Virginia

West Virginia Center on Budget & Policy: Senate Tax Plan a Bad Deal for West Virginia

February 19, 2020

Senate Republicans unveiled their latest proposal to eliminate the business personal property tax this week, passing the proposal out of the Senate Finance Committee. The plan, which builds upon an earlier proposal to eliminate the property tax on manufacturing equipment, machinery, and inventory, would blow a nearly $100 million hole in the state budget, introduce inconsistency in […]

State Rundown 2/13: What’s Trendy in State Tax Debates This Year

February 13, 2020 • By ITEP Staff

We wrote earlier this week about Trends We’re Watching in 2020, and this week’s Rundown includes news on several of those trends. Maine lawmakers are considering a refundable credit for caregivers. Efforts to tax high-income households made news in Maryland, Oregon, and Washington. Grocery taxes are receiving scrutiny in Alabama, Idaho, and Tennessee. Tax cuts or shifts are being discussed in Arizona, Nebraska, and West Virginia. And Arizona, Maryland, and Nevada continue to seek funding solutions for K-12 education as Alaska and Virginia do the same for transportation infrastructure.

State lawmakers have plenty to keep them busy on the tax policy front in 2020. Encouraging trends we’re watching this year include opportunities to enact and enhance refundable tax credits and increase the tax contributions of high-income households, each of which would improve tax equity and help to reduce income inequality.

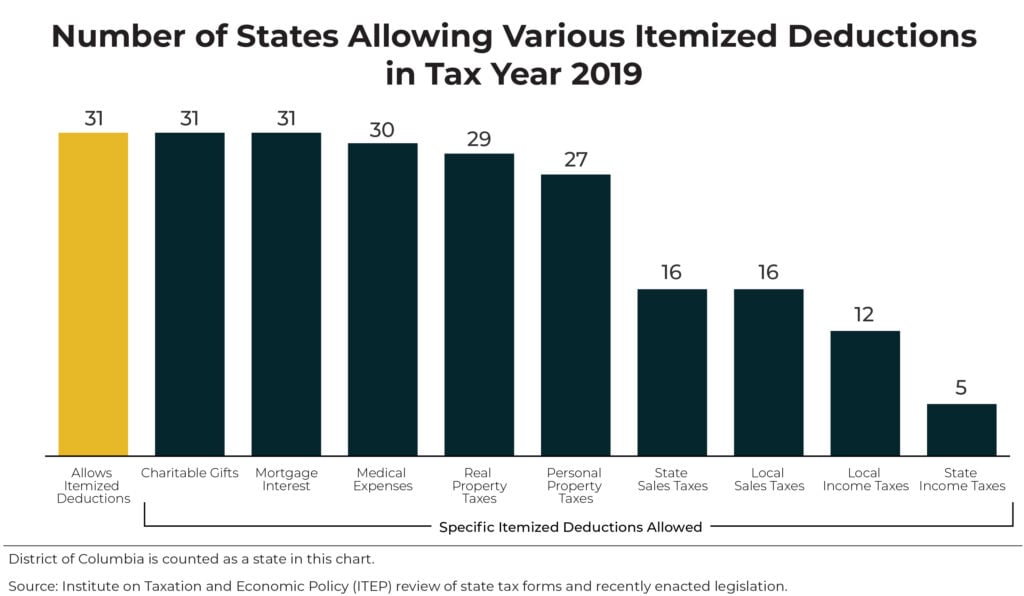

States Can Make Their Tax Systems Less Regressive by Reforming or Repealing Itemized Deductions

February 5, 2020 • By Carl Davis

Itemized deductions are problematic tax subsidies that need to close. The mortgage interest deduction, for instance, is often lauded as a way to help middle-class families afford homes and charitable deductions are touted as incentivizing gifts to charitable organizations. But the dirty little secret is that itemized deductions primarily benefit higher-income households while largely failing to achieve their purported goals.

