District of Columbia

This week, lawmakers in Louisiana, Pennsylvania, Rhode Island, Vermont, and the District of Columbia wrapped up their budgets in time for the new fiscal year that starts July first in most states, with some of these resolutions coming after contentious debates and repeated special sessions. New Jersey's debate is not yet finished as leaders clash over spending priorities and the taxes on millionaires and corporations needed to fund them. Meanwhile, signature drives to put tax-related questions on fall ballots are heating up in several other states. And our "What We're Reading" section includes helpful resources on implications of the Supreme…

All Bets are Off: State-Sponsored Sports Betting Isn’t Worth the Risk

June 13, 2018 • By Misha Hill

Many state legislators and regulators are considering expanding state-sponsored gambling by allowing betting on major league sports games. But the revenue states could bring in isn’t worth the risk.

Lottery, Casino and other Gambling Revenue: A Fiscal Game of Chance

June 12, 2018 • By ITEP Staff

Cash-strapped, tax-averse state lawmakers continue to seek unconventional revenue-raising alternatives to the income, sales, and property taxes that form the backbone of most state tax systems. However, gambling revenues are rarely as lucrative, or as long-lasting, as supporters claim.

Urban Milwaukee: What’s Wrong with Illinois?

May 30, 2018

Although Illinois is widely viewed as a blue state because of its recent record of supporting Democratic presidential candidates, from a “who pays” angle it looks much more like a red state, collecting a much higher proportion of taxes from low earners than high earners. The next chart, based on data developed by the Institute […]

SALT/Charitable Workaround Credits Require a Broad Fix, Not a Narrow One

May 23, 2018 • By Carl Davis

The federal Tax Cuts and Jobs Act (TCJA) enacted last year temporarily capped deductions for state and local tax (SALT) payments at $10,000 per year. The cap, which expires at the end of 2025, disproportionately impacts taxpayers in higher-income states and in states and localities more reliant on income or property taxes, as opposed to sales taxes. Increasingly, lawmakers in those states who feel their residents were unfairly targeted by the federal law are debating and enacting tax credits that can help some of their residents circumvent this cap.

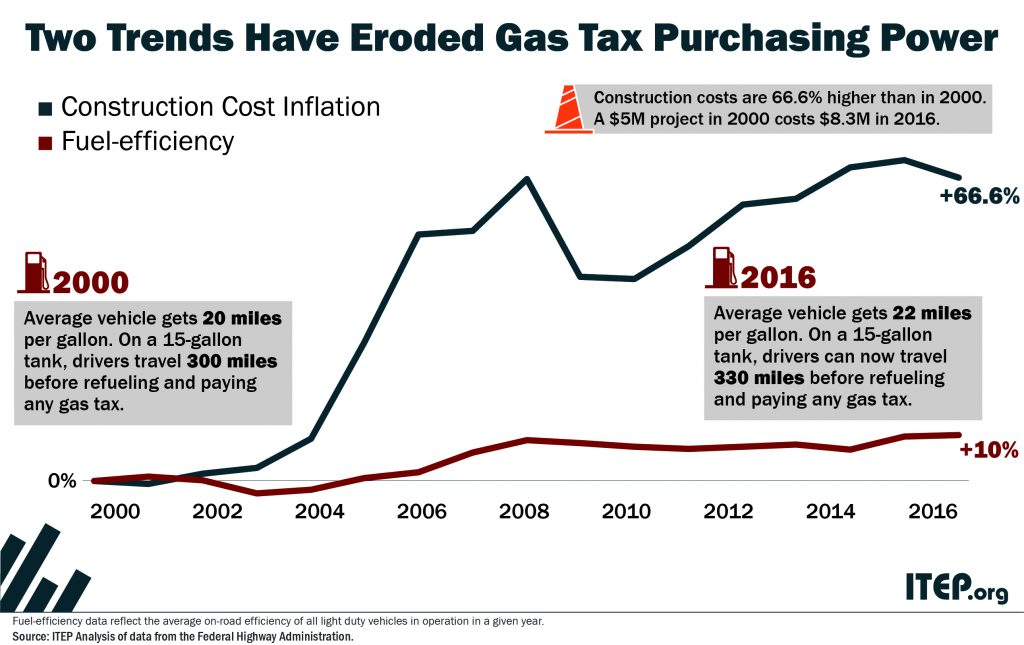

An updated version of this blog was published in April 2019. State tax policy can be a contentious topic, but in recent years there has been a remarkable level of agreement on one tax in particular: the gasoline tax. Increasingly, state lawmakers are deciding that outdated gas taxes need to be raised and reformed to fund infrastructure projects that are vital to their economies.

