Colorado

Trends We’re Watching in 2018, Part 3: Improvements to Tax Credits for Workers and Families

March 26, 2018 • By Aidan Davis

This has been a big year for state action on tax credits that support low-and moderate-income workers and families. And this makes sense given the bad hand low- and middle-income families were dealt under the recent Trump-GOP tax law, which provides most of its benefits to high-income households and wealthy investors. Many proposed changes are part of states’ broader reaction to the impact of the new federal law on state tax systems. Unfortunately, some of those proposals left much to be desired.

Amazon and Other E-Retailers Get a Free Pass from Some Local-Level Sales Taxes

March 26, 2018 • By Carl Davis

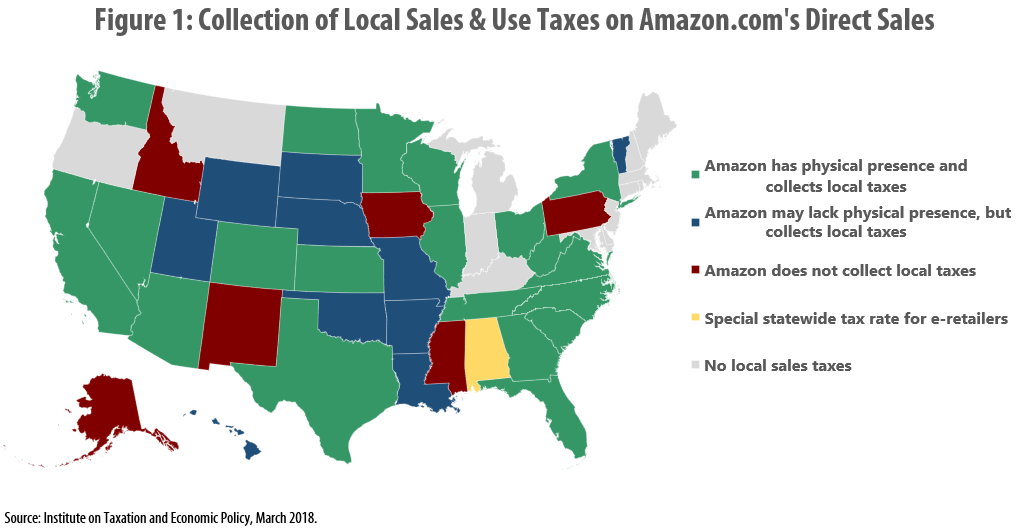

A new ITEP analysis reveals that in seven states (Alabama, Alaska, Idaho, Iowa, Mississippi, New Mexico, and Pennsylvania), the nation’s largest e-retailer, Amazon.com, is either not collecting local-level sales taxes or is charging a lower tax rate than local retailers. In other states, such as Colorado and Illinois, Amazon is collecting local tax because it has an in-state presence, but localities cannot collect taxes from other e-retailers based outside the state.

Many Localities Are Unprepared to Collect Taxes on Online Purchases: Amazon.com and other E-Retailers Receive Tax Advantage Over Local Businesses

March 26, 2018 • By Carl Davis

Online retailer Amazon.com made headlines last year when it began collecting every state-level sales tax on its direct sales. Savvy observers quickly noted that this change did not affect the company’s large and growing “marketplace” business, where it conducts sales in partnership with third-parties and rarely collects tax. But far fewer have noticed that even on its direct sales, Amazon is still not collecting some local-level taxes.

Colorado Fiscal Institute: Forecast Five: March 2018 Revenue Estimates

March 20, 2018

As a result of TCJA, Legislative Council estimates the state will see increased revenue of $196.5 million in FY 2018-2019, and $329.8 million in increases in FY 2019-2020. However, new analysis from the Institute on Taxation and Economic Policy suggests the revenue increase next year could be closer to $28 million.