State Itemized Deductions: Surveying the Landscape, Exploring Reforms

February 5, 2020 • By Carl Davis

State itemized deductions are generally patterned after federal law, though nearly every state makes significant changes to the menu of deductions available or the extent to which those deductions are allowed. This report summarizes the key details of each state’s itemized deduction policies and discusses various options for reforming those deductions with a focus on lessening their regressive impact and reducing their cost to state budgets.

State Rundown 1/30: Flip-Flops and Steady Marches in State Tax Debates

January 30, 2020 • By ITEP Staff

State tax and budget debates can turn on a dime sometimes, as in Utah this past week, where lawmakers unanimously repealed a tax package they had just approved in a special session last month. Delaware lawmakers are hoping to avoid the similarly abrupt end to their last effort to improve their Earned Income Tax Credit (EITC) by crafting a bill that Gov. John Carney will have no reason to unexpectedly veto as he did two years ago. But at other times, these debates just can’t change fast enough, as in New Hampshire and Virginia, where leaders are searching for revenue to address long-standing transportation needs, and in Hawaii, Nebraska, and North Carolina, where education funding issues remain painfully unresolved.

West Virginia Center on Budget & Policy: Who Pays? Rethinking West Virginia’s Tax System

January 28, 2020

To get a sense of a state’s values, one often need look no further than its tax system. What a state spends its tax dollars on and how it acquires those tax dollars typically reveals a lot about the priorities of its people—what they care about and what they stand for. In theory, it’s a […]

Washington Post: Va. Governor Proposes Gas Tax Increase

January 27, 2020

Virginia would join 31 states that have raised or reformed their gas tax in the last decade, according to the Institute on Taxation and Economic Policy. Read more

State tax and budget debates have arrived in a big way, with proposals from every part of the country and everywhere on the spectrum from good to bad tax policy. Just look to ARIZONA for a microcosm of nationwide debates, where education advocates have a plan to raise progressive taxes for school needs, Gov. Doug […]

State Rundown 1/8: States Need Clear Tax and Budget Policy Vision in 2020

January 8, 2020 • By ITEP Staff

Happy New Year readers! The Rundown is back to our usual weekly schedule as state legislative sessions and governors’ budgets and State of the State Addresses begin in earnest. Here’s to clear-eyed 20-20 vision guiding state tax and budget decisions in 2020! So far this year, the harm of Colorado’s TABOR policy and Alaska’s lack of an income tax are coming into focus in big ways. Utah advocates are hoping the benefit of hindsight will help convince voters to overturn a recently enacted tax overhaul. Lawmakers in states including Iowa, Maryland, and Virginia can clearly see a need for revenues,…

State Rundown 12/18: Utah’s Tax Fight Wraps Up As Other States’ Ramp Up

December 18, 2019 • By ITEP Staff

With the new year and many state legislative sessions just around the corner, most state tax and budget debates are just getting started. Arkansas will be among the states working to improve their roads and other infrastructure. Massachusetts will have to deal with revenue losses due to a misguided tax-cut trigger put in place in prior years. Maryland and South Dakota will be two of many states facing teacher pay shortages and other education funding needs. And debates over the legalization and taxation of cannabis will likely continue in California, Kentucky, New Jersey, and beyond. Utah lawmakers, on the other…

In the last few weeks, Florida Gov. Ron DeSantis has served up his budget proposal, which advocates are eager to dig into and hoping to contribute to with a delectable Earned Income Tax Credit proposal of their own. Utah lawmakers have been cooking up tax ideas as well, but haven’t yet decided when to come to the table to debate them. And Maryland leaders finalized their menu of needed education reforms, now moving on to assigning responsibilities for funding them. With respect to dividing up the pie, our “What We’re Reading” section below includes reporting on evidence that corporate tax…

