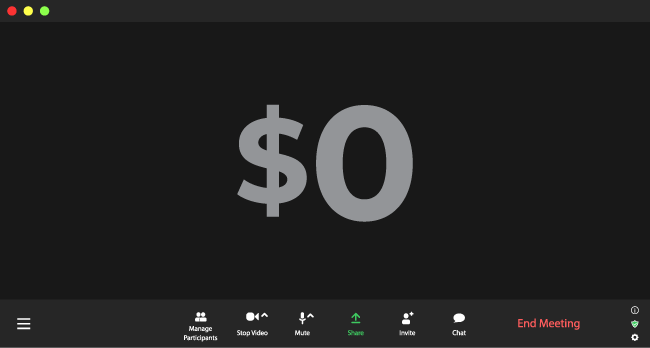

At least 55 of the largest corporations in America paid no federal corporate income taxes in their most recent fiscal year despite enjoying substantial pretax profits in the United States. This continues a decades-long trend of corporate tax avoidance by the biggest U.S. corporations, and it appears to be the product of long-standing tax breaks preserved or expanded by the 2017 Tax Cuts and Jobs Act (TCJA) as well as the CARES Act tax breaks enacted in the spring of 2020.

The tax-avoiding companies represent various industries and collectively enjoyed almost $40.5 billion in U.S. pretax income in 2020, according to their annual financial reports. The statutory federal tax rate for corporate profits is 21 percent. The 55 corporations would have paid a collective total of $8.5 billion for the year had they paid that rate on their 2020 income. Instead, they received $3.5 billion in tax rebates.

Their total corporate tax breaks for 2020, including $8.5 billion in tax avoidance and $3.5 billion in rebates, comes to $12 billion.

This report is based on ITEP’s analysis of annual financial reports filed by the nation’s largest publicly traded U.S.-based corporations in their most recent fiscal year. All data presented here come directly from the income tax notes of these reports. Some companies with unusual fiscal years have not yet filed such reports. Some publicly traded corporations paid nothing on profits in their most recent fiscal year but are not included in this report because they are not part of the S&P 500 or Fortune 500.

No-Tax Corporations Continue a Decades-Long Trend

For decades, the biggest and most profitable U.S. corporations have found ways to shelter their profits from federal income taxation. ITEP reports have documented such tax avoidance since the early years of the Reagan administration’s misguided tax-cutting experiment. A widely cited ITEP analysis of an eight-year period (2008 through 2015) confirmed that federal tax avoidance remained rampant before the TCJA.

Now, with most corporations reporting their third year of results under the new corporate tax laws pushed through by President Donald Trump in 2017, it is crystal clear that the TCJA failed to address loopholes that enable tax dodging—and may have made it worse.

The companies avoiding income taxes in 2020 represent very different sectors of the U.S. economy:

Food conglomerate Archer Daniels Midland enjoyed $438 million of U.S. pretax income last year and received a federal tax rebate of $164 million.

The delivery giant FedEx zeroed out its federal income tax on $1.2 billion of U.S. pretax income in 2020 and received a rebate of $230 million.

The shoe manufacturer Nike didn’t pay a dime of federal income tax on almost $2.9 billion of U.S. pretax income last year, instead enjoying a $109 million tax rebate.

The cable TV provider Dish Network paid no federal income taxes on $2.5 billion of U.S. income in 2020.

The software company Salesforce avoided all federal income taxes on $2.6 billion of U.S. income.

The U.S. income, current federal income tax and effective tax rates in 2020 for all 55 of the zero-tax companies are shown in the following table.

Companies’ Low Tax Rates Rely on a Variety of Familiar Tax Breaks

The Securities and Exchange Commission requires publicly traded companies to disclose U.S. pretax income, federal and state income tax paid on that income, and any significant factors affecting tax expense. For this reason, we can generally describe the tax breaks used by these 55 companies to get their tax expense to zero.

More than a dozen used a tax break for executive stock options to sharply reduce their income taxes last year. These include Advanced Micro Devices, Archer Daniels Midland, Booz Allen Hamilton, Charter Communications, Nike, and Salesforce.com. This tax break allows companies to write off stock-option related expenses for tax purposes that go far beyond expenses they report to investors.

At least half a dozen companies used the federal research and experimentation (R&E) credit to reduce their income taxes in 2020. These include HP, Nike, Jacobs Engineering, Advanced Micro Devices and Ecolab.

Tax breaks for renewable energy are part of the tax avoidance scheme for several companies, including Qurate Retail, Xcel Energy, DTE, and Duke Energy.

