California

Bloomberg: Hedge Funds, Tech Spur Texas Wealth Boom as California Fades

June 4, 2021

The growth comes with headaches. Traffic is getting worse and public transportation is limited. The influx of people is driving up housing prices, forcing up the cost of living by boosting property taxes. Given high levies on real estate and the state sales tax, the fiscal burden on middle-class people is higher in Texas than […]

Income Tax Increases in the President’s American Families Plan

May 25, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

President Biden’s American Families Plan includes revenue-raising proposals that would affect only very high-income taxpayers.[1] The two most prominent of these proposals would restore the top personal income tax rate to 39.6 percent and eliminate tax breaks related to capital gains for millionaires. As this report explains, these proposals would affect less than 1 percent of taxpayers and would be confined almost exclusively to the richest 1 percent of Americans. The plan includes other tax increases that would also target the very well-off and would make our tax system fairer. It would raise additional revenue by more effectively enforcing tax…

State Rundown 5/13: States Get Federal Aid and Guidance as Many Sessions Wind Down

May 13, 2021 • By ITEP Staff

We had our noses buried in new American Rescue Plan guidance...when we heard the refreshing news that Missouri leaders are on the verge of modernizing their tax code, not only by becoming the final state to apply sales taxes to online purchases, but also by enacting an Earned Income Tax Credit (EITC)...Meanwhile, tax debates are also highly active in California, Colorado, Louisiana, Maine, and Nebraska. We also share some of our own reporting on recent efforts in Arizona and several other states to undermine voter-approved reforms and democratic institutions themselves.

Nearly 20 Million Will Benefit if Congress Makes the EITC Enhancement Permanent

May 13, 2021 • By Aidan Davis

Overall, the EITC enhancement would provide a $12.4 billion boost in 2022 if made permanent, benefiting 19.5 million workers. It would have a particularly meaningful impact on the bottom 20 percent of eligible households who would receive more than three-fourths of the total benefit. Forty-one percent of households in the bottom 20 percent of earners would benefit, receiving an average income boost of 6.3 percent, or $740 dollars.

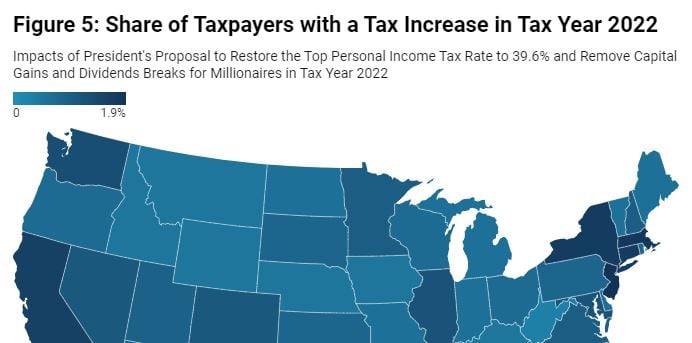

Effects of the President’s Capital Gains and Dividends Tax Proposals by State

May 6, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

President Biden’s proposal to eliminate the lower income tax rate on capital gains (profits from selling assets) and stock dividends for millionaires would affect less than half of one percent (0.4 percent) of U.S. taxpayers if it goes into effect in 2022. The share of taxpayers affected would be less than 1 percent in every state.

The Sacramento Bee: California parents would get big tax breaks under Biden proposal. Here’s how much to expect

May 1, 2021

Low and middle income families struggling to pay for child care and other expenses would see big new tax breaks through 2025 under the White House’s new child tax credit plan, according to a new analysis. Most of the breaks would go to households with incomes less than $51,700, but even those with lower six […]

Bloomberg: N.Y., New Jersey, California Hit Hardest by Biden Tax Changes

April 29, 2021

President Joe Biden’s plan to ramp up the income tax rate and capital gains tax rate as part of a $1.8 trillion stimulus plan would hit high-tax states like New York and California the hardest, while New Mexico and Mississippi would be least affected, according to research from the Institute on Taxation and Economic Policy. […]

Bold Progressive State Tax Victories Provide Bright Spots in Difficult Year

April 27, 2021 • By Dylan Grundman O'Neill

“Bold progressive victories” is probably not the first phrase that comes to mind when thinking about state laws enacted so far in 2021...But progressive advocates, lawmakers, and voters have won some tremendous victories in states recently...We should celebrate them for the achievements they are—and closely study them for lessons they can teach about how to bring about positive progressive change in these and other states.

