Texas

State Rundown 6/18: States Work to “Finalize” Budgets in Uncertain Times

June 18, 2020 • By ITEP Staff

Despite uncertainty all around the nation, a few states passed budgets this week and many more are negotiating to enact theirs before fiscal years close at the end of June. Colorado notably pared back some of its own tax breaks and limited the potential damage on its budget from new federal breaks. California also passed a budget but few in the state actually think the dealing is done. Iowa quietly enacted its budget too, though advocates in the state are making noise about non-fiscal bills that were added late in the game.

As calls to defund the police demonstrate, state and local decisions about funding priorities and how those funds are raised are deeply embedded in racial justice issues. Tax justice is also a key component in advancing racial justice. Racial wealth disparities are the result of countless historic inequities and tax policy choices are certainly among […]

State Rundown 5/20: State Revenue Crisis Getting Clearer…and Scarier

May 20, 2020 • By ITEP Staff

State policymakers are navigating incredibly uncertain waters these days as they attempt to get a firmer grasp on the scale of their revenue crises, identify painful budget cuts they may have to make in response, and look for ways to raise tax revenues coming from the households and corporations still bringing in large incomes and profits amid the pandemic—all while hoping that additional federal aid and greater flexibility in how they can use federal CARES Act funds will help relieve some of these difficult decisions.

Forbes: 4.3 Million Adults Eligible For Two $1,200 Stimulus Checks If HEROES Act Passes

May 15, 2020

The Institute On Taxation and Economic Policy (ITEP) estimates that over 4.3 million adults, as well as 3.5 million children, would benefit from this change in eligibility. The organization calculated that ITIN filers would receive over $9.4 billion in direct economic relief from the new economic impact payments. Moreover, the retroactive clause would mean disbursement […]

A bipartisan group of governors and senators from Louisiana to Maryland to Ohio have called for at least $500 billion in state and local fiscal relief. They also need specific help with testing, protective equipment, unemployment costs, Medicaid costs, social services, education and infrastructure. States can’t be on their own as they address the double whammy of plunging revenue and skyrocketing needs.

Chicago Tribune: Agencies scramble to help Lake County undocumented immigrants impacted by coronavirus crisis

April 18, 2020

According to the Institute on Taxation and Economic Policy, Illinois is one of six states that derive the most revenue from taxes paid by undocumented immigrants. California, Florida, New York, Texas and New Jersey, are also on the list. Read more

State Rundown 4/15: Tax Day Delayed but Other Important Work Accelerated

April 15, 2020 • By ITEP Staff

April 15 is traditionally the day federal and state income taxes are due, but like so much else, Tax Day is on hold for the time being. Meanwhile the pandemic’s disastrous and uneven effects on communities and shared institutions are decidedly not suspended. But nor are the efforts of individuals, advocates, and policymakers to develop solutions to respond to the immediate crisis while also building better systems going forward. ITEP’s recommendations for state tax policy responses are now available here, and this week’s Rundown includes experiences and perspectives on paths forward from around the country.

State Options to Shore up Revenues and Improve Tax Codes amid Pandemic

April 15, 2020 • By Dylan Grundman O'Neill, Meg Wiehe

The COVID-19 pandemic is an extraordinarily challenging time, as we see harm and struggle affecting the vast majority of our families, businesses, public services, and economic sectors. No one will be unaffected by the crisis, and everyone has a stake in the recovery and faces tough decisions. In the world of state fiscal policy, where revenue shortfalls are likely to be far bigger than can be filled by the initial $150 billion in federal aid or absorbed through funding cuts without causing major harm, tax increases must be among those decisions. Even with more federal support, states will need home-grown…

State Rundown 4/9: Pandemic’s Fiscal Effects Slowly Coming into Focus

April 9, 2020 • By ITEP Staff

The COVID-19 pandemic continued this week to wreak havoc on lives and communities around the world. The fiscal fallout of the virus in the states is growing as well, and beginning this week to come into sharper focus. This week’s Rundown brings together what we know of that slowly clarifying picture and how states are responding so far.

State Rundown 4/3: States Welcome Federal Aid, Seek Further Solutions

April 3, 2020 • By ITEP Staff

States and families got good news this week as Congress came together to pass major aid to help during the COVID-19 coronavirus pandemic. But that bright spot came amid an onslaught of very difficult news about the public health crisis and the economic and fiscal fallout accompanying it. This week’s Rundown brings you the latest on these developments and state and local responses to them.

