Trump-GOP Tax Law

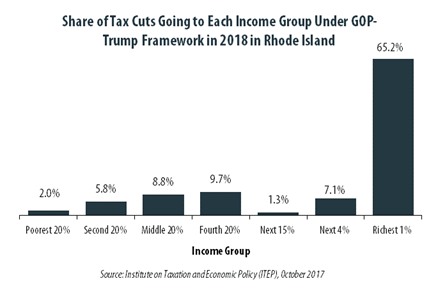

GOP-Trump Tax Framework Would Provide Richest One Percent in Rhode Island with 65.2 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Rhode Island equally. The richest one percent of Rhode Island residents would receive 65.2 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $528,800 next year. The framework would provide them an average tax cut of $55,510 in 2018, which would increase their income by an average of 3.1 percent.

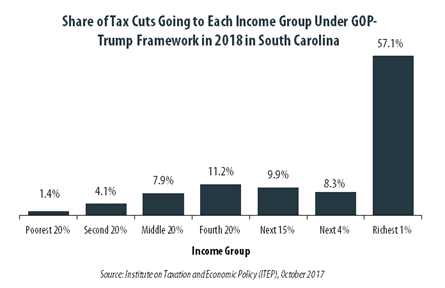

GOP-Trump Tax Framework Would Provide Richest One Percent in South Carolina with 57.1 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in South Carolina equally. The richest one percent of South Carolina residents would receive 57.1 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $478,100 next year. The framework would provide them an average tax cut of $52,250 in 2018, which would increase their income by an average of 4.6 percent.

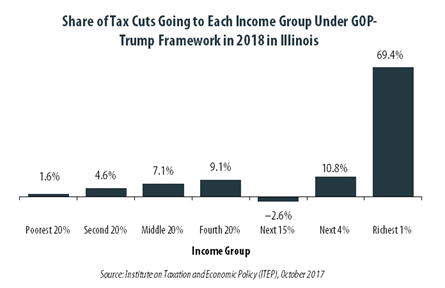

GOP-Trump Tax Framework Would Provide Richest One Percent in Illinois with 69.4 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Illinois equally. The richest one percent of Illinois residents would receive 69.4 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $651,700 next year. The framework would provide them an average tax cut of $84,170 in 2018, which would increase their income by an average of 3.1 percent.

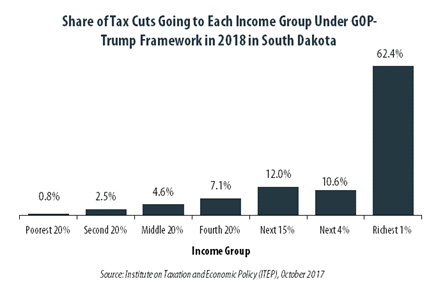

GOP-Trump Tax Framework Would Provide Richest One Percent in South Dakota with 62.4 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in South Dakota equally. The richest one percent of South Dakota residents would receive 62.4 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $589,600 next year. The framework would provide them an average tax cut of $129,120 in 2018, which would increase their income by an average of 7.3 percent.

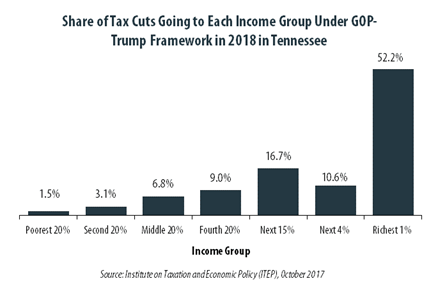

GOP-Trump Tax Framework Would Provide Richest One Percent in Tennessee with 52.2 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Tennessee equally. The richest one percent of Tennessee residents would receive 52.2 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $534,500 next year. The framework would provide them an average tax cut of $60,940 in 2018, which would increase their income by an average of 3.3 percent.

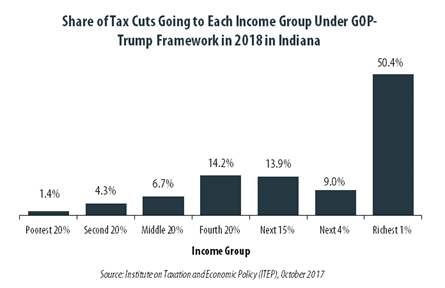

GOP-Trump Tax Framework Would Provide Richest One Percent in Indiana with 50.4 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Indiana equally. The richest one percent of Indiana residents would receive 50.4 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $500,500 next year. The framework would provide them an average tax cut of $54,510 in 2018, which would increase their income by an average of 3.5 percent.

