Recent Work

2146 items

State Rundown 1/24: States Reflect on MLK’s Dream and Teacher Uprisings

January 24, 2019 • By ITEP Staff

This week, as Americans in every state celebrated Martin Luther King Jr. Day and reflected on his dream of peaceful protest and racial and economic justice, many eyes were on the teachers’ strike pressing for parts of this dream amid the “curvaceous slopes of California.” Governors and lawmakers in many states—including Arizona, Georgia, Indiana, Louisiana, Nevada, New Mexico, South Carolina, and Wisconsin—discussed ways to raise pay for teachers and/or enhance education investments generally.

Yes, It’s Time to Talk about Progressive Taxes, Even a Wealth Tax

January 24, 2019 • By Alan Essig

Earlier today, several news organizations reported that Sen. Elizabeth Warren is set to formally propose a federal wealth tax. Immediately after, social media was atwitter with comments that ranged from praise to predictable outcries of how will the wealthy cope if forced to pay more in taxes.

A federal wealth tax on the richest 0.1 percent of Americans is a viable approach for Congress to raise revenue and is one of the few approaches that could truly address rising inequality. As this report explains, an annual federal tax of only 1 percent on the portion of any taxpayer’s net worth exceeding the threshold for belonging to the wealthiest 0.1 percent (likely to be about $32.2 million in 2020) could raise $1.3 trillion over a decade.

Thoughts about a Federal Wealth Tax and How It Could Raise Revenue, Address Income Inequality

January 23, 2019 • By Steve Wamhoff

Wealth inequality is much greater than income inequality. The 1 percent of Americans with the highest incomes receive about a fifth of the total income in the United States. In contrast, the top 1 percent of wealth holders in the United States own 42 percent of the nation’s wealth, according to estimates from University of California at Berkley economists Emmanuel Saez and Gabriel Zucman.

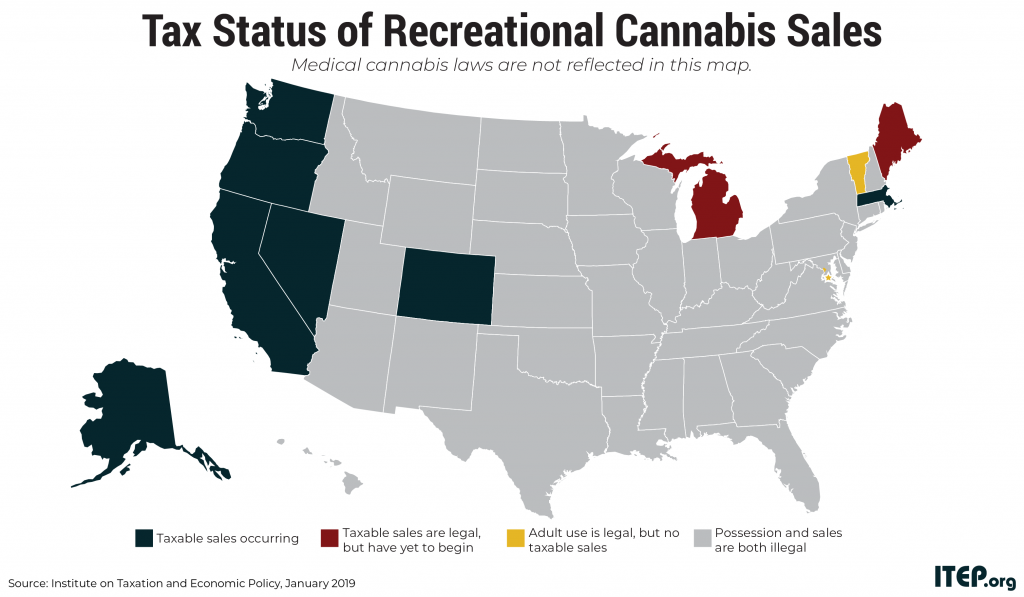

State policy toward cannabis is evolving rapidly. While much of the debate around legalization has rightly focused on potential health and criminal justice impacts, legalization also has revenue implications for state and local governments that choose to regulate and tax cannabis sales. This report describes the various options for structuring state and local taxes on cannabis and identifies approaches currently in use. It also undertakes an in-depth exploration of state cannabis tax revenue performance and offers a glimpse into what may lie ahead for these taxes.