Sales Taxes and Social Distancing: State and Local Governments May Face Their Steepest Sales Tax Decline Ever

April 2, 2020 • By Carl Davis, ITEP Staff, Meg Wiehe

One pressing question is what will an economic downturn in which consumers are anxious, facing job loss, or simply spending their time sheltering in place and not spending money in typical ways, mean for states’ ability to raise revenue?

Bloomberg:Billion-Dollar Blows to U.S. States Crater Spending Plans

April 1, 2020

At least 38 states and territories have issued some version of a stay-at-home order, shuttering parts of the economy as residents stay inside and restaurants and stores close. The result may be the steepest drop in sales taxes ever, according to the Institute on Taxation and Economic Policy, a left-leaning think tank. States like Florida, […]

State Rundown 3/4: Sun Shining on Progressive Tax Efforts This Week

March 4, 2020 • By ITEP Staff

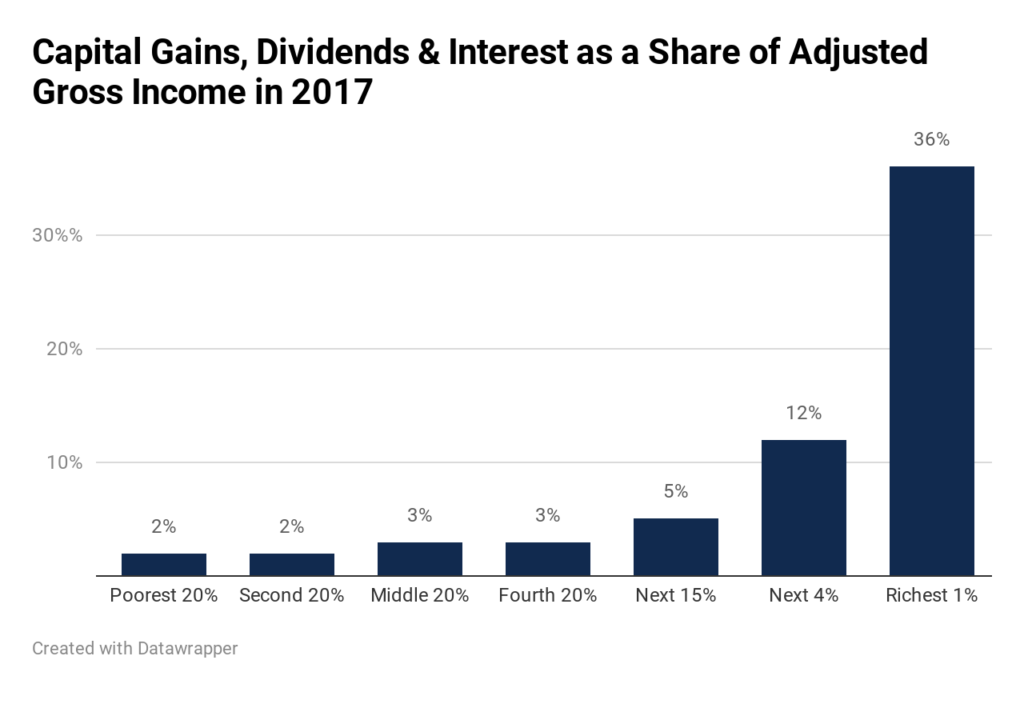

Wisconsin’s expansion of a capital gains tax break for high-income households represents a dark spot on this week’s state fiscal news, and the growing threat of COVID-19 is casting an ominous shadow over all of it, but otherwise the picture is pleasantly sunny, featuring small steps forward for sound, progressive tax policy. An initiative to create a graduated income tax in Illinois, for example, got a vote of confidence from a major ratings agency, while a similar effort went public in Michigan and two progressive income tax improvements were debated in Rhode Island. Gas tax updates made encouraging progress in…

Anti-tax activists’ convoluted claims that the rich pay too much in taxes broke new ground with an op-ed published last week in the Wall Street Journal. Penned by former Texas Sen. Phil Gramm and John Early, a former official of the Bureau of Labor Statistics, the piece is particularly misleading. The so-called evidence in support of their argument against raising taxes on the rich fails to correctly calculate effective tax rates.