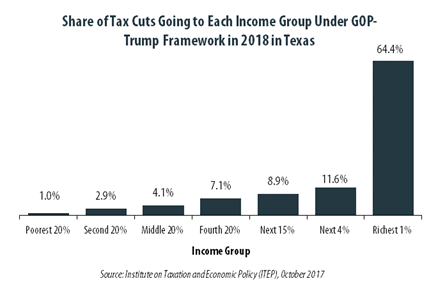

GOP-Trump Tax Framework Would Provide Richest One Percent in Texas with 64.4 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Texas equally. The richest one percent of Texas residents would receive 64.4 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $696,400 next year. The framework would provide them an average tax cut of $119,040 in 2018, which would increase their income by an average of 5.9 percent.

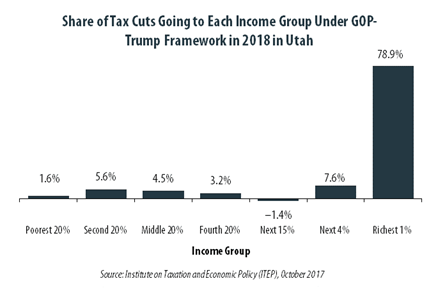

GOP-Trump Tax Framework Would Provide Richest One Percent in Utah with 78.9 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Utah equally. The richest one percent of Utah residents would receive 78.9 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $545,500 next year. The framework would provide them an average tax cut of $82,990 in 2018, which would increase their income by an average of 5.3 percent.

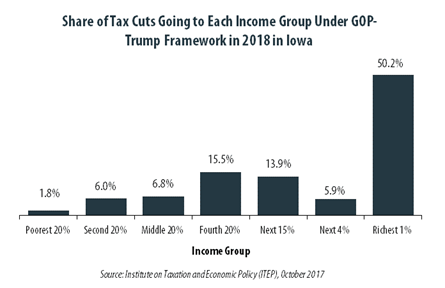

GOP-Trump Tax Framework Would Provide Richest One Percent in Iowa with 50.2 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Iowa equally. The richest one percent of Iowa residents would receive 50.2 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $440,800 next year. The framework would provide them an average tax cut of $50,050 in 2018, which would increase their income by an average of 4.3 percent.

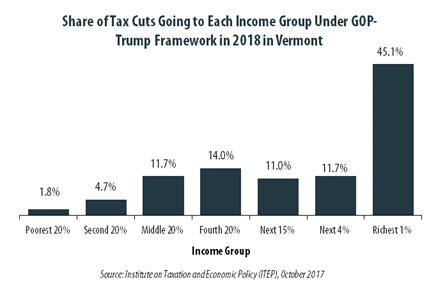

GOP-Trump Tax Framework Would Provide Richest One Percent in Vermont with 45.1 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Vermont equally. The richest one percent of Vermont residents would receive 45.1 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $505,400 next year. The framework would provide them an average tax cut of $45,250 in 2018, which would increase their income by an average of 3.8 percent.

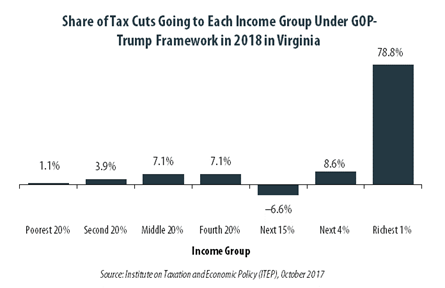

GOP-Trump Tax Framework Would Provide Richest One Percent in Virginia with 78.8 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Virginia equally. The richest one percent of Virginia residents would receive 78.8 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $640,000 next year. The framework would provide them an average tax cut of $83,010 in 2018, which would increase their income by an average of 4.8 percent.

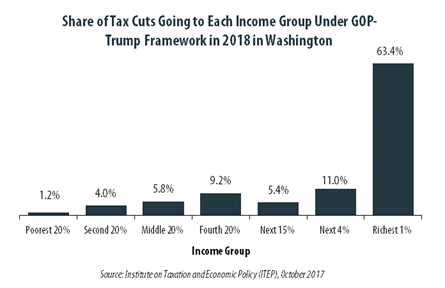

GOP-Trump Tax Framework Would Provide Richest One Percent in Washington with 63.4 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Washington equally. The richest one percent of Washington residents would receive 63.4 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $624,100 next year. The framework would provide them an average tax cut of $103,120 in 2018, which would increase their income by an average of 5.2 percent.