A provision in the Tax Cuts and Jobs Act allowing companies to immediately write off capital investments—the most extreme version of accelerated depreciation—helped several companies reduce their income tax substantially. Consolidated Edison, Williams, PPL and Sealed Air all used depreciation tax breaks to substantially reduce current income tax expense, as did at least a dozen other companies.

Notably, there is much we cannot know about factors reducing federal effective income tax rates for these corporations. The Securities and Exchange Commission only requires the disclosure of any tax provision that individually has a significant effect on tax rates and companies routinely take advantage of this limitation to combine the effect of different tax provisions into a single line item. For example, Sealed Air, Seaboard and Sanmina each disclose a substantial effect of “tax credits” on their income tax expense—a disclosure that tells us little about which provisions of tax law are involved. In the case of multinational corporations, it is often unclear whether the tax credits mentioned reduce U.S. taxes or foreign taxes.

How the CARES Act Creates Zero-Tax Corporations

Besides the standard array of tax breaks described above, the 2020 data introduce a new factor driving down corporate tax bills: the CARES Act, ostensibly designed to help people and businesses to stay afloat during the pandemic. Some companies used a CARES Act provision to “carry back” 2018 or 2019 losses to offset profits they reported in prior years, resulting in a rebate that reduced their 2020 taxes, in some cases to less than nothing.

Tax law previously allowed companies to carry back losses to offset profits in two prior years. The TCJA bars companies from doing this (although it still allows companies to carry losses forward to offset profits in future years). However, the CARES Act temporarily restored companies’ ability to carry back losses and, incredibly, is more generous than the pre-TCJA rules.

The CARES Act loosened rules for the treatment of losses not just in 2020, but also retroactively for losses reported in 2018 and 2019, which have nothing to do with the pandemic. Even worse, it allows corporations to carry back losses as far as five years. This means losses incurred in 2018, 2019, and 2020 can offset income taxed at the higher 35 percent tax rate in effect before 2018. Taxing profits at one rate while allowing losses to produce savings at a higher rate is an invitation for companies to play games, moving profits and losses around from one year to another on paper to reduce their tax bills.

The limited disclosures made by these 55 companies suggest that this opportunity is not lost on the leaders of profitable firms. These companies enjoyed at least $500 million of tax breaks last year from the CARES Act provision liberalizing loss carrybacks. In at least four cases (Mohawk Industries, Telephone & Data Systems, Treehouse Foods and Westlake Chemical), the CARES Act’s temporary tax benefit for loss carrybacks exceeds the full 21 percent tax liability these companies would have paid on their pretax profits in 2020 if no tax breaks were available to them.

The total tax benefits these 55 companies enjoyed from the carryback provisions are likely even larger. Several companies acknowledged substantial CARES Act benefits but did not separate the effect of the carryback changes. Other companies very likely chose not to disclose CARES Act benefits because their size was not “significant” for financial reporting purposes.

Not Just a Flash in the Pan: 26 Companies Pay Zero Federal Income Tax Over the Entire TCJA Era So Far

Corporate effective tax rates tend to be volatile, just as are corporate earnings. Yet for many companies reporting paying no tax on their profits in 2020, this result is part of a longer-term pattern. As the table below shows, 26 of the 55 companies were profitable tax avoiders for the three-year period during which the TCJA has been in effect. These 26 companies were profitable in each of the three years (2018, 2019 and 2020) and their total corporate federal income tax over that period was zero or negative.

Duke Energy paid, on balance, no federal income taxes on a total of $7.9 billion over the first three years of the TCJA.

FedEx achieved the same zero tax result on almost $6.9 billion of U.S. income during the past three years.

And Nike has paid no federal income tax in the TCJA era on $4.1 billion of U.S. pretax income.

All told, these 26 companies reported $77 billion in pretax U.S. income in the first three years of the TCJA, and collectively enjoyed a tax rebate of $4.6 billion.

Conclusion

When President Trump signaled his intention to cut corporate taxes in 2017, he and Congress had an opportunity to pare back the many loopholes that have allowed companies to avoid tax on much of their income since the early 1980s. But now, with three years of data published on the effective tax rates paid by publicly traded companies, it is clear that the TCJA has not meaningfully curtailed corporate tax avoidance and may even be encouraging it.

Fortunately, the policy remedies Congress shunned in 2017 remain available today. By paring the tax breaks identified in this report, or by re-introducing some form of a “minimum tax” requiring profitable companies to pay at least some tax in any profitable year, Congress and President Biden could take a major step toward a fairer and more sustainable tax system.

Another ITEP report explains in more detail how corporations avoid taxes, why this is a problem and what Congress can do about it.

Acknowledgments

The authors of this report would like to thank ITEP tax interns David Crawford and Devin Douglass for their work tabulating data for this analysis.