California

How the Revised Senate Tax Bill Would Affect California Residents’ Federal Taxes

November 13, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In California, 39 percent of the federal tax cuts would go to the richest 5 percent of residents, and 20 percent of households would face a tax increase, once the bill is fully implemented.

Senate Tax Plan Reserves Greatest Benefit for Richest Americans, Millions Face an Increase

November 13, 2017 • By ITEP Staff

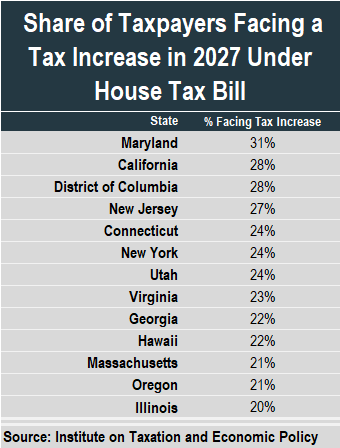

A 50-state analysis of the Senate tax proposal finds that not only would greatest share of benefits go to the richest Americans, but also more than one in 10 taxpayers would face a tax hike, with a large number of those taxpayers residing in states where residents pay higher state and local taxes.

House Tax Bill Would Put Property Tax Deduction Out of Reach for Most Households

November 13, 2017 • By ITEP Staff

The House of Representatives is expected to vote this week on a bill that would reduce federal revenues by roughly $1.5 trillion over the next decade. Despite the bill’s high price tag, many households would pay more in federal tax if the bill is enacted, in large part because it slashes the deduction for state […]

Flawed Data from House Leadership Attempts to Hide Tax Hikes Under Proposal

November 9, 2017 • By Carl Davis

In a story published yesterday evening, Politico reported that House leaders have been “working to create customized data models” to show lawmakers that their constituents will not face a tax increase under the tax bill being debated in the House. On this point, House leaders have taken on an impossible task.

State Rundown 11/8: Online Sales Tax Fight and Tax Subsidy Absurdity Go National

November 8, 2017 • By ITEP Staff

Internet sales tax fairness efforts gained momentum this week as most states joined together to encourage the US Supreme Court to allow them to collect taxes on online sales. Meanwhile, Montana lawmakers will enter special session next week to plug their revenue shortfall, Mississippi's (self-inflicted) revenue crunch is reaching unprecedented severity, and misguided corporate tax subsidies got mainstream attention from HBO's John Oliver and Rolling Stone.

Analysis of the House Tax Cuts and Jobs Act

November 6, 2017 • By Matthew Gardner, Meg Wiehe, Steve Wamhoff

The Tax Cuts and Jobs Act, which was introduced on Nov. 2 in the House of Representatives, would raise taxes on some Americans and cut taxes on others while also providing significant savings to foreign investors.

How the House Tax Proposal Would Affect California Residents’ Federal Taxes

November 6, 2017 • By ITEP Staff

The Tax Cuts and Jobs Act, which was introduced on November 2 in the House of Representatives, includes some provisions that raise taxes and some that cut taxes, so the net effect for any particular family’s federal tax bill depends on their situation. Some of the provisions that benefit the middle class — like lower tax rates, an increased standard deduction, and a $300 tax credit for each adult in a household — are designed to expire or become less generous over time. Some of the provisions that benefit the wealthy, such as the reduction and eventual repeal of the estate…

