Recent Work by ITEP

How States Can Help Shut Down Tax Havens by Cracking Down on Profit Shifting

January 17, 2019 • By Richard Phillips

A core problem with our corporate income tax laws at the federal and state levels is that they allow companies to use accounting gimmicks to shift significant amounts of their profits into low or zero-tax jurisdictions. Federal lawmakers had an opportunity to address this with the 2017 tax law, but they failed to do so, and, in fact, the law may incentivize more offshore tax avoidance. State lawmakers, however, can buck the federal trend and crack down on profit shifting themselves.

Who Pays and Why It Matters | MECEP Policy Insights Conference Keynote Address

January 16, 2019 • By Aidan Davis

States have broad discretion in how they secure the resources to fund education, health care, infrastructure, and other priorities important to communities and families. Aidan Davis with the Institute on Taxation and Economic Policy will offer a national perspective on state-level approaches to funding public investments and the implications of those approaches on tax fairness and revenue adequacy, and their economic outcomes. She’ll also provide insight on what’s in store for 2019 among the states.

State Rundown 1/10: States Should Resolve to Pursue Equitable Tax Options

January 10, 2019 • By ITEP Staff

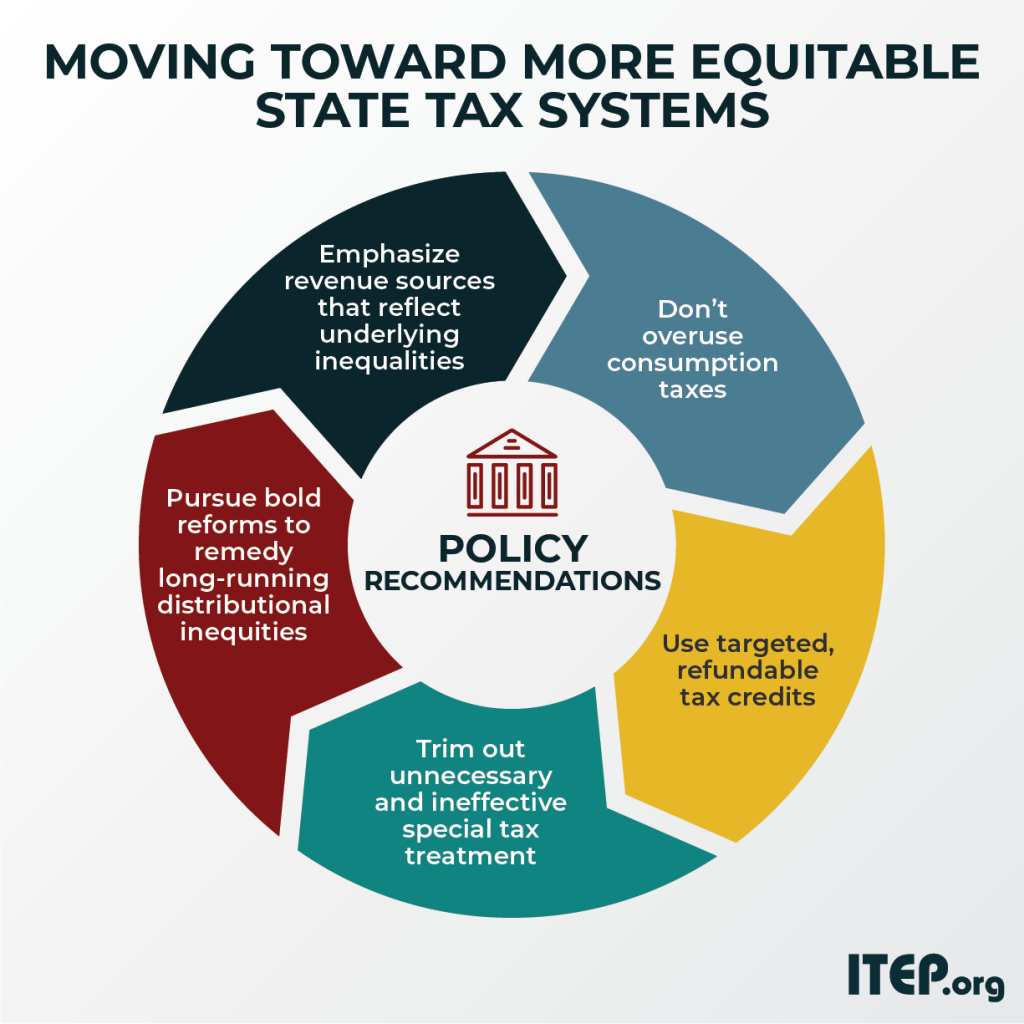

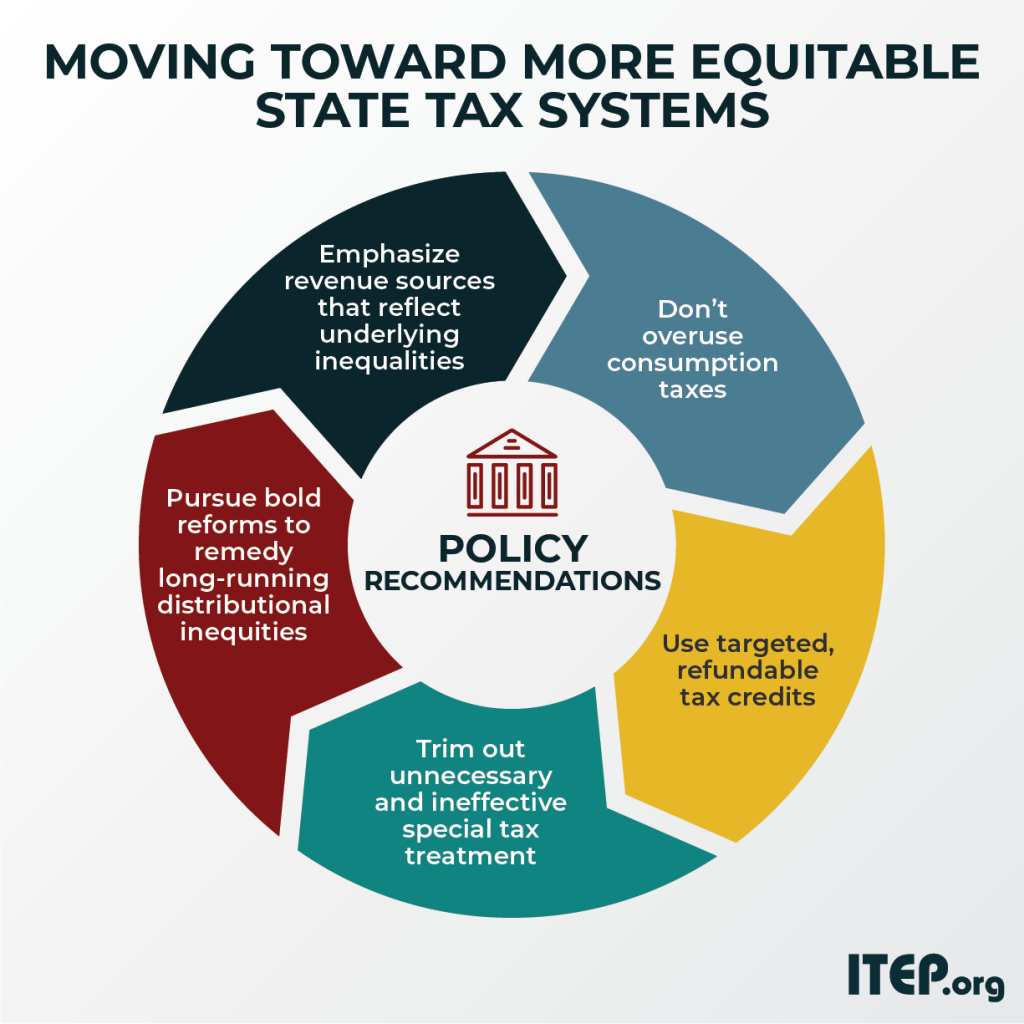

This week we released a handy guide of policy options for Moving Toward More Equitable State Tax Systems, and are pleased to report that many state lawmakers are promoting policies that are in line with our recommendations. For example, Puerto Rico lawmakers recently enacted a targeted EITC-like credit for working families, and leaders in Virginia and elsewhere are working toward similar improvements. Arkansas residents also saw their tax code improve as laws reducing regressive consumption taxes and enhancing income tax progressivity just went into effect. And there is still time for governors and legislators pushing for regressive income tax cuts…

