Mississippi

State Rundown 10/13: Soda Taxes, Business Subsidies, and Gas Taxes Considered in Several States

October 13, 2017 • By ITEP Staff

A comprehensive tax study is underway in Arkansas this week as other states hone in on more specific issues. Soda taxes hit setbacks in Illinois and Michigan, business tax subsidies faced scrutiny in Iowa and Missouri, and gas tax update efforts are underway in Mississippi and North Dakota.

State Rundown 10/4: Wildfires in Montana and Tax Cuts in Kansas Wreak Budget Havoc

October 4, 2017 • By ITEP Staff

This week, Kansas's school funding was again ruled unconstitutionally low and unfair, while Montana lawmakers indicated they'd rather let historic wildfires burn a hole through their budget than raise revenues to meet their funding needs. Meanwhile, a struggling agricultural sector continues to cause problems for Iowa and Nebraska, but legalized recreational marijuana is bringing good economic news to both California and Nevada.

Benefits of GOP-Trump Framework Tilted Toward the Richest Taxpayers in Each State

October 4, 2017 • By Steve Wamhoff

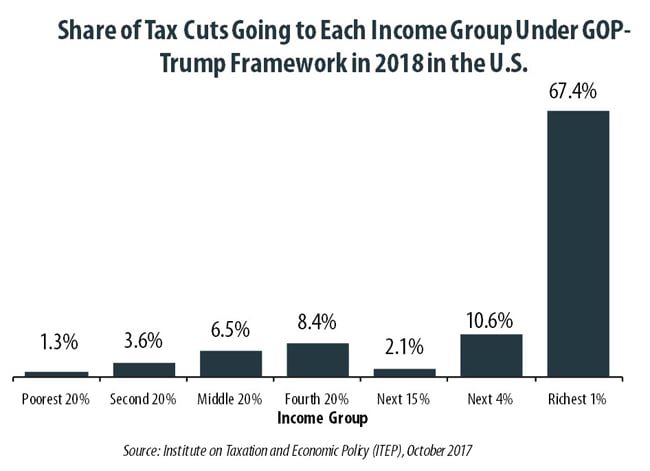

The “tax reform framework” released by the Trump administration and Congressional Republican leaders on September 27 would affect states differently, but every state would see its richest residents grow richer if it is enacted. In all but a handful of states, at least half of the tax cuts would flow to the richest one percent of residents if the framework took effect.

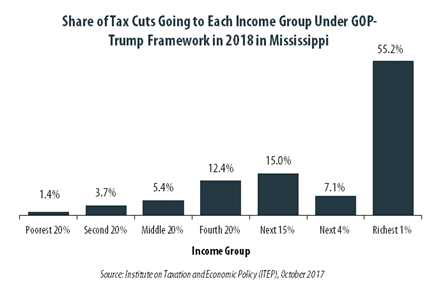

GOP-Trump Tax Framework Would Provide Richest One Percent in Mississippi with 55.2 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Mississippi equally. The richest one percent of Mississippi residents would receive 55.2 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $404,300 next year. The framework would provide them an average tax cut of $42,060 in 2018, which would increase their income by an average of 3.6 percent.

State Rundown 9/25: No Rest for the Weary as State Tax and Budget Debates Wind Down, Ramp Up

September 25, 2017 • By ITEP Staff

Last week, Wisconsin leaders finally came to agreement on a state budget, while their peers in Connecticut appear to be close behind them. Iowa lawmakers avoided a special session with a short-term fix and will have to return to their structural deficit issues next session, as will those in Louisiana who will face a $1 billion shortfall. Meanwhile, District of Columbia leaders have already resumed meeting and discussing tax and budget issues there.

Arkansas Times: Arkansas to Fare Worse Than Most States under Trump Tax Proposal, Report Says

September 8, 2017

We don’t have an actual tax bill to parse yet, but Arkansas Advocates for Children and Families has a helpful preview of how the cuts outlined by Trump earlier this year would affect Arkansas. It’s based on an analysis by the Institute on Taxation and Economic Policy. The key takeaway is that Arkansas is among the […]

In Mississippi 37.1 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Mississippi population (0.2 percent) earns more than $1 million annually. But this elite group would receive 37.1 percent of the tax cuts that go to Mississippi residents under the tax proposals from the Trump administration. A much larger group, 55.7 percent of the state, earns less than $45,000, but would receive just 6.3 percent of the tax cuts.