Cannabis Tax Debates are Ramping Up; Here’s What We’ve Learned from Five Years of Cannabis Taxation Thus Far

January 23, 2019 • By Carl Davis

This year lawmakers in Connecticut, Delaware, Hawaii, Illinois, New Jersey, New York, Rhode Island, and Vermont will all be debating the taxation of recreational cannabis. A new ITEP report reviews the track record of recreational cannabis taxes thus far and offers recommendations for structuring cannabis taxes to achieve stable revenue growth over the long haul.

State Rundown 1/18: Governors’ Speeches Kick Off State Fiscal Debates

January 18, 2019 • By ITEP Staff

Gubernatorial speeches and budget proposals dominated state fiscal news this week, as governors proposed a wide array of policies including positive reforms such as Earned Income Tax Credit (EITC) enhancements in CALIFORNIA, a capital gains tax on wealthy households in WASHINGTON, and investments in education in several states. Proposals to exempt more retirement income from tax, particularly for veterans, are a common theme so far this year, having been raised in multiple states including MARYLAND, MICHIGAN, and SOUTH CAROLINA. And NEW JERSEY became the fourth state with a $15 minimum hourly wage. Those wishing to better understand and influence important debates about equitable tax policy should mark their…

A Simple Fix for a $17 Billion Loophole: How States Can Reclaim Revenue Lost to Tax Havens

January 17, 2019 • By Richard Phillips

Enacting Worldwide Combined Reporting or Complete Reporting in all states, this report calculates, would increase state tax revenue by $17.04 billion dollars. Of that total, $2.85 billion would be raised through domestic Combined Reporting improvements, and $14.19 billion would be raised by addressing offshore tax dodging (see Table 1). Enacting Combined Reporting and including known tax havens would result in $7.75 billion in annual tax revenue, $4.9 billion from income booked offshore.

How States Can Help Shut Down Tax Havens by Cracking Down on Profit Shifting

January 17, 2019 • By Richard Phillips

A core problem with our corporate income tax laws at the federal and state levels is that they allow companies to use accounting gimmicks to shift significant amounts of their profits into low or zero-tax jurisdictions. Federal lawmakers had an opportunity to address this with the 2017 tax law, but they failed to do so, and, in fact, the law may incentivize more offshore tax avoidance. State lawmakers, however, can buck the federal trend and crack down on profit shifting themselves.

Who Pays and Why It Matters | MECEP Policy Insights Conference Keynote Address

January 16, 2019 • By Aidan Davis

States have broad discretion in how they secure the resources to fund education, health care, infrastructure, and other priorities important to communities and families. Aidan Davis with the Institute on Taxation and Economic Policy will offer a national perspective on state-level approaches to funding public investments and the implications of those approaches on tax fairness and revenue adequacy, and their economic outcomes. She’ll also provide insight on what’s in store for 2019 among the states.

