Connecticut

Trends We’re Watching in 2018, Part 1: State Responses to Federal Tax Cut Bill

March 5, 2018 • By Dylan Grundman O'Neill

Over the next few weeks we will be blogging about what we’re watching in state tax policy during 2018 legislative sessions. And there is no trend more pervasive in states this year than the need to sort through and react to the state-level impact of federal tax changes enacted late last year.

This week, major tax packages relating to the federal tax-cut bill made news in Georgia, Iowa, and Louisiana, as Minnesota and Oregon lawmakers also continue to work out how their states will be affected. New Mexico's legislative session has finished without significant tax changes, while Idaho and Illinois's sessions are beginning to heat up, and Vermont's school funding system is under the microscope.

State Rundown 2/8: State Responses to Federal Bill Gaining Steam

February 8, 2018 • By ITEP Staff

Several states this week are looking at ways to revamp their tax codes in response to the federal tax cut bill, with Georgia, Idaho, Maryland, Nebraska, and Vermont all actively considering proposals. Meanwhile, Connecticut, Louisiana, and Pennsylvania are working on resolving their budget shortfalls. And transportation funding is getting needed attention in Mississippi, Utah, and Wisconsin.

State Rundown 1/31: Low-Income Families’ Taxes Getting Some Much-Needed Attention

January 31, 2018 • By ITEP Staff

This week was promising for advocates of Earned Income Tax Credits (EITCs) and other tax breaks for workers and their families, which are making headway in Alabama, Maine, Massachusetts, Missouri, Utah, and Wisconsin. The week also saw the unveiling of a tax cut plan in Missouri, a budget-balancing tax increase package in Oklahoma, the end of an unproductive film tax credit in West Virginia, and a very busy week for tax policy in Utah.

Repealing, or Working Around, the Cap on State and Local Tax Deductions Would Make the Trump-GOP Tax Law Even More Unfair

January 17, 2018 • By Steve Wamhoff

A bipartisan proposal in Congress to eliminate the new $10,000 cap on federal deductions for state and local taxes (SALT) would cost more than $86 billion in 2019 alone and two-thirds of the benefits would go to the richest 1 percent of households. Unfortunately, “work around” proposals in some states to allow their residents to avoid the new federal cap would likely have the same regressive effect on the overall tax code.

Final GOP-Trump Bill Still Forces California and New York to Shoulder a Larger Share of Federal Taxes Under Final GOP-Trump Tax Bill; Texas, Florida, and Other States Will Pay Less

December 17, 2017 • By Meg Wiehe

Residents of California and New York pay a large amount of the nation’s federal personal income taxes relative to their share of the population. As illustrated by the table below, the final GOP-Trump tax bill expected to be approved this week would substantially increase the share of total federal personal income taxes (PIT) paid by both states. Connecticut, Maryland, Massachusetts, and New Jersey would also see their share of federal PIT increase.

How the Final GOP-Trump Tax Bill Would Affect Connecticut Residents’ Federal Taxes

December 16, 2017 • By ITEP Staff

The final tax bill that Republicans in Congress are poised to approve would provide most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill would go into effect in 2018 but the provisions directly affecting families and individuals would all expire after 2025, with […]

The Final Trump-GOP Tax Plan: National and 50-State Estimates for 2019 & 2027

December 16, 2017 • By ITEP Staff

The final Trump-GOP tax law provides most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill goes into effect in 2018 but the provisions directly affecting families and individuals all expire after 2025, with the exception of one provision that would raise their taxes. To get an idea of how the bill will affect Americans at different income levels in different years, this analysis focuses on the bill’s impacts in 2019 and 2027.

ITEP researchers have produced new reports and analyses that look at various pieces of the tax bill, including: the share of tax cuts that will go to foreign investors; how the plans would affect the number of taxpayers that take the mortgage interest deduction or write off charitable contributions, and remaining problems with the bill in spite of proposed compromises on state and local tax deductions.

As 2017 draws to close, Congress has yet to take legislative action to protect Dreamers. The young undocumented immigrants who were brought to the United States as children, and are largely working or in school, were protected by President Obama’s 2012 executive action, Deferred Action for Childhood Arrivals (DACA). But in September, President Trump announced that he would end DACA in March 2018. Instead of honoring the work authorizations and protection from deportation that currently shields more than 685,000 young people, President Trump punted their lives and livelihood to a woefully divided Congress which is expected to take up legislation…

