Immigration and Taxes

Palantir Pays Zero Federal Income Tax Despite Explosive Growth, Largely Due to Trump Tax Law

February 17, 2026 • By Matthew Gardner

Palantir reported $1.5 billion of U.S. income but paid exactly zero federal income tax in 2025. Despite explosive growth, tax breaks from the Trump tax law helped Palantir avoid paying even a dime of federal income tax on its earnings.

From Congressional discussions over the so-called "One Big Beautiful Bill Act" to debates on property taxes, ITEP kept busy this year analyzing tax proposals and showing Americans across the country how tax decisions affect them.

House Tax Bill Would Create a Parallel, Harsher Tax Code for Immigrant Filers and their Citizen Family Members

May 22, 2025 • By Carl Davis, Sarah Austin

Immigrant tax filers face a harsher tax code than citizens in some important respects. Sweeping tax legislation recently passed by the House of Representatives would apply new or stricter limits for immigrant tax filers to 10 additional areas of the tax code.

Millions of Citizen Children Would be Harmed by Proposal Billed as Targeting Immigrant Tax Filers

April 24, 2025 • By Emma Sifre, Joe Hughes

Congressional Republicans have floated a proposal to strip the Child Tax Credit from millions of children who are U.S. citizens and legal residents in situations where their parents do not have Social Security numbers. Approximately 4.5 million citizen children with Social Security numbers would lose access to the credit under this proposal.

IRS Cooperation with ICE Will Damage Public Trust, Putting Tax Revenues in Jeopardy

April 10, 2025 • By Marco Guzman

Attempts by the Department of Homeland Security to secure private information from the IRS on people who file taxes with an Individual Taxpayer Identification Number is a violation of federal privacy laws that protect taxpayers. It is also a change that could seriously damage public trust in the IRS, which could jeopardize billions of dollars in tax payments by hardworking immigrant families.

Sharp Turn in Federal Policy Brings Significant Risks for State Tax Revenues

April 9, 2025 • By Carl Davis

Summary The new presidential administration and Congress have indicated that they intend to bring about a dramatic federal retreat in funding for health care, food assistance, education, and other services that will push more of the responsibility for providing these essential services to the states. Meeting these new obligations would be a challenging task for […]

In last night’s address to Congress, President Trump spent more time insulting Americans, lying, and bragging than he did talking about taxes. But regardless of what President Trump and Elon Musk talk about most loudly and angrily, there is one clear policy that they and the corporations and billionaires that support them will try hardest […]

Turning IRS Agents to Deportation Will Reduce Public Revenues

February 11, 2025 • By Carl Davis, Jon Whiten

The Trump Administration’s plan to turn IRS agents into deportation agents will result in lower tax collections in addition to the harm done to the families and communities directly affected by deportations.

Undocumented Immigrants Pay More Than Their Fair Share of Taxes

January 6, 2025 • By ITEP Staff

Undocumented immigrants help fund teacher salaries, road and bridge repairs and other local quality-of-life improvements. They also pay into vital programs that make up our social safety net (including Social Security, Medicare and unemployment insurance) even though they will likely never see any benefits from these programs — because, in most circumstances, they are legally prohibited from accessing them.

As we close out 2024, we want to lift up the tax charts we published this year that received the most engagement from readers. Covering federal, state, and local tax work, here are our top charts of 2024.

Trump’s Plan to Vaporize the Economy Through Mass Deportation

September 16, 2024 • By Michael Ettlinger

This op-ed originally appeared in the Boston Globe. What would happen if 22 percent of America’s farmworkers vanished from the workforce? Would workers from across the country flock to the cotton fields of Texas, the sugar fields of Florida, and the peanut farms of Georgia to take low-paying jobs in the blazing heat? Or would […]

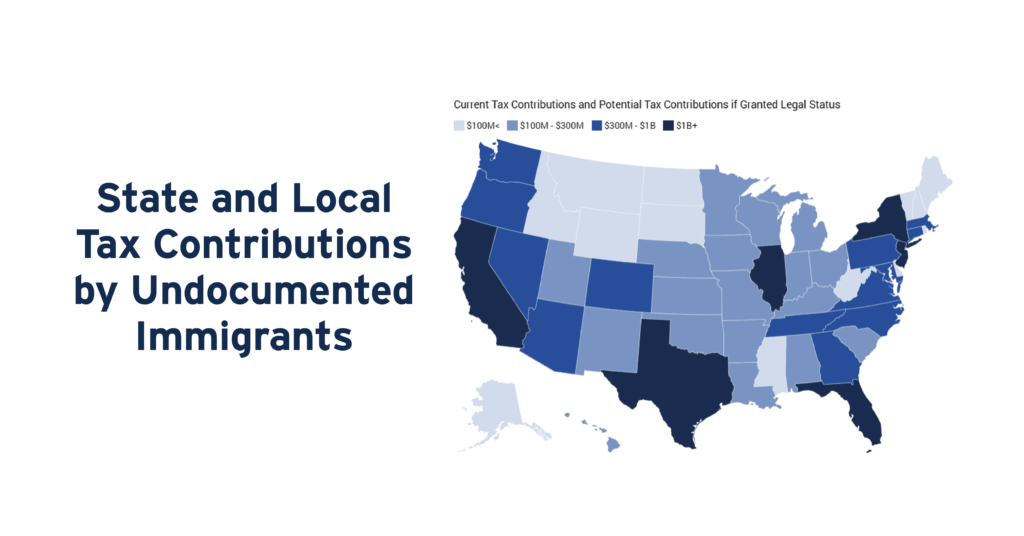

Undocumented immigrants pay taxes that help fund public infrastructure, institutions, and services in every U.S. state. Nearly 39 percent of the total tax dollars paid by undocumented immigrants in 2022 ($37.3 billion) went to state and local governments.

