing opioid crisis. Oregon lawmakers continue to try to address their chronic school underfunding with a $2 billion annual investment, in contrast to some of their counterparts in North Carolina who are responding to similar issues with the opposite approach, proposing to slash taxes in the face of their school funding issues – just as research highlighted in our What We’re Reading section shows the national teacher shortage to be even worse than previously thought.

— MEG WIEHE, ITEP Deputy Director, @megwiehe

Major State Tax Proposals and Developments

- HAWAII’s Gov. David Ige signed an estate tax increase into law late last week. The change increases estate taxes for Hawaii net taxable estates valued at over $10 million — a major step forward in requiring the wealthy to pay their fair share. — AIDAN DAVIS

- A recent bill in NORTH CAROLINA would cut taxes on corporations and individuals by rolling back the state’s franchise tax and increasing standard deductions. This proposal for slashing revenue gains momentum among lawmakers as the state’s teachers gear up for another walkout, demanding increased investment. — AIDAN DAVIS

- In contrast to North Carolina, OREGON lawmakers continue to try to raise $2 billion for schools, and talks are progressing, though they are unlikely to forestall a teacher protest over chronic underfunding issues planned to take place in May. — DYLAN GRUNDMAN

State Roundup

- DELAWARE, NEW JERSEY, and RHODE ISLAND are among the states currently considering taxing opioid producers to help fund public health needs related to the drugs. DELAWARE senators advanced a bill to raise $8 million over three years through such a tax, NEW JERSEY Phil Murphy wants to raise $21.5 million through his version, and RHODE ISLAND’s Senate president introduced an opioid tax that would raise $7.5 million per year to buy a drug that reverses the effects of an overdose.

- As CALIFORNIA lawmakers feel the pressure to adequately fund education, new tax proposals are in the mix, including the latest one which would raise the taxes on corporations that have the largest gaps in pay between their CEOs and lowest paid workers.

- As they do every spring, FLORIDA legislators are debating details of ineffective sales tax holidays rather than ways to meaningfully address their upside-down tax system. And after exempting feminine hygiene products from sales taxes last year, they may also join the trend of states exempting diapers.

- Legislators in HAWAII approved a plan to tax Airbnb and other short-term rentals. Both the House and Senate approved separate bills and are expected to meet later this month to work out differences. House lawmakers are also considering a measure to eliminate tax exemptions for real estate trusts (REITs).

- A bill to amend the ILLINOIS constitution to allow for a graduated income tax passed its first legislative hurdle yesterday when it passed out of the Senate committee. Gov. JB Pritzker is calling on lawmakers to give Illinois citizens the chance to vote on the measure in November 2020.

- Before adjourning this Monday, MARYLAND leaders overwhelmingly voted to extend the state’s child and dependent care expenses credit to more families, increasing the income cap from $50,000 to $143,000. They also approved more than $700 million over two years to go toward recommendations of the “Kirwan commission” to improve teacher pay, Pre-Kindergarten, and community schools.

- In MASSACHUSETTS, the House’s budget plan includes no new broad-based taxes.

- MISSOURI lawmakers, after enacting multiple rounds of income tax cuts in recent years, are faced with a revenue shortfall that threatens funding for basic services. But that hasn’t stopped some from advocating for digging the hole deeper still with new regressive income tax cuts.

- The MONTANA Senate tabled a bill that would have undermined the sovereignty of tribal nations. The proposal would have restructured the temporary tribal tax exemption program in ways that could have led to considerable legal costs for tribal and county governments.

- NEBRASKA lawmakers advanced a bill to lower property valuations for people affected by recent historic floods, and are likely to move on soon to larger proposals to reconfigure property taxation and school funding in the state, possibly funded through regressive sales taxes.

- NEVADA legislators are among those looking into replacing traditional gas taxes with vehicle miles traveled taxes.

- Supporters and opponents of promoting equity through a millionaires’ tax in NEW JERSEY are trying to win over the hearts and minds of state residents. Opponents have made themselves heard in the legislature, but a new analysis from Moody’s just re-confirmed that taxes do not drive people out of the state, and polls show 72 percent of New Jerseyans support the proposal.

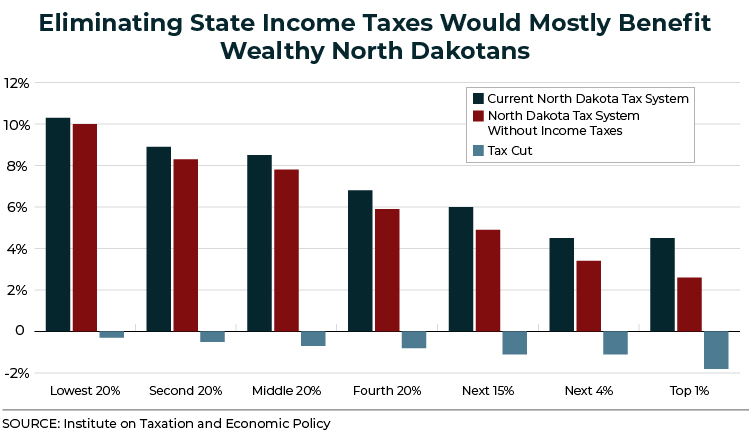

- NORTH DAKOTA House Republicans are trying to amend the budget to include their proposal to use volatile and unsustainable oil tax revenue to replace income taxes—even though the idea was shown to be misguided here and was roundly dismissed on a 41-4 vote in the Senate—so the Grand Forks Herald weighed in this week to make sure they got the message.

- Breezing past the deadline, lawmakers in OKLAHOMA continue to work on the state’s education budget. A controversial school tax credit bill that would allow $30 million a year in credits for contributions to certain organizations is among those that have gained approval from the state House.

- OREGON Gov. Kate Brown is also proposing tobacco tax increases including $2 per pack of cigarettes to help fill a funding shortfall in the state Medicaid program.

- WASHINGTON state leaders are considering raising business taxes to fund higher education needs including financial aid for middle-class students and better pay for community college faculty.

What We’re Reading

- Route Fifty reports on troubling new research from the Economic Policy Institute revealing that the national K-12 teacher shortage is “real, large and growing, and worse than we thought,” particularly in high-poverty school districts.

- The Center on Budget and Policy Priorities writes that VIRGINIA policymakers missed a big opportunity to advance racial equity by making the state’s Earned Income Tax Credit (EITC) refundable this year.

- A recent report from Ideas42 reviews the behavioral science research on tying low-income supports to work requirements and finds that rather than encouraging more productivity, they have deleterious effects on participants’ well-being while also reinforcing negative stereotypes among service providers and administrators.

If you like what you are seeing in the Rundown (or even if you don’t) please send any feedback or tips for future posts to Meg Wiehe at [email protected]. Click here to sign up to receive the Rundown via email.