Massachusetts

State Rundown 6/30: Resolutions Are in Order for the New Fiscal Year

June 30, 2021 • By ITEP Staff

Today is the last day of the fiscal year in many states, and some lawmakers might want to take the opportunity to make some new fiscal year resolutions. Legislators in Arizona, New Hampshire, Ohio, North Carolina, and Wisconsin, for example, should really cut back on the trickle-down tax-cut Kool-Aid, which may make parties with rich donors more fun but tends to be both harmful and habit-forming...

Taxing rich households and large corporations to fund vital investments in education and other shared priorities has long been a winner in the eyes of the American public, and more recently has also enjoyed a string of victories in state legislatures and at the ballot box. That win streak continued this week as Arizona’s voter-approved tax surcharge on the rich and Seattle, Washington’s payroll tax on high-profit, high-salary businesses both survived court challenges, and Massachusetts leaders approved a millionaires tax to go before voters next year.

State Rundown 6/7: Remaining State Legislative Sessions Are Heating up as Budget Deadlines Loom

June 7, 2021 • By ITEP Staff

Just as an early summer heatwave brought soaring temperatures this past weekend through much of the lower 48 states, several state legislative sessions are heating up as legislators scramble to make tough budget decisions. Massachusetts lawmakers are voting on a fiery new "millionaires' tax" that would support transportation and education revenue needs, and Connecticut will likely restore its state Earned Income Tax Credit (EITC) back to 30 percent. Illinois’s decision to cut back corporate tax breaks also provided a breath of fresh air. Unfortunately, we'd give other state tax proposals a more lukewarm reception: New Hampshire, North Carolina, and Ohio…

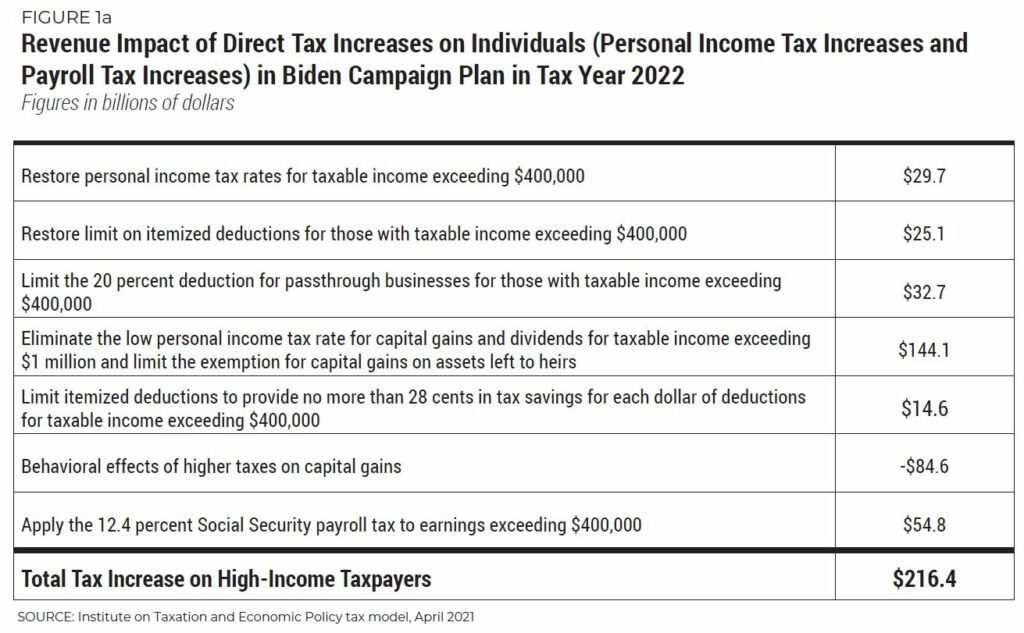

Income Tax Increases in the President’s American Families Plan

May 25, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

President Biden’s American Families Plan includes revenue-raising proposals that would affect only very high-income taxpayers.[1] The two most prominent of these proposals would restore the top personal income tax rate to 39.6 percent and eliminate tax breaks related to capital gains for millionaires. As this report explains, these proposals would affect less than 1 percent of taxpayers and would be confined almost exclusively to the richest 1 percent of Americans. The plan includes other tax increases that would also target the very well-off and would make our tax system fairer. It would raise additional revenue by more effectively enforcing tax…

“Tax Day” was earlier this week but the debates, research, and advocacy that determine our taxes and how they are used take place every day of the year...