Bloomberg: The Myth of the Middle-Class SALT Cap Victim

April 23, 2021

Once again, if you make well under $1 million a year and your tax rate really did go up from 2017 to 2018 because of the SALT cap, I’m not denying that your suffering is real. But you appear to be in a distinct minority even in New York, New Jersey, Connecticut, California and other […]

Just as a recent cold snap reminded us that spring has not fully sprung yet, this week’s news has been full of reminders that state fiscal debates aren’t quite finished either...

Young workers are confronting a harsh economic reality filled with student loan debt and far too few good-paying jobs. The pandemic reinforced this group’s long history of not receiving proper benefits, such as health insurance, from their employers. They also are often overlooked when it comes to policies that promote economic wellbeing. The federal Earned Income Tax Credit (EITC), for example, is a glowing success story. It lifted 5.8 million people out of poverty in 2018, including 3 million children. But a key shortcoming of the federal EITC: working adults without children in the home receive little to no benefit.

A new ITEP analysis provides critical data for the debate over whether to repeal the $10,000 cap on state and local tax (SALT) deductions. The report finds that repeal of the SALT cap without other reforms would worsen economic disparities and exacerbate racial inequities baked into the federal tax system.

Not Worth Its SALT: Tax Cut Proposal Overwhelmingly Benefits Wealthy, White Households

April 20, 2021 • By Carl Davis, ITEP Staff, Jessica Schieder

A previous ITEP analysis showed the lopsided distribution of SALT cap repeal by income level. The vast majority of families would not benefit financially from repeal and most of the tax cuts would flow to families with incomes above $200,000. This report builds on that work by using a mix of tax return and survey data within our microsimulation tax model to estimate the distribution of SALT cap repeal across race and ethnicity. It shows that repealing the SALT cap would be the latest in a long string of inequitable policies that have conspired to create the vast racial income…

California Budget & Policy Center: Promoting Racial Equity Through California’s Tax and Revenue Policies

April 15, 2021

Legacies of historical racist policies and ongoing discrimination in areas such as education, employment, and housing have barred many Californians of color from economic opportunities. As a result, Californians of color — particularly Black, Latinx, and American Indian Californians — are less likely to have high incomes and to have built enough wealth to be […]

Los Angeles Times: Column: California Democrats have a chance to flex some muscle and work to restore deductions for taxpayers

April 15, 2021

Standard deductions were nearly doubled and so were child credits. Importantly for many upper-middle-class Californians, the alternative minimum tax was significantly lowered. The Institute on Taxation and Economic Policy reports that if the caps were eliminated, half the savings for California would go to the richest — the top 1%. Read more

The Sacramento Bee: Rich Californians have most to gain if Congress lifts cap on local tax deductions, report says

April 11, 2021

State residents earning more than $992,800, California’s wealthiest 1%, could see an average savings of $98,650 in 2022, according to data from the Institute on Taxation and Economic Policy, a Washington-based economic analysis firm. Overall, Californians would save $33.4 billion next year if the SALT limits are lifted—with $17.4 billion of that going to people […]

