Alaska

State Rundown 2/19: Necktie (NCTI) Offers a Way Out of a Knotty Situation

February 19, 2026 • By ITEP Staff

State lawmakers are grappling with a range of challenges as their fiscal outlooks deteriorate, federal tax enforcement wanes (after the Trump administration cut the IRS workforce by 25 percent), and a rewritten federal tax code sends states scrambling to decide what changes they might want to make in their own codes.

State Tax Watch 2026

February 2, 2026 • By ITEP Staff

ITEP tracks tax discussions in legislatures across the country and uses our unique data capacity to analyze the revenue, distributional, and racial and ethnic impacts of many of these proposals. State Tax Watch offers the latest news and movement from each state.

As state legislative sessions ramp up across the country, property taxes are one of many issues dominating tax policy conversations in statehouses.

State Rundown 1/22: Cautious Tone Noticeable in Most Statehouses

January 22, 2026 • By ITEP Staff

Most states are adopting a very cautious approach so far this year as legislators begin their sessions and governors make their annual addresses, thanks to ongoing economic uncertainty and federal retrenchment.

Local Governments Are Increasingly Strapped: 2026 Will Bring New Challenges and New Opportunities

January 21, 2026 • By Kamolika Das

2025 saw an intensification of state and local tax fights across the country, as well as growing experimentation with local-option taxes, levies, fees, and tourism taxes aimed at keeping budgets afloat while also navigating political constraints imposed by state legislatures.

State Rundown 1/14: New Year Brings New Resolutions for Funding Key Priorities

January 14, 2026 • By ITEP Staff

State governors are beginning to lay out their top priorities as legislatures reconvene in statehouses around the country.

State Rundown 12/17: Tax Policy ‘Naughty or Nice’ List Has Late Entrants

December 17, 2025 • By ITEP Staff

With a little over a week left, some states are solidifying their spots on the tax policy “naughty or nice” list.

State Rundown 11/13: States Tackle Impending Deficits, Pennsylvania Secures an EITC

November 13, 2025 • By ITEP Staff

Revenue forecasts look increasingly grim as states anticipate shortfalls due to the slowing economy and impacts of the new federal tax law.

State Rundown 10/1: State and Local Governments Doing the Opposite of Shutting Down

October 1, 2025 • By ITEP Staff

State and local officials are staying very busy by considering a dizzying amount of reversals.

How Much Would Every Family in Every State Get if the Megabill’s Tax Cuts Given to the Rich Had Instead Been Evenly Divided?

July 14, 2025 • By Michael Ettlinger

If instead of giving $117 billion to the richest 1 percent, that money had been evenly divided among all Americans, we'd each get $343 - or nearly $1,400 for a family of four.

Analysis of Tax Provisions in the Trump Megabill as Signed into Law: National and State Level Estimates

July 7, 2025 • By Steve Wamhoff, Carl Davis, Joe Hughes, Jessica Vela

President Trump has signed into law the tax and spending “megabill” that largely favors the richest taxpayers and provides working-class Americans with relatively small tax cuts that will in many cases be more than offset by Trump's tariffs.

Trump Megabill Will Give $117 Billion in Tax Cuts to the Top 1% in 2026. How Much In Your State?

June 30, 2025 • By Michael Ettlinger

The predominant feature of the tax and spending bill working its way through Congress is a massive tax cut for the richest 1 percent — a $114 billion benefit to the wealthiest people in the country in 2026 alone.

How Much Do the Top 1% in Each State Get from the Trump Megabill?

June 30, 2025 • By Carl Davis

The Senate tax bill under debate right now would bring very large tax cuts to very high-income people. In total, the richest 1 percent would receive $114 billion in tax cuts next year alone. That would amount to nearly $61,000 for each of these affluent households.

Analysis of Tax Provisions in the House Reconciliation Bill: National and State Level Estimates

May 22, 2025 • By Carl Davis, Jessica Vela, Joe Hughes, Steve Wamhoff

The poorest fifth of Americans would receive 1 percent of the House reconciliation bill's net tax cuts in 2026 while the richest fifth of Americans would receive two-thirds of the tax cuts. The richest 5 percent alone would receive a little less than half of the net tax cuts that year.

State Rundown 5/15: State Tax Debates Carry On in the Midst of Chaotic Federal Tax Landscape

May 15, 2025 • By ITEP Staff

Even as most major headlines have been about the ever-changing landscape of federal tax policy, the latest “ideas of the week," and now the House tax bill, state tax policy continues to be a priority for lawmakers.

Want to know more about the tax and spending megabill that President Trump recently signed into law? We've got you covered.