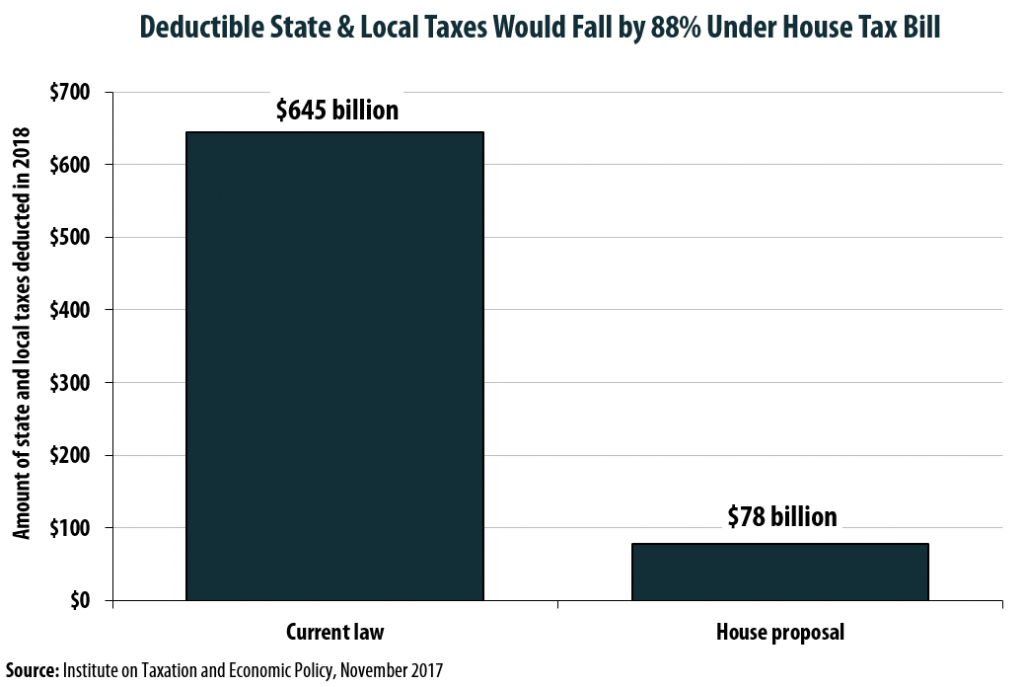

House Plan Slashes SALT Deductions by 88%, Even with $10,000 Property Tax Deduction

November 3, 2017 • By Carl Davis, Steve Wamhoff

One of the most contentious issues in the current federal tax debate is over what to do with the deduction for state and local taxes paid (the SALT deduction). Since the deduction’s benefits vary by state, the House proposal to drastically scale it back has led to an outcry among lawmakers from states such as New York, New Jersey, and California whose constituents would be impacted most dramatically by the change. In an attempt to address those concerns, House leadership agreed to partially retain the deduction for real estate property taxes paid (up to $10,000 per year) while still repealing…

State Rundown 11/1: Connecticut Balances Budget, Leaves Tax Code Out of Whack

November 1, 2017 • By ITEP Staff

This week a "historic" but highly problematic budget agreement was finally reached in Connecticut, Michigan lawmakers banned localities from taxing any food or beverages, and Nebraska and North Dakota both got unpleasant news about future revenues. Also see our "what we're reading" section for news on 11 states that have run up long-term fiscal deficits since 2002 and the impacts of flooding on local tax bases.

NY Daily News: D.C.’s Budget Takes Dead Aim at NYC

October 27, 2017

The Institute on Taxation and Economic Policy finds that 84% of the tax cuts received by New York State residents would go to the richest 1% of households here — those with income of at least $872,000. The one-percenters would get an average tax break of nearly $104,000, or 314 times the $330 that a […]

International Business Times: Do Lower Taxes Spur Economic Growth? What Happened In No-Tax States

October 26, 2017

Researchers at the non-partisan and non-profit Institute on Taxation and Economic Policy compared the nine states without personal income taxes, which include Florida, Texas and Washington, to the nine states with the highest top marginal tax rates over the last decade, which include California, New York and Oregon. They found the states with the highest […]

Trickle-Down Dries Up: States without personal income taxes lag behind states with the highest top tax rates

October 26, 2017 • By Carl Davis, Nick Buffie

Lawmakers who support reducing or eliminating state personal income taxes typically claim that doing so will spur economic growth. Often, this claim is accompanied by the assertion that states without income taxes are booming, and that their success could be replicated by any state that abandons its income tax. To help evaluate these arguments, this study compares the economic performance of the nine states without broad-based personal income taxes to their mirror opposites—the nine states levying the highest top marginal personal income tax rates throughout the last decade.

State Rundown 10/13: Soda Taxes, Business Subsidies, and Gas Taxes Considered in Several States

October 13, 2017 • By ITEP Staff

A comprehensive tax study is underway in Arkansas this week as other states hone in on more specific issues. Soda taxes hit setbacks in Illinois and Michigan, business tax subsidies faced scrutiny in Iowa and Missouri, and gas tax update efforts are underway in Mississippi and North Dakota.

