New Jersey

State Rundown 7/19: Wayfair Fallout and Ballot Preparation Dominate State Tax Talk

July 19, 2018 • By ITEP Staff

In the wake of the U.S. Supreme Court's recent Wayfair decision authorizing states to collect taxes owed on online sales, Utah lawmakers held a one-day special session that included (among other tax topics) legislation to ensure the state will be ready to collect those taxes, and a Nebraska lawmaker began pushing for a special session for the same reason. Voters in Colorado and Montana got more clarity on tax-related items they'll see on the ballot in November. And Massachusetts moves closer toward becoming the final state to enact a budget for the new fiscal year that started July 1 in…

Building on Momentum from Recent Years, 2018 Delivers Strengthened Tax Credits for Workers and Families

July 10, 2018 • By Aidan Davis

Despite some challenging tax policy debates, a number of which hinged on states’ responses to federal conformity, 2018 brought some positive developments for workers and their families. This post updates a mid-session trends piece on this very subject. Here’s what we have been following:

New Jersey avoided a second consecutive shutdown and proved that even against staunch opposition, progressive solutions to states' fiscal issues are attainable, and Arizona voters will likely have a chance to solve their education funding crisis in a similar way. Budget and tax debates remain to be resolved, however, in Maine and Massachusetts. Meanwhile, voters are gaining a clearer picture of what questions they will be asked on ballots this fall as signature drives conclude in several states.

With many state fiscal years beginning July 1, most states that will make decisions this year about federal tax conformity have now done so, so it is now time for an update on how well state policymakers have kept to, or veered from, the path we charted out earlier this year. Most states that have enacted laws in response to the federal changes have adhered to some but not all of the principles we laid out, with a few responding rather prudently and a handful charting a much more treacherous course of unfair, unsustainable policy based on unfounded promises of…

This week, lawmakers in Louisiana, Pennsylvania, Rhode Island, Vermont, and the District of Columbia wrapped up their budgets in time for the new fiscal year that starts July first in most states, with some of these resolutions coming after contentious debates and repeated special sessions. New Jersey's debate is not yet finished as leaders clash over spending priorities and the taxes on millionaires and corporations needed to fund them. Meanwhile, signature drives to put tax-related questions on fall ballots are heating up in several other states. And our "What We're Reading" section includes helpful resources on implications of the Supreme…

Washington Post: N.J. Approaches a Government Shutdown as Democrats Feud Over Tax on Millionaires

June 28, 2018

New Jersey is just days away from a government shutdown over a plan to raise taxes on the rich that has divided Democrats and revealed the political difficulty of raising funds for the party's ambitious social spending goals.

Wall Street Journal: As Treasury Targets Workarounds to Tax Law, Impact May Extend Beyond High-Tax States

June 27, 2018

Tax experts say the federal government will find it difficult if not impossible to write rules to stop the workarounds in New York, New Jersey and Connecticut without also limiting existing tax credits in Georgia, Alabama, South Carolina and elsewhere. According to a recent paper from law professors, 33 states currently have more than 100 […]

Governing: Why New Jersey Is Headed for Another Shutdown

June 26, 2018

But Meg Wiehe, deputy director of the left-leaning Institute on Taxation and Economic Policy, notes that the federal corporate income tax cut also has an effect on high-income earners. Historically, shareholders have been the biggest beneficiaries of corporate tax cuts. According to her organization’s research, that means New Jersey’s wealthiest 1 percent will still see […]

The U.S. Supreme Court made big news this morning by allowing states to collect taxes due on internet purchases, which will help put main-street and online retailers on an even playing field while also improving state and local revenues and the long-term viability of the sales tax as a revenue source. Many states remain focused on more local issues, however, as Louisiana's third special session of the year kicked off, Massachusetts won a living wage battle while losing an opportunity to put a popular millionaires tax proposal before voters, and major fiscal debates continue in Maine, New Jersey, and Vermont.

