New York

Quartz: The Republican tax plan takes aim at one of the biggest engines of US growth

November 30, 2017

As Los Angeles Times Jim Puzzanghera pointed out recently, California is already one of a handful of states that pays more to the federal government than it receives. The Republican plan currently being debated in the Senate is likely to make this imbalance even larger. While most of the country can expect to benefit from […]

The Atlantic: The Big Blue Losers in the GOP Tax Plan

November 28, 2017

Between the mortgage and SALT limits, the bills hit many upper-middle-class taxpayers, especially in blue states. The Institute on Taxation and Economic Policy calculates that by 2027 the Senate bill would raise taxes on about 45 percent of households between the 80th and 95th income percentiles in California, Virginia, New Jersey, and New York; and […]

ITEP has analyzed each of the tax proposals advanced by the House and Senate in recent weeks. While some details have changed, the bottom line is the same: The plans would disproportionately benefit corporations and the wealthy. The Senate tax plan ITEP’s latest analysis examined the proposal that passed the Senate Finance Committee on Nov. […]

Revised Senate Plan Would Raise Taxes on at Least 29% of Americans and Cause 19 States to Pay More Overall

November 18, 2017 • By ITEP Staff

The tax bill reported out of the Senate Finance Committee on Nov. 16 would raise taxes on at least 29 percent of Americans and cause the populations of 19 states to pay more in federal taxes in 2027 than they do today.

New York Times: Confused by Tax Bills?

November 17, 2017

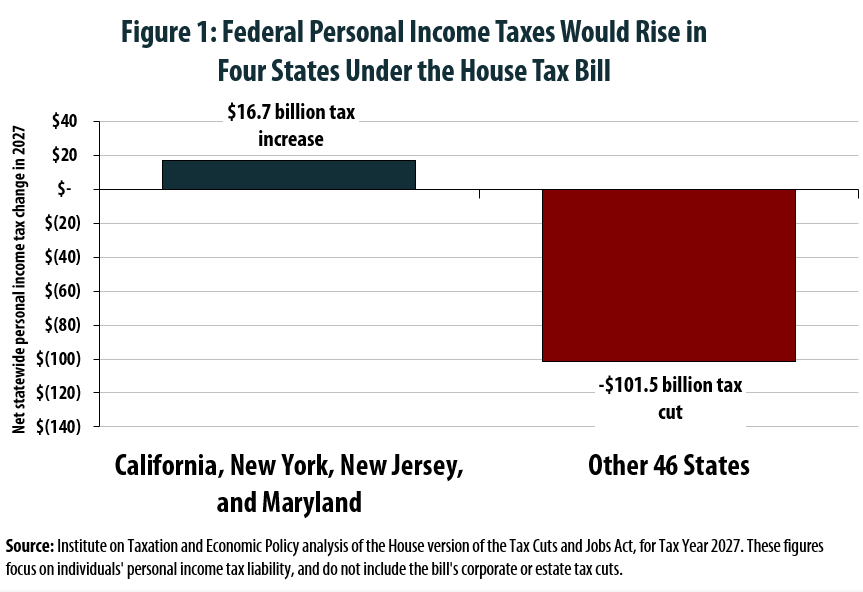

Compared with current law, the House bill, which was passed Thursday, would raise personal federal income taxes on California, New Jersey, New York and Maryland residents by $16.7 billion in 2027, according to an Institute on Taxation and Economic Policy analysis. Florida and Texas, however, would get $31.2 billion in cuts. Read more

New York Times: Billionaires Desperately Need Our Help

November 16, 2017

Now it’s fair to complain that the tax plan over all doesn’t give needy billionaires quite as much as they deserve. For example, the top 1 percent receive only a bit more than 25 percent of the total tax cuts in the Senate bill, according to the Institute on Taxation and Economic Policy. Read more