State Rundown 4/24: States Push Tax Cuts Despite Fiscal Uncertainty

April 24, 2025 • By ITEP Staff

While some states are preparing for uncertainty – slowing revenue growth, chaos from unpredictable tariffs, cuts to federal programs, etc. – others continue to move forward with plans for deep tax cuts. For instance, Georgia Gov. Brian Kemp signed legislation accelerating the cut to the personal income tax rate, which is currently phasing down. […]

IRS Cooperation with ICE Will Damage Public Trust, Putting Tax Revenues in Jeopardy

April 10, 2025 • By Marco Guzman

Attempts by the Department of Homeland Security to secure private information from the IRS on people who file taxes with an Individual Taxpayer Identification Number is a violation of federal privacy laws that protect taxpayers. It is also a change that could seriously damage public trust in the IRS, which could jeopardize billions of dollars in tax payments by hardworking immigrant families.

Residents and state lawmakers across the country are pushing back against anti-tax measures and are looking for ways to protect revenue and advance proposals that would raise revenue in progressive ways. This comes at a time when federal policy brings significant risks for state tax revenue.

Sharp Turn in Federal Policy Brings Significant Risks for State Tax Revenues

April 9, 2025 • By Carl Davis

Summary The new presidential administration and Congress have indicated that they intend to bring about a dramatic federal retreat in funding for health care, food assistance, education, and other services that will push more of the responsibility for providing these essential services to the states. Meeting these new obligations would be a challenging task for […]

March Madness kicks off today and the pressure is on as many states’ legislative sessions are nearing the final buzzer. Some state lawmakers are seemingly competing for the title of most regressive state tax policies while others are looking to lift up best practices for more equitable outcomes. The Mississippi legislature landed on a […]

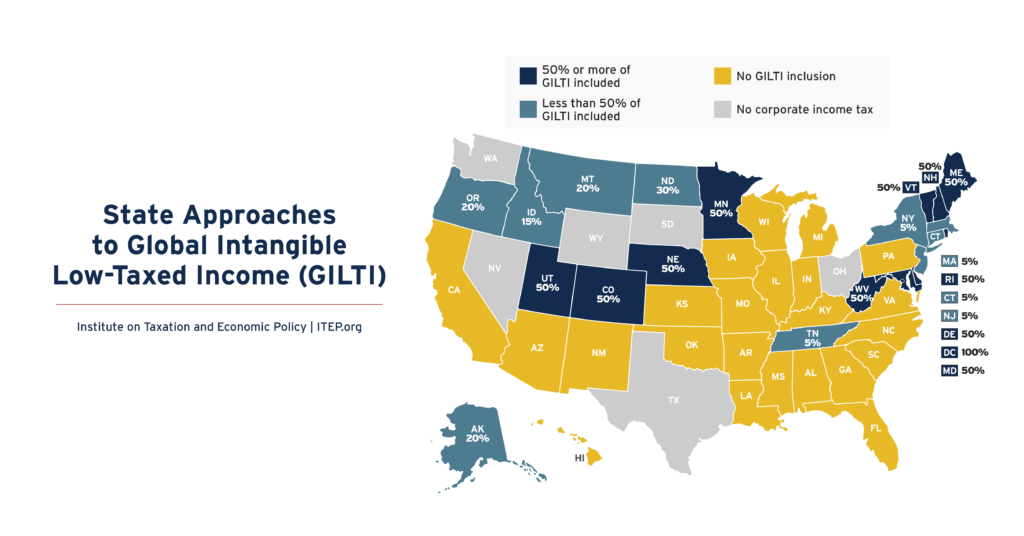

Many states with corporate income taxes include some amount of federally defined Global Intangible Low-Taxed Income (GILTI) in their tax bases. Twenty-one states plus D.C. include some amount of GILTI in their tax calculations in 2025.

State Rundown 3/6: In the Shadow of Chaotic Federal Policymaking States Seek to Tax the Top, Cut Taxes

March 6, 2025 • By ITEP Staff

Proposals from governors in both New Jersey and Wisconsin include provisions to tax high-income earners. Meanwhile, several major tax proposals are advancing in the great plains, with Iowa considering a major cut to unemployment taxes, North Dakota advancing new benefits for private schools, and Wyoming cutting property taxes. The District of Columbia is facing a more than a $1 billion revenue shortfall over the next three years, compared to previous estimates, and a mild recession due in large part to the layoffs of federal workers.

High-Rent, Low-Wealth: Addressing the Racial Wealth Gap through a Federal Renter Credit

March 3, 2025 • By Brakeyshia Samms, Emma Sifre, Joe Hughes

While the federal tax code has some policies focused on raising income of low earners, it contains fewer provisions designed specifically to address wealth inequality. A renter tax credit offers a simple, administratively practical means of reaching low-wealth populations through the federal tax code without requiring a comprehensive measurement of every household’s wealth.

Below is a list of tax expenditure reports published in the states.