State Rundown 5/17: Don’t Bet on Legal Sports Betting Solving State Budget Woes

May 17, 2018 • By ITEP Staff

This week the U.S. Supreme Court opened the door to legal sports gambling in the states (see our What We're Reading section), which will surely be a hot topic in state legislative chambers, but most states currently have more pressing matters before them. The teacher pay crisis made news in North Carolina, Alabama, and nationally. Louisiana, Oregon, and Vermont lawmakers are headed for special sessions over tax and budget issues. And several other states have recently reached or are very near the end of their legislative sessions.

State Rundown 5/3: Progressive Revenue Solutions to Fiscal Woes Gaining Traction

May 3, 2018 • By ITEP Staff

This week, Arizona teachers continued to strike over pay issues and advocates unveiled a progressive revenue solution they hope to put before voters, while a progressive income tax also gained support as part of a resolution to Illinois's budget troubles. Iowa and Missouri legislators continued to try to push through unsustainable tax cuts before their sessions end. And Minnesota and South Carolina focused on responding to the federal tax-cut bill.

Bloomberg BNA: Higher Gas Prices May Mean Paying States More in Taxes

May 1, 2018

As a result, a few states will see revenue gains from higher prices because their tax rates are tied to the price of fuel, rather than its volume, Carl Davis, research director for the left-leaning Institute on Taxation and Economic Policy, told Bloomberg Tax. Those states include California, Connecticut, Kentucky, Maryland, Nebraska, New Jersey, New […]

State & Local Tax Contributions of Young Undocumented Immigrants

April 30, 2018 • By ITEP Staff

This report specifically examines the state and local tax contributions of undocumented immigrants who are currently enrolled or immediately eligible for DACA and the fiscal implications of various policy changes. The report includes information on the national impact (Chart 1) and provides a state-by-state breakdown (Appendices 1 and 2).

Trends We’re Watching in 2018, Part 5: 21st Century Consumption Taxes

April 20, 2018 • By Misha Hill

We're highlighting the progress of a few newer trends in consumption taxation. This includes using the tax code to discourage consumption of everything from plastic bags to carbon and collecting revenue from emerging industries like ride sharing services and legalized cannabis sales.

State Rundown 4/13: Teacher Strikes, Special Sessions, Federal Cuts Haunting States

April 13, 2018 • By ITEP Staff

This Friday the 13th is a spooky one for many state lawmakers, as past bad fiscal decisions have been coming back to haunt them in the form of teacher strikes and walk-outs in Arizona, Kentucky, and Oklahoma. Meanwhile, policymakers in Maryland, Nebraska, New Jersey, Oregon, and Utah all attempted to exorcise negative consequences of the federal tax-cut bill from their tax codes. And our What We're Reading section includes yet another stake to the heart of the millionaire tax-flight myth and other good reads.

Vox: Immigrants Pay Taxes

April 13, 2018

The best estimates come from research by the Institute of Taxation and Economic Policy, a Washington, DC, think tank, which suggests that about half of undocumented workers in the United States file income tax returns. The most recent IRS data, from 2015, shows that the agency received 4.4 million income tax returns from workers who […]

This week, Kentucky legislators passed a bill shifting taxes onto low- and middle-income families, Oklahoma legislators reached a deal on education funding, and their counterparts in Kansas proffered multiple proposals for their education funding needs. Meanwhile, tax debates are coming down to the wire in Iowa, Missouri, and Nebraska, and responses to the federal tax-cut bill were settled on in Maryland, New York, and Wisconsin.

Preventing State Tax Subsidies for Private K-12 Education in the Wake of the New Federal 529 Law

February 23, 2018 • By Ronald Mak

This policy brief explains the federal and various state-level breaks for 529 plans and explores the potential impact that the change in federal treatment of 529 plans will have on state revenues.

What the Tax Cuts and Jobs Act Means for States – A Guide to Impacts and Options

January 26, 2018 • By ITEP Staff

The recently enacted Tax Cuts and Jobs Act (TCJA) has major implications for budgets and taxes in every state, ranging from immediate to long-term, from automatic to optional, from straightforward to indirect, from certain to unknown, and from revenue positive to negative. And every state can expect reduced federal investments in shared public priorities like health care, education, public safety, and basic infrastructure, as well as a reduced federal commitment to reducing economic inequality and slowing the concentration of wealth. This report provides detail that state residents and lawmakers can use to better understand the implications of the TCJA for…

DCFPI: As High-Income DC Taxpayers Reap Large Federal Tax Windfalls, DC Can Make Our Tax Code More Progressive

January 22, 2018

According to recent estimates from the Institute for Taxation and Economic Policy (ITEP), District of Columbia residents can expect to receive an $850 million federal tax break this year.

