Trump-GOP Tax Law

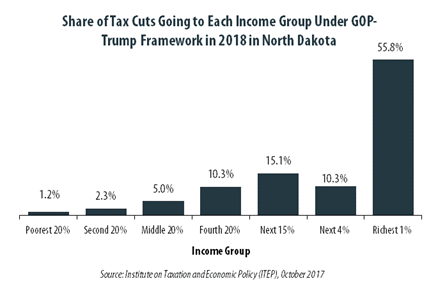

GOP-Trump Tax Framework Would Provide Richest One Percent in North Dakota with 55.8 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in North Dakota equally. The richest one percent of North Dakota residents would receive 55.8 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $693,800 next year. The framework would provide them an average tax cut of $111,620 in 2018, which would increase their income by an average of 6.5 percent.

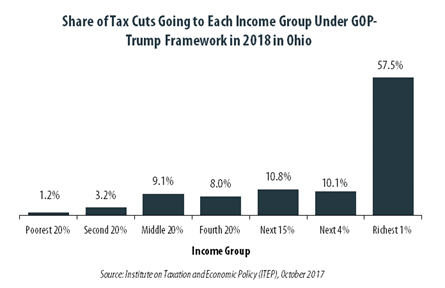

GOP-Trump Tax Framework Would Provide Richest One Percent in Ohio with 57.5 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Ohio equally. The richest one percent of Ohio residents would receive 57.5 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $483,100 next year. The framework would provide them an average tax cut of $56,280 in 2018, which would increase their income by an average of 3.7 percent.

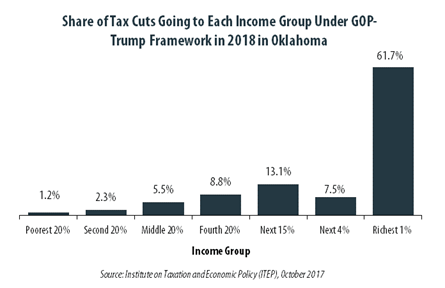

GOP-Trump Tax Framework Would Provide Richest One Percent in Oklahoma with 61.7 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Oklahoma equally. The richest one percent of Oklahoma residents would receive 61.7 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $498,400 next year. The framework would provide them an average tax cut of $72,150 in 2018, which would increase their income by an average of 5.5 percent.

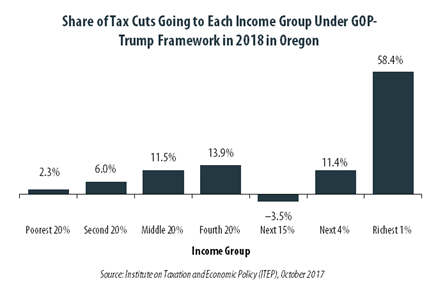

GOP-Trump Tax Framework Would Provide Richest One Percent in Oregon with 58.4 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Oregon equally. The richest one percent of Oregon residents would receive 58.4 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $532,000 next year. The framework would provide them an average tax cut of $42,090 in 2018, which would increase their income by an average of 2.5 percent.

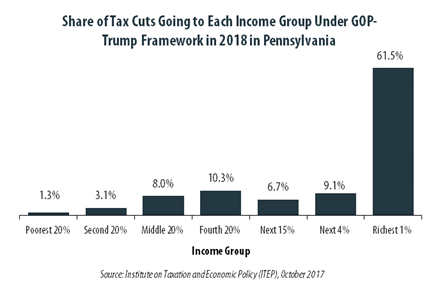

GOP-Trump Tax Framework Would Provide Richest One Percent in Pennsylvania with 61.5 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Pennsylvania equally. The richest one percent of Pennsylvania residents would receive 61.5 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $550,200 next year. The framework would provide them an average tax cut of $67,970 in 2018, which would increase their income by an average of 3.8 percent.

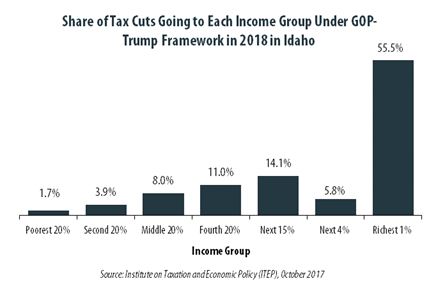

GOP-Trump Tax Framework Would Provide Richest One Percent in Idaho with 55.5 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Idaho equally. The richest one percent of Idaho residents would receive 55.5 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $457,600 next year. The framework would provide them an average tax cut of $52,540 in 2018, which would increase their income by an average of 3.7 percent.