Massachusetts Budget & Policy Center: Ending the Tax Penalty Against Working Immigrants: MA Should Follow Other States Extending EITC to Immigrant Tax Filers

May 17, 2021

The Earned Income Tax Credit (EITC) is a key program for reducing poverty in the United States. Together with the federal Child Tax Credit, these low-income federal credits lifted 7.5 million households above the poverty line in 2019, more than any other program except Social Security. In Massachusetts, the EITC provides support to more than […]

State Rundown 5/13: States Get Federal Aid and Guidance as Many Sessions Wind Down

May 13, 2021 • By ITEP Staff

We had our noses buried in new American Rescue Plan guidance...when we heard the refreshing news that Missouri leaders are on the verge of modernizing their tax code, not only by becoming the final state to apply sales taxes to online purchases, but also by enacting an Earned Income Tax Credit (EITC)...Meanwhile, tax debates are also highly active in California, Colorado, Louisiana, Maine, and Nebraska. We also share some of our own reporting on recent efforts in Arizona and several other states to undermine voter-approved reforms and democratic institutions themselves.

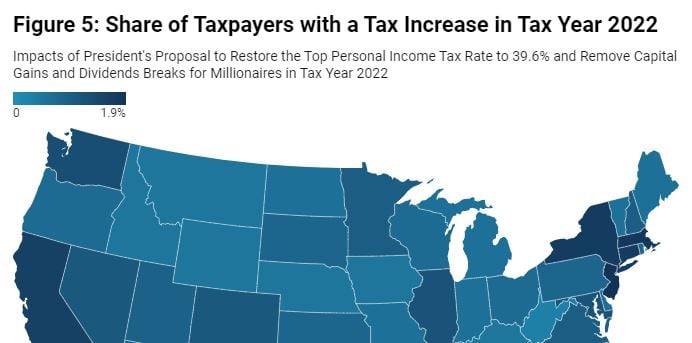

Effects of the President’s Capital Gains and Dividends Tax Proposals by State

May 6, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

President Biden’s proposal to eliminate the lower income tax rate on capital gains (profits from selling assets) and stock dividends for millionaires would affect less than half of one percent (0.4 percent) of U.S. taxpayers if it goes into effect in 2022. The share of taxpayers affected would be less than 1 percent in every state.

This week’s state fiscal news brings a reminder that even though advocates for great economic and racial justice have won some major progressive victories recently, anti-tax zealots have been hard at work too. Lawmakers advanced or enacted troubling regressive tax cuts or shifts in Idaho, Kansas, and Montana, and are actively debating them in Iowa, […]

State Rundown 4/14: More Progressive Wins in the Headlines this Week, but Mind the Fine Print

April 14, 2021 • By ITEP Staff

Two significant victories headlined state tax debates in the past week, as New Mexico leaders improved existing targeted tax credits to give bigger boosts and reach more families in need, and West Virginia lawmakers unanimously shut down a destructive effort to eliminate the state’s progressive income tax. These developments follow last week’s major wins for progressive taxation and targeted assistance in New York, and more good news is likely soon as Washington legislators continue to advance their own targeted credit for working families. Not all the news is positive though, as costly and/or regressive tax cuts remain on the table…

National and State-by-State Estimates of President Biden’s Campaign Proposals for Revenue

April 8, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

During his presidential campaign, Joe Biden proposed to change the tax code to raise revenue directly from households with income exceeding $400,000. More precisely, Biden proposed to raise personal income taxes on unmarried individuals and married couples with taxable income exceeding $400,000, and he also proposed to raise payroll taxes on individual workers with earnings exceeding $400,000. Just 2 percent of taxpayers would see a direct tax hike (an increase in either personal income taxes, payroll taxes, or both) if Biden’s campaign proposals were in effect in 2022. The share of taxpayers affected in each state would vary from a…

State Rundown 3/17: Momentum for Sound Progressive Tax Reforms Continues to Build

March 17, 2021 • By ITEP Staff

We wrote last week that the inclusion of fiscal relief for states and localities in Congress’s American Rescue Plan should free up state lawmakers’ time and attention to focus on the comprehensive reforms needed to address upside-down and inadequate tax codes, and some states are already doing just that.

