Recent Work

2161 items

Vacancy taxes will not single-handedly solve problems in cities, but they are worth considering to address housing shortages, land use, and building thriving communities.

State Rundown 11/13: States Tackle Impending Deficits, Pennsylvania Secures an EITC

November 13, 2025 • By ITEP Staff

Revenue forecasts look increasingly grim as states anticipate shortfalls due to the slowing economy and impacts of the new federal tax law.

Don’t Hold Your Breath Waiting for a Tariff Dividend from Trump

November 12, 2025 • By Steve Wamhoff

Trump gives a promise, with absolutely no plan, to give $2,000 to every American using tariff revenue.

Trump Goes Outside the Law to Give Even More Tax Cuts to the Wealthy

November 12, 2025 • By Steve Wamhoff

Trump's Treasury is overstepping far beyond its constitutional role by giving unlegislated tax cuts to the wealthy.

State Tax Dollars Shouldn’t Subsidize Federal Opportunity Zones

November 12, 2025 • By Eli Byerly-Duke

The Opportunity Zones program benefits wealthy investors more than it benefits disadvantaged communities.

State and Local Policymakers Can Resist Austerity Even Amid Historic Federal Retreat

November 6, 2025 • By Kamolika Das

The progressivity of the federal tax code has been waning. State and local policymakers should respond by protecting their revenue bases, promoting equity, and safeguarding vulnerable communities from harmful budget cuts.

In 2025, Voters Said Yes to Public Resources and Community Investments

November 6, 2025 • By Rita Jefferson

Important tax measures were on the ballot this week, and the outcomes are clear: many voters support new state and local spending to support critical services in their communities.

States Begin Decoupling from Flawed ‘QSBS’ Tax Break

November 6, 2025 • By Nick Johnson, Sarah Austin

A costly tax break for wealthy venture capitalists is drawing some critical attention from state policymakers.

The move was expected, given heavy lobbying from tax prep companies like Intuit and H&R Block to put a halt to the IRS’s popular Direct File program.

Despite being an off-year election, voters made a call for shared public investments at the polls.

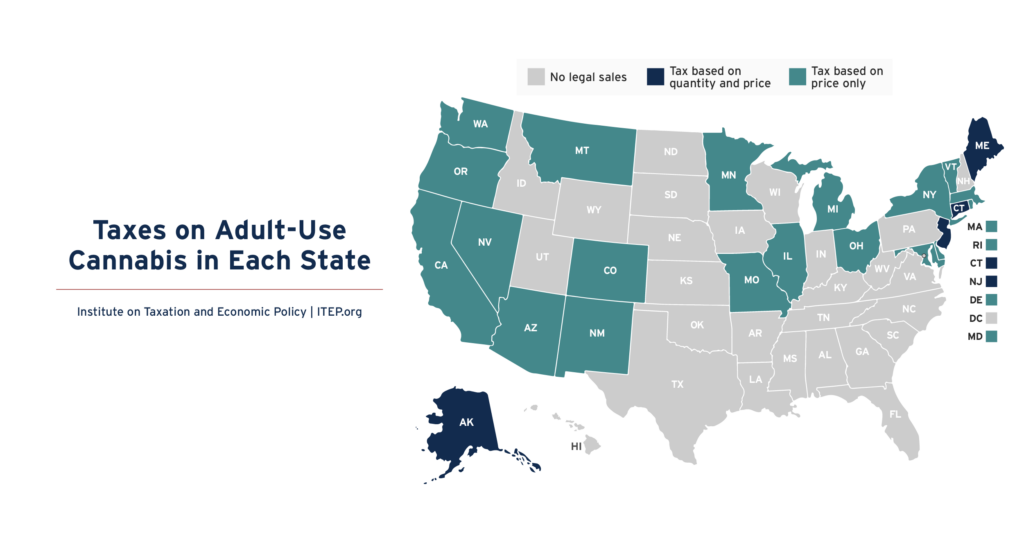

Twenty-three states have legalized the sale of cannabis for general adult use. Every state allowing legal sales applies an excise tax to cannabis based on the product’s quantity, its price, or both. Quantity taxes can be based on either overall product weight or the amount of THC sold. ITEP research indicates that taxes based on […]

Biden Tax Reforms Take a $16 Billion Bite Out of Trump’s Big Tax Giveaway to Meta

October 30, 2025 • By Matthew Gardner

Meta’s earnings setback is entirely attributable to an important tax reform championed by the Biden administration in 2022.

Oil and Gas Companies Are Paying Less Tax to the U.S. than to Foreign Governments

October 30, 2025 • By Matthew Gardner

Since 2017, these companies paid $135 billion in income taxes to foreign governments, but just $29 billion to the U.S.

The Wealth Proceeds Tax: A Simple Way for States to Tax the Wealthy

October 30, 2025 • By Sarah Austin, Carl Davis

Taxing the proceeds generated by wealth through a new Wealth Proceeds Tax is a simple way for states to raise billions in new revenue and improve the fairness of their tax systems.

States across the nation are debating how best to respond to costly new federal tax cuts.