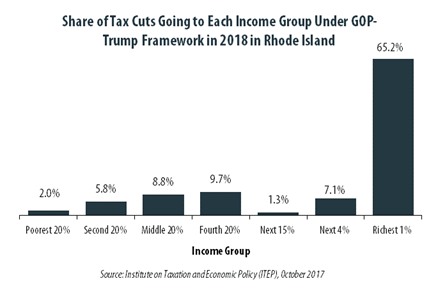

GOP-Trump Tax Framework Would Provide Richest One Percent in Rhode Island with 65.2 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Rhode Island equally. The richest one percent of Rhode Island residents would receive 65.2 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $528,800 next year. The framework would provide them an average tax cut of $55,510 in 2018, which would increase their income by an average of 3.1 percent.

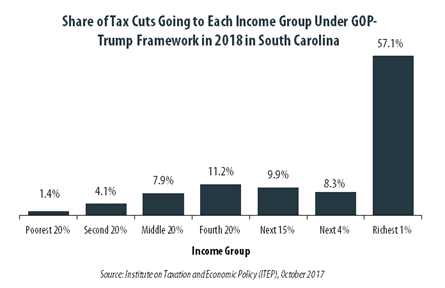

GOP-Trump Tax Framework Would Provide Richest One Percent in South Carolina with 57.1 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in South Carolina equally. The richest one percent of South Carolina residents would receive 57.1 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $478,100 next year. The framework would provide them an average tax cut of $52,250 in 2018, which would increase their income by an average of 4.6 percent.

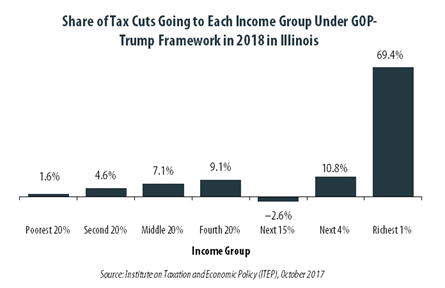

GOP-Trump Tax Framework Would Provide Richest One Percent in Illinois with 69.4 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Illinois equally. The richest one percent of Illinois residents would receive 69.4 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $651,700 next year. The framework would provide them an average tax cut of $84,170 in 2018, which would increase their income by an average of 3.1 percent.

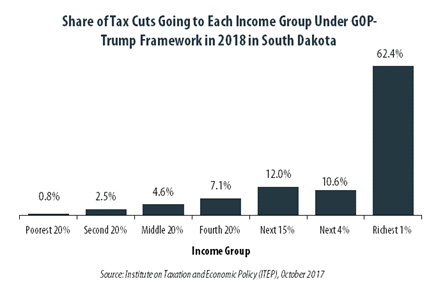

GOP-Trump Tax Framework Would Provide Richest One Percent in South Dakota with 62.4 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in South Dakota equally. The richest one percent of South Dakota residents would receive 62.4 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $589,600 next year. The framework would provide them an average tax cut of $129,120 in 2018, which would increase their income by an average of 7.3 percent.

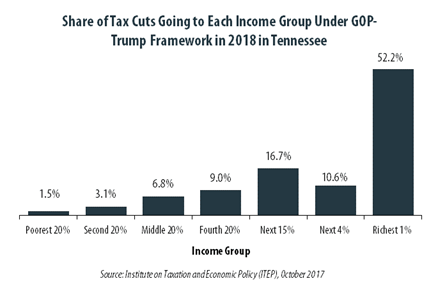

GOP-Trump Tax Framework Would Provide Richest One Percent in Tennessee with 52.2 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Tennessee equally. The richest one percent of Tennessee residents would receive 52.2 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $534,500 next year. The framework would provide them an average tax cut of $60,940 in 2018, which would increase their income by an average of 3.3 percent.

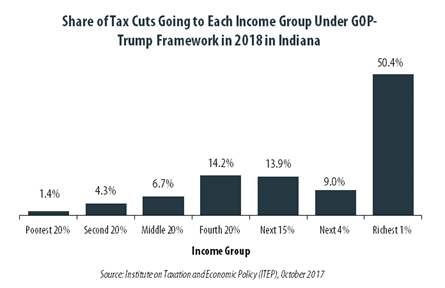

GOP-Trump Tax Framework Would Provide Richest One Percent in Indiana with 50.4 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Indiana equally. The richest one percent of Indiana residents would receive 50.4 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $500,500 next year. The framework would provide them an average tax cut of $54,510 in 2018, which would increase their income by an average of 3.5 percent.