State Rundown 1/17: Budget Deficits, Online Sales Tax, and More

January 17, 2018 • By ITEP Staff

The big news this week in state tax law is that the U.S. Supreme Court has agreed to take on the issue of online sales, nexus, and sales tax collection. States have increasingly lost out on sales tax revenues as more transactions have shifted online from brick-and-mortar stores and the laws determining who is required to collect and remit sales taxes haven't kept up. This is potentially good news for states—25 of which National Association of State Budget Officers (NASBO) reports started the new year with budgetary deficits. In other news, grappling with the local impact of federal tax reform…

These have been dark days for those who care about tax justice and public investments, but with the Winter Solstice this week and many states diving into their legislative sessions in January, longer days (and long work days) are soon to come! Governors and legislators are already proposing or hinting at their 2018 tax and budget plans in Alaska, California, Iowa, Maryland, and Washington. And transportation investments are getting strong support in Missouri, Oregon, and Virginia.

How the Final GOP-Trump Tax Bill Would Affect District of Columbia Residents’ Federal Taxes

December 16, 2017 • By ITEP Staff

The final tax bill that Republicans in Congress are poised to approve would provide most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill would go into effect in 2018 but the provisions directly affecting families and individuals would all expire after 2025, with […]

The Final Trump-GOP Tax Plan: National and 50-State Estimates for 2019 & 2027

December 16, 2017 • By ITEP Staff

The final Trump-GOP tax law provides most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill goes into effect in 2018 but the provisions directly affecting families and individuals all expire after 2025, with the exception of one provision that would raise their taxes. To get an idea of how the bill will affect Americans at different income levels in different years, this analysis focuses on the bill’s impacts in 2019 and 2027.

As 2017 draws to close, Congress has yet to take legislative action to protect Dreamers. The young undocumented immigrants who were brought to the United States as children, and are largely working or in school, were protected by President Obama’s 2012 executive action, Deferred Action for Childhood Arrivals (DACA). But in September, President Trump announced that he would end DACA in March 2018. Instead of honoring the work authorizations and protection from deportation that currently shields more than 685,000 young people, President Trump punted their lives and livelihood to a woefully divided Congress which is expected to take up legislation…

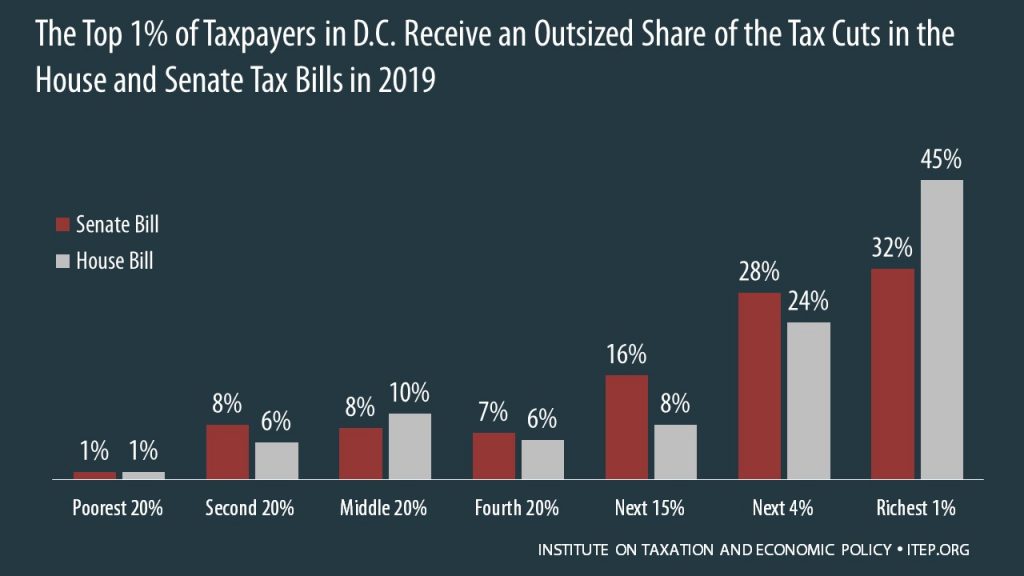

How the House and Senate Tax Bills Would Affect District of Columbia Residents’ Federal Taxes

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. The graph below shows that both bills are skewed to the richest 1 percent of District of Columbia residents.

National and 50-State Impacts of House and Senate Tax Bills in 2019 and 2027

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. National and 50-State data available to download.

A recent ITEP study concluded that the tax bill before the Senate would raise taxes on at least 29 percent of Americans and cause the populations of 19 states to pay more in federal taxes in 2027 than they do today, while providing foreign investors with more benefits than American households. This report delves deeper by breaking out impacts of different components of the Senate tax plan on U.S. taxpayers in 2019 and 2027. This approach leads to several conclusions.