State Rundown 2/20: Property Taxes and School Finance Take Center Stage

February 20, 2020 • By ITEP Staff

Property taxes and education funding are a major focus in state fiscal debates this week. California voters will soon vote on borrowing billions of dollars to fill just part of the funding hole created in large part by 1978’s anti-property-tax Proposition 13. Nebraska lawmakers are debating major school finance changes that some fear will create similar long-term fiscal issues. And Idaho and South Dakota leaders are looking to avoid that fate by reducing property taxes in ways that will target the families who most need the help. Meanwhile, Arkansas, Nevada, and New Hampshire are taking close looks at their transportation…

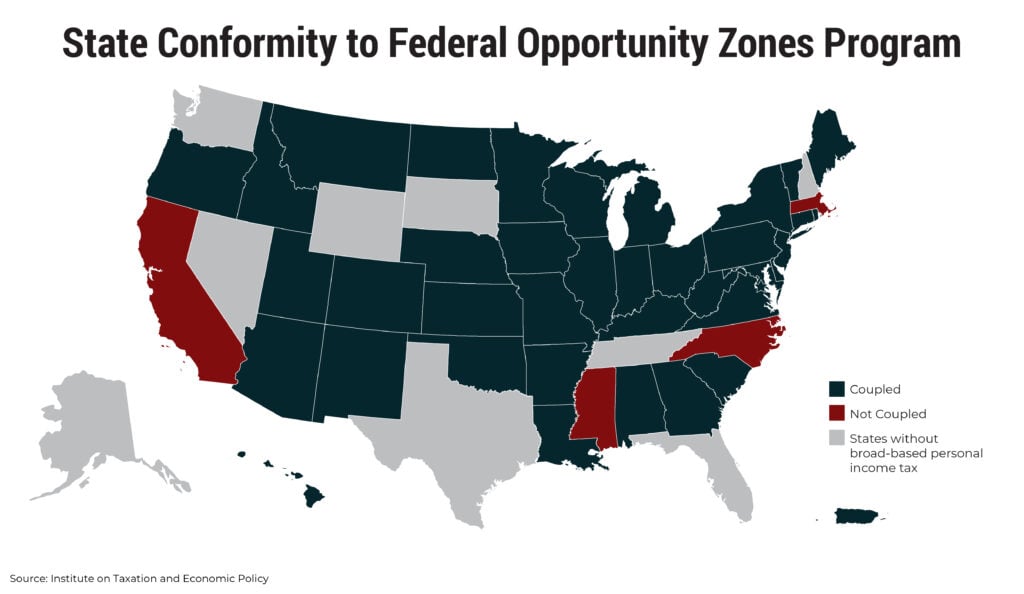

States Should Decouple from Costly Federal Opportunity Zones and Reject Look-Alike Programs

December 12, 2019 • By ITEP Staff

Post enactment of TCJA, lawmakers in most states needed to decide how to respond to the creation of this new program. Given the shortcomings of the federal Opportunity Zones program and its added potential costs to states, the most prudent course of action is three-pronged: States should move quickly to decouple; states should reject look-alike programs; and lawmakers should make investments directly into economically distressed areas.

State Rundown 11/6: State Voters Show Readiness to Fix Broken Tax Codes

November 6, 2019 • By ITEP Staff

Many of yesterday’s Election Day votes came down to questions of whether or not to improve on upside-down and often inadequate state and local tax systems. The status quo was maintained in Colorado, where voters failed to approve a proposition to allow the state to invest tax revenue in education and other needs, and in Texas, where a constitutional amendment was approved to prohibit the state from creating an income tax. But voters supported important reforms in other states by approving needed funding for schools in Idaho, opting to legalize and tax recreational cannabis in California. And for more on…

House Passes Landmark Bipartisan Bill to Crack Down on Shell Companies Used for Tax Evasion and Other Crimes

October 24, 2019 • By Steve Wamhoff

On Tuesday night, 25 Republicans joined nearly all the chamber’s Democrats to approve the Corporate Transparency Act, a bill that would require those creating a company to report its owners to the federal government. The White House expressed support but called for the House and Senate to work on certain details, creating the possibility that the measure could be enacted.

State Rundown 10/10: Always Something Old, Something New in State Tax Debates

October 10, 2019 • By ITEP Staff

Creative thinking from Pennsylvania lawmakers has helped them discover that the Wayfair ruling allowing states to collect sales tax from online retailers can also help them identify and tax corporate profits earned in their borders. Similarly, New York leaders had the vision to put bold environmental goals in place and identify a carbon price as a potential pay-for. Gubernatorial candidates in Mississippi and Kentucky showed less ingenuity, proposing tax cuts even though Mississippi is still phasing in a massive tax cut from a few years ago and Kentucky’s next election isn’t until 2020. Meanwhile, the old idea of eliminating income…

State Rundown 9/26: Shady State Business Tax Subsidies Coming to Light

September 26, 2019 • By ITEP Staff

Lawmakers in Michigan and New Hampshire made progress toward enacting their state budgets, though Michigan may yet end up in a government shutdown. Leaders in Wyoming advanced a proposal to create a limited tax on large corporations to raise some revenue and add a progressive element to their state’s tax code. Georgia agencies are forced to recommend their own funding cuts amid state income tax cuts. And business tax subsidies are looking particularly bad in Maryland, where subsidy money has been handed out without verification that companies were creating jobs, and New Jersey, where a false threat to leave the…