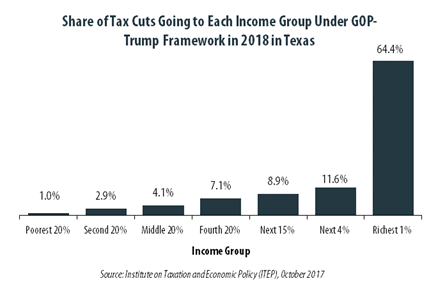

GOP-Trump Tax Framework Would Provide Richest One Percent in Texas with 64.4 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Texas equally. The richest one percent of Texas residents would receive 64.4 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $696,400 next year. The framework would provide them an average tax cut of $119,040 in 2018, which would increase their income by an average of 5.9 percent.

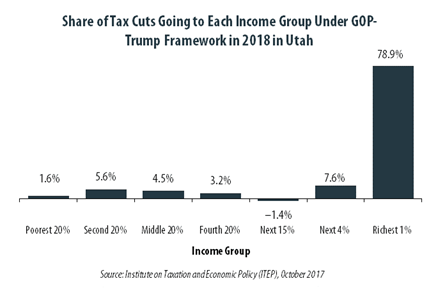

GOP-Trump Tax Framework Would Provide Richest One Percent in Utah with 78.9 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Utah equally. The richest one percent of Utah residents would receive 78.9 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $545,500 next year. The framework would provide them an average tax cut of $82,990 in 2018, which would increase their income by an average of 5.3 percent.

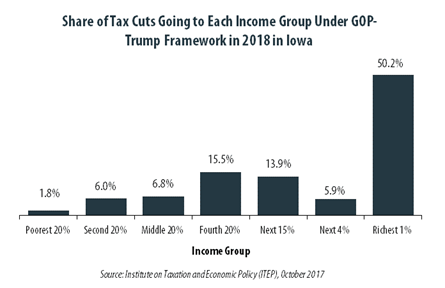

GOP-Trump Tax Framework Would Provide Richest One Percent in Iowa with 50.2 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Iowa equally. The richest one percent of Iowa residents would receive 50.2 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $440,800 next year. The framework would provide them an average tax cut of $50,050 in 2018, which would increase their income by an average of 4.3 percent.

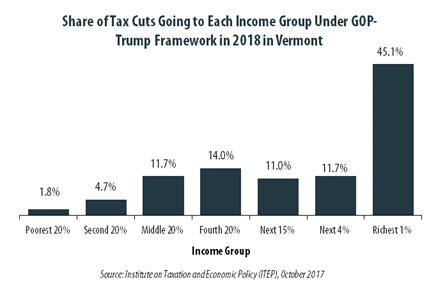

GOP-Trump Tax Framework Would Provide Richest One Percent in Vermont with 45.1 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Vermont equally. The richest one percent of Vermont residents would receive 45.1 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $505,400 next year. The framework would provide them an average tax cut of $45,250 in 2018, which would increase their income by an average of 3.8 percent.

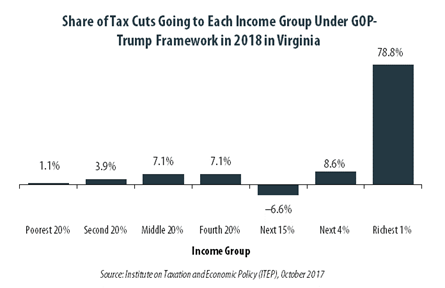

GOP-Trump Tax Framework Would Provide Richest One Percent in Virginia with 78.8 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Virginia equally. The richest one percent of Virginia residents would receive 78.8 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $640,000 next year. The framework would provide them an average tax cut of $83,010 in 2018, which would increase their income by an average of 4.8 percent.

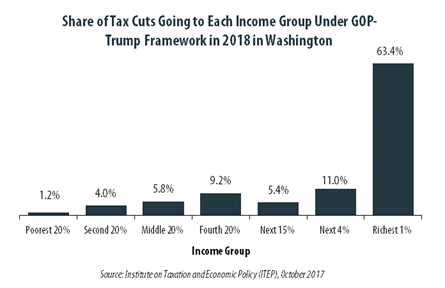

GOP-Trump Tax Framework Would Provide Richest One Percent in Washington with 63.4 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Washington equally. The richest one percent of Washington residents would receive 63.4 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $624,100 next year. The framework would provide them an average tax cut of $103,120 in 2018, which would increase their income by an average of 5.2 percent.

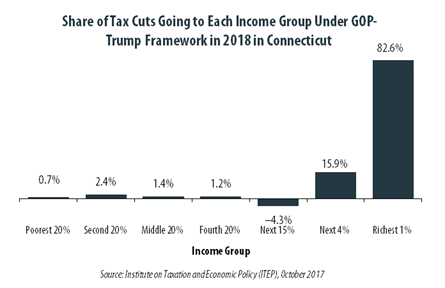

GOP-Trump Tax Framework Would Provide Richest One Percent in Connecticut with 82.6 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Connecticut equally. The richest one percent of Connecticut residents would receive 82.6 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $1,060,400 next year. The framework would provide them an average tax cut of $162,980 in 2018, which would increase their income by an average of 4.4 percent.

