Recent Work by ITEP

Frequently Asked Questions about Proposals to Repeal the Cap on Federal Tax Deductions for State and Local Taxes (SALT)

September 3, 2021 • By Carl Davis, ITEP Staff, Steve Wamhoff

Even though Democrats in Congress uniformly opposed the TCJA because its benefits went predominately to the rich, many Democratic lawmakers now want to give a tax cut to the rich by repealing the cap on SALT deductions.

It’s Not About Farms: Don’t Let Lies Crush Biden’s Tax Plan

September 2, 2021 • By Steve Wamhoff

Several former Democratic members of Congress have joined a campaign to misrepresent President Biden’s proposal to close a huge tax loophole for wealthy people with capital gains. This proposed reform is the cornerstone of the president’s tax plan. If lawmakers fall for the lies, Biden's plan will collapse. Instead, they should do what is both popular and fair: enact the plan intact so that millionaires and billionaires no longer escape the federal income tax.

Labor Day is around the corner and in the spirit of celebrating the achievements of workers around the country, we here at ITEP want to call attention to the states (and territories) that are using tax policy to support workers and residents alike...

We asked New York state resident Morris Pearl, former Blackrock executive and current chair of the Patriotic Millionaires, a few questions to hear straight from the mouth of a millionaire how the SALT cap and its proposed repeal would affect his life.

New Report from ITEP Describes Options for Changing the SALT Cap without Repealing It

August 26, 2021 • By Steve Wamhoff

A new report from ITEP provides policy recommendations to modify the $10,000 cap on federal tax deductions for state and local taxes (SALT), which was signed into law by President Trump as part of the Tax Cuts and Jobs Act. Because the SALT cap mostly restricts tax deductions for the richest 5 percent of Americans, the best options are to leave the cap as is or replace […]

Options to Reduce the Revenue Loss from Adjusting the SALT Cap

August 26, 2021 • By Carl Davis, ITEP Staff, Matthew Gardner, Steve Wamhoff

If lawmakers are unwilling to replace the SALT cap with a new limit on tax breaks that raises revenue, then any modification they make to the cap in the current environment will lose revenue and make the federal tax code less progressive. Given this, lawmakers should choose a policy option that loses as little revenue as possible and that does the smallest amount of damage possible to the progressivity of the federal tax code.

The One Thing Missing From the Qualified Business Income Deduction Conversation: Racial Equity

August 25, 2021 • By Marco Guzman

When crafting tax policy, lawmakers and bill authors often work backward, using a patchwork of changes to help achieve their stated goal. One important consideration that is routinely left out is what impact the change will have on racial equity. Such is the case with the qualified business income deduction, which is helping to further enrich wealthy business owners, the overwhelming majority of whom are white. At present, white Americans own 88 percent of private business wealth despite making up only 60 percent of the population. Meanwhile, Black and Hispanic families confronting much higher barriers to entrepreneurship each own less…

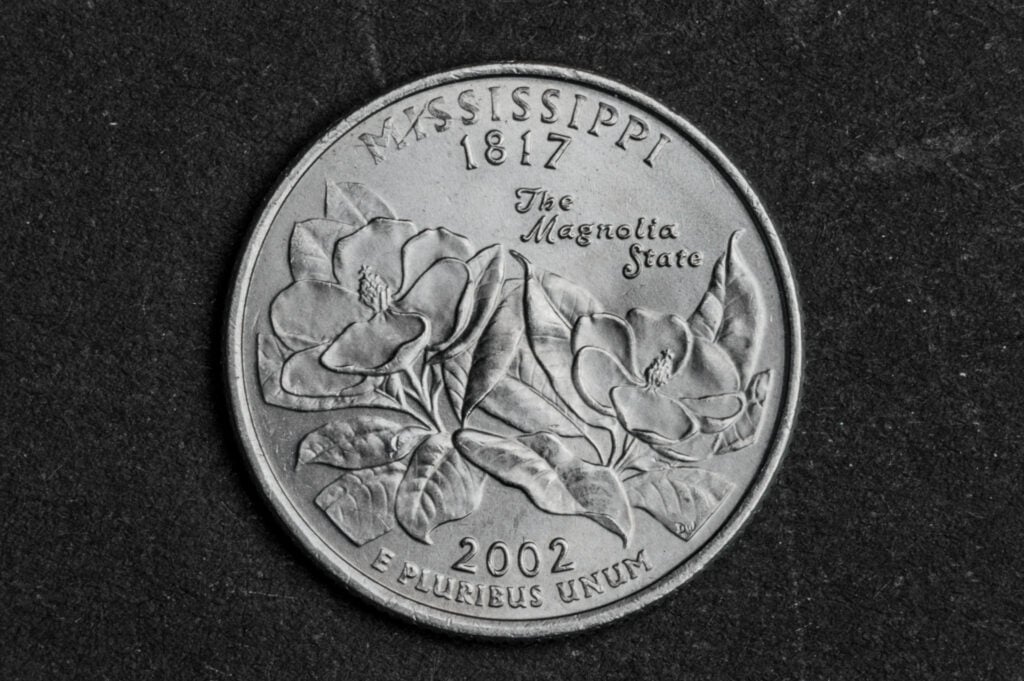

Eliminating the State Income Tax Would Wreak Havoc on Mississippi

August 25, 2021 • By Kamolika Das

History has repeatedly shown that such policies harm state economies, dismantle basic public services, and exacerbate tax inequities.

Summer is quickly (and sadly) coming to an end and if you’ve been away enjoying the great outdoors or off the grid, we’re here to help keep you up to date on what’s been happening on the tax front around the country...

State Experimentation with Sales Tax Holidays Magnifies Their Flaws

August 6, 2021 • By Dylan Grundman O'Neill

It’s back-to-school shopping season, so…everyone who buys a cell phone in Arkansas this weekend will do so sales-tax-free. For this whole week in Connecticut, and for the entire spring in New Mexico, the corporate owners of highly profitable multinational restaurant chains had the option to pocket their customers’ taxes rather than remit them to the state to fund vital public services, pass along those savings to their customers, or give a much-needed boost to their employees. And all told, about $550 million of state and local revenue will be forgone in 17 states this year through wasteful and poorly targeted…