District of Columbia

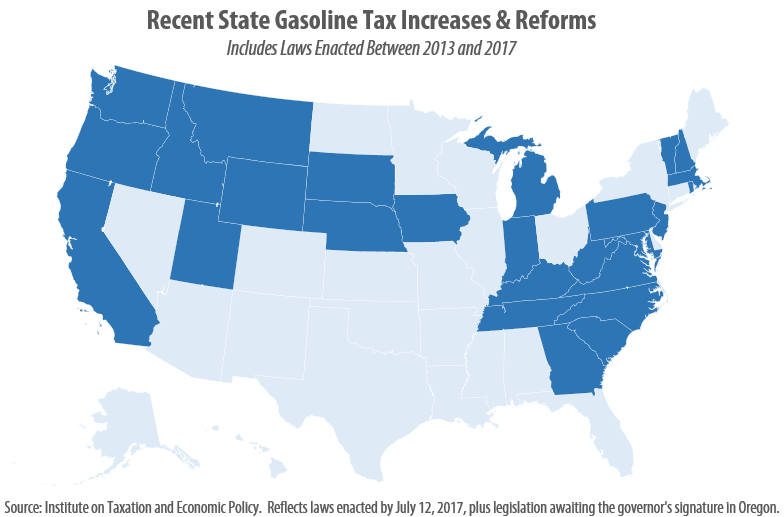

The flawed design of federal and state gasoline taxes has made it exceedingly difficult to raise adequate funds to maintain the nation’s transportation infrastructure. Thirty states and the federal government levy fixed-rate gas taxes where the tax rate does not change even when the cost of infrastructure materials rises or when drivers transition toward more fuel-efficient vehicles and pay less in gas tax. The federal government’s 18.4 cent gas tax, for example, has not increased in over twenty-three years. Likewise, nineteen states have waited a decade or more since last raising their own gas tax rates.

Senate Health Care Reform Bill Just as “Mean” as the House Version

June 26, 2017 • By Alan Essig

The Congressional Budget Office today released its score of the Senate Health Care proposal and the news is not good. It’s no wonder a narrow group of 13 lawmakers cobbled together the bill behind closed doors. Now that the measure has seen the light of day, we know that it epitomizes Robin Hood in reverse policies by snatching health coverage from 22 million people by 2026 (15 million in 2018) while showering tax cuts on the already wealthy.

Explaining our Analysis of Washington State’s Highly Regressive Tax Code

June 22, 2017 • By Carl Davis

Supporters of creating a local personal income tax in Seattle are rightly concerned about the lopsided nature of their state’s tax code. In a 50-state study titled Who Pays?, produced using our microsimulation tax model, we found that Washington State’s tax system is the most regressive in the nation.

Which States Benefit from the Tax Cuts in the GOP Health Plan?

June 15, 2017 • By Steve Wamhoff

Congressional Republicans’ plans to repeal the two largest tax increases on individuals that were enacted as part of the Affordable Care Act (ACA) would disproportionately benefit residents of Connecticut, New York, the District of Columbia and 10 other states. The remaining states would receive a share of the tax cuts that is less than their share of the total U.S. population.

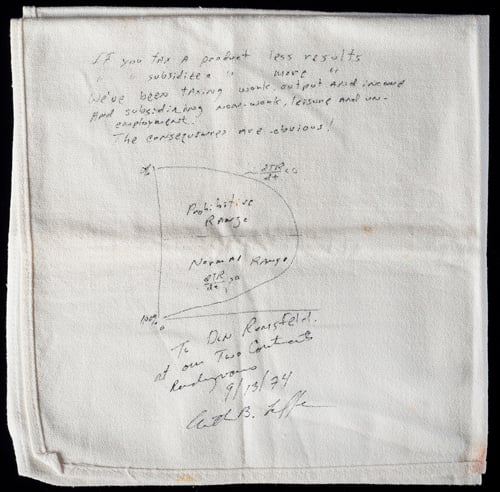

Sitting in the National Museum of American History in Washington, DC, hidden in the jumble of Americana like Thomas Jefferson’s desk, Michelle Obama’s inaugural gown and the ruby slippers worn in the Wizard of Oz, is a napkin with a drawing on it. Probably one of the least known exhibits in the museum, this napkin, quietly hiding behind glass lest some child wandering from a school group wipe his nose on it, has on several occasions destroyed the finances of the federal government and several state governments, most recently in Kansas.