New and returning policymakers have a tremendous opportunity to improve their constituents’ lives and their states’ economies through tax policy. This report distills the findings of “Who Pays?” into policy recommendations that can serve as a guide to new lawmakers, advocates, and others seeking to improve their state’s tax codes. It explains the importance of favoring taxes on income and wealth over taxes on consumption, the value of certain targeted tax benefits for families living in poverty, the need to abandon ineffective, unnecessary tax subsidies for high-income households, and the promise of bold new options for improving the regressive distributional…

For those looking to start improving on these inequitable tax systems today, we now also offer a helpful companion to “Who Pays?” called "Moving Toward More Equitable State Tax Systems." This new report distills the findings of “Who Pays?” into a set of policy recommendations – from the foundational to the aspirational – that residents of every state can draw from and start work on now.

How to Think About the 70% Top Tax Rate Proposed by Ocasio-Cortez (and Multiple Scholars)

January 8, 2019 • By Steve Wamhoff

The uproar deliberately steers clear of any real policy discussion about what a significantly higher marginal tax rate would mean. Her critics are mostly the same lawmakers who enacted a massive tax cut for the rich last year that was not debated seriously or supported by serious research. Meanwhile, multiple scholarly studies conclude a 70 percent top tax rate would be an optimal way to tax the very rich. Ocasio-Cortez has brought more attention to the very real need to raise revenue and do it in a progressive way.

Sometimes policy developments move at a rapid-fire pace, so we’re taking time over the next 12 days to reflect on some of the most significant federal and state tax policy developments and/or tax policy analyses that happened this year.