Nearly Half of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million Annually

August 17, 2017 • By ITEP Staff

A tiny fraction of the U.S. population (one-half of one percent) earns more than $1 million annually. But in 2018 this elite group would receive 48.8 percent of the tax cuts proposed by the Trump administration. A much larger group, 44.6 percent of Americans, earn less than $45,000, but would receive just 4.4 percent of the tax cuts.

Trump Touts Tax Cuts for the Wealthy as a Plan for Working People

July 26, 2017 • By Steve Wamhoff

Unless the administration takes a radically different direction on tax reform from what it has already proposed, its tax plan would be a monumental giveaway to the top 1 percent. The wealthiest one percent of households would receive 61 percent of all the Trump tax breaks, and would receive an average of $145,400 in 2018 alone.

2017 marked a sea change in state tax policy and a stark departure from the current federal tax debate as dubious supply-side economic theories began to lose their grip on statehouses. Compared to the predominant trend in recent years of emphasizing top-heavy income tax cuts and shifting to more regressive consumption taxes in the hopes […]

Hope Policy Institute: Mississippi’s Wealthiest Get the Most Benefit under New Federal Tax Cut Proposal

July 21, 2017

New research from the Institute on Taxation and Economic Policy (ITEP) looks at the potential effects of a tax cut proposal from the Trump Administration on families in the 50 states. The tax cut proposal would reduce the tax rate on corporate income from 35 percent to 15 percent, would repeal the estate tax, replace the current income tax brackets with three brackets at 10 percent, 25 percent, and 35 percent, eliminate most itemized deductions, except charitable giving and home mortgage interest, and create a new tax credit for childcare expenses, among other things.

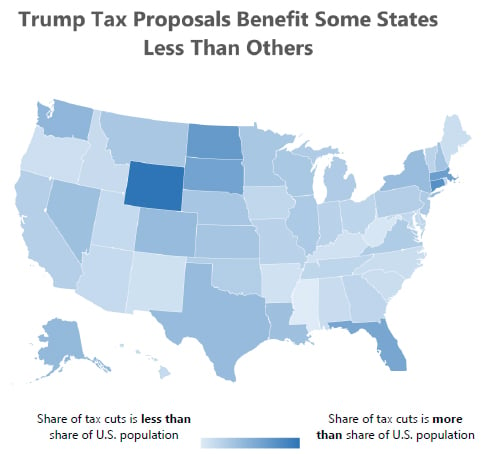

50-State Analysis of Trump’s Tax Outline: Poorer Taxpayers and Poorer States are Disadvantaged

July 20, 2017 • By Alan Essig

Not only would President Trump’s proposed tax plan fail to deliver on its promise of largely helping middle-class taxpayers, it also would shower a disproportionate share of the total tax cut on taxpayers in some of the richest states while southern and a few other states would receive a smaller share of the tax cut […]

Trump Tax Proposals Would Provide Richest One Percent in Mississippi with 47.8 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Mississippi would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,108,300 in 2018. They would receive 47.8 percent of the tax cuts that go to Mississippi’s residents and would enjoy an average cut of $62,390 in 2018 alone.

Trump’s $4.8 Trillion Tax Proposals Would Not Benefit All States or Taxpayers Equally

July 20, 2017 • By Matthew Gardner, Steve Wamhoff

The broadly outlined tax proposals released by the Trump administration would not benefit all taxpayers equally and they would not benefit all states equally either. Several states would receive a share of the total resulting tax cuts that is less than their share of the U.S. population. Of the dozen states receiving the least by this measure, seven are in the South. The others are New Mexico, Oregon, Maine, Idaho and Hawaii.

State Rundown 7/19: Handful of States Still Have Their Hands Full with Tax and Budget Debates

July 19, 2017 • By ITEP Staff

Tax and budget debates drag on in several states this week, as lawmakers continue to work in Alaska, Connecticut, Rhode Island, Pennsylvania, Texas, and Wisconsin. And a showdown is brewing in Kentucky between a regressive tax shift effort and a progressive tax reform plan. Be sure to also check out our "What We're Reading" section for a historical perspective on federal tax reform, a podcast on lessons learned from Kansas and California, and more!

