Iowa

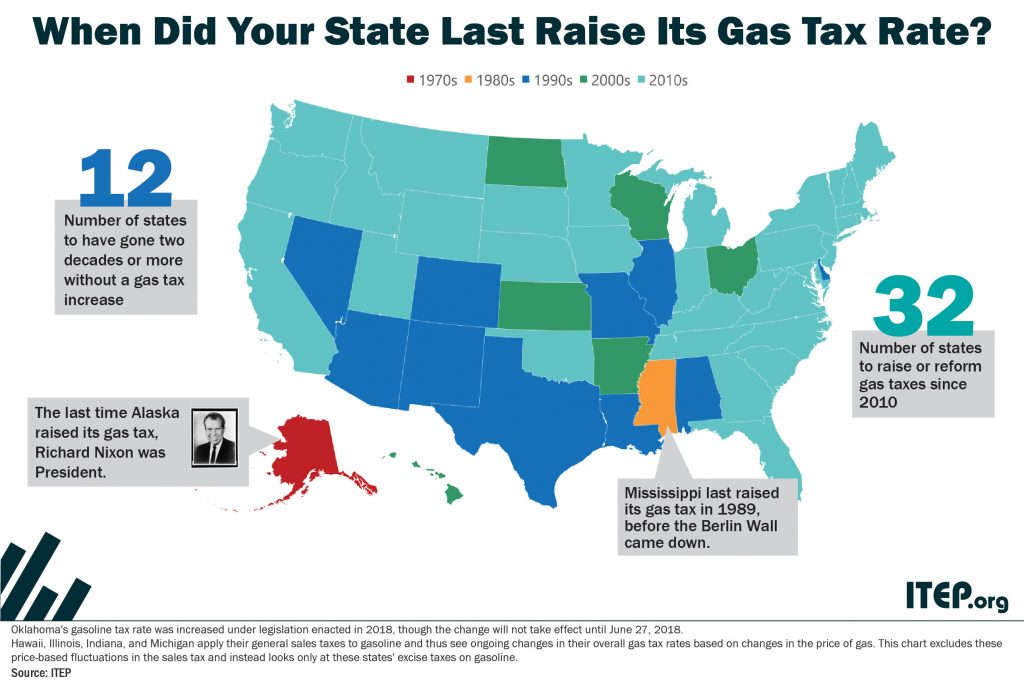

Many state governments are struggling to repair and expand their transportation infrastructure because they are attempting to cover the rising cost of asphalt, machinery, and other construction materials with fixed-rate gasoline taxes that are rarely increased.

State Rundown 5/9: Iowa Digs a New Hole as Other States Try to Avoid or Climb Out of Theirs

May 9, 2018 • By ITEP Staff

This week we have news of a destructive tax cut plan finally approved in Iowa just as one was narrowly avoided in Kansas. Tax debates in Minnesota and Missouri will go down to the wire. And residents of Arizona and Colorado are considering progressive revenue solutions to their states' education funding crises.

Washington Post: Iowa Republicans pitch ‘crisis-proof’ tax cuts. Democrats see another Kansas in the making.

May 8, 2018

"The trigger is a politically expedient way for lawmakers to claim they’ve cut your taxes without having to do anything immediately to make up for the consequences of reducing revenue," said Meg Wiehe, of the Institute on Taxation and Economic Policy, a left-leaning think tank.

Iowa Fiscal Partnership: Tax Plan Facts vs. Spin

May 5, 2018

As Iowa lawmakers consider the agreed-upon tax plan developed by Republican leadership and Governor Reynolds, sharp differences are clear from earlier proposals by the Governor and the House Ways and Means Committee.

State Rundown 5/3: Progressive Revenue Solutions to Fiscal Woes Gaining Traction

May 3, 2018 • By ITEP Staff

This week, Arizona teachers continued to strike over pay issues and advocates unveiled a progressive revenue solution they hope to put before voters, while a progressive income tax also gained support as part of a resolution to Illinois's budget troubles. Iowa and Missouri legislators continued to try to push through unsustainable tax cuts before their sessions end. And Minnesota and South Carolina focused on responding to the federal tax-cut bill.

Iowa Fiscal Partnership: IFP’s Tax Policy Kit

April 29, 2018

IFP's Tax Policy Kit offers resources for the public, advocates and policy makers who want to better understand the stakes — and sort away the spin — on state tax debates.

State Rundown 4/27: Arbor Day Brings Some Fruitful Tax Developments, Some Shady Proposals

April 27, 2018 • By ITEP Staff

This Arbor Day week, the seeds of discontent with underfunded school systems and underpaid teachers continued to spread, with walkouts occurring in both Arizona and Colorado. And recognizing the need to see the forest as well as the trees, the Arizona teachers have presented revenue solutions to get to the true root of the problem. In the plains states, tax cut proposals continue to pop up like weeds in Kansas and threaten to spread to Iowa and Missouri, where lawmakers are running out of time but are still hoping their efforts to pass destructive tax cuts will bear fruit.

