New Hampshire

Many state governments are struggling to repair and expand their transportation infrastructure because they are attempting to cover the rising cost of asphalt, machinery, and other construction materials with fixed-rate gasoline taxes that are rarely increased.

New Hampshire Fiscal Policy Institute: Revenue in Review: An Overview of New Hampshire’s Tax System and Major Revenue Sources

May 24, 2017

New Hampshire’s revenue system is relatively unique in the United States, as it lacks broad-based income and sales taxes and instead relies on a diversity of more narrowly-based taxes, fees, and other revenue sources to fund public services. This system presents both advantages and disadvantages to stable, adequate, and sustainable revenue generation.

Public Loss Private Gain: How School Voucher Tax Shelters Undermine Public Education

May 17, 2017 • By Carl Davis, Sasha Pudelski

One of the most important functions of government is to maintain a high-quality public education system. In many states, however, this objective is being undermined by tax policies that redirect public dollars for K-12 education toward private schools.

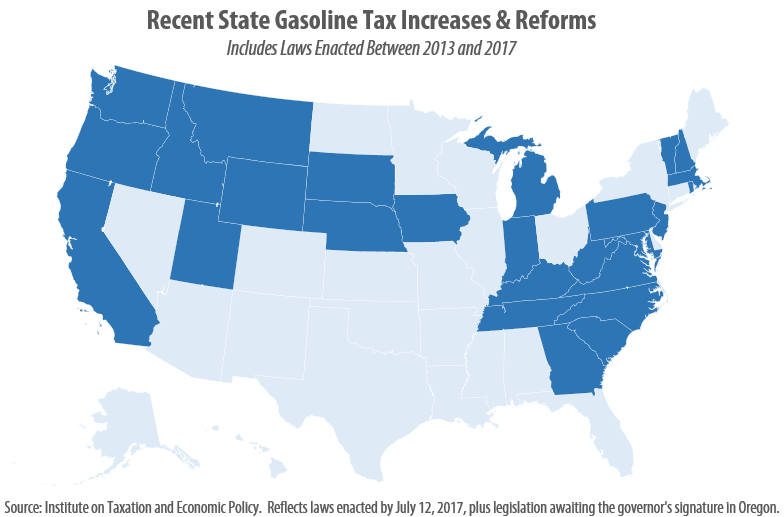

This post was updated July 12, 2017 to reflect recent gas tax increases in Oregon and West Virginia. As expected, 2017 has brought a flurry of action relating to state gasoline taxes. As of this writing, eight states (California, Indiana, Montana, Oregon, South Carolina, Tennessee, Utah, and West Virginia) have enacted gas tax increases this year, bringing the total number of states that have raised or reformed their gas taxes to 26 since 2013.

3 Percent and Dropping: State Corporate Tax Avoidance in the Fortune 500, 2008 to 2015

April 27, 2017 • By Aidan Davis, Matthew Gardner, Richard Phillips

The trend is clear: states are experiencing a rapid decline in state corporate income tax revenue. Despite rebounding and even booming bottom lines for many corporations, this downward trend has become increasingly apparent in recent years. Since our last analysis of these data, in 2014, the state effective corporate tax rate paid by profitable Fortune 500 corporations has declined, dropping from 3.1 percent to 2.9 percent of their U.S. profits. A number of factors are driving this decline, including: a race to the bottom by states providing significant “incentives” for specific companies to relocate or stay put; blatant manipulation of…

Charleston Gazette-Mail: Cutting WV Income Tax Likely to Backfire

April 11, 2017

There are nine states with no income tax: Alaska, Florida, Nevada, South Dakota, Texas, Washington, Wyoming, New Hampshire and Tennessee. Only Texas has seen job growth — as a result of being the center of the oil industry. The others have not; job growth has trailed population growth in the other eight. This is based […]

Testimony before the Alaska House Labor & Commerce Committee On House Bill 36

April 4, 2017 • By Matthew Gardner

Thank you for the opportunity to testify on the changes House Bill 36 would make to Alaska's tax treatment of pass-through income. The taxation of pass-through business entities has been a focal point of state and federal tax reform debates for over a quarter century, with a dual focus on minimizing the role of tax laws in determining the choice of business entity and on ensuring that the income of all business entities is subject to at least a minimal tax. My testimony makes two main points: 1. Alaska is one of a small number of states that do not…

What to Watch in the States: State Earned Income Tax Credits (EITC) on the Move

March 24, 2017 • By Misha Hill

While every state’s tax system is regressive, meaning lower income people pay a higher tax rate than the rich, some states aim to improve tax fairness through a state Earned Income Tax Credit (EITC). Federal lawmakers established the in 1975 to bolster the earnings of low-wage workers, especially workers with children and offset some of […]

State tax debates have been very active this week. Efforts to eliminate the income tax continue in West Virginia. Policymakers in many states are responding to revenue shortfalls in very different ways: some in Iowa, Mississippi, and Nebraska seek to dig the hole even deeper with tax cuts, while the Missouri House’s response has been […]

This week brings more news of states considering reforms to their consumption taxes, on everything from gasoline in South Carolina and Tennessee, to marijuana in Pennsylvania, to groceries in Idaho and Utah, and to practically everything in West Virginia. Meanwhile, the fiscal fallout of Kansas’s failed ‘tax experiment’ has new consequences as the state’s Supreme […]

