Colorado

States Should Enact, Expand Mansion Taxes to Advance Fairness and Shared Prosperity

June 26, 2024 • By Carl Davis, Erika Frankel

The report was produced in partnership with the Center on Budget and Policy Priorities and co-authored by CBPP’s Deputy Director of State Policy Research Samantha Waxman.[1] Click here to use our State Mansion Tax Estimator A historically large share of the nation’s wealth is concentrated in the hands of a few, a reality glaring in […]

Colorado General Assembly: HB24-1311 Family Affordability Tax Credit

May 31, 2024

Gov. Polis of Colorado signed the bill expanding its Child Tax Credit, which cites ITEP’s research on the second page of the bill text. Read the bill and its status.

State Rundown 5/22: When One Legislative Session Closes, Another Opens

May 22, 2024 • By ITEP Staff

State legislatures are wrapping up, but don’t stray too far from your state capital or you’ll miss out on the action...

Uncertainty abounds in state tax debates lately...

This week, special sessions with major tax implications are in the air...

This week, many states took steps toward enacting tax cuts...

Many state legislative sessions are wrapping up...

Fairness Matters: A Chart Book on Who Pays State and Local Taxes

April 11, 2024 • By ITEP Staff

State and local tax codes can do a lot to reduce inequality. But they add to the nation’s growing income inequality problem when they capture a greater share of income from low- or moderate-income taxpayers. These regressive tax codes also result in higher tax rates on communities of color, further worsening racial income and wealth divides.

Governors and legislative leaders in a dozen states have made calls to fully eliminate their taxes on personal or corporate income, after many states already deeply slashed them over the past few years. The public deserves to know the true impact of these plans, which would inevitably result in an outsized windfall to states’ richest taxpayers, more power in the hands of wealthy households and corporations, extreme cuts to basic public services, and more deeply inequitable state tax codes.

ITEP’s Kamolika Das Testifies on Pennsylvania’s Upside-Down Tax Code

March 4, 2024

Below is written testimony delivered by ITEP Local Policy Director Kamolika Das before the Pennsylvania House Finance Subcommittee on Tax Modernization & Reform on March 1, 2024. Good afternoon and thank you for this opportunity to testify. My name is Kamolika Das, I live in South Philly, and I’m the Local Tax Policy Director at […]

Colorado Department of Revenue: Property Tax Circuit Breaker Programs

March 4, 2024

Because property taxes are based upon property values, they are not as strongly connected to an ability to pay as the income tax. This can be particularly burdensome when income changes as a result of job loss, divorce, illness, or retirement. As a result, property taxes tend to be regressive.

State Tax Watch 2024

January 23, 2024 • By ITEP Staff

Updated July 15, 2024 In 2024, state lawmakers have a choice: advance tax policy that improves equity and helps communities thrive, or push tax policies that disproportionately benefit the wealthy, drain funding for critical public services, and make it harder for low-income and working families to get ahead. Despite worsening state fiscal conditions, we expect […]

Tax policy themes have begun to crop up in states as governors give their yearly addresses and legislators lay out their plans for the 2024 legislative season...

Colorado: Who Pays? 7th Edition

January 8, 2024 • By ITEP Staff

Colorado Download PDF All figures and charts show 2024 tax law in Colorado, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.2 percent) state and local tax revenue collected in Colorado. These figures depict Colorado’s EITC at its 2024 level of 38 percent […]

Though Turkey Day has passed, lawmakers in states across the U.S. have yet to get their fill of delicious tax policy goodness...

Hidden in Plain Sight: Race and Tax Policy in 2023 State Legislative Sessions

November 21, 2023 • By Brakeyshia Samms

Race was front and center in a lot of state policy debates this year, from battles over what’s being taught in schools to disagreements over new voting laws. Less visible, but also extremely important, were the racial implications of tax policy changes. What states accomplished this year – both good and bad – will acutely affect people and families of color.

States differ dramatically in how much they allow families to make choices about whether and when to have children and how much support they provide when families do. But there is a clear pattern: the states that compel childbirth spend less to help children once they are born.

State Rundown 11/8: Election Results Bring Victories, Opportunities for More Common-Sense Tax Reform

November 8, 2023 • By ITEP Staff

Voters had the chance to impact tax policy across the country on election day, and some chose to enact common-sense reforms to raise revenue...