State Rundown 5/31: Budget Woes Spurring Special Legislative Sessions

May 31, 2017 • By ITEP Staff

This week, special legislative sessions featuring tax and budget debates are underway or in the works in Kentucky, Minnesota, New Mexico, and West Virginia, as lawmakers are also running up against regular session deadlines in Illinois, Kansas, and Oklahoma. Meanwhile, a legislative study in Wyoming and an independent analysis in New Jersey are both calling for tax increases to overcome budget shortfalls.

Besides Eviscerating the Safety Net, Trump Budget Would Put States in a Fiscal Bind

May 26, 2017 • By Misha Hill

There has been considerable discussion about the human impact of the Trump budget’s draconian cuts to what remains of the social safety net. A long-standing conservative talking point in response to such criticism is that states can pick up the tab when federal dollars disappear. But at a time when many states are facing budget shortfalls and the effect of federal tax reform is yet to be determined, it is outlandish to suggest that states are flush with cash to make up for federal spending reductions.

This post was updated July 12, 2017 to reflect recent gas tax increases in Oregon and West Virginia. As expected, 2017 has brought a flurry of action relating to state gasoline taxes. As of this writing, eight states (California, Indiana, Montana, Oregon, South Carolina, Tennessee, Utah, and West Virginia) have enacted gas tax increases this year, bringing the total number of states that have raised or reformed their gas taxes to 26 since 2013.

Two states are on the verge of embracing a tried and tested anti-poverty policy, the Earned Income Tax Credit (EITC). In the past two weeks, lawmakers in both Hawaii and Montana passed EITC legislation, which governors in both states are expected to sign. Once officially enacted, these states will join 26 other states and the […]

3 Percent and Dropping: State Corporate Tax Avoidance in the Fortune 500, 2008 to 2015

April 27, 2017 • By Aidan Davis, Matthew Gardner, Richard Phillips

The trend is clear: states are experiencing a rapid decline in state corporate income tax revenue. Despite rebounding and even booming bottom lines for many corporations, this downward trend has become increasingly apparent in recent years. Since our last analysis of these data, in 2014, the state effective corporate tax rate paid by profitable Fortune 500 corporations has declined, dropping from 3.1 percent to 2.9 percent of their U.S. profits. A number of factors are driving this decline, including: a race to the bottom by states providing significant “incentives” for specific companies to relocate or stay put; blatant manipulation of…

States are experiencing a rapid decline in state corporate income tax revenue, and the downward trend has become increasingly pronounced in recent years. Despite rebounding bottom lines for many corporations, a new ITEP report, 3 Percent and Dropping: State Corporate Tax Avoidance in the Fortune 500, 2008 to 2015,finds that effective tax rates paid by […]

State & Local Tax Contributions of Young Undocumented Immigrants (2017)

April 25, 2017 • By Meg Wiehe, Misha Hill

This report specifically examines the state and local tax contributions of undocumented immigrants who are currently enrolled or immediately eligible for DACA and the fiscal implications of various policy changes. The report includes information on the national impact (Table 1) and provides a state-by-state breakdown (Appendix 1).

Comparing the Distributional Impact of Revenue Options in Alaska

April 24, 2017 • By Aidan Davis, Carl Davis

Alaska is facing a significant budget gap because of a sharp decline in the oil tax and royalty revenue that has traditionally been relied upon to fund government. This report examines five approaches for replacing some of the oil revenue that is no longer available: enacting a broad personal income tax, state sales tax, payroll tax, investment income tax, or cutting the Permanent Fund Dividend (PFD). Any of the options examined in this report could make a meaningful contribution toward closing Alaska’s budget gap. To allow for comparisons across options, this report examines policy changes designed to generate $500 million…

Aidan Davis

April 21, 2017 • By ITEP Staff

Aidan is ITEP’s acting state policy director. She coordinates ITEP’s state tax policy research and advocacy agenda and works closely with policymakers, legislative staff, national and state organizations across the country to advance policy solutions that aim to achieve equitable and sustainable state and local tax systems.

Vox: Undocumented Immigrants Pay Taxes Too: Here’s How They Do It

April 19, 2017

Unauthorized workers aren’t eligible for benefits like the earned income tax credit — which is what the green box on the screen was warning Gonzalez about. Nor can they get Social Security or Medicare. But the IRS still wants unauthorized immigrants to file their taxes, and many of them do. The best estimates from the […]

Atlanta Journal Constitution: Is a flat tax right for Georgia?