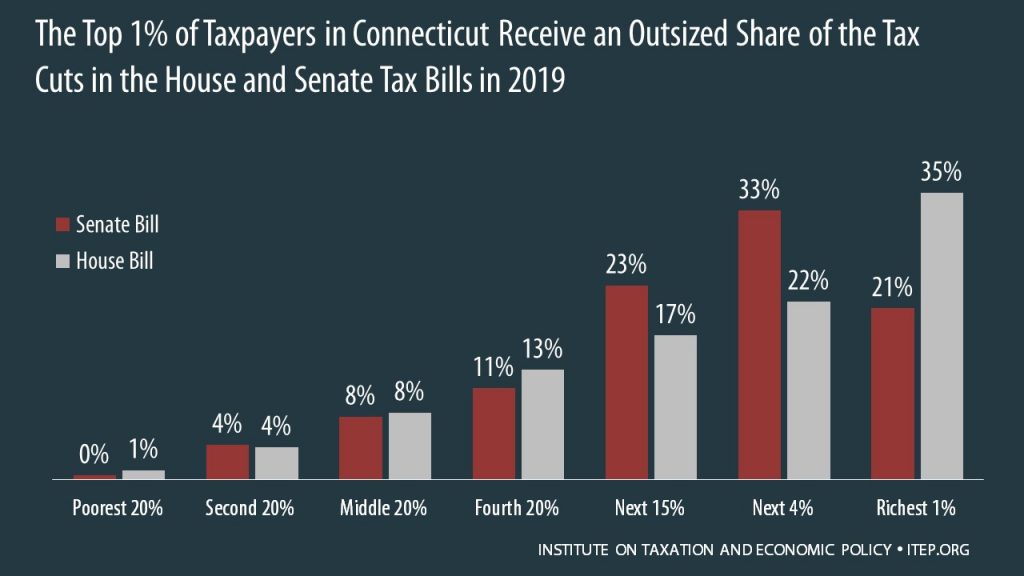

How the House and Senate Tax Bills Would Affect Connecticut Residents’ Federal Taxes

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. The graph below shows that both bills are skewed to the richest 1 percent of Connecticut residents.

National and 50-State Impacts of House and Senate Tax Bills in 2019 and 2027

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. National and 50-State data available to download.

A Corporate Tax Cut Would Benefit Coastal Investors, Not the Heartland

November 30, 2017 • By Carl Davis

The centerpiece of the House and Senate tax plans is a major tax cut for profitable corporations that the American public does not want, and that will overwhelmingly benefit a small number of wealthy investors living in traditionally “blue” states. New ITEP research shows that poorer states such as West Virginia, Oklahoma, Alabama, and Tennessee would be largely left behind by a corporate tax cut, while the lion’s share of the benefits would remain with a relatively small number of wealthy investors who tend to be concentrated in larger cities near the nation’s coasts.

ITEP has analyzed each of the tax proposals advanced by the House and Senate in recent weeks. While some details have changed, the bottom line is the same: The plans would disproportionately benefit corporations and the wealthy. The Senate tax plan ITEP’s latest analysis examined the proposal that passed the Senate Finance Committee on Nov. […]

Revised Senate Plan Would Raise Taxes on at Least 29% of Americans and Cause 19 States to Pay More Overall

November 18, 2017 • By ITEP Staff

The tax bill reported out of the Senate Finance Committee on Nov. 16 would raise taxes on at least 29 percent of Americans and cause the populations of 19 states to pay more in federal taxes in 2027 than they do today.

CNN: GOP Tax Plans Could Fuel the Suburban Revolt Against Trump

November 15, 2017

The bite from the GOP bill is deeper for upper-middle-class families in major metropolitan areas, particularly in Democratic-leaning states where taxes, and usually property values, are higher. While only about one-in-five families between the 80th and 95th income percentiles in most red states would face higher taxes by 2027 under the House GOP bill, that […]

How the Revised Senate Tax Bill Would Affect Connecticut Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Connecticut, 57 percent of the federal tax cuts would go to the richest 5 percent of residents, and 22 percent of households would face a tax increase, once the bill is fully implemented.

Senate Tax Plan Reserves Greatest Benefit for Richest Americans, Millions Face an Increase

November 13, 2017 • By ITEP Staff

A 50-state analysis of the Senate tax proposal finds that not only would greatest share of benefits go to the richest Americans, but also more than one in 10 taxpayers would face a tax hike, with a large number of those taxpayers residing in states where residents pay higher state and local taxes.

House Tax Bill Would Put Property Tax Deduction Out of Reach for Most Households

November 13, 2017 • By ITEP Staff

The House of Representatives is expected to vote this week on a bill that would reduce federal revenues by roughly $1.5 trillion over the next decade. Despite the bill’s high price tag, many households would pay more in federal tax if the bill is enacted, in large part because it slashes the deduction for state […]

Analysis of the House Tax Cuts and Jobs Act

November 6, 2017 • By Matthew Gardner, Meg Wiehe, Steve Wamhoff

The Tax Cuts and Jobs Act, which was introduced on Nov. 2 in the House of Representatives, would raise taxes on some Americans and cut taxes on others while also providing significant savings to foreign investors.