With many state legislative sessions about halfway through, the ripple effects of the federal tax-cut bill took a back seat this week as states focused their energies on their own tax and budget issues. Major proposals were released in Nebraska and New Jersey, one advanced in Missouri, and debates wrapped up in Florida, Utah, and Washington. Oklahoma and Vermont are considering ways to improve education funding, while California, New York, and Vermont look to require more of their most fortunate residents. And check in on "what we're reading" for resources on the online sales tax debate, the role of property…

State Rundown 2/28: February a Long Month for State Tax Debates

February 28, 2018 • By ITEP Staff

February may be the shortest month but it has been a long one for state lawmakers. This week saw Arizona, Idaho, Oregon, and Utah seemingly approaching final decisions on how to respond to the federal tax-cut bill, while a bill that appeared cleared for take-off in Georgia hit some unexpected turbulence. Other states are still studying what the federal bill means for them, and many more continue to debate tax and budget proposals independently of the federal changes. And be sure to check our "What We're Reading" section for news on corporate tax credits from multiple states.

This Valentine's week finds California, Georgia, Missouri, New York, Oregon, and other states flirting with the idea of coupling to various components of the federal tax-cut bill. Meanwhile, lawmakers seeking revenue solutions to budget shortfalls in Alaska, Oklahoma, and Wyoming saw their advances spurned, and anti-tax advocates in many states have been getting mixed responses to their tax-cut proposals. And be sure to check out our "what we're reading" section to see how states are getting no love in recent federal budget developments.

Colorado Fiscal Institute: Effect of Federal Tax Law on Revenue for Colorado and Colorado Taxpayers

January 31, 2018

The Colorado Fiscal Institute (CFI) has a long-time partnership with the Institute of Taxation and Economic Policy (ITEP) and their estimate of the impact on state revenue is significantly smaller than the current amounts predicted by the Colorado Legislature and the Colorado Governor’s Office. This brief explains the various components of the ITEP estimate.

Colorado Fiscal Institute: Colorado State Tax Basics

January 29, 2018

The Colorado Fiscal Institute (CFI) promotes tax and budget policies that are effective, efficient, equitable, transparent and accountable. Each year, CFI takes positions on new legislation that affects the sustainability and equity in Colorado's state budget and tax system.

What the Tax Cuts and Jobs Act Means for States – A Guide to Impacts and Options

January 26, 2018 • By ITEP Staff

The recently enacted Tax Cuts and Jobs Act (TCJA) has major implications for budgets and taxes in every state, ranging from immediate to long-term, from automatic to optional, from straightforward to indirect, from certain to unknown, and from revenue positive to negative. And every state can expect reduced federal investments in shared public priorities like health care, education, public safety, and basic infrastructure, as well as a reduced federal commitment to reducing economic inequality and slowing the concentration of wealth. This report provides detail that state residents and lawmakers can use to better understand the implications of the TCJA for…

State Rundown 1/25: States Begin Tax Debates while Still Racing to Understand Federal Bill

January 25, 2018 • By ITEP Staff

State legislative sessions are in full swing this week as states grapple with revenue shortfalls and the ramifications of the federal tax cut bill. Lawmakers in Alaska and Louisiana, for example, are debating how to handle their revenue shortfalls, and a tax cut proposal in Idaho has been received tepidly. And be sure to peruse our "What We're Reading" section for helpful perspectives on how states are affected by the federal tax cut bill.

State Rundown 1/17: Budget Deficits, Online Sales Tax, and More

January 17, 2018 • By ITEP Staff

The big news this week in state tax law is that the U.S. Supreme Court has agreed to take on the issue of online sales, nexus, and sales tax collection. States have increasingly lost out on sales tax revenues as more transactions have shifted online from brick-and-mortar stores and the laws determining who is required to collect and remit sales taxes haven't kept up. This is potentially good news for states—25 of which National Association of State Budget Officers (NASBO) reports started the new year with budgetary deficits. In other news, grappling with the local impact of federal tax reform…

State Rundown 1/4: Will States Show Resolve in a Challenging Year?

January 4, 2018 • By ITEP Staff

This week marks the beginning of what is bound to be a wild year for state tax and budget debates. Essentially every state is already working to sort through the complicated ramifications of the federal tax cuts passed in December, including Kansas, Michigan, Montana, and New Jersey highlighted below. These and other states will have important decisions to make about how to incorporate, reject, or mitigate various aspects of the new federal law, and will need considerable resolve to improve state tax policy to be more fair and more adequate – even as federal taxes become less so.

