Recent Work

2146 items

State Rundown 10/12: Local Jurisdictions Fighting for Revenues, Independence

October 12, 2018 • By ITEP Staff

Voters all around the country are educating themselves for the upcoming elections, notably this week around ballot initiatives in Arizona and Colorado and competing gubernatorial tax proposals in Georgia and Illinois. But not all eyes are on the elections, as the relationship between state and local policy made news in Delaware, Idaho, North Dakota, and Ohio.

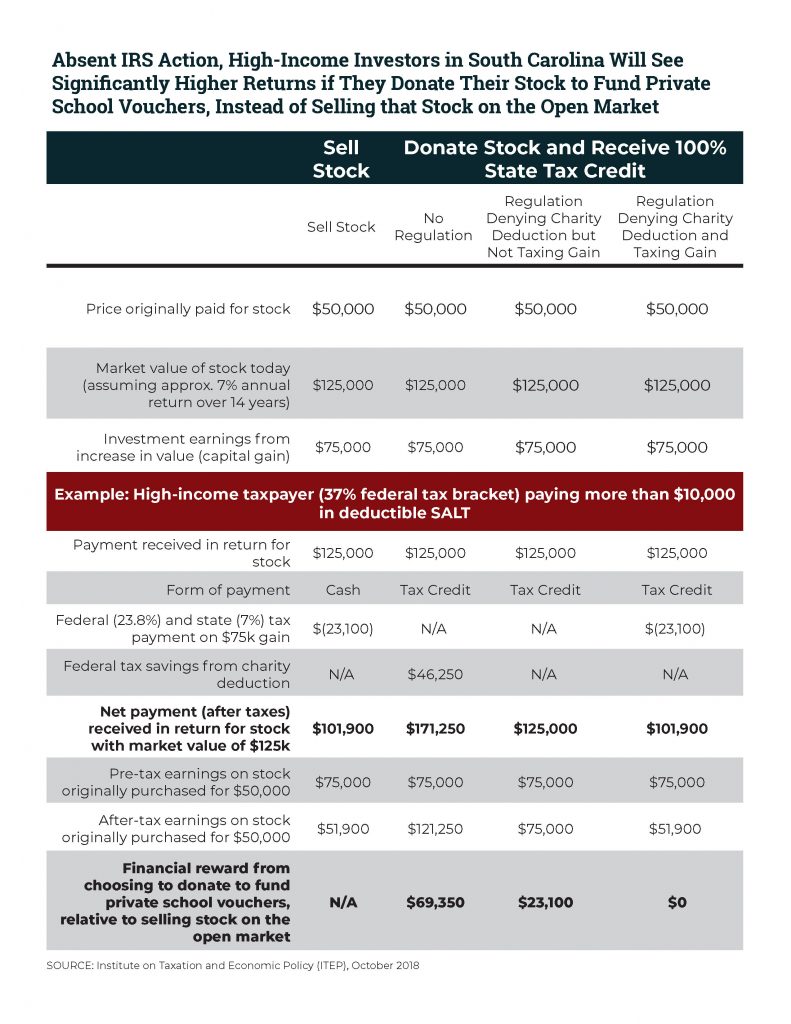

ITEP Comments and Recommendations on Proposed Section 170 Regulation (REG-112176-18)

October 11, 2018 • By Carl Davis

The IRS recently proposed a commonsense improvement to the federal charitable deduction. If finalized, the regulation would prevent not just the newest workarounds to the $10,000 deduction for state and local taxes (SALT), but also a longer-running tax shelter abused by wealthy donors to private K-12 school voucher programs. ITEP has submitted official comments outlining four key recommendations related to the proposed regulation.

