California

Forbes: 4.3 Million Adults Eligible For Two $1,200 Stimulus Checks If HEROES Act Passes

May 15, 2020

The Institute On Taxation and Economic Policy (ITEP) estimates that over 4.3 million adults, as well as 3.5 million children, would benefit from this change in eligibility. The organization calculated that ITIN filers would receive over $9.4 billion in direct economic relief from the new economic impact payments. Moreover, the retroactive clause would mean disbursement […]

State Rundown 5/7: State Fiscal Responses to Pandemic Starting to Get Real

May 7, 2020 • By ITEP Staff

State lawmakers are starting to use fiscal policy levers to address the COVID-19 pandemic, but the actions vary greatly and are just a start. Mississippi, for example, is one state still clarifying who has authority to determine how federal aid dollars are spent. Colorado, Georgia, Missouri, and Ohio are among the many states identifying painful funding cuts they will likely make to shared priorities like health care. The Louisiana House and the Minnesota Senate each advanced tax cuts and credits that could dig their budget holes even deeper. Connecticut leaders are looking at one of the more comprehensive packages, which…

Intended Consequences: Deliberate Disinvestment Caused Florida’s Unemployment Disaster

May 4, 2020 • By Stephanie Clegg

Florida politicians deliberately rigged the unemployment system after the Great Recession to avoid raising taxes on businesses. Now, in a pandemic, some out-of-work residents are left waiting more than six weeks for unemployment benefits while more than 280,000 others have been inexplicably denied. What’s happening in Florida underscores deeper challenges with systems that should help those in need, but instead are designed to fail them.

LA News: California should support immigrants with expanded tax credit eligibility

May 4, 2020

According to Public Policy Institute of California, there are more than 2 million undocumented immigrants in the state, more than 6 percent of the population. Many, if not most, undocumented workers pay federal, state and local taxes. In fact, an analysis by the Institute on Taxation and Economic Policy showed that undocumented immigrants living in […]

State Rundown 4/29: State Responses and Federal Aid Could Be Among “May Flowers” to Come

April 29, 2020 • By ITEP Staff

April has brought relentless showers of troublesome tax and budget news as the COVID-19 pandemic wreaked havoc on communities and the public services and institutions that both support and depend on them. There is hope, however, that these troubles have opened the eyes of policymakers and that May will bring more clarity and strong action in the form of federal fiscal relief as well as home-grown state and local responses.

In different ways, Earth Day and the COVID-19 pandemic convey a similar lesson: people around the world face shared struggles and disparate impacts, which they must work together to overcome through both emergency action and systemic change. In keeping with that lesson, state fiscal policy news this week was strikingly similar around the country, as states take account of the major threat posed by the pandemic to their budgets and attempt to grapple with its disproportionate impacts on communities of color and low-income families.

Chicago Tribune: Agencies scramble to help Lake County undocumented immigrants impacted by coronavirus crisis

April 18, 2020

According to the Institute on Taxation and Economic Policy, Illinois is one of six states that derive the most revenue from taxes paid by undocumented immigrants. California, Florida, New York, Texas and New Jersey, are also on the list. Read more

KQED: More ‘Peace of Mind’ for Undocumented Californians, Still May Not Be Enough

April 17, 2020

Unauthorized immigrants in California collectively pay about $3 billion in state and local taxes each year, according to the nonprofit Institute on Taxation and Economic Policy. Read more

Morally and Economically, Including Undocumented Immigrants Is the Right Thing to Do

April 17, 2020 • By ITEP Staff

Undocumented immigrants pay taxes and play an integral part in the social and economic welfare of our country, yet Congress left them almost entirely out of the CARES Act package. Fortunately, immigrants, workers and their allies are helping policymakers advance better policy approaches.