These have been dark days for those who care about tax justice and public investments, but with the Winter Solstice this week and many states diving into their legislative sessions in January, longer days (and long work days) are soon to come! Governors and legislators are already proposing or hinting at their 2018 tax and budget plans in Alaska, California, Iowa, Maryland, and Washington. And transportation investments are getting strong support in Missouri, Oregon, and Virginia.

How the Final GOP-Trump Tax Bill Would Affect Colorado Residents’ Federal Taxes

December 16, 2017 • By ITEP Staff

The final tax bill that Republicans in Congress are poised to approve would provide most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill would go into effect in 2018 but the provisions directly affecting families and individuals would all expire after 2025, with […]

The Final Trump-GOP Tax Plan: National and 50-State Estimates for 2019 & 2027

December 16, 2017 • By ITEP Staff

The final Trump-GOP tax law provides most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill goes into effect in 2018 but the provisions directly affecting families and individuals all expire after 2025, with the exception of one provision that would raise their taxes. To get an idea of how the bill will affect Americans at different income levels in different years, this analysis focuses on the bill’s impacts in 2019 and 2027.

State Rundown 12/13: Supermajority Laws Considered in Some States Even as They Confound Others

December 13, 2017 • By ITEP Staff

Supermajority requirements for tax increases are proving a major obstacle to responsible budgeting in Oklahoma, while ballot initiatives are being filed to alter or abolish Oregon‘s similar requirement, but a similar requirement is slowly advancing toward the ballot in Florida nonetheless. Displeasure with agricultural property taxes are spawning both a ballot initiative drive and a […]

As 2017 draws to close, Congress has yet to take legislative action to protect Dreamers. The young undocumented immigrants who were brought to the United States as children, and are largely working or in school, were protected by President Obama’s 2012 executive action, Deferred Action for Childhood Arrivals (DACA). But in September, President Trump announced that he would end DACA in March 2018. Instead of honoring the work authorizations and protection from deportation that currently shields more than 685,000 young people, President Trump punted their lives and livelihood to a woefully divided Congress which is expected to take up legislation…