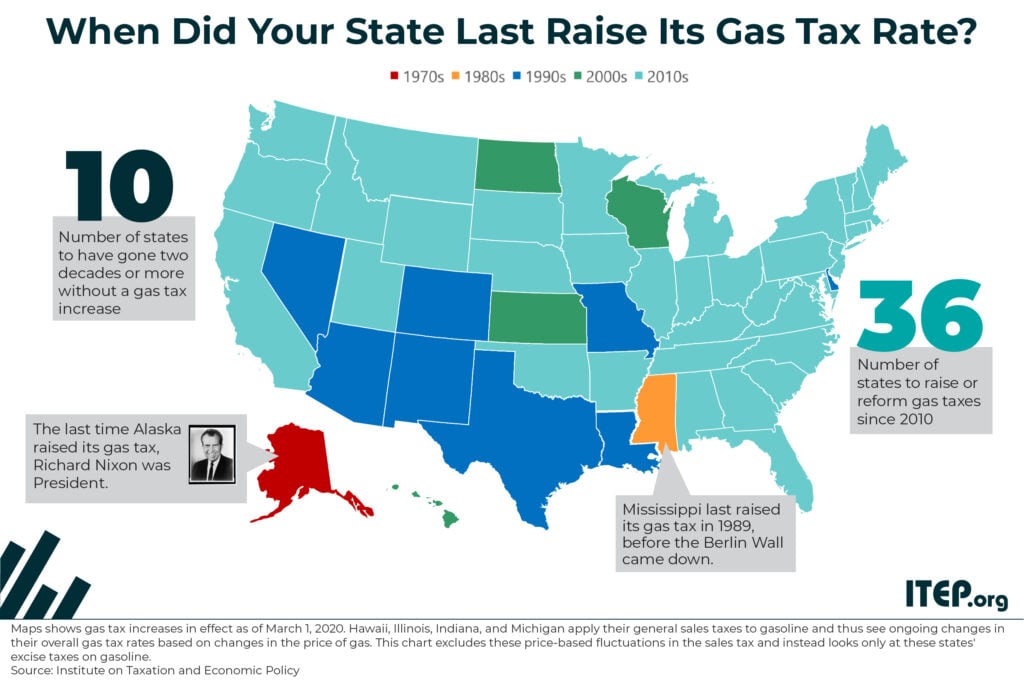

Many state governments are struggling to repair and expand their transportation infrastructure because they are attempting to cover the rising cost of asphalt, machinery, and other construction materials with fixed-rate gasoline taxes that are rarely increased.

State Rundown 2/24: State Tax Debates Quickly Thaw Out with Warmer Weather

February 24, 2021 • By ITEP Staff

Warming temperatures in many parts of the country this week seem to be thawing out state fiscal debates as well. Multiple states including California, Colorado, Maryland, and New Jersey saw movement on efforts to improve tax credits for low- and middle-income families. Mississippi House lawmakers suddenly rushed through a dangerous bill to eliminate the state’s income tax and shift those taxes onto lower-income households. Montana senators also approved regressive income tax cuts and South Dakota legislators advanced an anti-tax constitutional amendment, while lawmakers in Hawaii, Rhode Island, and Washington made progress on improving the progressivity of their tax codes. Gas…

States Are Finally Going Bold with Progressive Tax Efforts

February 4, 2021 • By Dylan Grundman O'Neill

Advocates, lawmakers, study commissions, and even governors in some states are proposing bold tax policy reforms that look beyond pandemic-induced budget shortfalls and the “K-shaped recovery” to address underlying inequities and underfunding that gave rise to them. These efforts include proposals to: end or reverse regressive tax policies like the preferential treatment of income derived from wealth over income earned through work; restore or strengthen estate and inheritance taxes to slow the concentration of wealth in ever-fewer hands; raise revenue and slow inequality with progressive income taxes; and many other ideas to right upside-down tax codes while raising the revenue…

NJ.com: Biden says GOP plan with $1,000 payments is too small as Senate moves ahead with his plan. Here’s the latest.