Study: Undocumented Immigrants Contribute Nearly $100 Billion in Taxes a Year

July 30, 2024 • By ITEP Staff

Contact: Jon Whiten ([email protected]) Immigration policies have taken center stage in public debates this year, but much of the conversation has been driven by emotion, not data. A new in-depth study from the Institute on Taxation and Economic Policy aims to help change that by quantifying how much undocumented immigrants pay in taxes – both […]

Undocumented immigrants paid $96.7 billion in federal, state, and local taxes in 2022. Providing access to work authorization for undocumented immigrants would increase their tax contributions both because their wages would rise and because their rates of tax compliance would increase.

Improving Refundable Tax Credits by Making Them Immigrant-Inclusive

July 17, 2024 • By Emma Sifre, Marco Guzman

Undocumented immigrants who work and pay taxes but don't have a valid Social Security number for either themselves or their children are excluded from federal EITC and CTC benefits. Fortunately, several states have stepped in to ensure undocumented immigrants are not left behind by the gaps in the federal EITC and CTC. State lawmakers should continue to ensure that immigrants who are otherwise eligible for these tax credits receive them.

Semafor: Immigration ‘Will Boost US Economy by $7 Trillion’ Over Next Decade

February 12, 2024

The ongoing surge of immigration to the United States will boost its economy by $7 trillion over the next decade by expanding the labor force and increasing consumer demand, a report from the nonpartisan Congressional Budget Office found.

President Joe Biden's American Families and Jobs plans intend to “build back better” and create a more inclusive economy. To fully live up to this ideal, the final plan must include undocumented people and their families.

ITIN Filer Data Gap: How Changing Laws, Lack of Data Disaggregation Limit Inclusive Tax Policy

June 17, 2021 • By Emma Sifre

Like U.S. citizens, noncitizens who live, work, or invest in the United States must file local, state and federal taxes. But in order to file personal income taxes, they must first be issued a processing number called an Individual Taxpayer Identification Number (ITIN) by the IRS. These numbers are issued to both legal permanent residents and nonresidents who are not eligible for Social Security numbers. ITINs do not imply immigration status, nor can they be used for immigration enforcement purposes, but they can be used to create burdensome barriers that make it difficult for ITIN holders to file taxes and…

Inclusive Child Tax Credit Reform Would Restore Benefit to 1 Million Young ‘Dreamers’

April 27, 2021 • By Marco Guzman

As the Biden administration maps out the next steps in America’s response to the coronavirus pandemic—through what is now being called the American Families Plan—it should make sure a proposed expansion of the Child Tax Credit (CTC) includes undocumented children who have largely been left out of federal relief packages this past year. Prior to 2017 Tax Cut and Jobs Act, all children regardless of their immigration status received the credit as long as their parents met the income eligibility requirements. This change essentially excluded around 1 million children and their families.

Beyond SCOTUS: States Recognize Need for More Inclusive Immigrant Policy

June 26, 2020 • By Marco Guzman

The U.S. Supreme Court last week halted an effort by the Trump administration that would have stripped DACA (Deferred Action for Childhood Arrivals) recipients of their lawful status in the country. The 5-4 ruling is a significant victory for immigrant rights advocates and over 643,000 Dreamers—as they’re known—who were brought here as children and have […]

Fiscal Policy Institute: Unemployment Insurance Taxes Paid for Undocumented Workers in NYS

May 14, 2020

In the midst of a pandemic, there has been a growing call for undocumented immigrants, who make up five percent of the New York State labor force, to be covered by some form of unemployment insurance. What is often overlooked in discussions of unemployment insurance is the extent to which undocumented immigrants are already part […]

Morally and Economically, Including Undocumented Immigrants Is the Right Thing to Do

April 17, 2020 • By ITEP Staff

Undocumented immigrants pay taxes and play an integral part in the social and economic welfare of our country, yet Congress left them almost entirely out of the CARES Act package. Fortunately, immigrants, workers and their allies are helping policymakers advance better policy approaches.

Oregon Center for Public Policy: Measure 105 Would Set Oregon Back

October 25, 2018

Immigrants, regardless of their immigration status, give the economy a boost. In Marion County alone, undocumented immigrants pay more than $14 million in taxes every year to local and state authorities. Oregon is better for having immigrants, and will be better for it for generations to come. Read more here

Oregon Center for Public Policy: Undocumented Workers in Multnomah County Pay Millions in Oregon Taxes

October 17, 2018

An estimated 27,000 undocumented Multnomah County residents pay nearly $19 million annually in state and local taxes. For perspective, that is enough to hire 217 teachers. Read more here

Oregon Center for Public Policy: Undocumented Workers in Washington County Pay Millions in Oregon Taxes

October 17, 2018

An estimated 27,000 undocumented Washington County residents pay more than $20 million annually in state and local taxes. For perspective, that is enough to hire 232 teachers. Read more here