State Rundown 6/28: States Scramble to Finish Budgets Before July Deadlines

June 28, 2017 • By ITEP Staff

This week, several states attempt to wrap up their budget debates before new fiscal years (and holiday vacations) begin in July. Lawmakers reached at least short-term agreement on budgets in Alaska, New Hampshire, Rhode Island, and Vermont, but such resolution remains elusive in Connecticut, Delaware, Illinois, Maine, Pennsylvania, Washington, and Wisconsin.

Many state governments are struggling to repair and expand their transportation infrastructure because they are attempting to cover the rising cost of asphalt, machinery, and other construction materials with fixed-rate gasoline taxes that are rarely increased.

State Rundown 6/14: Some States Wrapping Up Tax Debates, Others Looking Ahead to Next Round

June 14, 2017 • By ITEP Staff

This week lawmakers in California and Nevada resolved significant tax debates, while budget and tax wrangling continued in West Virginia, and structural revenue shortfalls were revealed in Iowa and Pennsylvania. Airbnb increased the number of states in which it collects state-level taxes to 21. We also share interesting reads on state fiscal uncertainty, the tax experiences of Alaska and Wyoming, the future of taxing robots, and more!

3 Percent and Dropping: State Corporate Tax Avoidance in the Fortune 500, 2008 to 2015

April 27, 2017 • By Aidan Davis, Matthew Gardner, Richard Phillips

The trend is clear: states are experiencing a rapid decline in state corporate income tax revenue. Despite rebounding and even booming bottom lines for many corporations, this downward trend has become increasingly apparent in recent years. Since our last analysis of these data, in 2014, the state effective corporate tax rate paid by profitable Fortune 500 corporations has declined, dropping from 3.1 percent to 2.9 percent of their U.S. profits. A number of factors are driving this decline, including: a race to the bottom by states providing significant “incentives” for specific companies to relocate or stay put; blatant manipulation of…

States are experiencing a rapid decline in state corporate income tax revenue, and the downward trend has become increasingly pronounced in recent years. Despite rebounding bottom lines for many corporations, a new ITEP report, 3 Percent and Dropping: State Corporate Tax Avoidance in the Fortune 500, 2008 to 2015,finds that effective tax rates paid by […]

Tax Justice Digest: 50-State Analysis of GOP Health Care Plan, Ensuring State Sales Taxes Keep Pace with Our Changing Economy

March 23, 2017 • By ITEP Staff

In the Tax Justice Digest we recap the latest reports, blog posts, and analyses from Citizens for Tax Justice and the Institute on Taxation and Economic Policy. Here’s a rundown of what we’ve been working on lately. State-by-State Analysis of GOP Health Care Plan By now, it’s widely known that the GOP health care plan […]

This week in state tax news saw major changes debated in Hawaii and West Virginia and proposed in North Carolina, a harmful flat tax proposal in Georgia, new ideas for ignoring revenue shortfalls in Mississippi and Nebraska, an unexpected corporate tax proposal from the governor of Louisiana, gas tax bills advance in South Carolina and […]

Hope Policy Institute: Everyone Pays Taxes, Including Undocumented Immigrants

March 21, 2017

According to a new report by the Institute on Taxation and Economic Policy (ITEP), it is estimated that undocumented immigrants in Mississippi pay almost $22,684,000 in state and local taxes. Nationally, undocumented immigrants pay over $11.74 billion in state and local taxes. The report, entitled “Undocumented Immigrants’ State and Local Tax Contributions,” highlights the contributions of undocumented immigrants as taxpayers to state and local governments.

State tax debates have been very active this week. Efforts to eliminate the income tax continue in West Virginia. Policymakers in many states are responding to revenue shortfalls in very different ways: some in Iowa, Mississippi, and Nebraska seek to dig the hole even deeper with tax cuts, while the Missouri House’s response has been […]

State Rundown 3/1: Will Tax Cut Proposals Be “In Like a Lion, Out Like A Lamb”?

March 1, 2017 • By ITEP Staff

Tax cuts have been proposed in many states already this year, but amid so much uncertainty, it remains to be seen how successful those efforts will be. This week saw one dangerous, largely regressive tax cut proposal move in Georgia, new budget proposals in Louisiana and New Jersey, a new plan to close West Virginia‘s […]