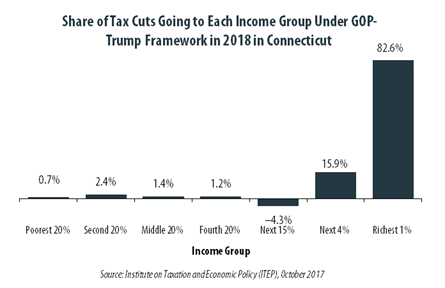

GOP-Trump Tax Framework Would Provide Richest One Percent in Connecticut with 82.6 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Connecticut equally. The richest one percent of Connecticut residents would receive 82.6 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $1,060,400 next year. The framework would provide them an average tax cut of $162,980 in 2018, which would increase their income by an average of 4.4 percent.

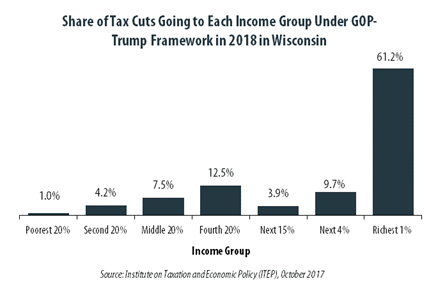

GOP-Trump Tax Framework Would Provide Richest One Percent in Wisconsin with 61.2 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Wisconsin equally. The richest one percent of Wisconsin residents would receive 61.2 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $525,900 next year. The framework would provide them an average tax cut of $75,550 in 2018, which would increase their income by an average of 4.2 percent.

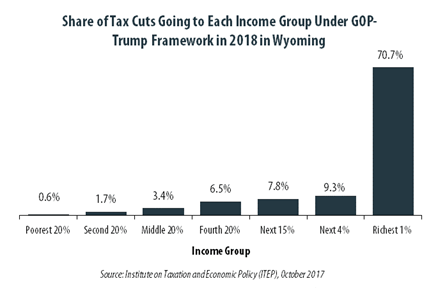

GOP-Trump Tax Framework Would Provide Richest One Percent in Wyoming with 70.7 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Wyoming equally. The richest one percent of Wyoming residents would receive 70.7 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $542,400 next year. The framework would provide them an average tax cut of $180,480 in 2018, which would increase their income by an average of 7.3 percent.

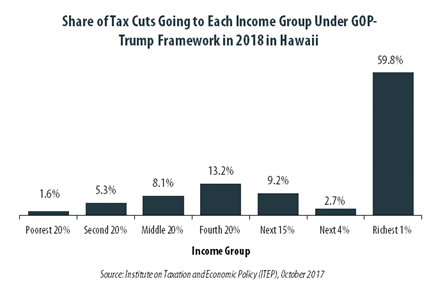

GOP-Trump Tax Framework Would Provide Richest One Percent in Hawaii with 59.8 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Hawaii equally. The richest one percent of Hawaii residents would receive 59.8 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $470,500 next year. The framework would provide them an average tax cut of $39,750 in 2018, which would increase their income by an average of 3.5 percent.

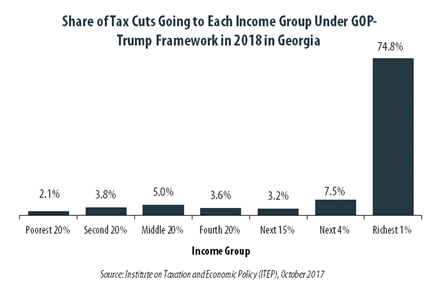

GOP-Trump Tax Framework Would Provide Richest One Percent in Georgia with 74.8 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Georgia equally. The richest one percent of Georgia residents would receive 74.8 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $552,200 next year. The framework would provide them an average tax cut of $83,070 in 2018, which would increase their income by an average of 4.0 percent.

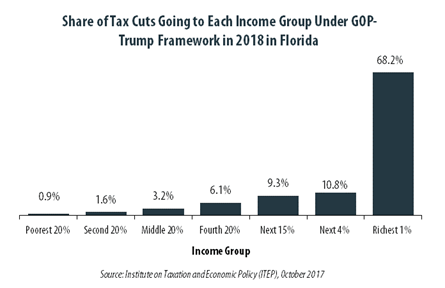

GOP-Trump Tax Framework Would Provide Richest One Percent in Florida with 68.2 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Florida equally. The richest one percent of Florida residents would receive 68.2 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $620,400 next year. The framework would provide them an average tax cut of $130,300 in 2018, which would increase their income by an average of 4.7 percent.

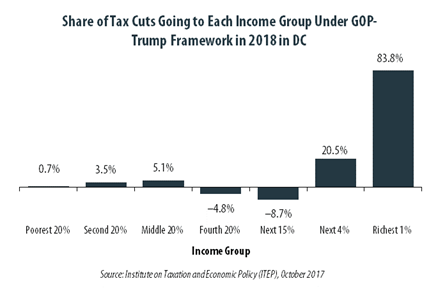

GOP-Trump Tax Framework Would Provide Richest One Percent in The District of Columbia with 83.8 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in the District equally. The richest one percent of District of Columbia residents would receive 83.8 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $1,022,000 next year. The framework would provide them an average tax cut of $147,500 in 2018, which would increase their income by an average of 4.9 percent.