State Rundown 12/31/9999: IRS Glitch and Legislative Impasses Extend Tax Season

April 20, 2018 • By ITEP Staff

This week the IRS website asked some would-be tax filers to return after December 31, 9999. State legislators don't have quite that much time, but are struggling to wrap up their tax debates on schedule as well. Iowa legislators, for example, are ironically still debating tax cuts despite having run out of money to cover their daily expenses for the year. Nebraska's session wrapped up, but its tax debate continues in the form of a call for a special session and the threat of an unfunded tax cut going before voters in November. Mississippi's tax debate has been revived by…

State Rundown 4/13: Teacher Strikes, Special Sessions, Federal Cuts Haunting States

April 13, 2018 • By ITEP Staff

This Friday the 13th is a spooky one for many state lawmakers, as past bad fiscal decisions have been coming back to haunt them in the form of teacher strikes and walk-outs in Arizona, Kentucky, and Oklahoma. Meanwhile, policymakers in Maryland, Nebraska, New Jersey, Oregon, and Utah all attempted to exorcise negative consequences of the federal tax-cut bill from their tax codes. And our What We're Reading section includes yet another stake to the heart of the millionaire tax-flight myth and other good reads.

The U.S. Supreme Court is scheduled to consider a case next week (South Dakota v. Wayfair, Inc.) that has the potential to significantly improve states and localities’ ability to enforce their sales tax laws on Internet purchases.

What to Expect if the Supreme Court Allows for Online Sales Tax Collection

April 11, 2018 • By Carl Davis

Online shopping is hardly a new phenomenon. And yet states and localities still lack the authority to require many Internet retailers to collect the sales taxes that their locally based, brick and mortar competitors have been collecting for decades.

This week, Kentucky legislators passed a bill shifting taxes onto low- and middle-income families, Oklahoma legislators reached a deal on education funding, and their counterparts in Kansas proffered multiple proposals for their education funding needs. Meanwhile, tax debates are coming down to the wire in Iowa, Missouri, and Nebraska, and responses to the federal tax-cut bill were settled on in Maryland, New York, and Wisconsin.

Trends We’re Watching in 2018, Part 4: Tax Cuts & Tax Shifts

April 4, 2018 • By Lisa Christensen Gee

While a lot of tax activities in the states this year have focused on figuring out the impact of federal tax changes on states' bottom lines and residents, there also have been unrelated efforts to cut state taxes or shift from personal income taxes to more regressive sales taxes.

Teachers’ Strikes Are Emblematic of Larger Tax Challenges for States

March 30, 2018 • By Meg Wiehe

As other researchers as well as journalists have noted, teachers striking or threatening to strike over low wages and overall lack of investment isn’t simply a narrative about schools and public workers’ pay. It is illustrative of a broader conflict over tax laws and how states and local jurisdictions fund critical public services that range from K-12 education, public safety, roads and bridges, health care, parks, to higher education.

Politifact: The Facts Behind Trump’s Jabs at Amazon on Taxes, USPS and Lost Retail Jobs

March 30, 2018

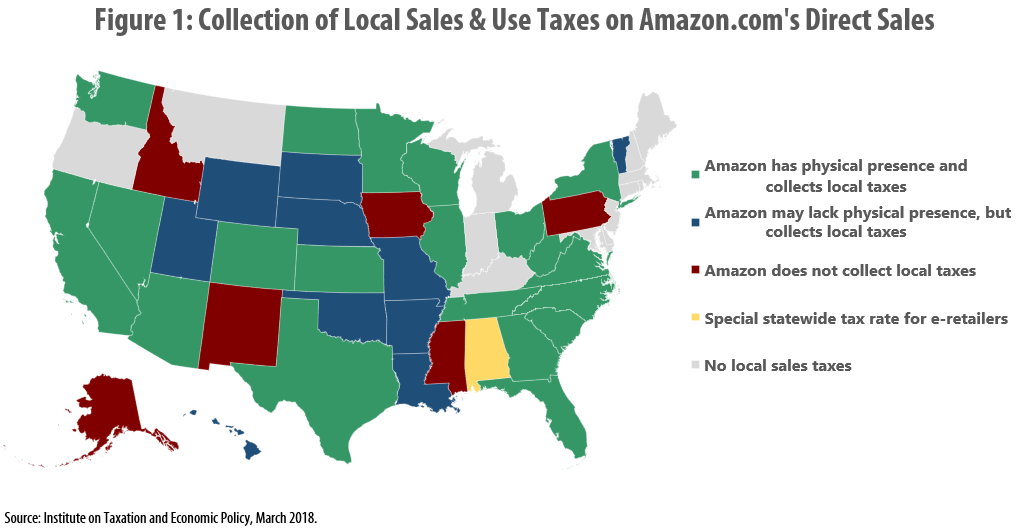

Amazon paid $957 million in income tax in 2017, according to regulatory filings. Amazon paid nothing in federal taxes this year thanks to tax credits and, in large part, Trump’s new tax law. But the Institute on Taxation and Economic Policy found that Amazon is either not collecting local taxes or is charging a lower […]