NorthJersey.com: NJ Lottery Operator Northstar Wants $97 Million Raise and Less Money for New Jersey

June 15, 2018

In neighboring Pennsylvania, the Legislature in 2014 approved decreasing the minimum profit margin from 27 percent to 25 percent and projected net revenue would increase by $40 million over the following three to four years. Since the change, Pennsylvania’s net revenues decreased cumulatively by $35 million, according to research by the Institute on Taxation and […]

State Rundown 6/13: Budget Crunch Time Sets in as State Fiscal Years Come to Close

June 13, 2018 • By ITEP Staff

With many state fiscal years ending June 30th, budget negotiations were completed recently in California, Illinois, Michigan, and North Carolina. New Jersey remains a state to watch as a government shutdown looms but leaders continue to disagree about a proposed millionaires tax, corporate taxes, and school funding. In other states looking to wealthy individuals and large corporations for needed revenues, Arizona's teacher pay crisis could be solved with a tax on its highest-income residents and a similar proposal in Massachusetts is polling well, but Seattle's new "head tax" could be on the chopping block.

All Bets are Off: State-Sponsored Sports Betting Isn’t Worth the Risk

June 13, 2018 • By Misha Hill

Many state legislators and regulators are considering expanding state-sponsored gambling by allowing betting on major league sports games. But the revenue states could bring in isn’t worth the risk.

State Rundown 6/1: Time Is Ripe for Closer Look at Intergovernmental Relations

June 1, 2018 • By ITEP Staff

This week, Virginia lawmakers overcame their budget impasse and approved an expansion of Medicaid, North Carolina's behind closed doors budget debate appears to be wrapping up, and Vermont's special session continues in the wake of the governor's vetoes of the state budget and accompanying tax bills. New research highlighted in our What We're Reading section shows that both corporate income tax cuts and business tax subsidies contribute to wider economic inequality. And the possible reconstitution of a federal commission on intergovernmental relations could not come soon enough, as other headlines this week include a state-to-local shift in school funding, governments…

As IRS Prepares to Act, Red-State Taxpayers Profit from Use of SALT “Workaround Credits”

May 24, 2018 • By Carl Davis

A new ITEP report explains the close parallels between the new workaround credits and existing state tax credits, including those benefiting private schools. The report comes the same day that the IRS and Treasury Department announced they would seek new regulations related to these tax credits. It notes that the SALT workarounds are emblematic of a broader weakness with the federal charitable deduction. And it cautions regulators to avoid a “narrow fix” that will only address the newest SALT workarounds (which, so far, have only been enacted in blue states) without also addressing other abuses of the deduction, which have…

Washington Post: NJ Democrats Loved the Idea of Taxing the Rich Until They Could Actually Do It

May 24, 2018

A spokesman for Sweeney, the state Senate president, said families earning over $1.1 million in New Jersey already face an average $738 tax hike under the GOP law, citing data from the Institute on Taxation and Economic Policy (ITEP), a left-leaning think tank. That number accounts only for the GOP tax law’s changes for households […]

New Jersey Policy Perspective: Fast Facts: Proposed Tax Changes Would Bring More Balance to New Jersey’s Tax Code

May 24, 2018

The tax changes proposed in Gov. Murphy’s first budget would bring more balance to New Jersey’s tax code by raising taxes on the wealthiest one percent while reducing them for the lowest-income New Jerseyans.[1] Updating the tax code would also raise nearly $2 billion in new revenue for targeted investments in early education, public transit, health care and other essential public services.

State Efforts to Shield Taxpayers From SALT Cap Expose Deeper Flaws with Tax Incentives for Charitable Contributions

May 23, 2018 • By Carl Davis

Long before the tax law passed, some states abused the idea of charitable giving to funnel public money to various activities, such as private K-12 education, by reimbursing up to 100 percent of their taxpayers’ donations with tax credits. The flimsy, hastily-written SALT deduction cap enacted last year made this type of gaming even easier than before, and it was entirely predictable that states would respond by enacting more tax credits of this type.