Bloomberg: GOP Tax Plan Seen Hurting Middle Class in N.Y., 8 Other States

October 5, 2017 • By ITEP Staff

The ITEP report concludes that many of the most affected people would be middle-income and upper-middle income taxpayers. For example, in Maryland, about one-third of those making from $48,700 to $73,700 would face a tax hike, while 41 percent of those between $73,700 and $126,500, would face an increase, the study says. And almost 65 […]

State Rundown 10/4: Wildfires in Montana and Tax Cuts in Kansas Wreak Budget Havoc

October 4, 2017 • By ITEP Staff

This week, Kansas's school funding was again ruled unconstitutionally low and unfair, while Montana lawmakers indicated they'd rather let historic wildfires burn a hole through their budget than raise revenues to meet their funding needs. Meanwhile, a struggling agricultural sector continues to cause problems for Iowa and Nebraska, but legalized recreational marijuana is bringing good economic news to both California and Nevada.

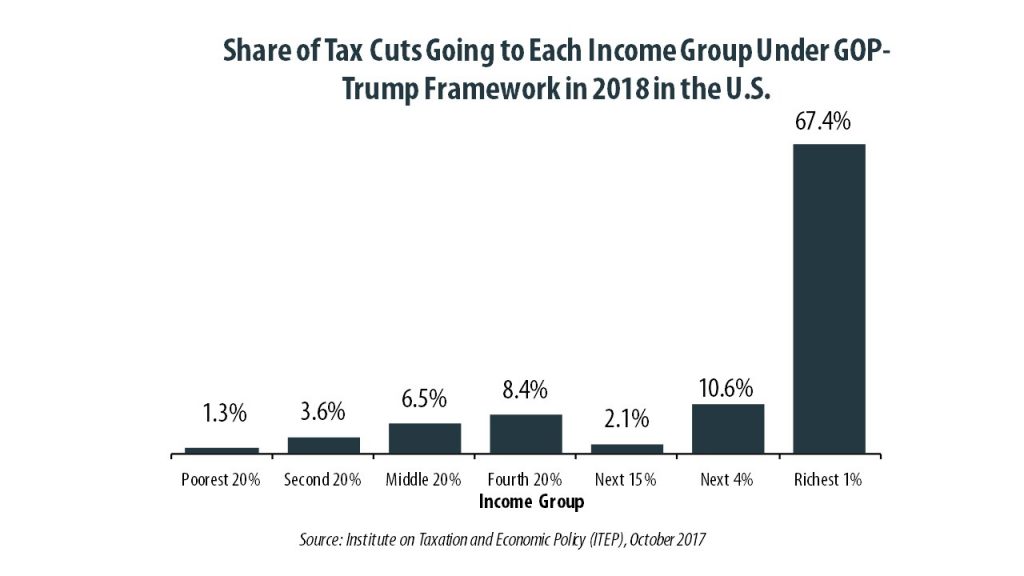

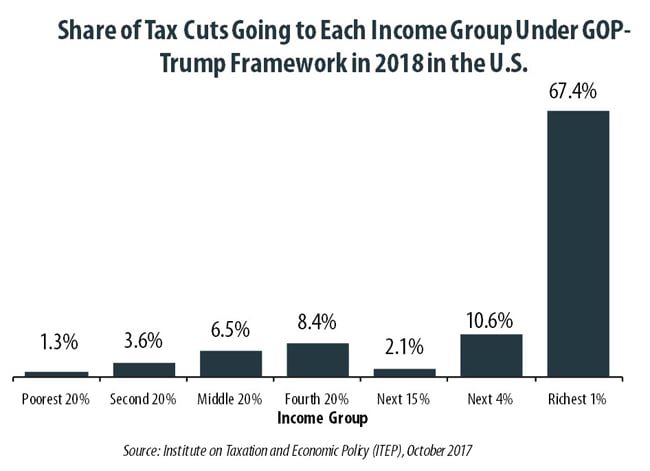

50-State Analysis: GOP-Trump Tax Proposal Would Give the Store Away to the Wealthy, Exacerbate the Income Divide