New York Times: Republican Tax Plan Puts Corporations over People

November 16, 2017

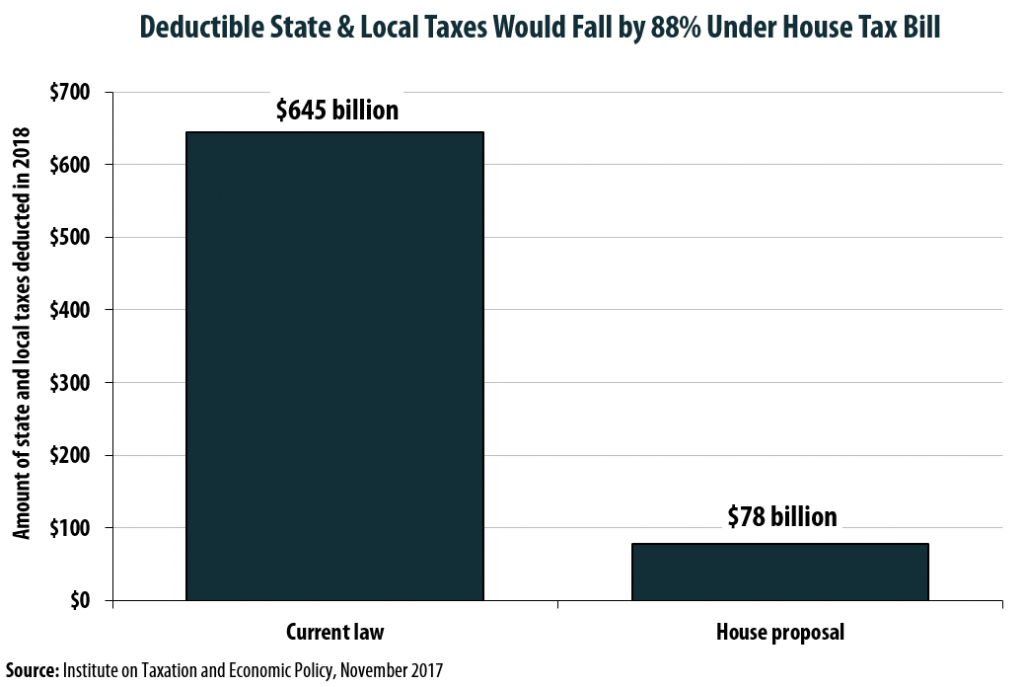

The plans also differ on their treatment of state and local tax deductions. The Senate would kill them entirely. The House would maintain them only for property taxes and cap the deduction at $10,000 a year. Economists generally say that those tax breaks are inefficient. But eliminating them, in the context of the House bill, […]

Los Angeles Times: A Tax Bill No Responsible California Lawmaker Should Support

November 16, 2017

But the bill’s cuts in personal tax rates, its increase in the standard deduction and other benefits for individual taxpayers are partially offset by reductions in some popular tax deductions — including those for state and local taxes and mortgage interest payments, many of whose beneficiaries live in states with high income or sales taxes […]

CNN: GOP Tax Plans Could Fuel the Suburban Revolt Against Trump

November 15, 2017

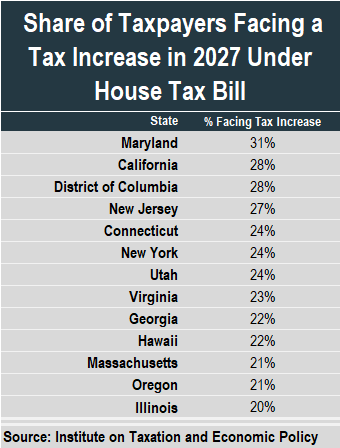

The bite from the GOP bill is deeper for upper-middle-class families in major metropolitan areas, particularly in Democratic-leaning states where taxes, and usually property values, are higher. While only about one-in-five families between the 80th and 95th income percentiles in most red states would face higher taxes by 2027 under the House GOP bill, that […]

House Tax Plan Offers an Exceptionally Bad Deal for California, New York, New Jersey, and Maryland

November 14, 2017 • By Carl Davis

An ITEP analysis reveals that four states would see their residents pay more in aggregate federal personal income taxes under the House’s Tax Cuts and Jobs Act. While some individual taxpayers in every state would face a tax increase, only California, New York, Maryland, and New Jersey would see such large increases that their residents’ overall personal income tax payments rise when compared to current law.