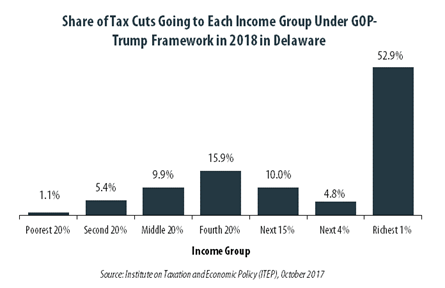

GOP-Trump Tax Framework Would Provide Richest One Percent in Delaware with 52.9 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Delaware equally. The richest one percent of Delaware residents would receive 52.9 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $497,100 next year. The framework would provide them an average tax cut of $49,370 in 2018, which would increase their income by an average of 2.7 percent.

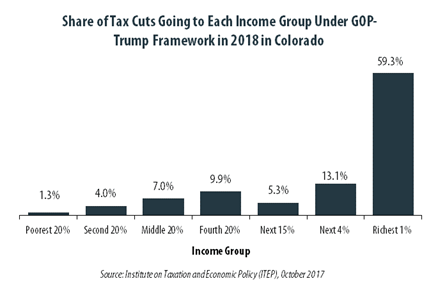

GOP-Trump Tax Framework Would Provide Richest One Percent in Colorado with 59.3 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Colorado equally. The richest one percent of Colorado residents would receive 59.3 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $637,800 next year. The framework would provide them an average tax cut of $86,480 in 2018, which would increase their income by an average of 4.7 percent.

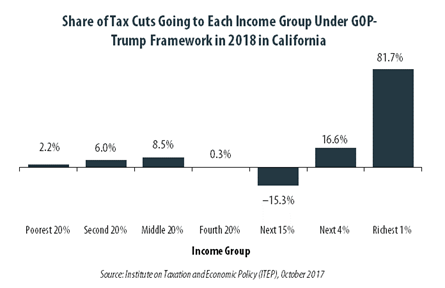

GOP-Trump Tax Framework Would Provide Richest One Percent in California with 81.7 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in California equally. The richest one percent of California residents would receive 81.7 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $864,900 next year. The framework would provide them an average tax cut of $90,160 in 2018, which would increase their income by an average of 3.3 percent.

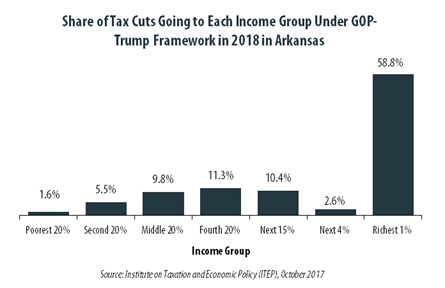

GOP-Trump Tax Framework Would Provide Richest One Percent in Arkansas with 58.8 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Arkansas equally. The richest one percent of Arkansas residents would receive 58.8 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $490,000 next year. The framework would provide them an average tax cut of $51,370 in 2018, which would increase their income by an average of 3.8 percent.

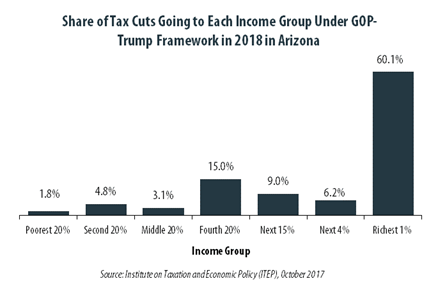

GOP-Trump Tax Framework Would Provide Richest One Percent in Arizona with 60.1 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Arizona equally. The richest one percent of Arizona residents would receive 60.1 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $470,200 next year. The framework would provide them an average tax cut of $59,210 in 2018, which would increase their income by an average of 4.4 percent.

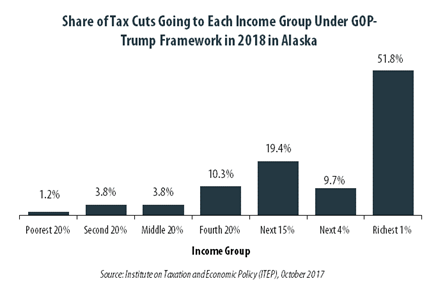

GOP-Trump Tax Framework Would Provide Richest One Percent in Alaska with 51.8 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Alaska equally. The richest one percent of Alaska residents would receive 51.8 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $615,800 next year. The framework would provide them an average tax cut of $77,880 in 2018, which would increase their income by an average of 5.5 percent.