October 4, 2017 • By Alan Essig

A 50-state analysis of the GOP tax framework reveals the top 1 percent of taxpayers would receive a substantial tax cut while middle- and upper-middle-income taxpayers in many states would pay more, the Institute on Taxation and Economic Policy said today. The GOP continues to tout its tax plan as “beneficial to the middle class.” […]

Benefits of GOP-Trump Framework Tilted Toward the Richest Taxpayers in Each State

October 4, 2017 • By Steve Wamhoff

The “tax reform framework” released by the Trump administration and Congressional Republican leaders on September 27 would affect states differently, but every state would see its richest residents grow richer if it is enacted. In all but a handful of states, at least half of the tax cuts would flow to the richest one percent of residents if the framework took effect.

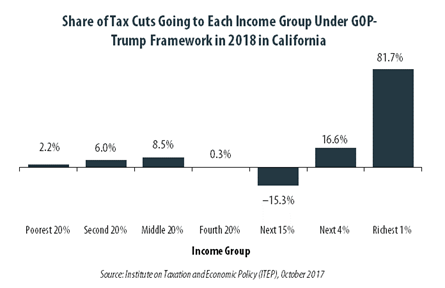

GOP-Trump Tax Framework Would Provide Richest One Percent in California with 81.7 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in California equally. The richest one percent of California residents would receive 81.7 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $864,900 next year. The framework would provide them an average tax cut of $90,160 in 2018, which would increase their income by an average of 3.3 percent.

State Rundown 9/28: Wisconsin Budget Finalized, Oklahoma Special Session Underway

September 28, 2017 • By ITEP Staff

This week, Wisconsin's leaders finalized the state budget at last, while those in Oklahoma began a special session to close their state's revenue shortfall. Soda tax fights made news in Illinois and Pennsylvania. And New Jersey offered Amazon $5 billion in tax subsidies.

State Rundown 9/25: No Rest for the Weary as State Tax and Budget Debates Wind Down, Ramp Up

September 25, 2017 • By ITEP Staff

Last week, Wisconsin leaders finally came to agreement on a state budget, while their peers in Connecticut appear to be close behind them. Iowa lawmakers avoided a special session with a short-term fix and will have to return to their structural deficit issues next session, as will those in Louisiana who will face a $1 billion shortfall. Meanwhile, District of Columbia leaders have already resumed meeting and discussing tax and budget issues there.

Poverty is Down, But State Tax Codes Could Bring It Even Lower

September 15, 2017 • By Misha Hill

The U.S. Census Bureau released its annual data on income, poverty and health insurance coverage this week. For the second consecutive year, the national poverty rate declined and the well-being of America’s most economically vulnerable has generally improved. In 2016, the year of the latest available data, 40.6 million (or nearly 1 in 8) Americans were living in poverty.

Astonishingly, tax policies in virtually every state make it harder for those living in poverty to make ends meet. When all the taxes imposed by state and local governments are taken into account, every state imposes higher effective tax rates on poor families than on the richest taxpayers.

State Rundown 9/13: The Year of Unprecedented State Budget Impasses Continues

September 13, 2017 • By ITEP Staff

This week, Pennsylvania lawmakers risk defaulting on payments due to their extremely overdue budget and Illinois legislators will borrow billions to start paying their backlog of unpaid bills. Governing delves into why there were more such budget impasses this year than in any year in recent memory. And Oklahoma got closure from its Supreme Court on whether closing special tax exemptions counts as "raising taxes" (it doesn't).

Reducing the Cost of Child Care Through State Tax Codes in 2017

September 11, 2017 • By ITEP Staff

Low- and middle-income working parents spend a significant portion of their income on child care. As the number of parents working outside of the home continues to rise, child care expenses have become an unavoidable and increasingly unaffordable expense. This policy brief examines state tax policy tools that can be used to make child care more affordable: a dependent care tax credit modeled after the federal program and a deduction for child care expenses.

Rewarding Work Through State Earned Income Tax Credits in 2017

September 11, 2017 • By ITEP Staff

The Earned Income Tax Credit (EITC) is a policy designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, providing the opportunity for struggling families to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been magnified as many states have enacted and later expanded their own credits.