State Rundown 4/15: Tax Day Delayed but Other Important Work Accelerated

April 15, 2020 • By ITEP Staff

April 15 is traditionally the day federal and state income taxes are due, but like so much else, Tax Day is on hold for the time being. Meanwhile the pandemic’s disastrous and uneven effects on communities and shared institutions are decidedly not suspended. But nor are the efforts of individuals, advocates, and policymakers to develop solutions to respond to the immediate crisis while also building better systems going forward. ITEP’s recommendations for state tax policy responses are now available here, and this week’s Rundown includes experiences and perspectives on paths forward from around the country.

Our elected officials have to listen to we the people and change their approach. Going forward, corporate voices cannot continue to steer. Instead, families, communities and working individuals have to lead our policymaking so it better helps people struggling now.

Pot Sector Cut Off From Federal Pandemic Loans, Turns to States

April 14, 2020

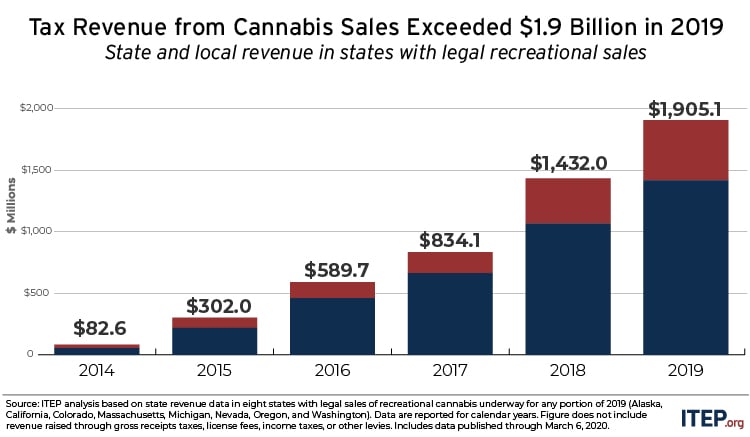

Pot has boosted state tax revenues in recent years, funding core state initiatives from education to infrastructure to health care. California collected about $629 million in taxes on cannabis in 2019. Washington raised more tax revenue than any other state in 2019, about $67 per person, according to a study by the Institute on Taxation […]

Bloomberg: Pot, Liquor ‘Essential’ to Keep Up Spirits, Revenue During Virus

April 10, 2020

The state of Washington raised the most cannabis tax revenue last year—$67.31 per person, according to the Institute on Taxation and Economic Policy. That compares with $60.11 per person raised in Colorado, $53.50 in Nevada, $38.83 in Alaska, $31.75 in Oregon, $15.93 in California, and $12.92 in Massachusetts, the institute said. Read more

State Rundown 4/9: Pandemic’s Fiscal Effects Slowly Coming into Focus

April 9, 2020 • By ITEP Staff

The COVID-19 pandemic continued this week to wreak havoc on lives and communities around the world. The fiscal fallout of the virus in the states is growing as well, and beginning this week to come into sharper focus. This week’s Rundown brings together what we know of that slowly clarifying picture and how states are responding so far.

Returning to the Economic Status Quo After COVID-19 Crisis Should Not Be an Option

April 6, 2020 • By Jenice Robinson

It will take immense imagination, unyielding political will and a fundamental reordering of our policy priorities to adequately address the problems of this moment and unrig our economy.

State Rundown 4/3: States Welcome Federal Aid, Seek Further Solutions

April 3, 2020 • By ITEP Staff

States and families got good news this week as Congress came together to pass major aid to help during the COVID-19 coronavirus pandemic. But that bright spot came amid an onslaught of very difficult news about the public health crisis and the economic and fiscal fallout accompanying it. This week’s Rundown brings you the latest on these developments and state and local responses to them.

House Democrats’ Suggestion of Retroactively Repealing SALT Cap is a Poor Emergency Relief Measure

March 31, 2020 • By Steve Wamhoff

The House Democrats have plenty of ideas to help workers and families and boost the economy, but Speaker Nancy Pelosi’s recent idea to repeal the cap on deductions for state and local taxes (SALT) is not one of them. The 2017 Trump-GOP tax law includes many provisions that should be repealed. Unfortunately, Congressional Democrats have long made it clear that they want to start by repealing the $10,000 cap on SALT deductions, which is one of the law's few provisions that restrict tax breaks for the rich.

