Illinois

Over the past week Utah continued its slow march toward a more inequitable tax code...

Many state legislative sessions are in the final stretch...

Local Mansion Taxes: Building Stronger Communities with Progressive Taxes on High-Value Real Estate

March 14, 2024 • By Andrew Boardman

More than one dozen cities and counties levy progressive taxes on high-price real estate transactions — sometimes called mansion taxes — and over a dozen more are considering such policies. By asking buyers and sellers with greater financial means to contribute more to the common good, these policies are equipping communities with resources to make progress on critical challenges of local and national concern.

Anti-tax interests finally found the end of the tax cutting appetite in a few states this week...

ITEP’s Kamolika Das Testifies on Pennsylvania’s Upside-Down Tax Code

March 4, 2024

Below is written testimony delivered by ITEP Local Policy Director Kamolika Das before the Pennsylvania House Finance Subcommittee on Tax Modernization & Reform on March 1, 2024. Good afternoon and thank you for this opportunity to testify. My name is Kamolika Das, I live in South Philly, and I’m the Local Tax Policy Director at […]

State legislative sessions are in full swing with New Jersey and Oklahoma both particularly active this week...

State Rundown 2/22: Some Top-Heavy Tax Cut Proposals are Getting the Chop

February 22, 2024 • By ITEP Staff

With many state legislatures now in full swing with activity heating up, some tax cut proposals have lost steam...

State Rundown 2/8: Flowers, Chocolates, and Tax Cuts for the Wealthy?

February 8, 2024 • By ITEP Staff

While we were hoping to get progressive tax policy wins for Valentine’s Day, many state lawmakers have another idea in mind...

State Rundown 1/26: Wealth Taxes Drawing Interest Early in Legislative Sessions

January 26, 2024 • By ITEP Staff

Bills are moving and state legislative sessions are picking up across the country, giving elected officials the opportunity to consider two distinct paths when it comes to tax policy...

State Tax Watch 2024

January 23, 2024 • By ITEP Staff

Updated July 15, 2024 In 2024, state lawmakers have a choice: advance tax policy that improves equity and helps communities thrive, or push tax policies that disproportionately benefit the wealthy, drain funding for critical public services, and make it harder for low-income and working families to get ahead. Despite worsening state fiscal conditions, we expect […]

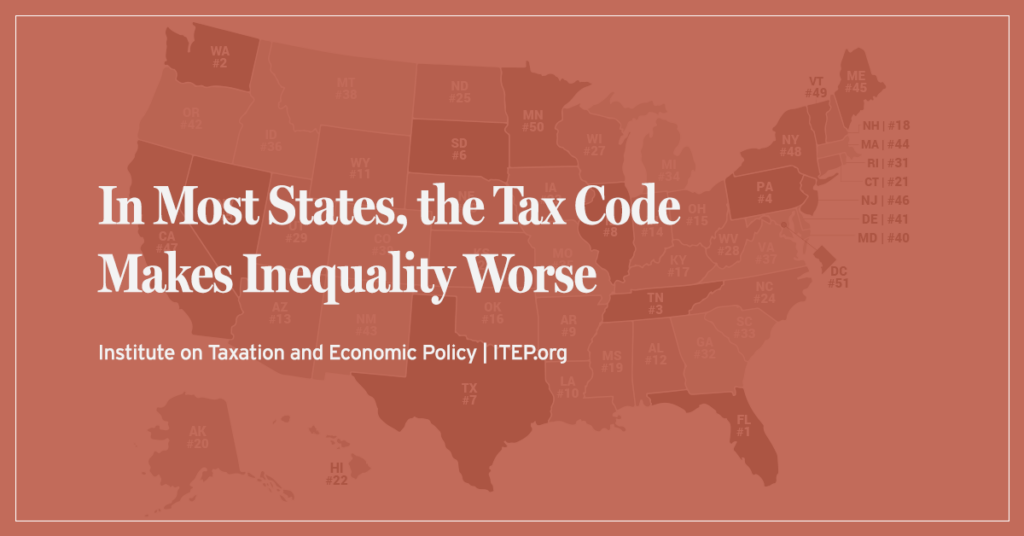

The findings of Who Pays? go a long way toward explaining why so many states are failing to raise the amount of revenue needed to provide full and robust support for our public schools.