SALT/Charitable Workaround Credits Require a Broad Fix, Not a Narrow One

May 23, 2018 • By Carl Davis

The federal Tax Cuts and Jobs Act (TCJA) enacted last year temporarily capped deductions for state and local tax (SALT) payments at $10,000 per year. The cap, which expires at the end of 2025, disproportionately impacts taxpayers in higher-income states and in states and localities more reliant on income or property taxes, as opposed to sales taxes. Increasingly, lawmakers in those states who feel their residents were unfairly targeted by the federal law are debating and enacting tax credits that can help some of their residents circumvent this cap.

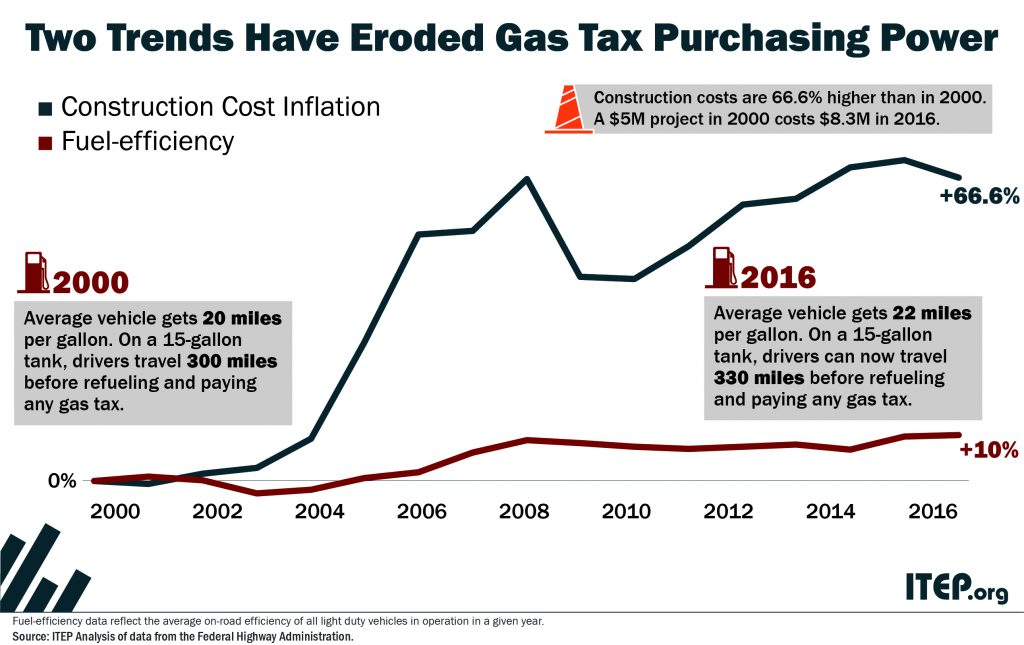

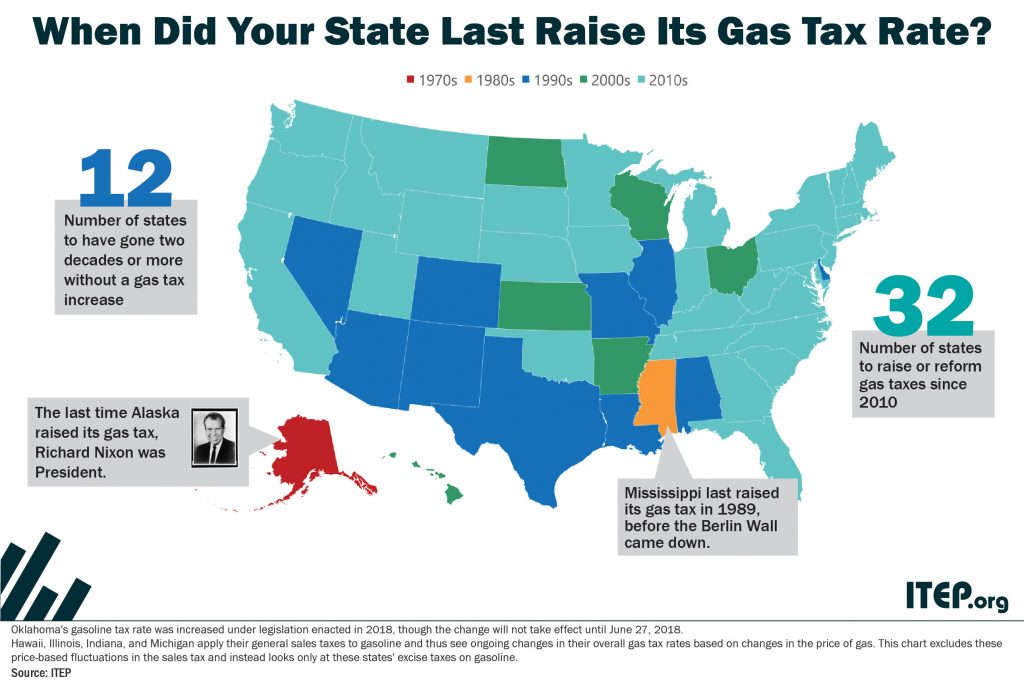

An updated version of this blog was published in April 2019. State tax policy can be a contentious topic, but in recent years there has been a remarkable level of agreement on one tax in particular: the gasoline tax. Increasingly, state lawmakers are deciding that outdated gas taxes need to be raised and reformed to fund infrastructure projects that are vital to their economies.

Many state governments are struggling to repair and expand their transportation infrastructure because they are attempting to cover the rising cost of asphalt, machinery, and other construction materials with fixed-rate gasoline taxes that are rarely increased.

New Jersey’s new governor, Phil Murphy campaigned on a promise to raise state income taxes on millionaires, a proposal that is supported by 70 percent of the state and was, until recently, backed by New Jersey’s Senate President, Steve Sweeney. In recent months, Sweeney changed his position on the proposed millionaires tax and called for an increase in New Jersey’s corporate tax instead. The idea of hiking taxes on corporations is not a bad one, particularly since corporations received a windfall from the Tax Cuts and Jobs Act. But Sweeney’s new opposition to an income tax hike for the state’s…

State Rundown 5/17: Don’t Bet on Legal Sports Betting Solving State Budget Woes