Fortune: President Trump Claims Amazon Pays “Little or No Taxes.” Here’s Where He’s Wrong

March 30, 2018

Where Trump is correct: Amazon doesn’t collect taxes on behalf of third-party vendors, and it still may not collect some local taxes, giving it an advantage over some traditional retailers, according to the Institute on Taxation and Economic Policy, a think tank. According to an analysis from the ITEP, the gap between the tax rate […]

Bloomberg Law: Trump’s Amazon Tweet Comes at Eventful Time for State-Local Taxes

March 30, 2018

Meanwhile, Amazon may not be paying its share of local sales taxes. A report released March 26 by the left-leaning Institute on Taxation and Economic Policy said Amazon either doesn’t collect and remit local sales tax or is charging a lower sales tax rate than traditional retailers in seven states: Alabama, Alaska, Idaho, Iowa, Mississippi, […]

Dallas Morning News: Texas Was Tougher Than Other States in Dealing with Amazon on Sales Taxes

March 30, 2018

When a Dallas resident or shopper in College Station or Lubbock makes a purchase from Amazon or any other online retailer with a physical presence in Texas such as Wayfair and RH.com, the state gets its 6.25 percent. The cities get their local sales taxes too. In Dallas, that’s an additional 2 percent for a […]

New York Times: As Amazon Steps Up Tax Collections, Some Cities Are Left Out

March 27, 2018

When Amazon agreed last year to begin collecting sales tax in New Mexico, state officials celebrated what they said could be tens of millions of dollars in annual tax revenue. But they aren’t cheering in Albuquerque City Hall. A year after that announcement, New Mexico’s largest city hasn’t seen a dime from Amazon. That’s because […]

Seattle Times: As Amazon steps up tax collections, some cities are left out

March 27, 2018

Thanks in part to a series of deals with state governments in recent years, Amazon is collecting sales tax in every state that has one. But those deals do not always extend to taxes assessed by local governments. The company still is not collecting sales taxes in dozens of cities, including Philadelphia, Pittsburgh and Cedar […]

Bloomberg BNA: Tax Breaks Plentiful for Second Amazon HQ Even Without Bids

March 27, 2018

Amazon also benefits at the state and local level when it comes to sales tax, according to a report released March 26 by the Institute on Taxation and Economic Policy based in Washington, D.C. In seven states—Alabama, Alaska, Idaho, Iowa, Mississippi, New Mexico, and Pennsylvania—Amazon is either not collecting local taxes or charging a lower […]

Amazon Maintains Sales Tax Advantage over Local Businesses

March 26, 2018 • By ITEP Staff

This report concludes that lack of consistent sales tax collection is contributing to an unlevel playing field for local businesses “because millions of shoppers are able to pay less tax if they choose to buy from out-of-state companies over the Internet rather than at local stores.” It recommends that states explore reforms to bring their sales tax policies into the digital age.

Amazon and Other E-Retailers Get a Free Pass from Some Local-Level Sales Taxes

March 26, 2018 • By Carl Davis

A new ITEP analysis reveals that in seven states (Alabama, Alaska, Idaho, Iowa, Mississippi, New Mexico, and Pennsylvania), the nation’s largest e-retailer, Amazon.com, is either not collecting local-level sales taxes or is charging a lower tax rate than local retailers. In other states, such as Colorado and Illinois, Amazon is collecting local tax because it has an in-state presence, but localities cannot collect taxes from other e-retailers based outside the state.

Many Localities Are Unprepared to Collect Taxes on Online Purchases: Amazon.com and other E-Retailers Receive Tax Advantage Over Local Businesses

March 26, 2018 • By Carl Davis

Online retailer Amazon.com made headlines last year when it began collecting every state-level sales tax on its direct sales. Savvy observers quickly noted that this change did not affect the company’s large and growing “marketplace” business, where it conducts sales in partnership with third-parties and rarely collects tax. But far fewer have noticed that even on its direct sales, Amazon is still not collecting some local-level taxes.

State Rundown 3/22: Some Spring State Tax Debates in Full Bloom, Others Just Now Surfacing

March 22, 2018 • By ITEP Staff

The onset of spring this week proved to be fertile ground for state fiscal policy debates. A teacher strike came to an end in West Virginia as another seems ready to begin in Oklahoma. Budgets were finalized in Florida, West Virginia, and Wyoming, are set to awaken from hibernation in Missouri and Virginia, and are being hotly debated in several other states. Meanwhile Idaho, Iowa, Maryland, and Minnesota continued to grapple with implications of the federal tax-cut bill. And our What We're Reading section includes coverage of how states are attempting to further public priorities by taxing carbon, online gambling,…