Blog

1303 posts

Minnesota Poised to Enact Landmark Loophole-Closing Corporate Tax Reforms

May 7, 2023 • By Matthew Gardner

With Minnesota poised to enact worldwide combined reporting of corporate income taxes, business lobbyists are pulling out all the stops to make state lawmakers believe the apocalypse is upon them.

While the conversations on the debt ceiling heat up in the nation's capital, debates on state tax policy also continue to unfold in capitol buildings across the nation...

The GOP is Finally Ready to Raise Taxes. (Or, When a Tax Hike is Not a Tax Hike.)

May 3, 2023 • By Joe Hughes

House Republicans recently voted to rescind the green energy and electric vehicle tax credits that were enacted last Congress as part of the Inflation Reduction Act. This newfound willingness to raise taxes stands in contrast to the recent position of almost the entire House Republican Caucus.

Minnesota’s House, Senate and Governor’s office have each proposed their own vision as to how the state should maximize its $17.5 billion surplus and raise new revenue, and these tax plans make one thing clear: Minnesota lawmakers are serious about using tax policy to advance tax equity and improve the lives of Minnesotans.

A compelling new examination over multiple years and multiple states found that infants are more likely to survive to age one in states that raise more revenue and raise it from those most able to pay. Generating taxes from rich people and corporations can help babies make it to their first birthday.

Kansas Avoids Flat Tax Proposal: Narrow Victory a Cautionary Tale for Other States

April 27, 2023 • By Brakeyshia Samms

Kansas lawmakers failed to override Gov. Laura Kelly’s veto of a damaging flat tax package. In doing so, the state narrowly avoided traveling again down the same disastrous yet well-worn path of deep income tax cuts. States across the country can learn from Kansas’s experience by rethinking tax policy decisions and broader statewide priorities.

This week the importance of state tax policy is center stage once again...

Racial Justice Requires Tax Justice: Our Analysis Helps Deliver Both

April 24, 2023 • By Amy Hanauer

ITEP’s analytical approach, our comprehensive microsimulation model, and our unique state-level capacities enable us to do pioneering analyses that enrich the debate on racial justice in tax policy that no other entity can do.

State Rundown 4/19: Revenue Discussions Heat Up Like the Temperature

April 19, 2023 • By ITEP Staff

Tax season has ended for most filers, but the topic remains a hot one in states around the country...

Why is My Refund So Much Smaller This Year? Only the Good (Tax Credits) Die Young.

April 18, 2023 • By Joe Hughes

This year millions of American families are finding that their refunds are much smaller than last year—or that they even owe taxes back to the government—because of the expiration of the expanded Child Tax Credit and Earned Income Tax Credit that were in effect in 2021. The lapse of the expanded credits affects a majority of the middle class, but lower-income households are particularly likely to feel the sting.

Everything! Taxing wealthy people and corporations and using the revenue for paid leave, child care, education, health care and college would transform America for girls and women of every race and family type, in every corner of this country.

State Rundown 4/12: Tax Day 2023 – A Good Reminder of the Impact of Our Collective Investments

April 12, 2023 • By ITEP Staff

With Tax Day quickly approaching it’s worth taking some time to reflect not just on tax forms (though those are important!), but also on the current state of state tax policy...

Deep Public Investment Changes Lives, Yet Too Many States Continue to Seek Tax Cuts

April 12, 2023 • By Aidan Davis

When state budgets are strong, lawmakers should put those revenues toward building a stronger and more inclusive society for the long haul. Yet, many state lawmakers have made clear that their top priority is repeatedly cutting taxes for the wealthy.

As Tax Day approaches, it’s worth thinking about not only the taxes that we individually pay but the overall condition of our tax code as well. State tax codes, while perhaps less discussed than the federal system, are critically important. Depending on how they are designed, state taxes can improve or worsen economic and racial […]

This week, a bill out of Arkansas that would cut the top personal income tax rate and the corporate income tax rate found its way to the governor’s desk...

Lawmakers have repeatedly stepped on the same rake of slashing tax rates and expecting revenues to magically go up. Now they want middle-class Americans to be the ones who get hit in the face. The con is getting tired. If Congress wants to reel in the debt then it’s time to raise taxes on the wealthy.