February 3, 2021

The Institute on Taxation and Economic Policy, a progressive research group, said that 90% of New Jersey adults and 91% of children would receive at least a partial payment. But that’s a lower percentage than any other state, tied with Massachusetts. Of the 5.6 million adults in the state who would receive a stimulus check, […]

As states kick off their 2021 legislative sessions, it’s clear that many governors and lawmakers are attempting to “take a mulligan” on the last year and recycle tax-slashing ideas that were already bad in 2020 and are even worse now as states try to recover from the Covid-19 pandemic and accompanying downturn...On a brighter note, Illinois leaders showed they did learn from the events of 2020, passing a major criminal justice reform bill and payday loan protections intended to reduce racial inequities.

State Rundown 11/24: Lawmakers and Families Thankful to Be Nearing End to 2020

November 24, 2020 • By ITEP Staff

Just as people will search their hearts to give thanks this week for the small and large things that got them through a difficult year, state lawmakers are also doing their best to count their blessings while keeping fingers crossed for badly needed federal relief to give them something to be truly grateful for.

State Rundown 11/13: States Can Find Inspiration in Arizona Ballot Success; Must Look to Congress for More Immediate Help

November 13, 2020 • By ITEP Staff

Although progressive tax policy doesn’t always succeed in in statehouses or voting booths, Arizona voters showed once again that when offered a clear choice, most people resoundingly support requiring fairer tax contributions from rich individuals and highly profitable corporations over allowing their schools and other shared priorities to wither and decay. Still, a similar effort in Illinois and a more complicated measure in California were defeated, and anti-tax zealots in West Virginia and many other states will continue to push for tax cuts for the rich and defunding public investments, leaving much work to be done to advance tax justice.

State Rundown 10/28: Anti-Tax Horror Stories Proving Less Spooky in 2020

October 28, 2020 • By ITEP Staff

Even with Halloween coming up this weekend, months of dealing with the horrors of the Covid-19 pandemic have made it hard to scare anyone in the closing months of 2020, which state lawmakers and residents are showing by voting in droves and supporting policies they had been more trepidatious about in recent years.

State Rundown 10/21: States Preparing Ingredients for 2021 Fiscal Debates

October 21, 2020 • By ITEP Staff

State lawmakers around the nation are already looking well past the upcoming election to the legislative debates they’ll be cooking up in 2021. In Iowa and Nebraska, anti-tax groups are thawing out regressive tax shift ideas they had put on ice earlier in the pandemic. In Delaware, a lawsuit and recent settlement have put educational and property tax inequities on the menu for the upcoming session. Meanwhile New Jersey and New York are both looking to add stock to their revenue mixes with progressive taxes on stock trades.

Supreme Court Would Provide Massive Tax Cut for the Rich if It Strikes Down Affordable Care Act

October 13, 2020 • By Steve Wamhoff

If the Supreme Court strikes down the Affordable Care Act (ACA), as argued for by the Trump administration and the president’s nominee to the court, Amy Coney Barrett, one under-appreciated result will be a tax break of roughly $40 billion annually for about 3 percent of Americans, who all have incomes of more than $200,000.

The biggest news for state and local fiscal debates this week was that federal fiscal relief to help with their pandemic-induced revenue crises is effectively off the table for at least another month. But if there is a silver lining to this federal inaction, it may be that it coincides with New Jersey’s success filling part of its own revenue shortfall through a millionaires tax, as well as with prominent wealth managers admitting that their rich clients don’t flee to other states in response to such taxes (see “What We’re Reading”). Combined, these three developments could encourage state leaders elsewhere…

New ITEP Report Shows Few Taxpayers in Each State Paying More Under Biden’s Tax Plan

October 7, 2020 • By Steve Wamhoff

An ITEP report finds that taxes that people pay directly would stay the same or go down in 2022 for 98.1 percent of Americans under President-elect Joe Biden’s tax plan.

New 50-State Analysis of Biden Revenue-Raising Tax Proposals

October 7, 2020 • By ITEP Staff

A state-by-state analysis of President-elect Joe Biden’s proposal to raise taxes for filers with income of more than $400,000 finds that in 2022, just 1.9 percent of all taxpayers would face a direct tax increase. This would vary only slightly by state. For example, in West Virginia, 0.6 percent of taxpayers would see an increase, and in Connecticut, 3.7 percent of taxpayers’ taxes would increase.