How the House Tax Proposal Would Affect Connecticut Residents’ Federal Taxes

November 6, 2017 • By ITEP Staff

The Tax Cuts and Jobs Act, which was introduced on November 2 in the House of Representatives, includes some provisions that raise taxes and some that cut taxes, so the net effect for any particular family’s federal tax bill depends on their situation. Some of the provisions that benefit the middle class — like lower tax rates, an increased standard deduction, and a $300 tax credit for each adult in a household — are designed to expire or become less generous over time. Some of the provisions that benefit the wealthy, such as the reduction and eventual repeal of the estate…

State Rundown 11/1: Connecticut Balances Budget, Leaves Tax Code Out of Whack

November 1, 2017 • By ITEP Staff

This week a "historic" but highly problematic budget agreement was finally reached in Connecticut, Michigan lawmakers banned localities from taxing any food or beverages, and Nebraska and North Dakota both got unpleasant news about future revenues. Also see our "what we're reading" section for news on 11 states that have run up long-term fiscal deficits since 2002 and the impacts of flooding on local tax bases.

Bloomberg BNA: N.Y., N.J., Connecticut Hurt Most If State Deduction Ditched

October 10, 2017 • By ITEP Staff

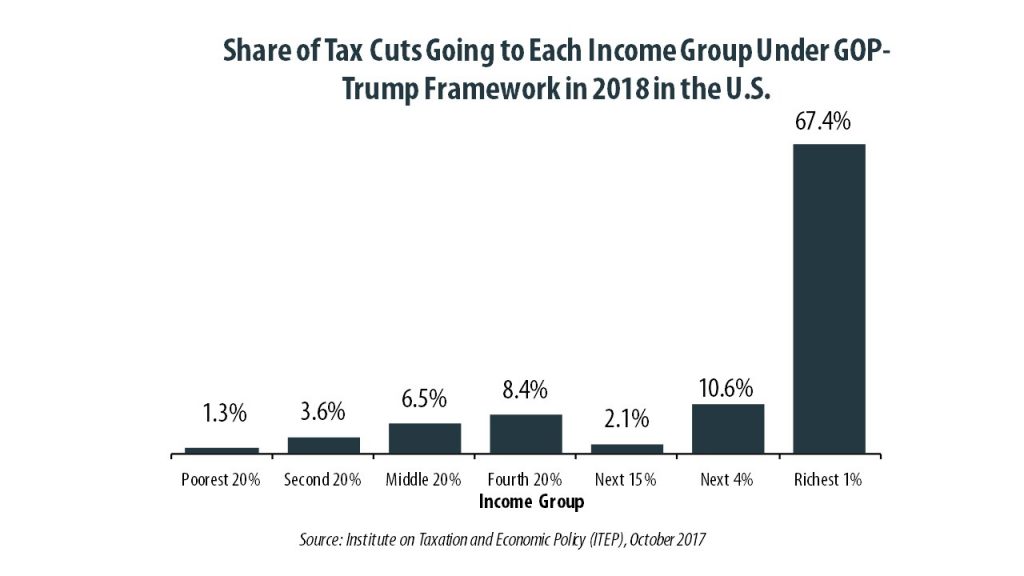

The White House has said the tax reform framework was crafted with the middle class in mind. However, a report released Oct. 4 by the Institute on Taxation and Economic Policy, said the richest 1 percent of residents in all but a handful of states would receive at least half of the tax cuts being […]

Select State News Coverage of ITEP’s 50-State Analysis of the GOP Tax Proposal

October 10, 2017

The Sentinel: Trump Tax Even in Harrisburg Will Feature Truckers The Columbus Dispatch: 15% of Ohioans Could See Tax Increase Under GOP Plan KGW Portland: Richest Oregonians Benefit Most from Proposed Tax Cuts Raleigh News & Observer: The Racial Wealth Divide Could Grow with Tax Changes Northwest Indiana Times: Hoosiers Would Lose in Trump Tax […]

50-State Analysis: GOP-Trump Tax Proposal Would Give the Store Away to the Wealthy, Exacerbate the Income Divide

October 4, 2017 • By Alan Essig

A 50-state analysis of the GOP tax framework reveals the top 1 percent of taxpayers would receive a substantial tax cut while middle- and upper-middle-income taxpayers in many states would pay more, the Institute on Taxation and Economic Policy said today. The GOP continues to tout its tax plan as “beneficial to the middle class.” […]