Blog

1298 posts

The idea of exempting overtime pay from income tax has gained traction, but there's little evidence it's an effective policy. Alabama tried it in 2023 but ended the policy after just two years. Their reversal highlights how exempting overtime is an expensive gimmick and a distraction from real worker issues.

State legislatures are enjoying a relatively quiet period right now, though it is merely a temporary calm before the storm of the federal tax and budget debate begins raging again.

North Carolina Tax Proposal Prioritizes Millionaires Over Everyone Else

June 11, 2025 • By Dylan Grundman O'Neill, Miles Trinidad

North Carolina Senators are proposing to yet again ignore the core needs of the majority of North Carolinians in favor of more income tax cuts for the wealthy few. The Senate's budget would take the personal income tax rate to 1.99 percent as soon as 2031 if certain revenue triggers are met, once again delivering billions of dollars in tax cuts mostly to the rich. And the cost of those tax cuts for North Carolina will be steep cuts to the state’s future, including public education and community colleges.

The ‘Big, Beautiful’ Bill Creates a $5 Billion Tax Shelter for Private School Donors

June 9, 2025 • By Amy Hanauer

On May 22, Congress passed the House reconciliation bill or “One Big Beautiful Bill Act” by a one-vote margin. The bill’s dozens of destructive tax provisions would supercharge inequality and force devastating cuts to health and food aid that have been bedrocks of the American safety net since the 1960s.

As the Washington, D.C. region heads toward a likely recession, local policymakers will need to look to new revenue sources to help lessen the pain. In D.C., lawmakers ought to adopt a simple reform that would raise substantial revenue and make the District’s business tax system fairer.

Our tax policies enable people like Elon Musk and Donald Trump to accumulate more wealth than anyone could ever use in a lifetime. They then use it to steer elections and shape public policy to further enrich themselves and others like them. We should defeat the enormously destructive tax bill in Congress and instead craft tax policy that taxes the rich, makes our democracy more fair, and returns resources to the rest of the country.

State Rundown 6/5: States Wrap Sessions, Some Prepare for Fiscal Uncertainty

June 5, 2025 • By ITEP Staff

States use the final hours of their legislative sessions to address deficits and preserve revenue in preparation for the times ahead.

Trump’s Last Tax Cuts Failed Americans Like Me. Let’s Not Repeat the Mistake.

June 5, 2025 • By Brakeyshia Samms

Now as more GOP tax cuts for the rich move through Congress, history is poised to repeat itself. The bill would disproportionately benefit the well-off — and harm the financial well-being of millions of working Americans, including Black women like me.

Amid Economic Uncertainty, Delaware Lawmakers Should Consider Progressive Revenue Proposals

June 4, 2025 • By Miles Trinidad

Delaware leaders cited the ongoing federal tax debate and economic uncertainty amid the Trump administration's tariffs and trade wars as reasons to delay pursuing some of the progressive tax increases that Gov. Matt Meyers proposed in recent months. But just the opposite is needed. Delaware lawmakers should advance tax policies that can simultaneously protect state revenue to fund important priorities and improve tax equity in the state ahead of the approaching fiscal storm.

Sweeping Federal Tax and Spending Changes Threaten Local Governments

June 3, 2025 • By Kamolika Das

Given this environment, local leaders must do what they can to preserve and strengthen progressive revenue tools, advocate for expanded local taxing authorities and flexibility, and push their state leaders to decouple from harmful federal tax changes.

Five Issues for States to Watch in the Federal Tax Debate

June 3, 2025 • By Dylan Grundman O'Neill, Kamolika Das, Marco Guzman, Miles Trinidad, Neva Butkus

This post covers five particularly notable provisions for states: increasing deductions for state and local taxes (SALT) paid, allowing more generous tax write-offs for businesses, offering new avenues for capital gains tax avoidance to people contributing to private school voucher funds, carving tips and overtime out of the tax base, and re-upping Opportunity Zone tax breaks for wealthy investors.

House Bill’s $164 Billion Giveaway to Multinational Corporations Puts America Last

May 27, 2025 • By Sarah Austin

The House of Representatives’ recently passed tax bill changes course on taxing multinational corporations engaged in shifting U.S. profits overseas, offering massive tax giveaways that weaken American revenues and risk sending more American corporate investment offshore.

State Rundown 5/21: Big and Not-So Beautiful Tax Cut Bills Abound in States

May 21, 2025 • By ITEP Staff

As a sprawling, regressive tax bill continues to take shape at the federal level, many states are moving forward with major tax cut proposals of their own.

The House of Representatives unveiled a sprawling piece of tax legislation earlier this week that would extend temporary tax changes enacted in 2017 and layer various kinds of tax cuts and increases on top. The JCT analysis makes clear that the House tax plan would be regressive, meaning it would offer larger tax cuts as a share of income to high-income taxpayers than to either middle-class or working-class families. It also makes clear that most of the tax cuts would go to families with above-average incomes.

Trump Megabill Will Encourage Dynastic Wealth Hoarding by Further Weakening the Estate Tax

May 15, 2025 • By Jon Whiten

The tax and spending megabill signed into law by President Trump on July 4 will cut nearly $200 billion from food assistance, affecting tens of millions adults and children, while providing an estate tax cut costing roughly the same amount to a few thousand people who will leave behind more than $7 million to their heirs.