This week we are following a number of significant proposals being debated or introduced including reinstating the income tax in Alaska and eliminating the tax in West Virginia, establishing a regressive tax-cut trigger in Nebraska, restructuring the Illinois sales tax, moving New Mexico to a flat income tax and broader gross receipts tax, and updating […]

Below is a list of notable resources for information on state taxes and revenues: Alabama Alabama Department of Revenue Alabama Department of Finance – Executive Budget Office Alabama Department of Revenue – Tax Incentives for Industry Alabama Legislative Fiscal Office Alaska Alaska Department of Revenue – Tax Division Alaska Office of Management & Budget Alaska […]

Fairness Matters: A Chart Book on Who Pays State and Local Taxes

January 26, 2017 • By Carl Davis, Meg Wiehe

When states shy away from personal income taxes in favor of higher sales and excise taxes, high-income taxpayers benefit at the expense of low- and moderate-income families who often face above-average tax rates to pick up the slack. This chart book demonstrates this basic reality by examining the distribution of taxes in states that have pursued these types of policies. Given the detrimental impact that regressive tax policies have on economic opportunity, income inequality, revenue adequacy, and long-run revenue sustainability, tax reform proponents should look to the least regressive, rather than most regressive, states in crafting their proposals.

This report explains the workings, and problems, with state-level tax subsidies for private K-12 education. It also discusses how the Internal Revenue Service (IRS) has exacerbated some of these problems by allowing taxpayers to claim federal charitable deductions even on private school contributions that were not truly charitable in nature. Finally, an appendix to this report provides additional detail on the specific K-12 private school tax subsidies made available by each state.

A new study released today provides the best evidence yet that progressive state income taxes are not leading to any meaningful amount of “tax flight” among top earners.

Distributional Analyses of Revenue Options for Alaska

April 13, 2016 • By Aidan Davis, Carl Davis

Alaskans are faced with a stark fiscal reality. Following the discovery of oil in the 1960s and 1970s, state lawmakers repealed their personal income tax and began funding government primarily through oil tax and royalty revenues. For decades, oil revenues filled roughly 90 percent of the state's general fund.

Huffington Post: How Some States Are Trying To Fix Their Crumbling Infrastructure

July 6, 2015

Carl Davis, research director at the Institute on Taxation and Economic Policy, said efforts to raise state taxes to pay for roads and bridges exploded this year. In 2013 and 2014, four states (Massachusetts, New Hampshire, Vermont and Wyoming) increased their gas taxes, while Maryland, Pennsylvania and Rhode Island indexed the gas tax to either […]

Keene Sentinel: On Tax Day, a Look at New Hampshire’s Budget Battle

April 15, 2015

According to the Institute on Taxation and Economic Policy, “On average, poor homeowners and renters pay more of their incomes in property taxes than do any other income group — and the wealthiest taxpayers pay the least.” The institute issues a report every few years noting the effects of state and local tax policies on […]

Morning Sentinel: Will Cutting Taxes Make Maine Stronger?

January 24, 2015

We can envision this future by looking at neighboring New Hampshire, which has neither general sales nor income tax, but relies heavily on the regressive property tax. There, according to the Institute on Taxation and Economic Policy, the poorest fifth pay 8.3 percent of their incomes in state and local taxes, while the wealthiest fifth […]

New Hampshire Fiscal Policy Institute: Low-Income Taxpayers in New Hampshire Pay Three Times the Tax Rate Paid by the Wealthiest Granite Staters

January 21, 2015

A new study released today by the Institute on Taxation and Economic Policy (ITEP) finds that the lowest income Granite Staters pay an effective tax rate that is three times that paid by the state’s wealthiest residents. Read the full report

New Hampshire Fiscal Policy Institute: New Hampshire’s Tax System Asks Far Less of the Wealthy than of the Poor

January 21, 2015

More than five years after the end of the Great Recession, many Granite Staters are still struggling. The typical household’s income has yet to recover the ground it lost during the economic downturn, while wages for individuals and families at the bottom of the income distribution are still where they were two decades ago. A […]

New Hampshire Voice: Poor families pay bigger share of their income in taxes than wealthy families

January 16, 2015

“The analysis by the Institute on Taxation and Economic Policy that evaluates the local tax burden in every state concluded that when it comes to paying taxes, the people who earn less pay more. In simple terms the low-and middle-income families’ in each state spend more money on state and local taxes than wealthy people. […]

Concord Monitor: Common-sense reforms can address inequality, budget shortfalls

January 15, 2015

“A comprehensive national report issued this week demonstrates that New Hampshire’s state and local tax system asks far more of low- and moderate-income taxpayers than wealthy ones. The report, released by the Institute on Taxation and Economic Policy, finds that, on average, non-elderly individuals and families in the bottom fifth of the income distribution in […]

NPR: Gas Tax Hike to Fuel Fixes to Roads and Bridges

December 9, 2014

“There’s kind of been a switch that’s been flipped,” says Carl Davis, a senior analyst with the nonprofit Institute on Taxation and Economic Policy Davis says gas tax increases are now on the table in states across the country, from New Jersey to Utah to South Carolina to South Dakota. Democratic governors in Delaware, Vermont […]

Bloomberg BNA: Will Massachusetts’ Rejection of Inflation-Adjusted Gas Tax Have Federal Implications?

November 6, 2014

States have varying gas tax rate structures, which can be boiled down to one of two general forms: a fixed-rate tax or a variable-rate tax. Flat-rate gas taxes, like those in now Massachusetts and New Hampshire, collect a certain number of cents per gallon of gas purchased. Meanwhile, variable-rate taxes are calculated one of several […]