State Rundown 9/12: Work Continues to Flip the Script on Backwards Tax Codes

September 12, 2019 • By ITEP Staff

Residents of several states are spending their palindrome week reading ballot initiatives forwards and backwards to decide whether or not to support them, including measures to improve education funding in California and Idaho, allow Alaska and Colorado to invest more in public services, and constitutionally prohibit income taxation in Texas. New Jersey lawmakers are giving the same thorough treatment to the state’s corporate tax subsidies. And advocates in Chicago, Illinois, have a bold proposal to flip the script on upside-down taxes there. But devotees of good policy and honest government in North Carolina won’t want to re-read yesterday’s news in…

State Rundown 8/15: A Tax-Subsidy Cease-Fire in Kansas and Missouri

August 15, 2019 • By ITEP Staff

Over the last couple of weeks, leaders in Kansas and Missouri reached a historic agreement to stop giving away tax subsidies just to entice companies a couple of miles across their shared state line. Meanwhile, policymakers in Alaska resolved a stand-off over education funding...by cutting education funding slightly less. And California voters may be voting in 2020 on a stronger reform to the notoriously inequitable property tax effects of “Proposition 13.”

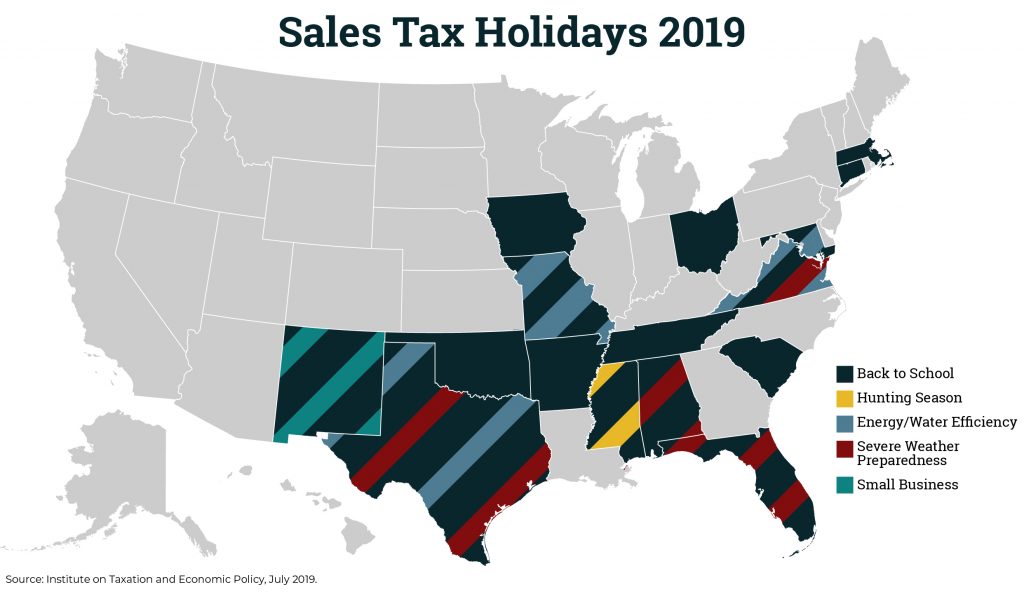

WPEC: Retailers Ready for Back-to-School Tax ‘Holiday’

July 31, 2019

But not everyone is sold on the value of sales-tax holidays. The Washington, D.C.-based Institute on Taxation and Economic Policy, a non-profit liberal think tank, calls such holidays an “outdated gimmick.” Dylan Grundman, a senior policy analyst for the institute, argued in a news release that the brief holiday periods don’t reduce taxes for low- […]

New York Times: State and Local Taxes Are Worsening Inequality

July 21, 2019

Low-income households in Illinois pay about 14 cents in state and local taxes from every dollar of income, while the state’s most affluent households pay about 7 cents per dollar. That gap between the poor and the wealthy in Illinois is one of the largest in any state, but the poor pay taxes at higher […]

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 17, 2019 • By Dylan Grundman O'Neill

Lawmakers in many states have enacted “sales tax holidays” (16 states will hold them in 2019), to provide a temporary break on paying the tax on purchases of clothing, school supplies, and other items. While these holidays may seem to lessen the regressive impacts of the sales tax, their benefits are minimal. This policy brief looks at sales tax holidays as a tax reduction device.