Arkansas

Most States Used Surpluses to Reduce Taxes But Not in Sustainable or Progressive Ways

July 22, 2022 • By Kamolika Das

The average person on the street would have no idea that many states experienced unprecedented budget surpluses this year. Iowa, for instance, has the most structurally deficient bridges of any state with nearly 1 in 5 falling apart. The Iowa Board of Regents proposed a 4.25 percent tuition increase for all three state universities and […]

From the Bay State to the Golden State, lawmakers across the nation are making deals and negotiating budgets with major tax implications...

Creating Racially and Economically Equitable Tax Policy in the South

June 21, 2022 • By Kamolika Das

The South's negative outcomes on measures of wellbeing are the result of a century and a half of policy choices. Lawmakers have many options available to make concrete improvements to tax policy that would raise more revenue, do so equitably, and generate resources that could improve schools, healthcare, social services, infrastructure, and other public resources.

Some Lawmakers Continue to Mythologize Income Tax Elimination Despite Widespread Opposition

April 19, 2022 • By Kamolika Das

One of the most surprising trends this legislative session is that conservative leaders and the business community joined with progressive advocates to oppose income tax repeal plans. There is a general consensus that income tax repeal is a step too far.

Bloomberg: Did You Pay Your ‘Fair Share’ of Federal Income Tax This Year?

March 31, 2022

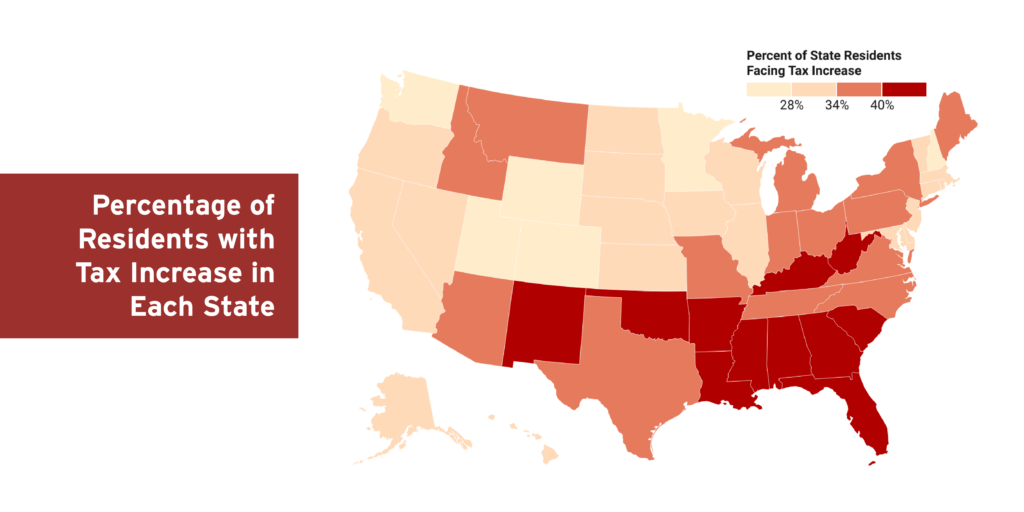

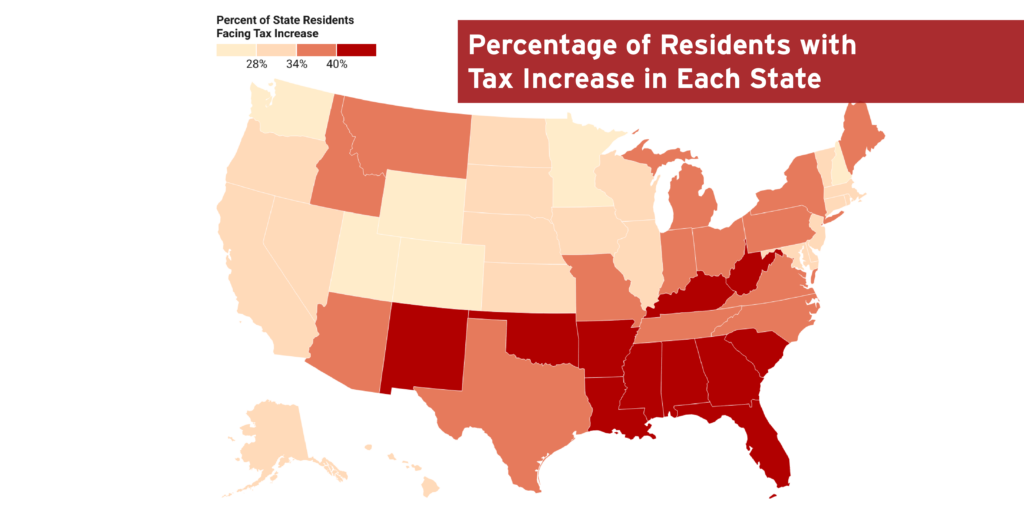

And according to the Institute on Taxation and Economic Policy, the impact would have a definite geographic tilt. The states where more than 40% of residents would face tax increases are largely in the South, including Mississippi, West Virginia, Arkansas, Louisiana, Alabama, Kentucky, Oklahoma, Georgia, New Mexico, South Carolina, and Florida. read more

New 50-State Analysis: Poorest Two-Fifths Would Bear the Brunt of Sen. Rick Scott’s Proposed Tax Increase

March 7, 2022 • By ITEP Staff

“Billionaires are getting richer, and some of them are altogether avoiding taxes or paying a tiny percentage relative to their income and wealth. The 2017 tax law further worsened inequality by giving huge tax breaks to the rich. It’s inconceivable that a lawmaker would propose to single out the most vulnerable households for higher taxes.” --Steve Wamhoff

State-by-State Estimates of Sen. Rick Scott’s “Skin in the Game” Proposal

March 7, 2022 • By Steve Wamhoff

A proposal from Sen. Rick Scott would increase taxes for more than 35% of Americans, with the poorest fifth of Americans paying 34% of the tax increase.