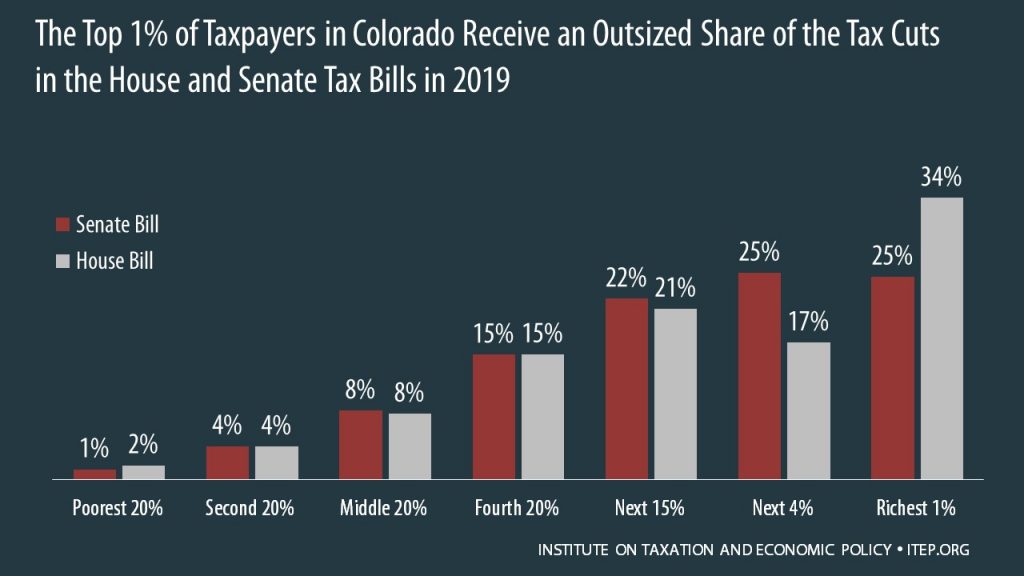

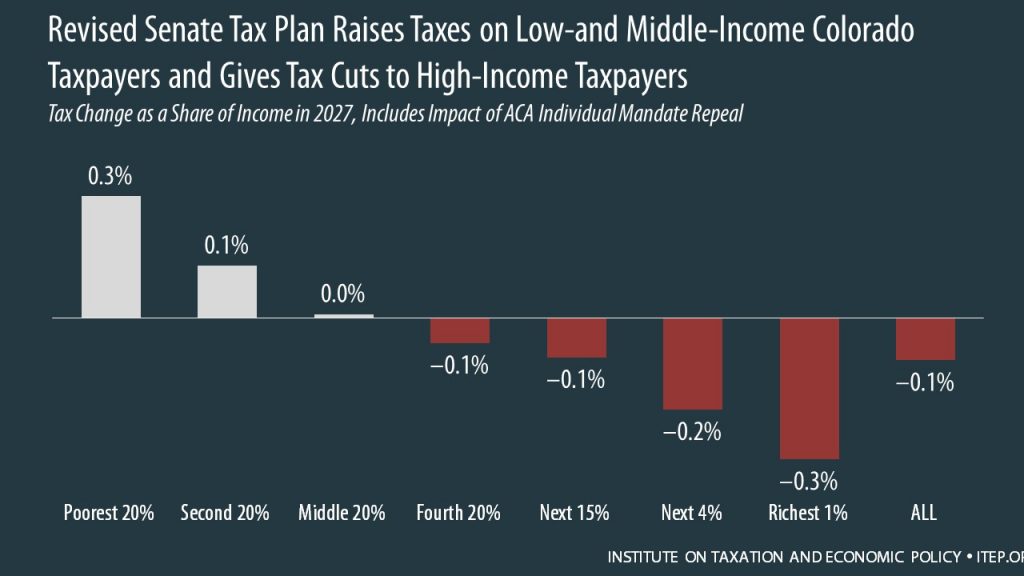

How the House and Senate Tax Bills Would Affect Colorado Residents’ Federal Taxes

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. The graph below shows that both bills are skewed to the richest 1 percent of Colorado residents.

National and 50-State Impacts of House and Senate Tax Bills in 2019 and 2027

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. National and 50-State data available to download.

Revised Senate Plan Would Raise Taxes on at Least 29% of Americans and Cause 19 States to Pay More Overall

November 18, 2017 • By ITEP Staff

The tax bill reported out of the Senate Finance Committee on Nov. 16 would raise taxes on at least 29 percent of Americans and cause the populations of 19 states to pay more in federal taxes in 2027 than they do today.

Denver Magazine: How the House and Senate Tax Plans Would Affect Coloradans

November 16, 2017

To pay for its extensive perks for the wealthy, the House bill adds $1.5 trillion to the national deficit over 10 years, according to the Institute on Taxation and Economic Policy (ITEP). It also cuts or caps popular middle-class tax deductions for homeowners, families, and students, and intentionally excludes millions of low-income children from modest […]

CNN: GOP Tax Plans Could Fuel the Suburban Revolt Against Trump

November 15, 2017

The bite from the GOP bill is deeper for upper-middle-class families in major metropolitan areas, particularly in Democratic-leaning states where taxes, and usually property values, are higher. While only about one-in-five families between the 80th and 95th income percentiles in most red states would face higher taxes by 2027 under the House GOP bill, that […]

How the Revised Senate Tax Bill Would Affect Colorado Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Colorado, 53 percent of the federal tax cuts would go to the richest 5 percent of residents, and 14 percent of households would face a tax increase, once the bill is fully implemented.

Analysis of the House Tax Cuts and Jobs Act

November 6, 2017 • By Matthew Gardner, Meg Wiehe, Steve Wamhoff

The Tax Cuts and Jobs Act, which was introduced on Nov. 2 in the House of Representatives, would raise taxes on some Americans and cut taxes on others while also providing significant savings to foreign investors.