KQED: New COVID-19 Relief Benefits Leave Out Millions Of Undocumented Immigrants

March 31, 2020

In California, undocumented residents contribute $3 billion annually in state and local taxes, according to the nonprofit Institute on Taxation and Economic Policy. Immigrants who are not eligible for a Social Security number, including undocumented ones, can use an Individual Tax Identification Number to pay taxes. The federal government collected $13.7 billion from taxpayers using […]

State Rundown 3/26: Pandemic’s Health and Fiscal Fallout Continues to Grow

March 26, 2020 • By ITEP Staff

This week’s Rundown brings you the most useful reading and resources about how states are affected by and responding to the COVID-19 pandemic. These include: landing pages for the most up-to-date lists of state policy responses; ITEP’s own materials on state policy options and the federal response bills; insights on how a race-forward approach can improve these efforts at all levels; updates on state fiscal troubles and legislative postponements; and the developing picture of which states and communities could be affected more than others.

State Rundown 3/19: Spring Is Here but States Brace for Long Winter

March 19, 2020 • By ITEP Staff

As the COVID-19 pandemic continues to disrupt more and more aspects of life and cause greater and greater harms to public health and the economy, information is changing by the hour. State policymakers, if they are even able to convene, are wholly focused on how to respond to the crisis. The pandemic is certain to pose a series of fiscal challenges for states and their economies, and this week’s Rundown focuses on the most helpful resources and the latest state-by-state updates available.

The Sacramento Bee: Trump has big plans for California highway repair, but no plan to pay for it

March 12, 2020

While there’s no way to know how much states increases would be curbed if federal taxes were higher, if at all, Carl Davis, research director at Washington, D.C., Institute on Taxation and Economic Policy, saw two reasons for the state increases. One is that the cost of asphalt, concrete, machine and labor has gone up. […]

Politico: That’s a lot of tax relief

March 11, 2020

Just looking at sales and excise taxes, the eight states where recreational pot was legal in 2019 raised close to $2 billion in revenue, according to Carl Davis of the liberal Institute on Taxation and Economic Policy. That adds up to an increase of around a third, or nearly a half-billion dollars. Why the big […]

ITEP Testimony on the Illinois Earned Income Credit

March 11, 2020 • By Lisa Christensen Gee

Read as PDF Testimony of Lisa Christensen Gee, Director of Special Initiatives, Institute on Taxation and Economic Policy Submitted to: Illinois House Revenue Committee Chairman Zalewski, committee members—thank you for holding this subject matter hearing this morning on the Earned Income Credit (EIC) and its importance for hard working Illinoisans and their families. My name […]

State and Local Cannabis Tax Revenue Jumps 33%, Surpassing $1.9 Billion in 2019

March 10, 2020 • By Carl Davis

Excise and sales taxes on cannabis raised more than $1.9 billion in 2019. This represents a jump of nearly half a billion dollars, or 33 percent, compared to a year earlier. These are the findings of an ITEP analysis of newly released tax revenue data from the eight states where legal sales of adult-use cannabis took place last year.

State Rundown 3/4: Sun Shining on Progressive Tax Efforts This Week

March 4, 2020 • By ITEP Staff

Wisconsin’s expansion of a capital gains tax break for high-income households represents a dark spot on this week’s state fiscal news, and the growing threat of COVID-19 is casting an ominous shadow over all of it, but otherwise the picture is pleasantly sunny, featuring small steps forward for sound, progressive tax policy. An initiative to create a graduated income tax in Illinois, for example, got a vote of confidence from a major ratings agency, while a similar effort went public in Michigan and two progressive income tax improvements were debated in Rhode Island. Gas tax updates made encouraging progress in…