Arkansas Advocates for Children and Families: Tax Cut Plan Even More Expensive, Skewed Toward The Wealthy

February 7, 2022

The likely proposal for the long-discussed special session seems to have settled, and its main feature would be to cut the top personal and corporate income tax rates. This disproportionately benefits the wealthy, and the corporate income tax cut will largely be captured by out-of-state shareholders, meaning the revenue will leave the state economy entirely. […]

The New Trend: Short-Sighted Tax Cuts for the Rich Will Not Grow State Economies

January 10, 2022 • By Neva Butkus

The same legislators who touted tax cuts for the rich as solution to our problems before the pandemic are also saying tax cuts for the rich are a solution during the pandemic. Tax cuts cannot be a solution to everything, especially at a time when the richest Americans are amassing more wealth than ever.

Rather than resorting to tax cuts, which can eventually create revenue shortfalls, lawmakers should determine whether they have adequately invested in people and communities. There are better ways to leverage tax systems to help those who need it most.

State Rundown 12/15: Making Our State Tax Naughty or Nice List & Checking it Twice

December 15, 2021 • By ITEP Staff

As the holiday season kicks into full gear, we’re putting the finishing touches on our State Tax Naughty or Nice list, and it looks like some late entrants are making a good case to be included...

Bloomberg: SALT Debate Forces Rich Americans to Confront Widening Tax Gap

December 10, 2021

Lawmakers in Arizona, Arkansas, Idaho, Iowa, Louisiana, Missouri, Montana, North Carolina, Ohio and Oklahoma have also approved cuts to their top personal income tax going into effect either this year or in future years. “There are states moving in different directions,” said Carl Davis, research director at the left-leaning Institute on Taxation and Economic Policy. […]

Arkansas Democrat-Gazette: Income tax cut bills roll through Arkansas House and Senate; steel plant incentive also meets approval

December 9, 2021

The state Democratic House Caucus held a news conference Wednesday morning to release several proposals that they said would be a better use of the $600 million a year that the Institute on Taxation and Economic Policy estimated was how much the income tax rate cuts would eventually reduce state general revenue. The House Democrats’ […]

The end of Spooky Season is near but that hasn’t stopped state lawmakers from adding their frightening plans into the bubbling cauldron of bad tax policy ideas...

The release of the ‘Pandora Papers’ showed once again that states and their tax systems play an important role in wealth inequality, and in this case, worsening it...

Arkansas Times: Arkansas income tax cut plan favors the rich. Duh.

October 8, 2021

Analyses by the Institute on Taxation and Economic Policy (ITEP) show that plans to cut the top income tax rate would largely benefit Arkansans with the highest incomes and cost hundreds of millions in annual revenue. ITEP estimates that cutting the top tax rate from 5.9 percent to 5.5 percent would cost the state $138 million annually. […]

Arkansas Advocates for Children and Families: Proposed Cuts to the Top Tax Rate Are Costly and Heavily Favor the Rich

October 8, 2021

As the Arkansas Legislature concludes the 2021 general session, our attention must turn to the special session they are preparing to begin to discuss personal income tax cuts. Although income tax cuts may sound like something everyday Arkansans would welcome, when we examine the details, it turns out most Arkansans will be getting a bad […]

One of the few industries to excel during the economic downturn brought on by the pandemic has been the marijuana business, and lawmakers around the country are taking notice as they try to ensure that sales in their state are both legal and subject to tax...

Though we can’t fault anyone for being distracted by the major stories of the day, we at ITEP remain committed to keeping you up to date on what’s happening in the tax world around you...

Summer is quickly (and sadly) coming to an end and if you’ve been away enjoying the great outdoors or off the grid, we’re here to help keep you up to date on what’s been happening on the tax front around the country...

State Experimentation with Sales Tax Holidays Magnifies Their Flaws

August 6, 2021 • By Dylan Grundman O'Neill

It’s back-to-school shopping season, so…everyone who buys a cell phone in Arkansas this weekend will do so sales-tax-free. For this whole week in Connecticut, and for the entire spring in New Mexico, the corporate owners of highly profitable multinational restaurant chains had the option to pocket their customers’ taxes rather than remit them to the state to fund vital public services, pass along those savings to their customers, or give a much-needed boost to their employees. And all told, about $550 million of state and local revenue will be forgone in 17 states this year through wasteful and poorly targeted…

State Rundown 8/4: Tis the Season…for Unnecessary Sales Tax Holidays

August 4, 2021 • By ITEP Staff

It’s beginning to look a lot like that time of year again. That’s right, it’s sales tax holiday season and states across the country are doing their best to induce spending that would probably occur regardless...

State Rundown 6/30: Resolutions Are in Order for the New Fiscal Year

June 30, 2021 • By ITEP Staff

Today is the last day of the fiscal year in many states, and some lawmakers might want to take the opportunity to make some new fiscal year resolutions. Legislators in Arizona, New Hampshire, Ohio, North Carolina, and Wisconsin, for example, should really cut back on the trickle-down tax-cut Kool-Aid, which may make parties with rich donors more fun but tends to be both harmful and habit-forming...

State Rundown 6/24: Late June State Fiscal Debates Unusually Active

June 24, 2021 • By ITEP Staff

Delayed legislative sessions and protracted federal aid debates have made for a busier June than normal for state fiscal debates. Arizona, New Hampshire, and North Carolina legislators, for example, are still pushing for expensive and regressive tax cuts in their states while they remain in session...

“Tax Day” was earlier this week but the debates, research, and advocacy that determine our taxes and how they are used take place every day of the year...