State Rundown 1/10: States Should Resolve to Pursue Equitable Tax Options

January 10, 2019 • By ITEP Staff

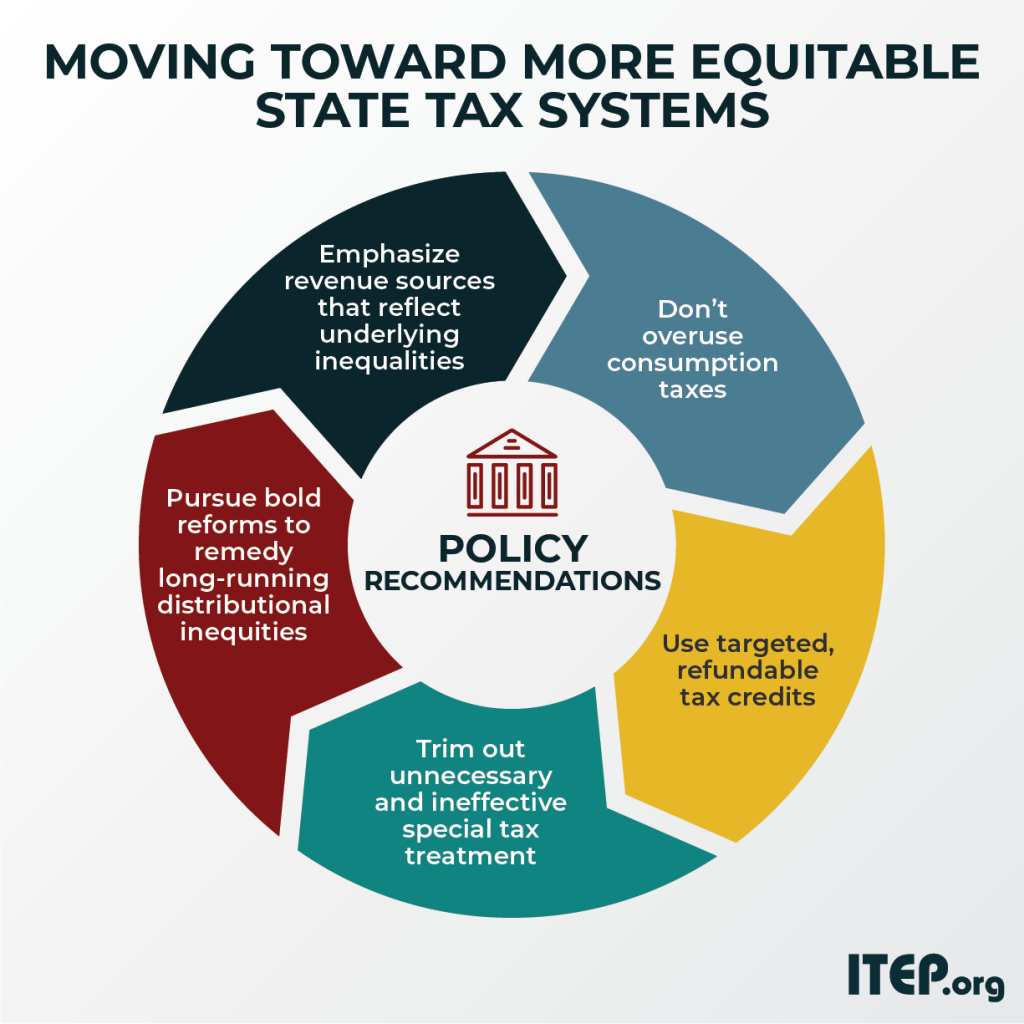

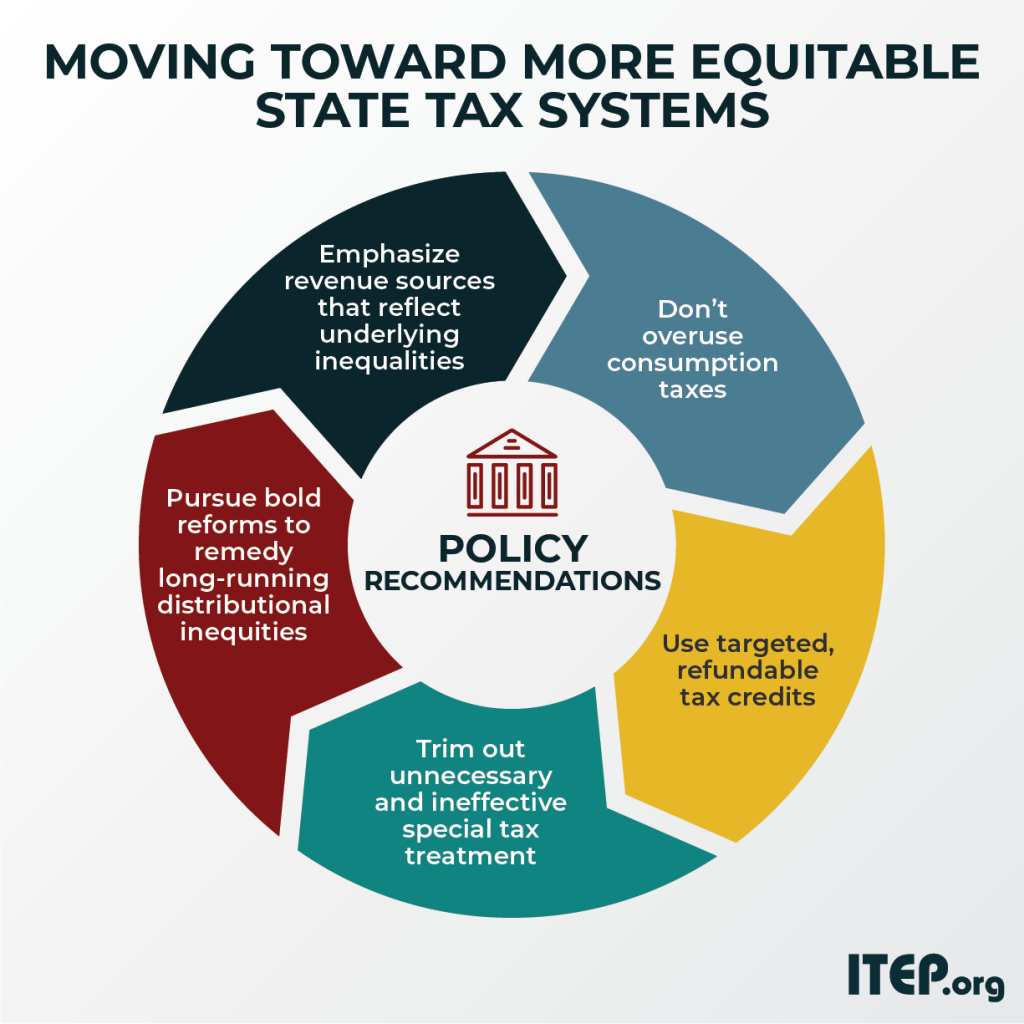

This week we released a handy guide of policy options for Moving Toward More Equitable State Tax Systems, and are pleased to report that many state lawmakers are promoting policies that are in line with our recommendations. For example, Puerto Rico lawmakers recently enacted a targeted EITC-like credit for working families, and leaders in Virginia and elsewhere are working toward similar improvements. Arkansas residents also saw their tax code improve as laws reducing regressive consumption taxes and enhancing income tax progressivity just went into effect. And there is still time for governors and legislators pushing for regressive income tax cuts…

New and returning policymakers have a tremendous opportunity to improve their constituents’ lives and their states’ economies through tax policy. This report distills the findings of “Who Pays?” into policy recommendations that can serve as a guide to new lawmakers, advocates, and others seeking to improve their state’s tax codes. It explains the importance of favoring taxes on income and wealth over taxes on consumption, the value of certain targeted tax benefits for families living in poverty, the need to abandon ineffective, unnecessary tax subsidies for high-income households, and the promise of bold new options for improving the regressive distributional…

For those looking to start improving on these inequitable tax systems today, we now also offer a helpful companion to “Who Pays?” called "Moving Toward More Equitable State Tax Systems." This new report distills the findings of “Who Pays?” into a set of policy recommendations – from the foundational to the aspirational – that residents of every state can draw from and start work on now.

How to Think About the 70% Top Tax Rate Proposed by Ocasio-Cortez (and Multiple Scholars)

January 8, 2019 • By Steve Wamhoff

The uproar deliberately steers clear of any real policy discussion about what a significantly higher marginal tax rate would mean. Her critics are mostly the same lawmakers who enacted a massive tax cut for the rich last year that was not debated seriously or supported by serious research. Meanwhile, multiple scholarly studies conclude a 70 percent top tax rate would be an optimal way to tax the very rich. Ocasio-Cortez has brought more attention to the very real need to raise revenue and do it in a progressive way.

Sometimes policy developments move at a rapid-fire pace, so we’re taking time over the next 12 days to reflect on some of the most significant federal and state tax policy developments and/or tax policy analyses that happened this year.