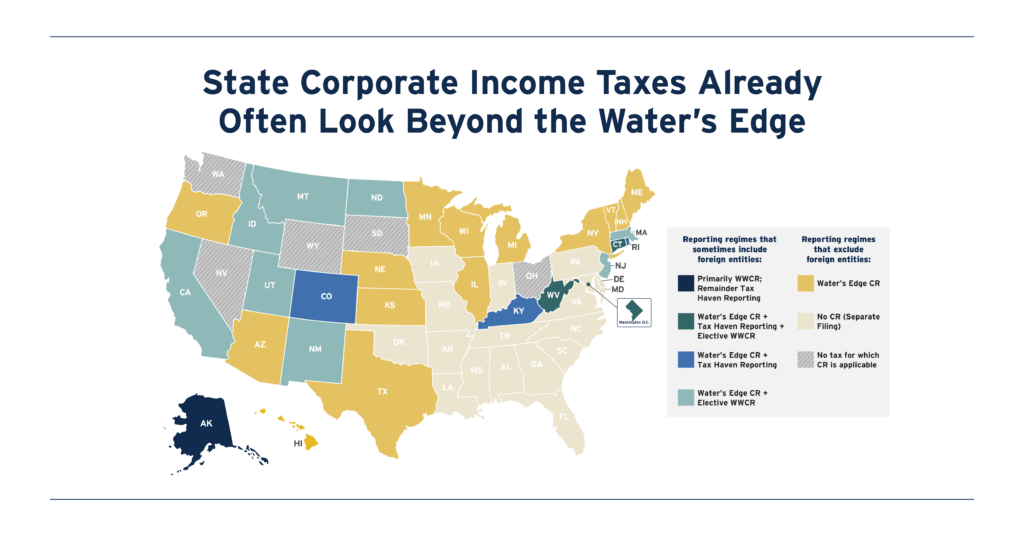

Far From Radical: State Corporate Income Taxes Already Often Look Beyond the Water’s Edge

November 7, 2023 • By Carl Davis, Matthew Gardner

State lawmakers are increasingly interested in reforming their corporate tax bases to start from a comprehensive measure of worldwide profit. This provides a more accurate, and less gameable, starting point for calculating profits subject to state corporate tax. Mandating this kind of filing system, known as worldwide combined reporting (WWCR), would be transformative, as it would all but eliminate state corporate tax avoidance done through the artificial shifting of profits into low-tax countries.

Local Earned Income Tax Credits: How Localities Are Boosting Economic Security and Advancing Equity with EITCs

October 30, 2023 • By Andrew Boardman, Galen Hendricks, Kamolika Das

Leading localities are using refundable EITCs to boost incomes and reduce taxes for workers and families with low and moderate incomes. These local credits build on the success of EITCs at the federal and state levels, reduce economic hardship and improve the fairness of the tax code.

State Rundown 10/26: Off-Year Ballot Measures and State & Local Tax Policy

October 26, 2023 • By ITEP Staff

November elections are creeping closer and closer and while that typically means a new batch of lawmakers are elected, it also means voters have another chance to help shape state and local tax policy...

2023’s State and Local Tax Ballot Measures: Voters to Weigh in on Property Taxes, Wealth Taxes, and More

October 24, 2023 • By Jon Whiten

Even in this slow year for candidate elections, the decisions that voters in states and cities make could strengthen or weaken revenue for needs in their communities and could change how taxes are distributed across the income spectrum. In the places where tax fairness is on the ballot, much is at stake.

State Tax Credits Have Transformative Power to Improve Economic Security

September 12, 2023 • By Aidan Davis

The latest analysis from the U.S. Census Bureau provides an important reminder of the compelling link between public investments and families’ economic well-being. Policy decisions can drastically reduce poverty and improve family economic stability for low- and middle-income families alike, as today’s data release shows.

States are Boosting Economic Security with Child Tax Credits in 2023

September 12, 2023 • By Aidan Davis, Neva Butkus

Fourteen states now provide Child Tax Credits to reduce poverty, boost economic security, and invest in children. This year alone, lawmakers in three states created new Child Tax Credits while lawmakers in seven states expanded existing credits. To maximize impact, lawmakers should consider making their credits fully refundable, not including an earnings requirement, setting a maximum amount per child instead of per household, setting state-specific phase-out ranges that target low- and middle-income families, indexing to inflation, and offering the option of advanced payments.

Boosting Incomes, Improving Equity: State Earned Income Tax Credits in 2023

September 12, 2023 • By Aidan Davis, Neva Butkus

Nearly two-thirds of states (31 plus the District of Columbia and Puerto Rico) have an Earned Income Tax Credit, an effective tool that boosts low-paid workers’ incomes and helps lower-income families achieve greater economic security. This year, 12 states expanded and improved EITCs.