Recent Work by ITEP

Chained CPI Would Raise Everyone’s Personal Income Taxes in the Future, Would Hurt the Poor Right Away

November 30, 2017 • By Steve Wamhoff

One of the findings is that every income group would face higher personal income taxes in years after 2025 (including 2027). Chained CPI would gradually push taxpayers into higher income tax brackets and make the standard deduction, the Earned Income Tax Credit, and several other breaks less generous over time. The switch to chained CPI would cause some low-income people to face a tax hike starting in 2019, the second year the plan would be in effect.

The State Rundown is back from Thanksgiving break with a heaping helping of leftover state tax news, but beware, some of it may be rotten.

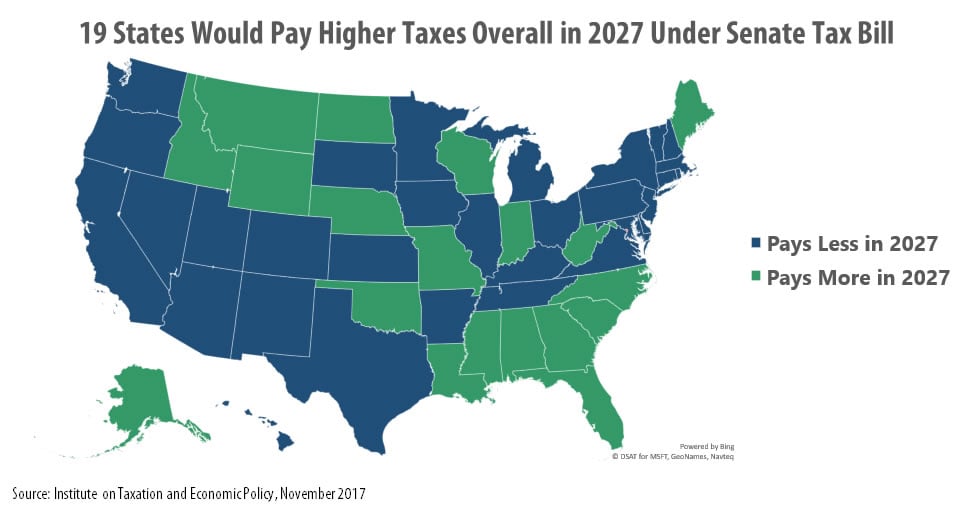

A recent ITEP study concluded that the tax bill before the Senate would raise taxes on at least 29 percent of Americans and cause the populations of 19 states to pay more in federal taxes in 2027 than they do today, while providing foreign investors with more benefits than American households. This report delves deeper by breaking out impacts of different components of the Senate tax plan on U.S. taxpayers in 2019 and 2027. This approach leads to several conclusions.

Mick Mulvaney and the 19 States Paying Higher Taxes Under the Senate Tax Bill

November 22, 2017 • By Steve Wamhoff

One of the more surprising findings of ITEP’s recent estimates on the Senate tax bill is that 19 states would pay more overall in federal taxes if the bill becomes law. This is not just an increase in the personal income taxes paid (which would happen in some states under the House bill). This is an increase in their net federal taxes overall, even including the assumed benefits of corporate tax cuts and estate tax cuts.

The Senate Tax Plan’s Big Giveaway to Multinational Corporations

November 21, 2017 • By Richard Phillips

Instead of addressing the hundreds of billions in lost federal tax revenue due to offshore tax avoidance schemes, the Senate tax bill would forgive most of the taxes owed on these profits and open the floodgates to even more offshore profit-shifting in the future.

ITEP has analyzed each of the tax proposals advanced by the House and Senate in recent weeks. While some details have changed, the bottom line is the same: The plans would disproportionately benefit corporations and the wealthy. The Senate tax plan ITEP’s latest analysis examined the proposal that passed the Senate Finance Committee on Nov. […]

Revised Senate Plan Would Raise Taxes on at Least 29% of Americans and Cause 19 States to Pay More Overall

November 18, 2017 • By ITEP Staff

The tax bill reported out of the Senate Finance Committee on Nov. 16 would raise taxes on at least 29 percent of Americans and cause the populations of 19 states to pay more in federal taxes in 2027 than they do today.

The Bottom 40 Percent Has Grown Poorer, So Why Are Tax Cut Plans Focused on the Rich and Corporations?

November 14, 2017 • By Jenice Robinson

The bottom line is that the rich and corporations are doing fine. We don’t need legislative solutions that fix non-existent problems. Only in a world of alternative facts does the top 0.2 percent of estates need to be exempt from the estate tax, for example.

Shopping for a Tax Haven: How Nike and Apple Accelerated Their Tax Avoidance Strategies, according to the Paradise Papers

November 14, 2017 • By Steve Diese

A year and a half after the release of the Panama Papers, a new set of data leaks, the Paradise Papersreleased by the International Consortium of Investigative Journalists (ICIJ) provides important new information on the tax dodging of wealthy individuals as well as multinational corporations.

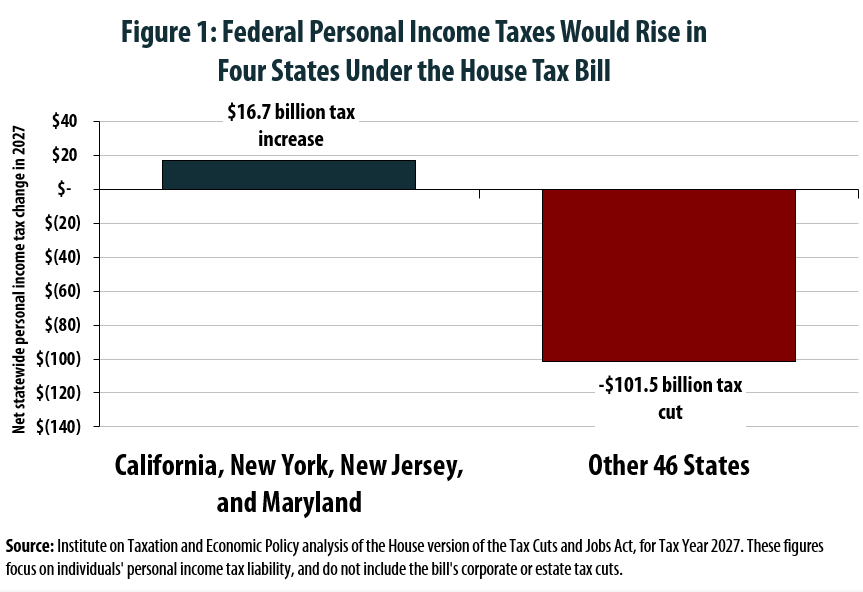

House Tax Plan Offers an Exceptionally Bad Deal for California, New York, New Jersey, and Maryland

November 14, 2017 • By Carl Davis

An ITEP analysis reveals that four states would see their residents pay more in aggregate federal personal income taxes under the House’s Tax Cuts and Jobs Act. While some individual taxpayers in every state would face a tax increase, only California, New York, Maryland, and New Jersey would see such large increases that their residents’ overall personal income tax payments rise when compared to current law.