April 11, 2017

That’s the problem Tharpe has with studies like the Wallethub.com survey. That 50-state look at state taxes found Georgia has a tax burden of 8.2 percent of individual personal income. The Washington, DC,-based financial services website ranked Georgia slightly better than Arizona and just behind Washington state. When I tweeted out those findings, Tharpe was quick to […]

This week in state tax news we saw a destructive tax cut effort defeated in Georgia, a state shutdown avoided in New York, and lawmakers hone in on major tax debates in Massachusetts, Nebraska, South Carolina, and WestVirginia. State efforts to collect taxes owed on online purchases continue to heat up as well. — Meg […]

Testimony before the Alaska House Labor & Commerce Committee On House Bill 36

April 4, 2017 • By Matthew Gardner

Thank you for the opportunity to testify on the changes House Bill 36 would make to Alaska's tax treatment of pass-through income. The taxation of pass-through business entities has been a focal point of state and federal tax reform debates for over a quarter century, with a dual focus on minimizing the role of tax laws in determining the choice of business entity and on ensuring that the income of all business entities is subject to at least a minimal tax. My testimony makes two main points: 1. Alaska is one of a small number of states that do not…

In the Tax Justice Digest we recap the latest reports, blog posts, and analyses from Citizens for Tax Justice and the Institute on Taxation and Economic Policy. Here’s a rundown of what we’ve been working on lately. Corporations Offshore Cash Hoard Grows to $2.6 Trillion U.S. corporations now hold a record $2.6 trillion offshore, a […]

International Business Times: Republican Health Care Plan: Trumpcare Gives Wealthiest 1% A $31B Taxcut

March 31, 2017

The wealthiest Americans will see the biggest benefit from the Republican plan to repeal the tax on investments and additional Medicare tax in the Republican American Health Care Act, a state-by-state analysis by the Institute on Taxation and Economic Policy indicates, with California and the District of Columbia the biggest winners. The analysis indicated the […]

State Rundown 3/29: More States Looking to Raise or Protect Revenues Amid Fiscal and Federal Uncertainty

March 29, 2017 • By ITEP Staff

This week we see West Virginia, Georgia, Minnesota, and Nebraska continue to deliberate regressive tax cut proposals, as the District of Columbia considers cancelling tax cut triggers it put in place in prior years, and lawmakers in Hawaii, Washington, Kansas, and Delaware ponder raising revenues to shore up their budgets. Meanwhile, gas tax debates continue […]

A growing number of Americans are getting rides or booking short-term accommodations through online platforms such as Uber and Airbnb. This is nothing new in concept; brokers have operated for hundreds of years as go-betweens for producers and consumers. The ease with which this can be done through the Internet, however, has led to millions of people using these services, and to some of the nation's fastest-growing, high-profile businesses. The rise of this on-demand sector, sometimes referred to as the "gig economy" or, by its promoters, the "sharing economy," has raised a host of questions. For state and local governments,…

Undocumented Immigrants’ State & Local Tax Contributions

March 1, 2017 • By Lisa Christensen Gee, Meg Wiehe, Misha Hill

Public debates over federal immigration reform, specifically around undocumented immigrants, often suffer from insufficient and inaccurate information about the tax contributions of undocumented immigrants, particularly at the state level. The truth is that undocumented immigrants living in the United States paybillions of dollars each year in state and local taxes. Further, these tax contributions would increase significantly if all undocumented immigrants currently living in the United States were granted a pathway to citizenship as part of comprehensive immigration reform. Or put in the reverse, if undocumented immigrants are deported in high numbers, state and local revenues could take a substantial…

What to Watch in the States: State-Federal Relationship Shifting

February 28, 2017 • By Dylan Grundman O'Neill

So far in this series on tax policy topics to watch in 2017, we’ve covered important state debates in areas such as attempts to weaken or eliminate progressive taxes and needed updates to gas taxes and sales taxes. As if those topics weren’t enough to keep state lawmakers up at night, they will be making […]

Combined Reporting of State Corporate Income Taxes: A Primer

February 24, 2017 • By Dylan Grundman O'Neill, Meg Wiehe

Over the past several decades, state corporate income taxes have declined markedly. One of the factors contributing to this decline has been aggressive tax avoidance on the part of large, multi-state corporations, costing states billions of dollars. The most effective approach to combating corporate tax avoidance is combined reporting, a method of taxation currently employed in more than half of the states that tax corporate income. The two most recent states to enact combined reporting are Rhode Island in 2014 and Connecticut in 2015. In several states, including Connecticut, Illinois, Massachusetts, Rhode Island, and Vermont, lawmakers adopted the policy after…