How the Revised Senate Tax Bill Would Affect New York Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In New York, 38 percent of the federal tax cuts would go to the richest 5 percent of residents, and 19 percent of households would face a tax increase, once the bill is fully implemented.

Senate Tax Plan Reserves Greatest Benefit for Richest Americans, Millions Face an Increase

November 13, 2017 • By ITEP Staff

A 50-state analysis of the Senate tax proposal finds that not only would greatest share of benefits go to the richest Americans, but also more than one in 10 taxpayers would face a tax hike, with a large number of those taxpayers residing in states where residents pay higher state and local taxes.

House Tax Bill Would Put Property Tax Deduction Out of Reach for Most Households

November 13, 2017 • By ITEP Staff

The House of Representatives is expected to vote this week on a bill that would reduce federal revenues by roughly $1.5 trillion over the next decade. Despite the bill’s high price tag, many households would pay more in federal tax if the bill is enacted, in large part because it slashes the deduction for state […]

Flawed Data from House Leadership Attempts to Hide Tax Hikes Under Proposal

November 9, 2017 • By Carl Davis

In a story published yesterday evening, Politico reported that House leaders have been “working to create customized data models” to show lawmakers that their constituents will not face a tax increase under the tax bill being debated in the House. On this point, House leaders have taken on an impossible task.

New York Times: Want Kids, a Degree or a Home? The Tax Bill Would Cost You

November 8, 2017

That is why taxes would go up for about 45 percent of middle-class taxpayers by 2026 under the House bill, according to an analysis by The Times. By contrast, the people in the top 1 percent of income will get an average tax cut of $64,720 a year by 2027, according to the Institute on […]

New York Times: Republican Plan Would Raise Taxes on Millions

November 7, 2017

Few independent economists find evidence to support that claim. Analyses published since the plan was introduced last week have consistently found that some middle-class families would see their taxes go up immediately, compared with existing law. One such analysis, from the Institute on Taxation and Economic Policy, found that 8 percent of middle-income earners would […]