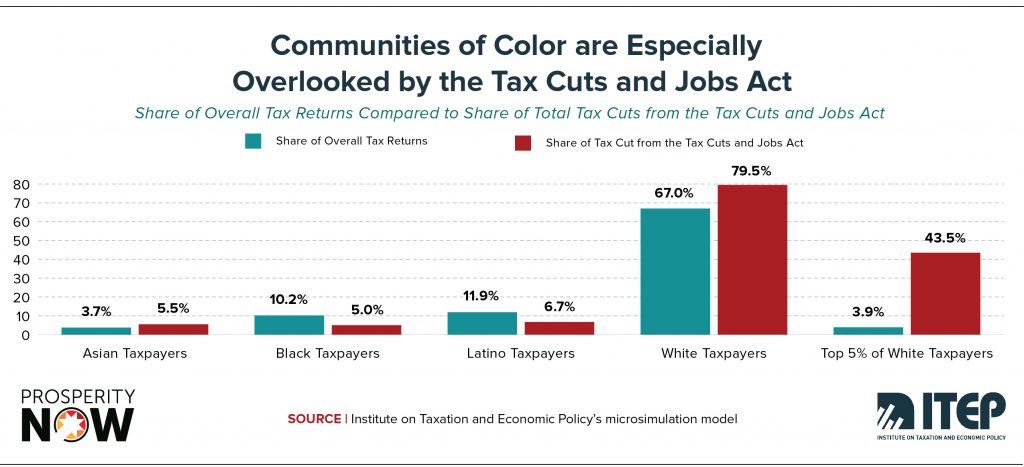

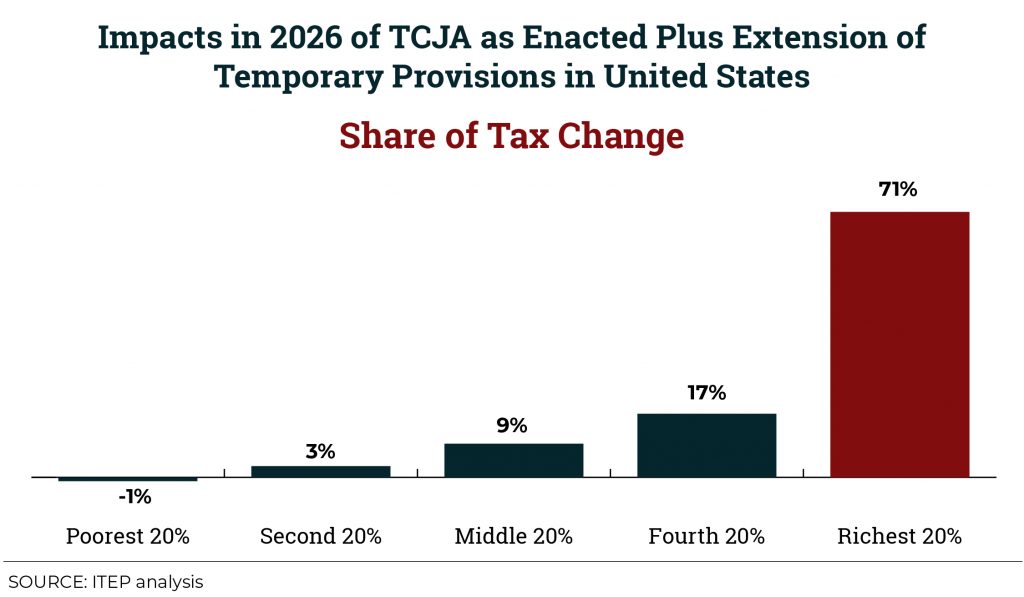

Race, Wealth and Taxes: How the Tax Cuts and Jobs Act Supercharges the Racial Wealth Divide

October 11, 2018 • By Meg Wiehe

A newly released report by Prosperity Now and the Institution on Taxation and Economic Policy, Race, Wealth and Taxes: How the Tax Cuts and Jobs Act Supercharges the Racial Wealth Divide, finds that the TCJA not only adds unnecessary fuel to the growing problem of overall economic inequality, but also supercharges an already massive racial wealth divide to an alarming extent.

‘Financial Exposure’ Showcases Tax Misconduct by Powerful Individuals and Corporations

October 10, 2018 • By Peter Della-Rocca

Elise J. Bean’s Financial Exposure reiterates the point that tax avoidance and tax evasion were endemic to our financial system long before allegations against a sitting president brought them to the forefront of the public consciousness.

South Carolina lawmakers have finally passed a federal conformity bill in response to last year’s federal tax-cut legislation. Voters in many states are hearing a lot about tax-related questions they’ll see on the ballot in November, particularly residents of Florida, Montana, and Oregon, where corporate donors and other anti-tax interests are spending major sums to alter policy in their states. And states continue to work on ensuring they can collect online sales taxes and, in some states, online sports betting taxes.