State Rundown 1/11: Sounding the Alarm on Regressive State & Local Tax Codes

January 11, 2024 • By ITEP Staff

States got a wake-up call this week as ITEP released the latest edition of our flagship Who Pays? report...

The vast majority of state and local tax systems are upside-down, with the wealthy paying a far lesser share of their income in taxes than low- and middle-income families. Yet a few states have made strides to buck that trend and have tax codes that are somewhat progressive and therefore do not worsen inequality.

Tax Systems in 44 States Exacerbate Inequality, In-Depth ‘Who Pays?’ Study Finds

January 9, 2024 • By ITEP Staff

The vast majority of state and local tax systems are upside-down, with the wealthy paying a far lesser share of their income in taxes than low- and middle-income families. That’s according to the latest edition of the Institute on Taxation and Economic Policy’s Who Pays?, the only distributional analysis of tax systems in all 50 states and the District of Columbia.

Illinois: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Illinois Download PDF All figures and charts show 2024 tax law in Illinois, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (98.6 percent) state and local tax revenue collected in Illinois. State and local tax shares of family income Top 20% Income Group […]

Even as revenue collections slow in many states, some are starting the push for 2024 tax cuts early. For instance, policymakers in Georgia and Utah are already making the case for deeper income tax cuts. Meanwhile, Arizona lawmakers are now facing a significant deficit, the consequence of their recent top-heavy tax cuts. There is another […]

Though Turkey Day has passed, lawmakers in states across the U.S. have yet to get their fill of delicious tax policy goodness...

Local Earned Income Tax Credits: How Localities Are Boosting Economic Security and Advancing Equity with EITCs

October 30, 2023 • By Andrew Boardman, Galen Hendricks, Kamolika Das

Leading localities are using refundable EITCs to boost incomes and reduce taxes for workers and families with low and moderate incomes. These local credits build on the success of EITCs at the federal and state levels, reduce economic hardship and improve the fairness of the tax code.

State Rundown 10/26: Off-Year Ballot Measures and State & Local Tax Policy

October 26, 2023 • By ITEP Staff

November elections are creeping closer and closer and while that typically means a new batch of lawmakers are elected, it also means voters have another chance to help shape state and local tax policy...

State Rundown 9/27: Some States are Looking to Paint the Budgets Red

September 27, 2023 • By ITEP Staff

When it comes to investments, state lawmakers across the country are positioning their states to be in the red as they pass or debate further tax cuts that will overwhelmingly benefit the wealthy – and some states are now adding an additional coat of red paint...

The U.S. Census Bureau released its annual assessment of poverty in America this week...

State Tax Credits Have Transformative Power to Improve Economic Security

September 12, 2023 • By Aidan Davis

The latest analysis from the U.S. Census Bureau provides an important reminder of the compelling link between public investments and families’ economic well-being. Policy decisions can drastically reduce poverty and improve family economic stability for low- and middle-income families alike, as today’s data release shows.

Boosting Incomes, Improving Equity: State Earned Income Tax Credits in 2023

September 12, 2023 • By Aidan Davis, Neva Butkus

Nearly two-thirds of states (31 plus the District of Columbia and Puerto Rico) have an Earned Income Tax Credit, an effective tool that boosts low-paid workers’ incomes and helps lower-income families achieve greater economic security. This year, 12 states expanded and improved EITCs.

While a number of state tax laws are debated, approved, and vetoed in any given year, many go unnoticed...

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

August 2, 2023 • By Marco Guzman

Nineteen states have sales tax holidays on the books in 2023, and these suspensions will cost nearly $1.6 billion in lost revenue this year. Sales tax holidays are poorly targeted and too temporary to meaningfully change the regressive nature of a state’s tax system. Overall, the benefits of sales tax holidays are minimal while their downsides are significant.