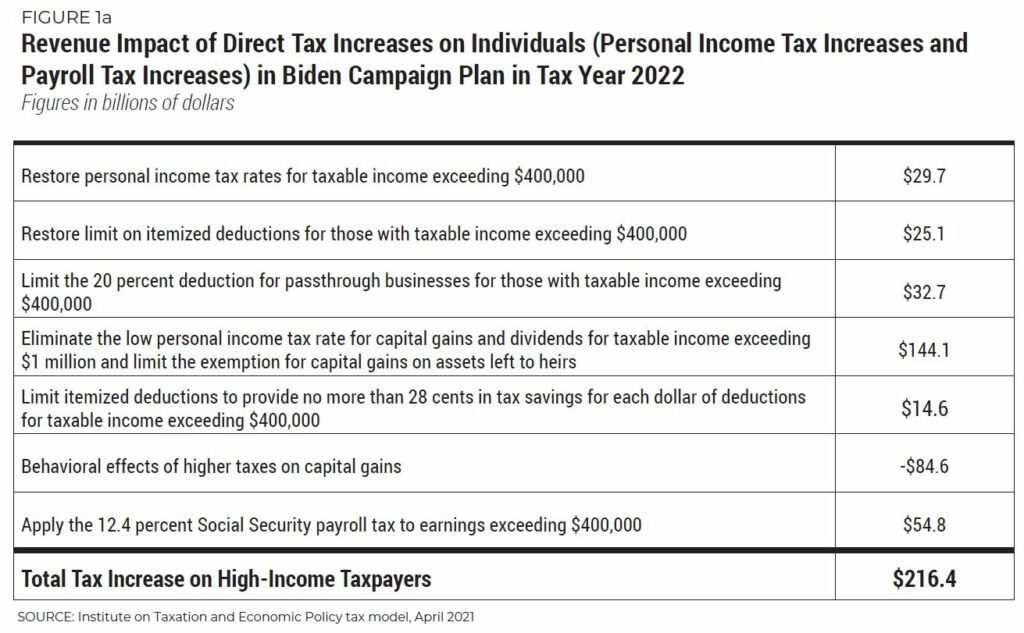

National and State-by-State Estimates of President Biden’s Campaign Proposals for Revenue

April 8, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

During his presidential campaign, Joe Biden proposed to change the tax code to raise revenue directly from households with income exceeding $400,000. More precisely, Biden proposed to raise personal income taxes on unmarried individuals and married couples with taxable income exceeding $400,000, and he also proposed to raise payroll taxes on individual workers with earnings exceeding $400,000. Just 2 percent of taxpayers would see a direct tax hike (an increase in either personal income taxes, payroll taxes, or both) if Biden’s campaign proposals were in effect in 2022. The share of taxpayers affected in each state would vary from a…