Minnesota’s Tax Code Should Be Based on Ability to Pay, Not Year of Birth

March 31, 2023 • By Carl Davis, Eli Byerly-Duke

Minnesota lawmakers are considering a carveout that would treat seniors much more favorably than young families. The proposal would fully exempt all Social Security income from state income tax, even for seniors with exceptionally high incomes.

Over the past week Washington state saw a major victory for tax fairness after the state Supreme Court held the state’s capital gains tax—passed in 2021—constitutional...

From dedicating new taxes to fund climate action and public health to vacancy and “mansion” taxes, many local leaders are already exploring ways to make their tax systems more progressive and sustainable. ITEP is committed to helping local leaders and advocates build on this work by advancing knowledge about local tax solutions.

Race-Conscious Tax Policy Discourse is Shifting the Conversation About the Tax Code

March 27, 2023 • By Brakeyshia Samms

As we look ahead to what comes next in our journey to a more race-conscious tax policy debate, it’s worth reflecting on how we got here and what we’ve learned along the way.

As nature bursts into life and color with the arrival of spring, state tax proposals are doing the same as the legislative seeds planted by lawmakers earlier this year start to grow, blossom, and in some cases rot. However, some governors are not entirely happy with what state lawmakers have produced.

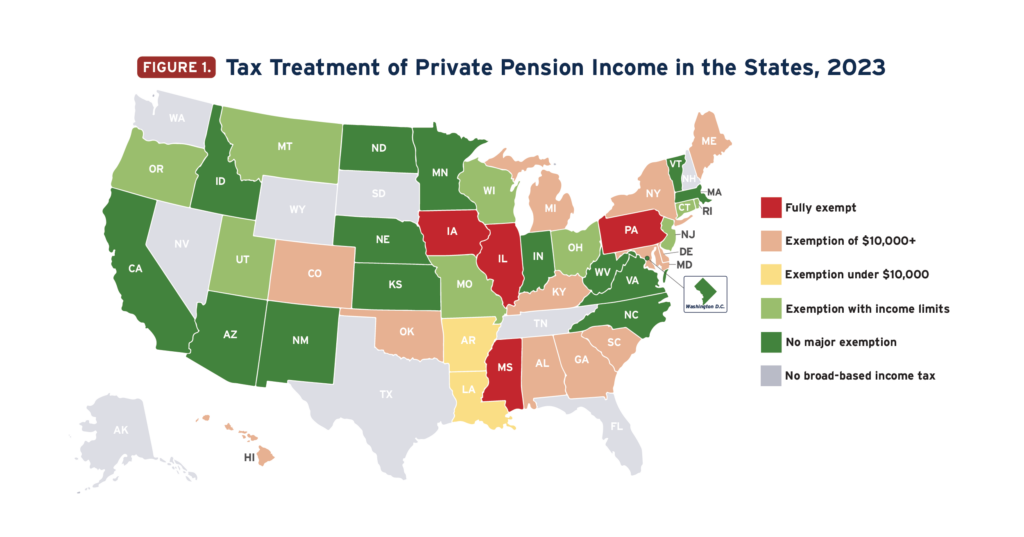

States Prioritize Old Over Young in Push for Larger Senior Tax Subsidies

March 23, 2023 • By Carl Davis, Eli Byerly-Duke

Under a well-designed income tax based on ability to pay, it is simply not necessary to offer special tax subsidies to older adults but not younger families. At the end of the day, your income tax bill should depend on what you can afford to pay, not the year you were born. It’s really as simple as that.

It’s March and state lawmakers are showing why the Madness isn’t only reserved for the basketball court...

As one of the most prosperous countries in human history, we have enough resources for our collective needs. By better taxing corporations and the wealthiest, we can generate revenue to improve family security, strengthen our communities, and reduce the debt too.

Politifalse: A Fact-Checker Does Biden an Injustice on Taxes Paid by Billionaires

March 9, 2023 • By Michael Ettlinger

Most Americans pay more in Social Security and Medicare payroll taxes than they pay in federal personal income tax. So just looking at the personal income tax for comparison misses most of the taxes middle-income Americans pay. That is not true for billionaires because a much, much smaller proportion of their income is subject to the federal payroll taxes.