State Rundown 10/24: State Tax Talk Makes Like a Tree and Gets Colorful

October 24, 2019 • By ITEP Staff

As autumn brings a colorful display of foliage to many states, so too are tax proposals taking on interesting hues as states move from the summer off-season toward 2020 legislative sessions. Ohio lawmakers are blue in the face from debating and re-debating tax and budget issues there. Maryland residents again showed they can’t be called yellow-bellied when it comes to footing the bill for needed education improvements, showing their broad support for higher taxes to fund those needs even despite a hefty price tag. Alaska, Michigan, and other states are giving the green light to laws implementing their new ability…

State Rundown 9/26: Shady State Business Tax Subsidies Coming to Light

September 26, 2019 • By ITEP Staff

Lawmakers in Michigan and New Hampshire made progress toward enacting their state budgets, though Michigan may yet end up in a government shutdown. Leaders in Wyoming advanced a proposal to create a limited tax on large corporations to raise some revenue and add a progressive element to their state’s tax code. Georgia agencies are forced to recommend their own funding cuts amid state income tax cuts. And business tax subsidies are looking particularly bad in Maryland, where subsidy money has been handed out without verification that companies were creating jobs, and New Jersey, where a false threat to leave the…

State Tax Codes as Poverty Fighting Tools: 2019 Update on Four Key Policies in All 50 States

September 26, 2019 • By Aidan Davis

This report presents a comprehensive overview of anti-poverty tax policies, surveys tax policy decisions made in the states in 2019 and offers recommendations that every state should consider to help families rise out of poverty. States can jump start their anti-poverty efforts by enacting one or more of four proven and effective tax strategies to reduce the share of taxes paid by low- and moderate-income families: state Earned Income Tax Credits, property tax circuit breakers, targeted low-income credits, and child-related tax credits.

State lawmakers seeking to make residential property taxes more affordable have two broad options: across-the-board tax cuts for taxpayers at all income levels, such as a homestead exemption or a tax cap, and targeted tax breaks that are given only to particular groups of low- and middle-income taxpayers. This policy brief surveys the advantages and disadvantages of the circuit breaker approach to reducing property taxes.

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2019

September 26, 2019 • By Aidan Davis

The Earned Income Tax Credit (EITC) is a policy designed to bolster the incomes of low-wage workers and offset some of the taxes they pay, providing the opportunity for families struggling to afford the high cost of living to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been magnified as many states have enacted and later expanded their own credits.

State Rundown 9/12: Work Continues to Flip the Script on Backwards Tax Codes

September 12, 2019 • By ITEP Staff

Residents of several states are spending their palindrome week reading ballot initiatives forwards and backwards to decide whether or not to support them, including measures to improve education funding in California and Idaho, allow Alaska and Colorado to invest more in public services, and constitutionally prohibit income taxation in Texas. New Jersey lawmakers are giving the same thorough treatment to the state’s corporate tax subsidies. And advocates in Chicago, Illinois, have a bold proposal to flip the script on upside-down taxes there. But devotees of good policy and honest government in North Carolina won’t want to re-read yesterday’s news in…

The Half Sheet: Over 1 Million Virginia Taxpayers Expected to Miss Out on Refund Checks

September 11, 2019

If everything goes according to schedule, Virginia’s tax department will begin issuing $110 refund checks – $220 for joint filers – to Virginia taxpayers beginning next week and continuing through the first half of October. The checks are the result of tax legislation signed into law earlier this year. Unfortunately, not every tax filer will […]

The hottest, stickiest month of the year has left a grimy feeling on several state tax debates, as Idaho lawmakers find themselves unable to fund the state’s priorities after years of cutting taxes, Alaskans express their support for public investments to their governor’s polling office and then watch the governor slash them anyway, New Jersey lawmakers go to bat for ineffective and corrupt business tax subsidies, and residents of North Carolina watch their representatives pursue cheap political points over sound investments and thoughtful policy. Nonetheless, residents and advocates on the other side of these and other debates have fought long…

OHIO legislators passed a budget with unfortunate income tax cuts for high-income households. Other states turned their attention to unconventional ideas during their legislative off-seasons, for better and for worse. And there are many gems to be found in our “What We’re Reading” section below, including new research on the racial inequities that continue to pervade our communities and schools.