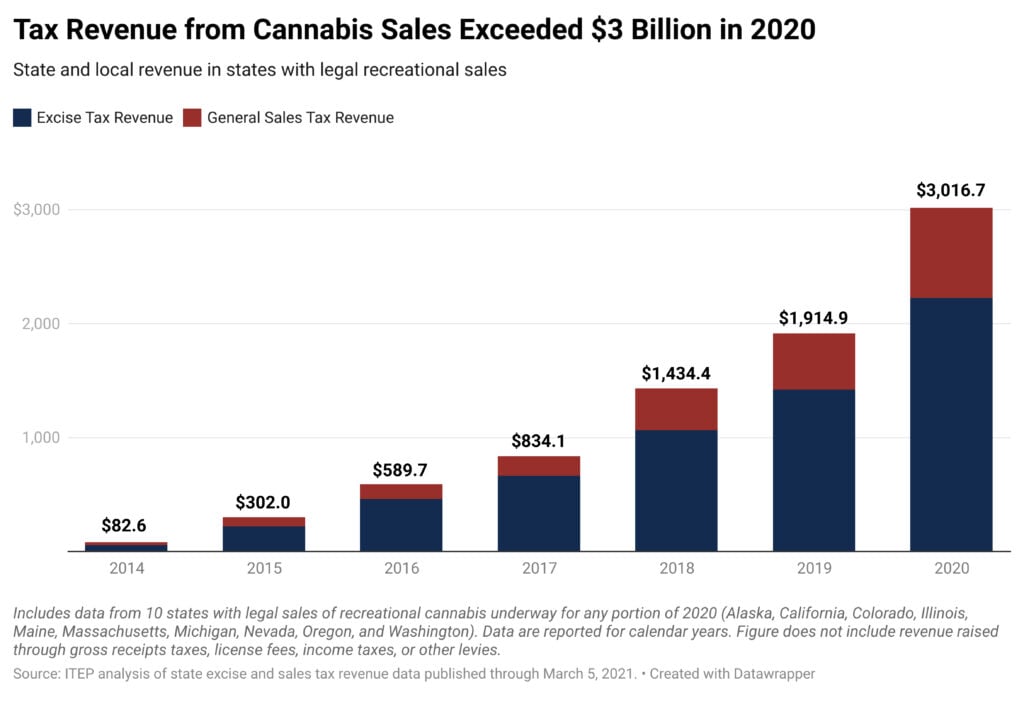

The Joint Blog: Report: State and Local Cannabis Tax Revenue Jumps 58%, Surpassing $3 Billion in 2020

April 4, 2021

According to a new report conducted and released by the Institute on Taxation and Economic Policy, tax revenue from state-legal marijuana sales rose significantly in 2020 to surpass $3 billion. “Powered by an expanding legal market and a pandemic-driven boost in cannabis use, excise and sales taxes on cannabis jumped by more than $1 billion […]

Taxes and Racial Equity: An Overview of State and Local Policy Impacts

March 31, 2021 • By ITEP Staff

Historic and current injustices, both in public policy and in broader society, have resulted in vast disparities in income and wealth across race and ethnicity. Employment discrimination has denied good job opportunities to people of color. An uneven system of public education funding advantages wealthier white people and produces unequal educational outcomes. Racist policies such as redlining and discrimination in lending practices have denied countless Black families the opportunity to become homeowners or business owners, creating extraordinary differences in intergenerational wealth. These inequities have long-lasting effects that compound over time.

California Budget & Policy Center: American Rescue Plan Provides Assistance to Millions of Californians

March 30, 2021

This latest round of federal fiscal relief will help reduce hardship as a result of the pandemic, particularly for Californians with low incomes and people of color, and begins to set the stage for a more equitable economic recovery. This report outlines key provisions of the plan and what it means for Californians. Read more

State Rundown 3/17: Momentum for Sound Progressive Tax Reforms Continues to Build

March 17, 2021 • By ITEP Staff

We wrote last week that the inclusion of fiscal relief for states and localities in Congress’s American Rescue Plan should free up state lawmakers’ time and attention to focus on the comprehensive reforms needed to address upside-down and inadequate tax codes, and some states are already doing just that.

MinnPost: Is Minnesota’s Tax System Unfair?

March 15, 2021

The Institute on Taxation and Economic Policy’s regular assessment of state taxes concludes that just five states and the District of Columbia have positive scores on progressivity: California, Delaware, New Jersey, Vermont and Minnesota. The progressive systems rely less on consumption taxes and more on income taxes, with rates that increase with wealth. They also […]

State and Local Cannabis Tax Revenue Jumps 58%, Surpassing $3 Billion in 2020

March 15, 2021 • By Carl Davis

Cannabis taxes are a small part of state and local budgets, clocking in at less than 2 percent of tax revenue in the states with legal adult-use sales. But they’re also one of states’ fastest-growing revenue sources. Powered by an expanding legal market and a pandemic-driven boost in cannabis use, excise and sales taxes on […]

San Francisco Chronicle: California Schools, Governments and Residents to Get Billions in COVID Stimulus

March 9, 2021

The bill includes another round of direct stimulus payments to Americans. The nonpartisan Institute on Taxation and Economic Policy estimates that 22 million adults and 9 million children in California will benefit from the $1,400 checks. The bill also expands the child tax credit from $2,000 per year to $3,000 for children over the age […]

Although lawmakers in some states continue to push for expensive and regressive tax cuts that would primarily benefit wealthy households, worsen economic and racial injustices, and undermine funding for key public services, this week’s state fiscal news is dominated by efforts to do the opposite. Leaders in the District of Columbia, Maine, Nebraska, New York, Washington, and Wyoming made recent headlines by advocating for policies that improve on upside-down tax codes and generate needed funding for shared priorities like schools and health care.