New York Times: Republican Tax Rewrite Helps Some Millionaires but Hurts Other

November 7, 2017

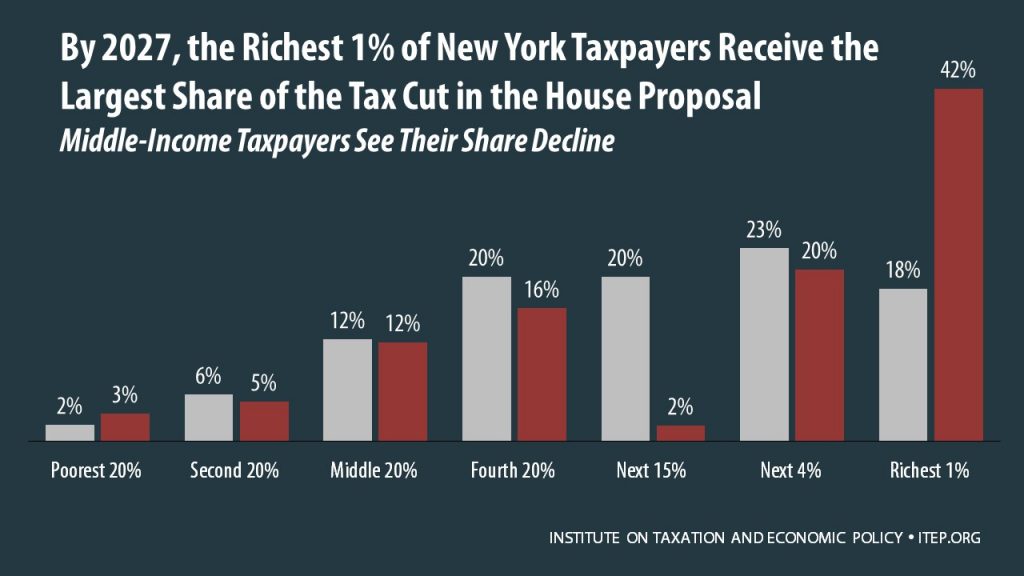

The independent Institute on Taxation and Economic Policy said on Monday that the top 1 percent of income earners, those who make just under $500,000 a year or more, would receive nearly half of the bill’s tax benefits a decade from now. That group of taxpayers would consistently see income gains from the bill, and […]

New York Magazine: The Richest One Percent of America Gets Half the Trump Tax Cuts

November 6, 2017

Well, now the House GOP has filled in all the missing details, and the result … would overwhelmingly benefit the rich. An analysis by the Institute on Taxation and Economic Policy, a left-leaning think tank whose calculations are broadly respected, finds that the highest-earning one percent of households would receive nearly half the direct benefit […]

Analysis of the House Tax Cuts and Jobs Act

November 6, 2017 • By Matthew Gardner, Meg Wiehe, Steve Wamhoff

The Tax Cuts and Jobs Act, which was introduced on Nov. 2 in the House of Representatives, would raise taxes on some Americans and cut taxes on others while also providing significant savings to foreign investors.

How the House Tax Proposal Would Affect New York Residents’ Federal Taxes

November 6, 2017 • By ITEP Staff

The Tax Cuts and Jobs Act, which was introduced on November 2 in the House of Representatives, includes some provisions that raise taxes and some that cut taxes, so the net effect for any particular family’s federal tax bill depends on their situation. Some of the provisions that benefit the middle class — like lower tax rates, an increased standard deduction, and a $300 tax credit for each adult in a household — are designed to expire or become less generous over time. Some of the provisions that benefit the wealthy, such as the reduction and eventual repeal of the estate…

Apple is the most valuable public company of all time with a market value of more than $800 billion. Last year, it cleared $45.7 billion[iii] in profits after taxes, making it the most profitable company in the Fortune 500 for the third straight year.

House Plan Slashes SALT Deductions by 88%, Even with $10,000 Property Tax Deduction

November 3, 2017 • By Carl Davis, Steve Wamhoff

One of the most contentious issues in the current federal tax debate is over what to do with the deduction for state and local taxes paid (the SALT deduction). Since the deduction’s benefits vary by state, the House proposal to drastically scale it back has led to an outcry among lawmakers from states such as New York, New Jersey, and California whose constituents would be impacted most dramatically by the change. In an attempt to address those concerns, House leadership agreed to partially retain the deduction for real estate property taxes paid (up to $10,000 per year) while still repealing…

Mother Jones: Republicans Fast Track Tax Cut for the Wealthy

October 27, 2017

Most of the Republican opposition came from the GOP’s plan to eliminate deductions for state and local taxes, with 11 Republicans from New York and New Jersey voting against the bill. Eliminating the deduction, which disproportionately affects well-off families in high-tax states, is the main reason why Trump’s plan would raise taxes on one in six Americans, […]

NY Daily News: D.C.’s Budget Takes Dead Aim at NYC

October 27, 2017

The Institute on Taxation and Economic Policy finds that 84% of the tax cuts received by New York State residents would go to the richest 1% of households here — those with income of at least $872,000. The one-percenters would get an average tax break of nearly $104,000, or 314 times the $330 that a […]

International Business Times: Do Lower Taxes Spur Economic Growth? What Happened In No-Tax States

October 26, 2017

Researchers at the non-partisan and non-profit Institute on Taxation and Economic Policy compared the nine states without personal income taxes, which include Florida, Texas and Washington, to the nine states with the highest top marginal tax rates over the last decade, which include California, New York and Oregon. They found the states with the highest […]