It’s that time of year again. Members of Congress and the White House are negotiating the federal budget. Winter temperatures are unpredictable due to climate change. And news outlets, organizations and others are releasing end-of-year lists and the tax wonks at ITEP are joining the chorus. If you’re lucky enough to have some time off over the next couple of weeks or find yourself curling up on the couch this winter in need of a way to pass the time, the tax policy wonks at ITEP have compiled a winter reading/listening list that will appeal to wonks and non-wonks alike.

State Rundown 12/19: Time to Rest and Recharge for Big Year Ahead

December 19, 2018 • By ITEP Staff

With many people enjoying time off over the next couple weeks, and the longest nights of the year coming over the weekend, now is a good time to get plenty of rest and relaxation in advance of what is likely to be a very busy 2019 for state fiscal policy and other debates. Among those debates, Kentucky lawmakers will be returning to topics they could not resolve in a brief special session held this week, New Jersey and New York will both be deciding how to legalize and tax cannabis, and gas tax updates will be on the agenda in…

Five Things to Know on the One-Year Anniversary of the Tax Cuts and Jobs Act

December 17, 2018 • By Richard Phillips

While it has only been a year since passage of the Tax Cuts and Jobs Act (TCJA), it’s clear the law largely is both a debacle and a boondoggle. Below are the five takeaways about the legacy and continuing effect of the TCJA. 1. The Tax Cuts and Jobs Act will substantially increase income, wealth, and racial inequality. 2. The Tax Cuts and Jobs Act will continue to substantially increase the deficit. 3. The Tax Cuts and Jobs Act is not significantly boosting growth or jobs. 4. The Tax Cuts and Jobs Act continues to be very unpopular. 5. Despite…