State Rundown 5/15: State Tax Debates Carry On in the Midst of Chaotic Federal Tax Landscape

May 15, 2025 • By ITEP Staff

Even as most major headlines have been about the ever-changing landscape of federal tax policy, the latest “ideas of the week," and now the House tax bill, state tax policy continues to be a priority for lawmakers.

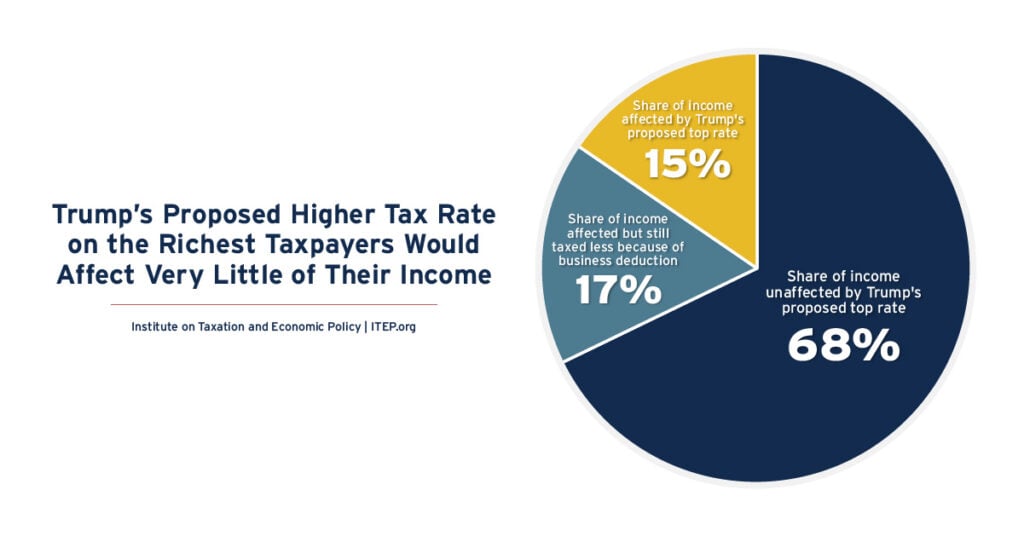

Trump’s Proposed Higher Tax Rate on the Richest Taxpayers Would Affect Very Little of Their Income

May 10, 2025 • By Carl Davis, Steve Wamhoff

President Donald Trump has proposed allowing the top rate to revert from 37 percent to 39.6 percent for taxable income greater than $5 million for married couples and $2.5 million for unmarried taxpayers. But many other special breaks in the tax code would ensure that most income of very well-off people would never be subject to Trump’s 39.6 percent tax rate.

State Rundown 5/7: As Budget Season Heats Up, Tax Proposals Are Getting Serious

May 7, 2025 • By ITEP Staff

With spring in full bloom ,many state lawmakers are reaching tax policy agreements. Out west, lawmakers in North Dakota and Texas have moved major property tax cuts. Meanwhile, in the east and south, Vermont appears likely to pass an expansion to its Child Tax Credit and Earned Income Tax Credit, and South Carolina lawmakers are aiming to make deep, drastic cuts to the state’s income tax.

America Has Left the Building: U.S. Loses from Our Global Tax Policy Choices, Others Could Gain

May 5, 2025 • By Amy Hanauer

Countries that once looked to the U.S. for direction on tax policy have concluded they need to form alliances without us. If so, it will often be to the benefit of other people around the globe and to the deficit of U.S. communities.

State Rundown 5/1: State Tax Debates Wrapping Up, and Just Beginning

May 1, 2025 • By ITEP Staff

The rampant uncertainty this year extends far beyond the national economy and federal policy, as many state legislatures are declaring their tax and budget debates finished, and just getting started, sometimes in the same breath.

Equitable (and Less Equitable) Washington State Revenue Raisers

April 24, 2025 • By Dylan Grundman O'Neill

Washington state came into the year with strong tax justice momentum. Lawmakers’ innovative Capital Gains Excise Tax on the state’s highest-income households was upheld by the state and federal Supreme Courts and was overwhelmingly affirmed by voters despite a well-funded repeal effort. The new tax is bringing in much-needed revenue for schools, child care, and […]

State Rundown 4/24: States Push Tax Cuts Despite Fiscal Uncertainty

April 24, 2025 • By ITEP Staff

While some states are preparing for uncertainty – slowing revenue growth, chaos from unpredictable tariffs, cuts to federal programs, etc. – others continue to move forward with plans for deep tax cuts. For instance, Georgia Gov. Brian Kemp signed legislation accelerating the cut to the personal income tax rate, which is currently phasing down. […]

Millions of Citizen Children Would be Harmed by Proposal Billed as Targeting Immigrant Tax Filers

April 24, 2025 • By Emma Sifre, Joe Hughes

Congressional Republicans have floated a proposal to strip the Child Tax Credit from millions of children who are U.S. citizens and legal residents in situations where their parents do not have Social Security numbers. Approximately 4.5 million citizen children with Social Security numbers would lose access to the credit under this proposal.

The tariffs proposed by Donald Trump, which are far larger than any on the books today, would significantly raise the prices faced by American consumers across the income scale.

Missouri is Sleepwalking into a Half-Billion Dollar Tax Cut for the Rich

April 22, 2025 • By Carl Davis

Missouri lawmakers are debating a tax cut that will mostly benefit the wealthiest in the state, while relying on an unrealistic estimate of what it will cost.