May 17, 2018 • By ITEP Staff

This week the U.S. Supreme Court opened the door to legal sports gambling in the states (see our What We're Reading section), which will surely be a hot topic in state legislative chambers, but most states currently have more pressing matters before them. The teacher pay crisis made news in North Carolina, Alabama, and nationally. Louisiana, Oregon, and Vermont lawmakers are headed for special sessions over tax and budget issues. And several other states have recently reached or are very near the end of their legislative sessions.

New Jersey Policy Perspectives: DACA Recipients Contribute $59 Million Per Year in Taxes

May 15, 2018

The ITEP study found that New Jersey’s young immigrants eligible for DACA contribute $59 million in state and local taxes each year, the seventh highest level of all fifty states. These contributions would increase by $38 million per year – the sixth most of all states – if all of those eligible for DACA enrolled […]

Bloomberg BNA: Higher Gas Prices May Mean Paying States More in Taxes

May 1, 2018

As a result, a few states will see revenue gains from higher prices because their tax rates are tied to the price of fuel, rather than its volume, Carl Davis, research director for the left-leaning Institute on Taxation and Economic Policy, told Bloomberg Tax. Those states include California, Connecticut, Kentucky, Maryland, Nebraska, New Jersey, New […]

No Need for the MythBusters, the Millionaire Tax Flight Myth is Busted Again

May 1, 2018 • By Dacey Anechiarico

One of the most repeated myths in state tax policy is called “millionaire tax flight,” where millionaires are allegedly fleeing states with high income tax rates for states with lower rates. This myth has been used as an argument in state tax debates for years but Cristobal Young argues in his book, “The Myth of the Millionaire Tax Flight,” that both Democrats and Republicans are “searching for a crisis that does not really exist,” and that there is no evidence to support this myth.