Recent Work by ITEP

ANALYSIS: Cash and Tax Provisions in Biden’s Economic Recovery Plan

January 15, 2021 • By Steve Wamhoff

The $1.9 trillion economic recovery plan, known as the American Rescue Plan, announced by President-elect Biden contains, among other provisions, expanded cash payments and changes to the Child Tax Credit (CTC) and the Earned Income Tax Credit (EITC).

Happy Double Take: A President Who Takes Economic Challenges Seriously

January 15, 2021 • By Amy Hanauer

After a solid year of federal policy doing too little to combat staggering job loss, spiking poverty, a raging pandemic and nearly 400,000 COVID deaths, we are ready for a leader who wants to hunker down and get to work on behalf of the people. So we did a happy double take when President-elect Joe Biden outlined his economic plan last night.

As states kick off their 2021 legislative sessions, it’s clear that many governors and lawmakers are attempting to “take a mulligan” on the last year and recycle tax-slashing ideas that were already bad in 2020 and are even worse now as states try to recover from the Covid-19 pandemic and accompanying downturn...On a brighter note, Illinois leaders showed they did learn from the events of 2020, passing a major criminal justice reform bill and payday loan protections intended to reduce racial inequities.

New Jersey lawmakers passed an innovative tax design that other states debating cannabis legalization should look to for inspiration. The state officially legalized cannabis in November when voters overwhelmingly approved a constitutional amendment by a margin of 67 to 33 percent. The amendment applied the state’s general sales tax to cannabis and allowed local governments to create their own taxes on the industry. The legislature added the most notable part of the tax structure last month with a Social Equity Excise Fee.

New Leadership Should Seize Tax Justice Mandate; Cash Payments Offer On-ramp

January 8, 2021 • By Amy Hanauer

With the victory of Senators-elect Raphael Warnock and Jon Ossoff in Georgia, Democrats now control all three branches of government. New leaders should seize this moment to create a tax code that does much more to reduce inequality and to resource long-overdue investments in climate, health, education and other essentials. Most immediately, the historic election shifts power, making it easier to deliver on the promise to increase the recently enacted $600 cash payments to $2,000 per person.

State Rundown 1/7: State Work Continues in Shadow of National Events

January 7, 2021 • By ITEP Staff

Though most people’s attention is rightly focused on events unfolding in the nation’s capital this week, state legislative debates are also underway or soon to begin in many states, including proposals to tax the rich in New York and Rhode Island, provide a boost to low-income families in California, and legalize and tax cannabis in Missouri and Rhode Island.

How the Proposed $2,000 Cash Payments Compare to the $600 Already Provided by Congress

January 6, 2021 • By Steve Wamhoff

On Dec. 28, the House of Representatives passed the Caring for Americans with Supplemental Help (CASH) Act of 2020, which would increase the cash payment recently provided by Congress from $600 per person to $2,000 per person, among other changes. New estimates from ITEP compare the impacts of $2,000 payments to $600 payments.

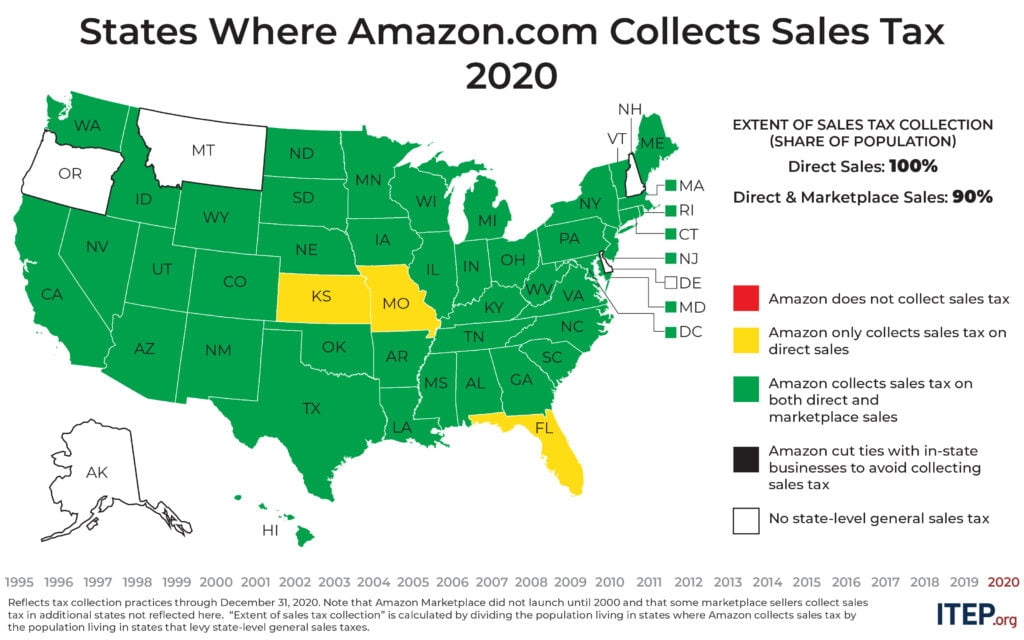

Today, Amazon is collecting state-level sales taxes on all its direct sales but it still usually fails to collect sales tax on the large volume of sales it makes through the Amazon Marketplace. This points to a broader problem in state tax enforcement that lawmakers in many states are moving quickly to address with laws and administrative action requiring tax collection by Amazon and other large online marketplaces such as Etsy and eBay.

Ghosts of Fiscal Crunches Past, Present, Future Have Advice for State Lawmakers

December 21, 2020 • By Dylan Grundman O'Neill

State policymakers and advocates may face some long sleepless nights as they close the book on 2020 and prepare for the important decisions they’ll be making in 2021 and beyond. So we at ITEP have consulted with ghosts of fiscal crunches past, present, and future, and distilled their lessons into seven key things to keep in mind for 2021 tax and budget debates:

National and State-by-State Estimates of New $600 Cash Payments

December 21, 2020 • By Steve Wamhoff

The House and Senate are about to pass the first COVID-19 relief legislation since the CARES Act was enacted in March. The new relief package includes, among other provisions, cash payments of $600 per person, which is half as large as the payments provided under the CARES Act, but also extends payments to spouses and children of certain undocumented immigrants who were left out of the previous payments.