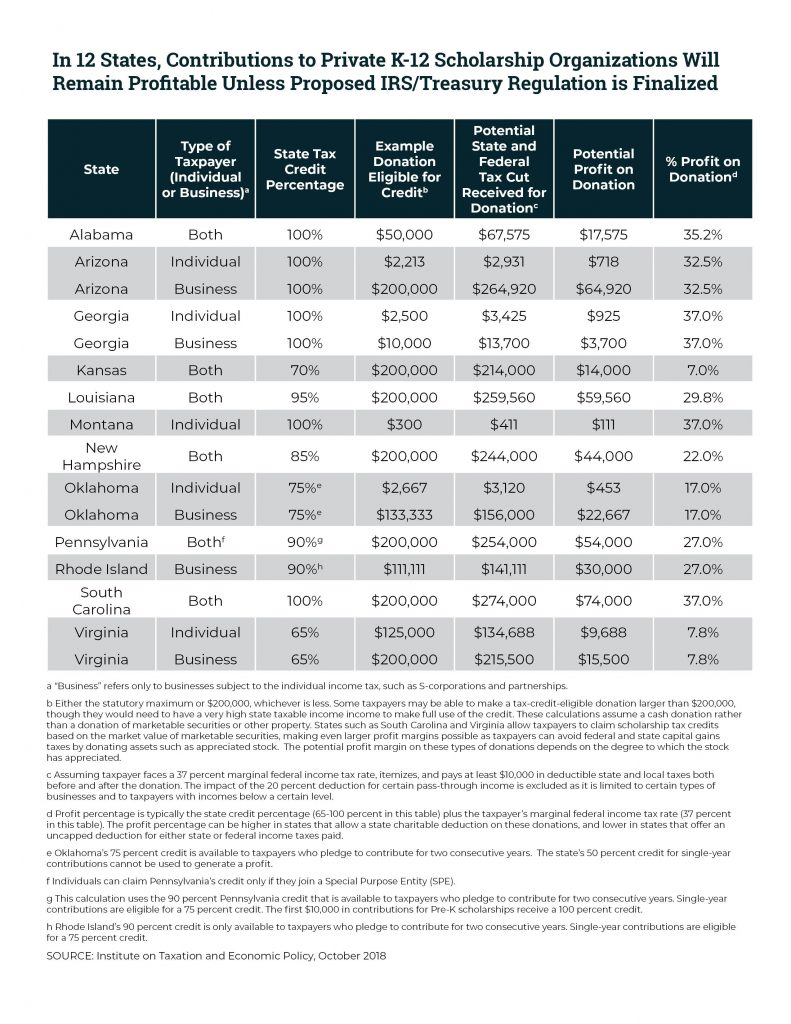

Twelve States Offer Profitable Tax Shelter to Private School Voucher Donors; IRS Proposal Could Fix This

October 2, 2018 • By Carl Davis

A proposed IRS regulation would eliminate a tax shelter for private school donors in twelve states by making a commonsense improvement to the federal tax deduction for charitable gifts. For years, some affluent taxpayers who donate to private K-12 school voucher programs have managed to turn a profit by claiming state tax credits and federal tax deductions that, taken together, are worth more than the amount donated. This practice could soon come to an end under the IRS’s broader goal of ending misuse of the charitable deduction by people seeking to dodge the federal SALT deduction cap.

So-Called “Universal Savings Accounts” in Tax Cuts 2.0 Are a Giveaway to the Most Affluent Taxpayers

September 27, 2018 • By Steve Wamhoff

This week, House Republicans have taken up bills they call tax cuts “2.0.” Most of the attention, so far, has focused on the bill that extends—at great cost—the temporary parts of the Tax Cuts and Jobs Act (TCJA). But other legislation in the package contains provisions that make the whole deal even more tilted toward the richest households, including one that would create “Universal Savings Accounts.” Far from being universal, these new savings vehicles would benefit the same high-income households that enjoy the bulk of the tax cuts from TCJA.

Tax Cuts 2.0 Resources

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. GOP leaders wrote the bill this way to adhere to their own rule that limits how much a piece of legislation can add to the federal debt. But it’s clear that proponents planned all along to make those provisions permanent. Less than a month after the law passed, the White House and Republican leaders began calling for a second round of tax cuts. Now, they have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which…

State Rundown 9/26: States Cleaning Up from Florence, Gearing Up for November

September 26, 2018 • By ITEP Staff

Affordable housing efforts made news in Minnesota and Virginia this week, as tax breaks for homeowners and other victims of Hurricane Florence were made available in multiple states. Meanwhile, New Jersey is still looking into legalizing and taxing cannabis, and Wyoming continues to consider a corporate income tax. And gubernatorial candidates and ballot initiative efforts will give voters in many states much to consider in the November elections.