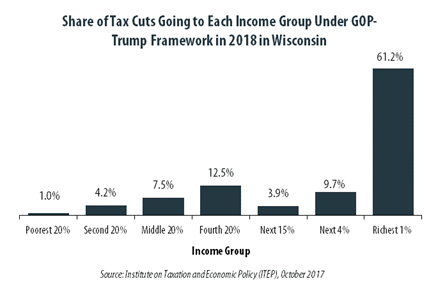

GOP-Trump Tax Framework Would Provide Richest One Percent in Wisconsin with 61.2 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Wisconsin equally. The richest one percent of Wisconsin residents would receive 61.2 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $525,900 next year. The framework would provide them an average tax cut of $75,550 in 2018, which would increase their income by an average of 4.2 percent.

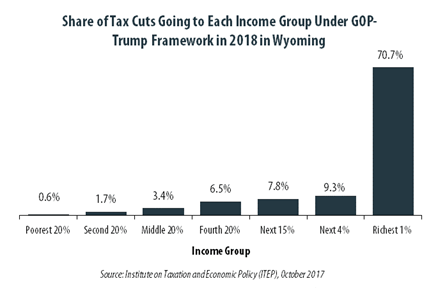

GOP-Trump Tax Framework Would Provide Richest One Percent in Wyoming with 70.7 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Wyoming equally. The richest one percent of Wyoming residents would receive 70.7 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $542,400 next year. The framework would provide them an average tax cut of $180,480 in 2018, which would increase their income by an average of 7.3 percent.

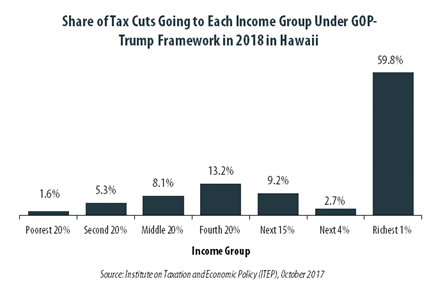

GOP-Trump Tax Framework Would Provide Richest One Percent in Hawaii with 59.8 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Hawaii equally. The richest one percent of Hawaii residents would receive 59.8 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $470,500 next year. The framework would provide them an average tax cut of $39,750 in 2018, which would increase their income by an average of 3.5 percent.

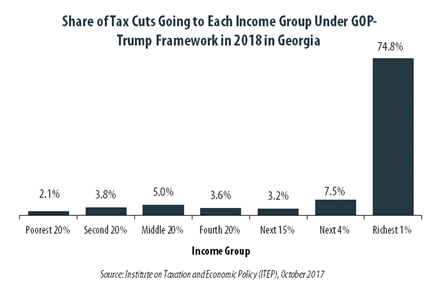

GOP-Trump Tax Framework Would Provide Richest One Percent in Georgia with 74.8 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Georgia equally. The richest one percent of Georgia residents would receive 74.8 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $552,200 next year. The framework would provide them an average tax cut of $83,070 in 2018, which would increase their income by an average of 4.0 percent.

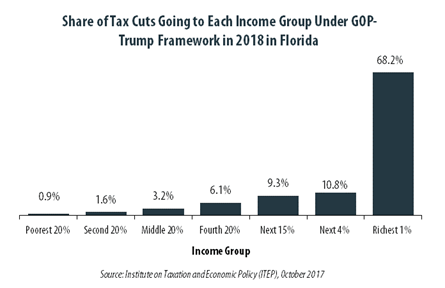

GOP-Trump Tax Framework Would Provide Richest One Percent in Florida with 68.2 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Florida equally. The richest one percent of Florida residents would receive 68.2 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $620,400 next year. The framework would provide them an average tax cut of $130,300 in 2018, which would increase their income by an average of 4.7 percent.

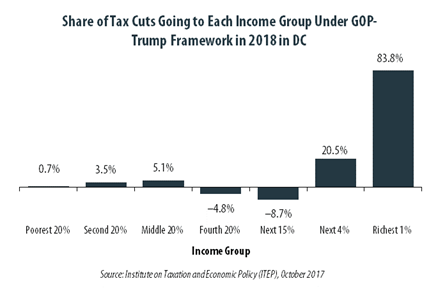

GOP-Trump Tax Framework Would Provide Richest One Percent in The District of Columbia with 83.8 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in the District equally. The richest one percent of District of Columbia residents would receive 83.8 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $1,022,000 next year. The framework would provide them an average tax cut of $147,500 in 2018, which would increase their income by an average of 4.9 percent.