Following is a statement by Alan Essig, executive director of the Institute on Taxation and Economic Policy, regarding the Tax Cuts and Jobs Act passed tonight by the U.S. Senate.

“Tonight, lawmakers demonstrated that their top priority is satisfying the policy wants of the wealthy and the powerful. Tax increases and loss of health care for millions of hardworking low- and middle-income families apparently are inconsequential collateral damage as long as well-heeled donors and corporations get their tax cuts.

“It’s not too late to change course. But so far, Republican leaders have demonstrated that, for them, the only voices that matter in this debate belong to those who fund their campaigns.”

ITEP has resources on specific pieces of the Senate plan:

- Senate Pass-Through Deduction Threatens to Undermine State Tax Systems

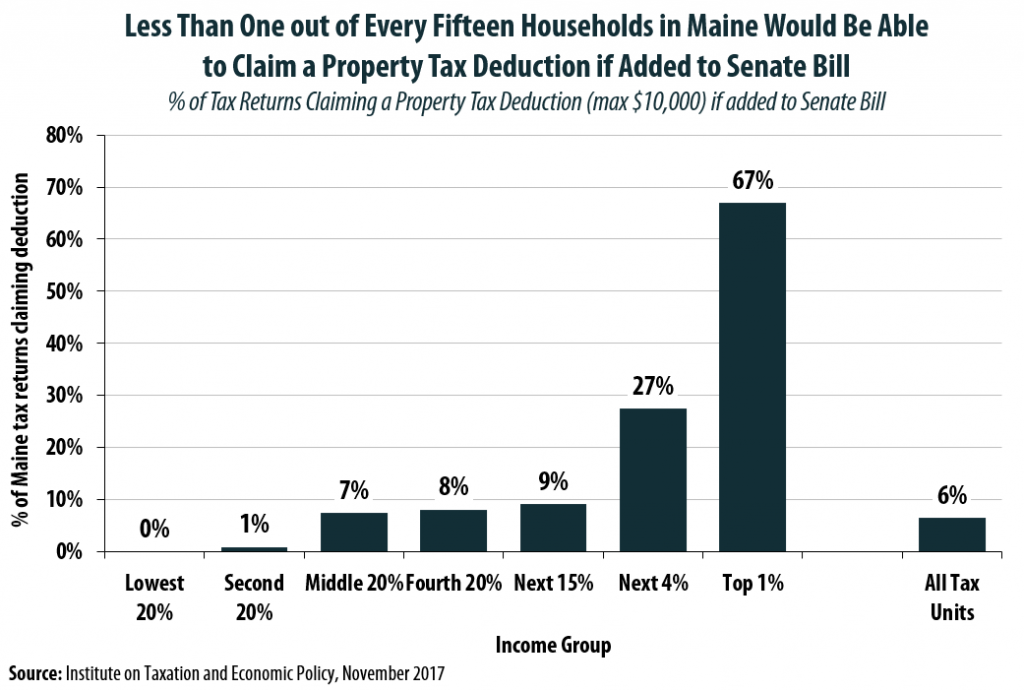

- Collins Pushed for Property Tax Break That Very Few of Her Constituents Can Take

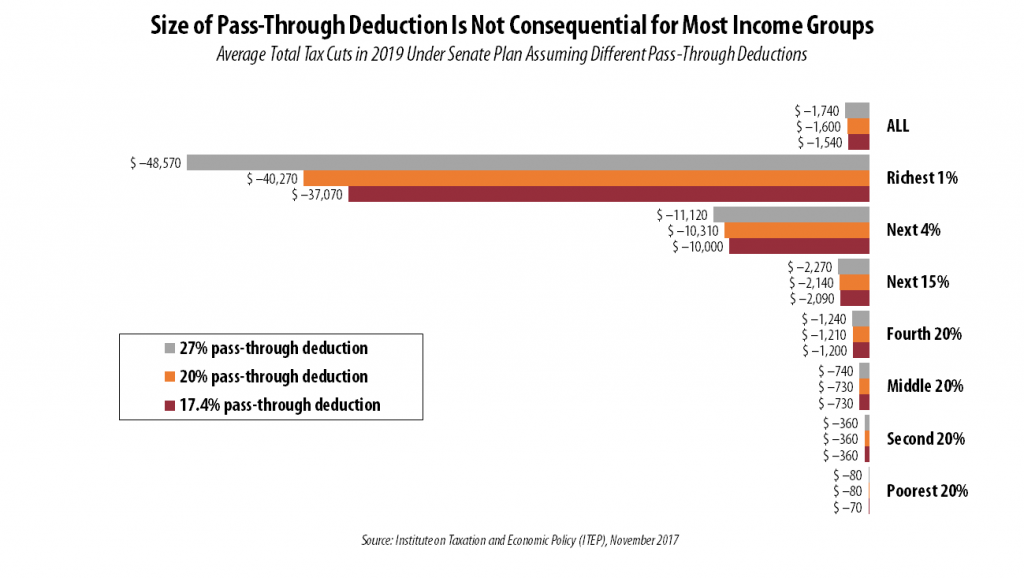

- The Size of Pass-Through Break Is Only Meaningful for the Wealthy

- A Corporate Tax Cut Would Benefit Coastal Investors, Not the Heartland

- Lawmakers Are Allowing Special Interests to Trump the Wants of Their Constituents

- Chained CPI Would Raise Everyone’s Taxes in the Future, Hurt the Poor Right Away

- Real Tax Reform Would Eliminate Tax Breaks for Real Estate Investors, Like Trump

- The Senate Tax Plan’s Big Giveaway to Multinational Corporations

Or visit itep.org for a full list of our resources on the tax debate, including analyses of both the House and Senate plans.