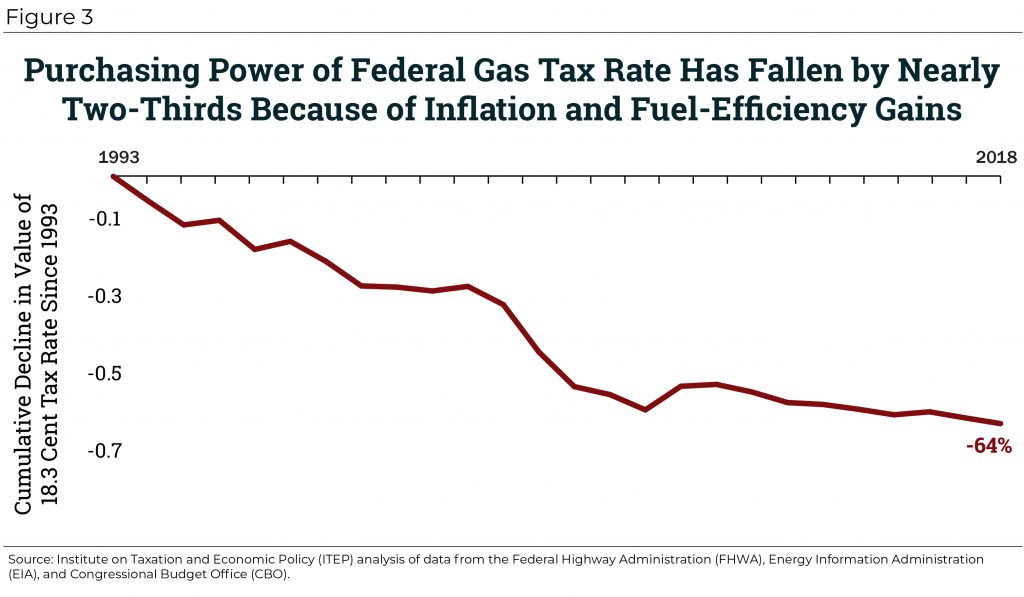

An Unhappy Anniversary: Federal Gas Tax Reaches 25 Years of Stagnation

September 25, 2018 • By Carl Davis

The federal gas tax was last raised on Oct. 1, 1993, the same year that the classic movie Groundhog Day was unveiled to the American public. In the film, Phil Connors (played by Bill Murray) gets caught in a time loop and spends decades reliving the same cold, February day in Punxsutawney, Penn. Those of us lamenting the 25-year stagnation of the federal gas tax can’t help but feel some of that same sense of repetition. Federal lawmakers occasionally discuss updating the gas tax, but top lawmakers have yet to put in the effort needed to shepherd such a change…

Oxfam Report Finds Pharmaceuticals Profiteering Off Crises in Developing Countries

September 20, 2018 • By Peter Della-Rocca

The report indicates, pharmaceutical companies have taken steps to hide their profits in low-tax countries, sapping billions in revenue from the governments that invest in the science that drives their products and safeguard the patents that undergird their business. Pharmaceutical companies made use of a familiar battery of methods to exploit the international system this way, including inversions to disguise an American company as a foreign one and passing profits into low-tax jurisdictions through artificial usage fees on intangible assets like intellectual property.

State Tax Codes Can Help Mitigate Poverty and Impact of Federal Tax Cuts on Low- and Middle-Income Families

September 20, 2018 • By Misha Hill

The national poverty rate declined by 0.4 percentage points to 12.3 percent in 2017. According to the U.S. Census, this was not a statistically significant change from the previous year. 39.7 million Americans, including 12.8 million children, lived in poverty in 2017. Median household income also increased for the third consecutive year, but this was […]

IRS Reopens Tax Loophole Sought by Sen. Toomey, but it Won’t Work in Pennsylvania

September 20, 2018 • By Carl Davis

A recent IRS clarification, which appears to have been a pet project of Sen. Pat Toomey (R-PA), has been widely interpreted as reopening a loophole the agency had proposed closing just weeks earlier. But while the announcement creates an opening for aggressive tax avoidance in many states, Pennsylvania, ironically enough, isn’t one of them.

The Rundown is back after a few-week hiatus, with lots of state fiscal news and quality research to share! Maine lawmakers found agreement on a response to the federal tax-cut bill, states continue to sort out how they’ll collect online sales taxes in the wake of the Wayfair decision, and policymakers in several states have been working on summer tax studies and other preparations for 2019 legislative sessions. Meanwhile, work on ballot measures and candidate tax plans to go before voters in November has been even more active, particularly in Arizona, California, Florida, Hawaii, and Missouri. Our “What We’re Reading” section has lots of great research and reading on inequalities, cities turning…

State Tax Codes as Poverty Fighting Tools: 2018 Update on Four Key Policies in All 50 States

September 17, 2018 • By Aidan Davis, Misha Hill

This report presents a comprehensive overview of anti-poverty tax policies, surveys tax policy decisions made in the states in 2018, and offers recommendations that every state should consider to help families rise out of poverty. States can jumpstart their anti-poverty efforts by enacting one or more of four proven and effective tax strategies to reduce the share of taxes paid by low- and moderate-income families: state Earned Income Tax Credits, property tax circuit breakers, targeted low-income credits, and child-related tax credits.