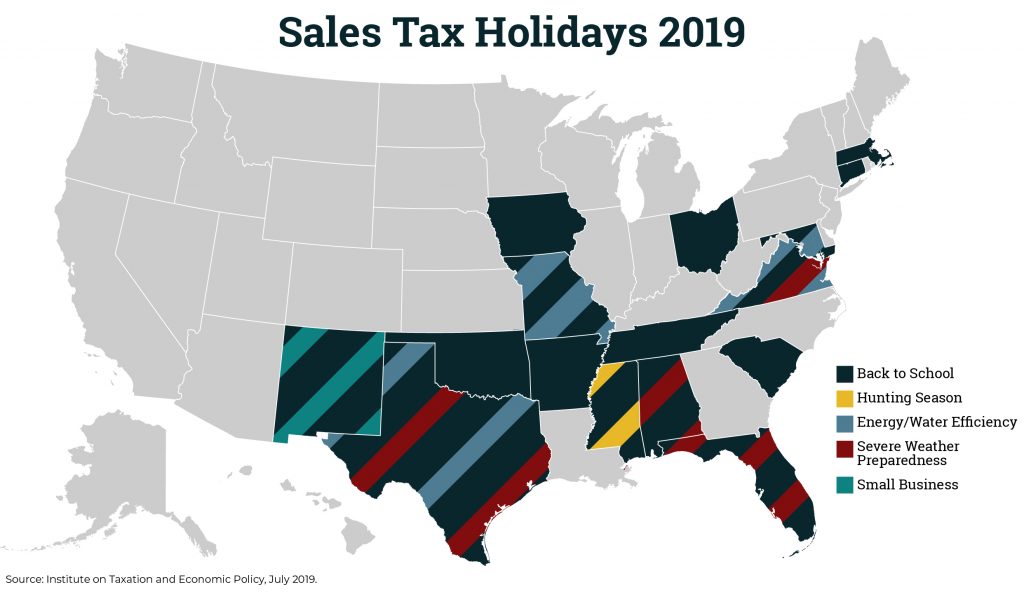

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 17, 2019 • By Dylan Grundman O'Neill

Lawmakers in many states have enacted “sales tax holidays” (16 states will hold them in 2019), to provide a temporary break on paying the tax on purchases of clothing, school supplies, and other items. While these holidays may seem to lessen the regressive impacts of the sales tax, their benefits are minimal. This policy brief looks at sales tax holidays as a tax reduction device.

We've said it before, and we'll say it again: states don't have to wait for federal lawmakers to make moves toward progressive tax policy. And so far, 2019 has been a good year for equitable and sustainable tax policy in the states. With July 1 marking the start of a new fiscal year for most states, this special edition of the Rundown looks at how discussions in 2019 have been dominated by plans to raise revenue for vital investments, tax the rich and corporations fairly, use the tax code to help workers and families and advance racial equity, and shore…

Daily Progress: Opinion/Commentary: New IRS Rule Narrows Tax Loophole in Virginia

July 7, 2019

First, people and businesses making stock contributions, rather than cash, may still be able to profit from their donations through avoidance of capital gains taxes. A fix suggested by the Institute on Taxation and Economic Policy is to require taxpayers to pay capital gains tax if they receive a large state tax credit as compensation […]

State Rundown 6/27: States Look at Raising Incomes at the Bottom, Taxes at the Top

June 27, 2019 • By ITEP Staff

Low-income working families got good news and bad news this week, as Earned Income Tax Credit (EITC) enhancements passed in California and advanced in Oregon, while minimum wage increases failed in Pennsylvania, Rhode Island, and Wisconsin. Meanwhile, the momentum for taxing wealth and the very rich continued to grow, as more one-percenters called for enacting progressive taxes, and Inequality.org held a star-studded conference on why and how to do so.